Metal Additive Manufacturing in China: An overview of systems manufacturers

What’s happening in metal Additive Manufacturing in China? Quite a lot it seems; however, the extent and nature of this activity, and what can be expected from Chinese systems manufacturers in the coming years, can be unclear to Western observers. In the following report, Joseph Kowen offers a brief look into the current state of the metal AM industry in China. As well as presenting an overview of machine-related activity in this fast-growing part of the world, he considers to what extent we can expect to see an increased presence of Chinese suppliers in western countries. [First published in Metal AM Vol. 4 No. 3, Autumn 2018 | 20 minute read | View on Issuu | Download PDF]

Additive Manufacturing in China is a hive of activity and continues to grow in action and interest from year to year. The first forays into what was then known as rapid prototyping began as early as the first half of the 1990s. Led by a select number of academic institutions, which actively followed technological developments in western countries, the Chinese Additive Manufacturing segment has flourished. Academia’s interest in the field was led by Tsinghua University, which began its research on material extrusion and sheet lamination systems.

Wohlers Report, which tracks the status of AM worldwide, lists twenty-four China-based system manufacturers which were either selling or about to begin selling industrial systems as of March 2018. This is out of a total of 135 industrial AM system manufacturers worldwide, or almost 18%.

The Chinese government has been proactive in encouraging the development of Additive Manufacturing. In November 2017, the Chinese government, led by the Ministry of Industry and Information Technology, announced an ‘Action Plan for Additive Manufacturing Industry Development (2017–2020)’. The government plans to turn AM in China into a $3 billion industry. Metal AM plays a big part in the plan.

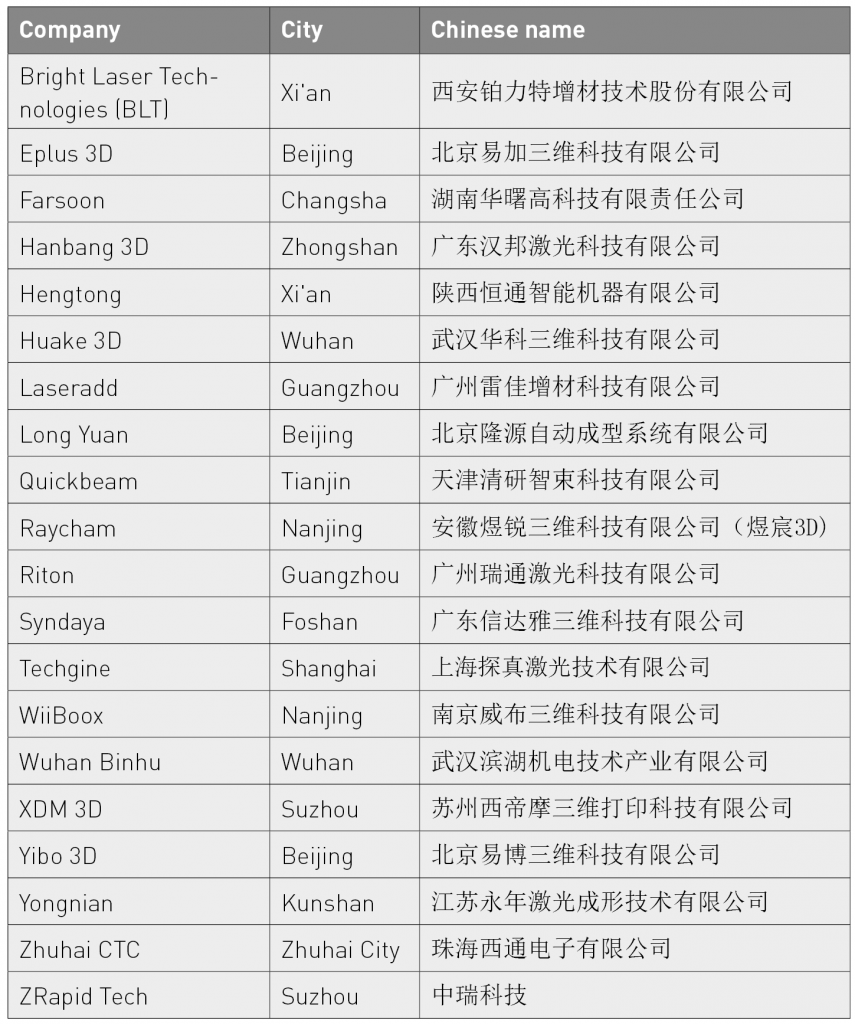

A review of the metal AM industry in China, and conversations with local industry figures, indicate that there are now twenty metal AM systems manufacturers in China. An additional two companies are close to commercialising systems. This report briefly identifies and introduces these companies. It does not enter deeply into processes, materials and technologies, except to describe the field of activity of each provider. On the materials side, unless otherwise stated, the systems are able to process parts in a relatively standard range of metallic materials. Comparisons of features and quality of parts are beyond the scope of this article, the purpose of which is simply to generate ‘a bird’s eye view’ of the players and offer an understanding of the overall lie of the land. Our hope is that, armed with a map of the terrain, those interested in obtaining further information will have a guide with which to go out and find more details for themselves.

As a broad generalisation, while there is an exceptional growth of activity in China – possibly unequalled in any other single country – the latest innovations and new discoveries in metal AM do not originate there. This is not to diminish in any way the importance of what is happening in the country; there is value in taking ideas invented elsewhere and commercialising them, with all that commercialisation entails. This includes productisation, price and promotion. As we shall see, the sheer extent of the developments in metal AM in China make activities there worthy of interest. As is the norm in most new technological areas, not all of the companies will be equally successful, but the number of metal AM projects in China suggests that the market there has recognised the potential of metal AM and wishes to play a part in exploiting some of that potential. Investors are willing to risk real money to sit at the table and play. There certainly is a buzz emanating from China.

The technologies and the companies

All of the twenty metal AM system providers in China provide systems based on metal Powder Bed Fusion (PBF). Four of them also offer systems using Directed Energy Deposition (DED) technologies. Systems that print sand moulds or polymer/wax patterns used to cast metal parts are also strictly speaking ‘metal AM’ systems producers. However, due to the fact that a secondary process is required to produce the metal part, these systems are generally not considered true metal AM systems, and are not covered here.

Table 1 lists the companies producing metal AM systems in China and the city in which they are headquartered. The Chinese names of the companies have also been added, because in some cases the English name will differ in translation. Fig. 2 shows the location of the companies in China, giving a good sense of the geographical breadth of the industry.

We will describe in brief each of the metal AM systems providers, which are listed in alphabetical order of the short-form English name:

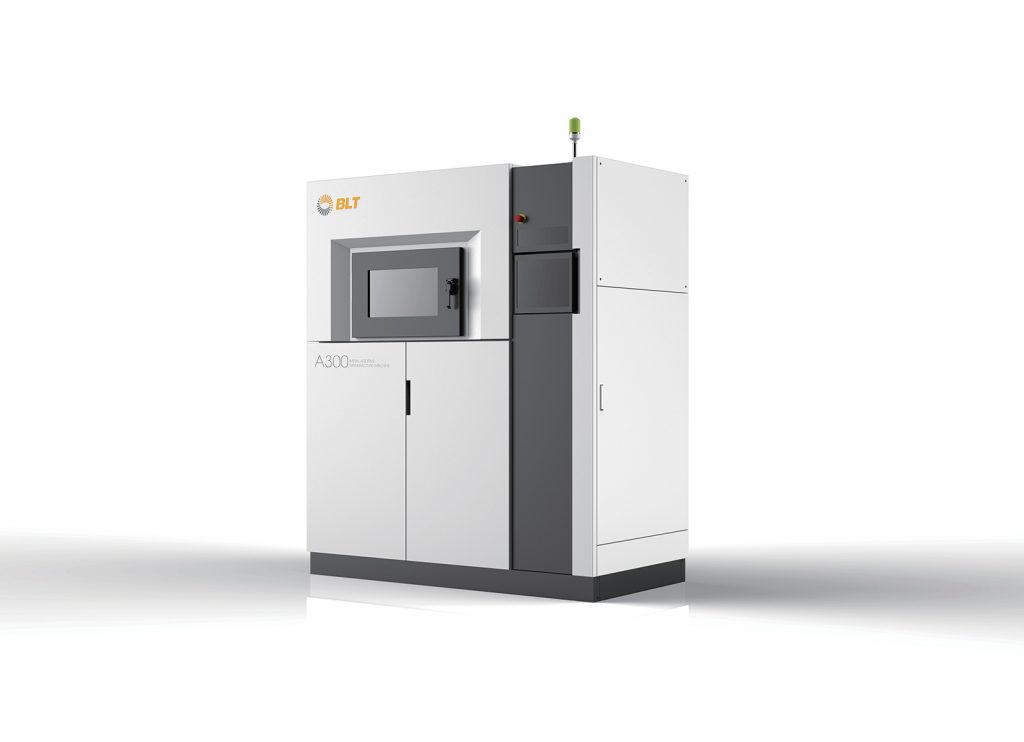

Bright Laser Technologies (BLT)

Xi’an Bright Laser Technologies Co., Ltd.

BLT was founded in 2011 by Prof Huang Weidong, a researcher in metal AM since 1995. It has a staff of over 300 and the company claims about 40% of them work in R&D. In addition to producing metal machines of their own, BLT is a distributor of metal machines for EOS, the German AM pioneer. The company is also a service provider. It is not clear if the combination of system developer, system distributor and service provider is a viable model for the future and something might have to be adjusted as company and the industry matures. In addition to PBF, the company offers two directed energy deposition models, the largest of which, the BLT-C1000, has a build volume of 1,500 x 1,000 x 1,000 mm (59 x 39.4 x 39.4 in). BLT is a pure metal AM company.

Eplus3D

Beijing Eplus 3D Tech. Co., Ltd.

Eplus is a well-known company with a history of selling polymer AM systems. Its polymer line includes both PBF and Vat Photopolymerisation (VP). Shining 3D, a well-known manufacturer of 3D optical scanning systems, is a leading investor in the company and also serves as a sales channel for Eplus3D machines. In 2017, the company launched a metal PBF system and currently offers three models, the largest being a four-laser system with a build volume of 500 x 500 x 500 mm (19.7 x 19.7 x 19.7 in)

Farsoon Technologies

Hunan Farsoon High-Tech Co., Ltd.

Farsoon is one of the best-known Chinese AM companies, primarily due to its personal and historical connection to the early days of additive technology in the US. Farsoon initially began developing polymer PBF systems in China after its establishment in 2009 and sold its first system in 2011. In 2015, the company launched the FS271M metal system for sale in China and first showcased the product internationally at formnext 2016.

The company currently offers three metal AM systems. The FS421M is its largest system with a build chamber volume of 425 x 425 x 420 mm (16.7 x 16.7 x 16.5 in). In March 2018, Farsoon partnered with major material suppliers to provide it with certified metal powders for sale in China and the US. The company is in the process of expanding its international presence. In May 2017, it opened an integrated demonstration centre in the US, and in April 2018 a subsidiary in Germany. The company is already a fixture at all major international trade shows in Asia-Pacific, the Americas and Europe.

Hanbang 3D

Guangdong Hanbang 3D Tech Co., Ltd.

Hanbang 3D began developing metal AM based on metal PBF in 2007. Its first commercial system was sold in 2013 and second-generation systems were released in 2015. The HBD280 is its largest system, with a build volume of 250 x 250 x 300 mm (9.8 x.9.8 x 11.8 in.). Hanbang 3D is a metal-only AM company.

Hengtong

Shaanxi Hengtong Intelligent Machine Co., Ltd.

Hengtong offers a wide range of systems in a number of product lines. The company is affiliated with Xi’an Jiaotong University. The company has diverse offerings outside the AM area, such as optical scanning and CNC machining. Its products in the Additive Manufacturing space range from material extrusion desktop machines to industrial VP systems. Hengtong does offer a small-volume metal system, but this product does not seem to be well developed. This is an example of a company wishing to enter into the metal AM space, but is not a metal AM company at its core.

Huake 3D

Wuhan Huake 3D Technology Co. Ltd.

Huake 3D was jointly established by Huazhong University of Science and Technology Industry Group and Hexu Holdings. It offers a wide range of industrial industrial polymer, sand and ceramic AM systems. It has two metal PBF system models, the largest of which is the HK M280 with a build volume of 280 x 280 x 300 mm (11 x 11 x 11.8 in.)

Laseradd

Laseradd Technology (Guangzhou) Co., Ltd.

Laseradd specialises in metal AM, although they do also offer one polymer PBF system. The company’s Dimetal range consists of three systems, starting at 50 x 50 x 50 mm (2 x 2 x 2 in.) up to 250 x 250 x 300 mm (9.8 x 9.8 x 11.8 in.). The company’s development team originated from the South China University of Technology, which has been working on metal AM technology for fifteen years. The company debuted its machines in 2018.

Long Yuan

Beijing Long Yuan Automated Fabrication Systems Co., Ltd.

Long Yuan was an early entrant into the Additive Manufacturing world, being established in 1994. It produces a range of polymer and sand PBF machines, and launched a metal PBF system in 2014. The AFS-M260 has a build volume of 260 x 260 x 350 mm (10.2 x 10.2 x 13.8 in.) and is its largest unit. The company also offers a number of DED systems and operates a parts service.

Quickbeam

Tianjin SciTsing QuickBeam Tech.Co., Ltd.

This company spun out of Tsinghua University in 2015. Its Powder Bed Fusion technology is based on an Electron Beam Melting (EBM) technology, similar to that offered by GE Additive’s Arcam unit, and called Electron Beam Selective Zone Melting, or EBSM. The QbeamAero has a build volume of 350 x 350 x 400 mm (13.8 x 13.8 x 15.7 in.).

Raycham3D

Raycham Laser Technology Group Co., Ltd.

Raycham was established in 2013 to develop industrial laser applications, including systems for Additive Manufacturing. It offers both PBF and DED systems. The latter is based on the company’s laser cladding technology. It offers five DED systems and two metal PBF machines. The company offers a parts service. Its 3D subsidiary also distributes non-metal AM systems.

Riton

Riton Laser Co., Ltd.

Riton produces a variety of cutting and marking machines, primarily for the medical industry. In line with its medical focus, the company launched a metal AM system for the production of dental parts in stainless steel, cobalt-chrome and titanium. The D280 has a build volume with a limited z-axis of 80 mm (3.1 in.) suited primarily to dental applications.

Syndaya

Guangdong Syndaya 3D Technology Co., Ltd.

Syndaya is a wholly owned subsidiary of Foshan Nanhai ZhongNan Machinery. It offers a range of four metal PBF systems. The DiMetal range of machines (not to be confused with the Dimetal line offered by Laseradd) starts with a small build volume machine of 50 x 50 x 50 mm (2 x 2 x 2 in.) and extends up to the DiMetal-400 with a volume of 400 x 400 x 400 mm (15.7 x 15.7 x 15.7 in.). The company also offers a parts service.

Techgine

Shanghai Techgine Laser Technology Co., Ltd.

Techgine is a spin-off from the Shanghai Electric Group, one of China’s oldest and largest industrial concerns. The company was founded by the Additive Manufacturing team from Huazhong University of Science and Technology, led by Professor Zeng Xiao Yan. The academic research was formally spun off into a commercial entity in March 2016. The company produces three systems. The largest system offered is the TZ-SLM500A which has a build volume of 500 x 500 x 1000 mm (19.7 x 19.7 x 39.4 in.), and is equipped with up to four 1,000W lasers.

Wiiboox

Nanjing Wiiboox 3D Technology Co., Ltd.

In August 2018, Wiiboox announced the launch of a metal PBF printer called the SLM250. The company offers a very diverse range of 3D printing and AM products, from desktop systems to scanners, and even a food printer. While a metal machine is in its catalogue, Wiiboox is scarcely known in industrial AM, despite having been founded in 2014. It is unclear if the company developed the machine or sells a private label version of another machine.

Wuhan Binhu

Wuhan Binhu Mechanical & Electrical Co. Ltd.

Wuhan Binhu was one of the earliest companies in the AM space in China. It was founded in the first half of the 1990s and for many years developed polymer AM systems. It has introduced a single metal PBF system.

XDM 3D

Suzhou XDM 3D Printing Technology Co. Ltd.

In 2017, XDM3D announced the launch of a large format metal AM machine. At the time of its release, the machine was stated to be the largest of its kind, though larger systems have since become available. The four-laser XDM 750 has a build volume of 750 x 750 x 500 mm (29.5 x 29.5 x 19.7 in.). The company was founded by Professor Zhang Zhengwen of Chongqing University.

Yibo 3D

Beijing Yibo 3D Technology Co., Ltd.

The company was founded in 2008 and is a provider of a range of polymer AM solutions. It recently launched a small frame metal PBF machine.

Yongnian

Jiangsu Yongnian Laser Forming Technology Co., Ltd.

Yongnian was established in 2012. It is located in Jiangsu Kunshan High-Tech Zone Robot Industry Park. It was founded by Professor Yan Yongnian of Tsinghua University. The company produces both metal PBF and DED systems.

Zhuhai CTC

Zhuhai CTC Electronic Co., Ltd.

The company was founded in 2004 and sells a wide range of Additive Manufacturing systems, including non-industrial systems. It entered the metal AM space in 2016 with the introduction of the Walnut PBF systems. The series consists of three models from small-to-medium size. The Walnut 26 is the only model currently available for sale.

ZRapid Tech

ZRapid Technologies Co., Ltd.

ZRapid is an established provider of VP systems, with a full range of eight machines. It also sells polymer PBF machines. The company joined the ranks of metal AM providers with two machines, the largest of which is the iSLM280 with a build volume of 300 x 250 x 350 mm (11.8 x 9.8 x 13.8 in.). ZRapid is planning to expand its activities outside of China. It has appeared in the last two major AM events in Europe (formnext) and the US (RAPID+TCT).

TSC Laser and Sailong Metal are another two companies that are in the process of commercializing metal AM systems.

Models of expansion into metal AM

As already noted, a large number of companies have signalled their intention to address the metal AM market. However, the models of how they go about this task differ from what we see elsewhere. There are a number of paths in western countries. The first and most obvious is a pure-play start up development of metal AM. Examples would be SLM Solutions and Arcam, to name just two. Acquisition is another route, albeit not that common. An example would be 3D Systems’ acquisition of Layerwise. A third route is organic growth into metal AM based on experience gained in polymer AM. The prime example of this would be EOS, which moved into metals only after acquiring knowledge and experience in polymers.

In China, there have been no apparent acquisitions by larger AM companies of metal AM start-ups. The dominant path to metal AM has been to leverage knowledge in polymer PBF and use it as a springboard into metal. The most prominent example of this is Farsoon. Eplus3D developed a full range of polymer PBF machines before adding metal, and Huake also developed a full line of polymer systems before addressing metal PBF. Long Yuan followed a similar path, first developing polymer and sand PBF systems before advancing to metal. Wuhan Binhu, Yibo 3D and ZRapid also follow this model.

There are a number of companies that have developed metal AM systems from the ground up: BLT, Hanbang, Laseradd, Quickbeam, Syndaya and XDM 3D. One company, Raycham, has leveraged technological know-how from the laser area to develop metal AM systems.

A number of companies have added metal PBF machines to their catalogues seemingly as a way of meeting a commercial need to be in metal AM, though without any apparent technological underpinnings. In this category we find Hengtong, which was originally a VP system manufacturer, although with some experience developing one system for sand mould printing. Riton has no background in Additive Manufacturing, but was drawn into the space because of its dental focus. Wiiboox creates the appearance of a marketplace for a wide variety of AM technologies. Similarly, Zhuhai CTC lacks roots in PBF, despite launching three systems.

Finally, it is important to note the role that academia plays not only in developing the technology, but in commercialising it. While some key industry technologies originated on campuses, the commercialisation process was generally a separate activity. The examples that come to mind are binder jetting from MIT and SLS from the University of Texas. In the case of Chinese metal AM, many of the companies commercialising systems are still closely connected to the academic institutions that incubated them. Examples of this are: BLT (Northwestern Polytechnical University); Hengtong (Xi’an Jiaotong University); Huake 3D (Huazhong University of Science and Technology); Laseradd (South China University of Technology); Quickbeam (Tsinghua University); Techgine (Huazhong University of Science and Technology); Yongnian (Tsinghua University); XDM 3D (Chongqing University).

International expansion

A number of the leading companies have indicated their intention to expand internationally. Some, such as Farsoon, have made significant progress. One way to measure international intentions is to examine which international events Chinese companies have recently attended. Of the twenty companies on the Chinese metal AM listing, the following companies attended formnext in Frankfurt in November 2017 in one capacity or another: Bright Laser Technologies, Farsoon, and ZRapid had their own booths, and Hanbang and Quickbeam were represented as co-exhibitors.

Only Farsoon has taken practical steps to establish a permanent presence internationally. Non-metal AM companies from China have also taken this route, most notably Shanghai Uniontech, a pioneer in vat photopolymerisation systems since the late 1990s.

Conclusions

Can we expect a flood of Chinese companies in Western markets? Not so quickly. For one thing, quality and reliability have to be proven in most cases. For another, in high-tech systems, price alone is not going to be reason enough to buy a less recognisable brand. The price is amortised over the lifetime of the machine in any event, so the effect on the cost of each printed part is marginal.

Finally, many of these companies’ entries into metal AM are very recent developments. There may be IP issues on some aspects of a system. As observers of the AM market are quick to point out, small details are often the difference between successful and less successful machines. While development cycles for new machines have shortened considerably, and although some Chinese companies might be inspired by what they see in more mature metal platforms developed primarily in Europe, it is still not a straight and quick line to market for less-mature brands.

The wealth of activity in China should be viewed as confirmation of the mid- to long-term potential of metal AM, with manufacturing being the operative word. China prides itself on being a global industrial engine and the embrace of metal AM as a manufacturing modality is noteworthy. This is especially true in a country where lower costs, inexpensive labour and mass-production are generally the differentiators. The fact that so many companies have taken the plunge into metal should be particularly encouraging. Established international AM brands are still in demand in China. The largest single systems sale in the history of AM was disclosed by Germany’s SLM Solutions in 2017 and involved the procurement of fifty SLM 280 machines valued at €28−43 million. The purchaser of these systems was an organisation in China.

Finally, we cannot ignore new technologies in the metal AM space. At the IMTS show in Chicago in September 2018, HP revealed a new metal binder jetting technology. Other companies, including Desktop Metal and Stratasys, have launched or announced new metal printing technologies. It is too soon to tell how they compare to proven metal PBF or DED systems and how this might affect the commercialisation of older technology in China. New technologies must inevitably give some pause for thought, even among Chinese entrepreneurs and managers who are perhaps less risk averse than their Western counterparts. Since the IP of new technologies will be protected, even in China, this will present a significant hurdle for Chinese companies, as it no doubt will for metal PBF systems in the west.

The Chinese market is exciting, but also an enigma. Even colleagues on the ground are sometimes unaware of all of the advances and identities of participants, such is the extent and pace of development there. Many companies are not likely to make it, or will consolidate, as is the way of things. One way or the other, we expect a lot of news from China.

Acknowledgements

Special thanks to Jack Cheng of Farsoon Technologies and Jin Tianshi of voxeljet China for help in the preparation of this article. Thanks also to Michael Kowen, a PhD candidate at the University of California, Berkeley, specialising in comparative corporate technology culture in China and the US.

Author

Joseph Kowen is an industry analyst and consultant who has been involved in rapid prototyping and AM since 1999. He is a principal of Intelligent AM, a consultancy specialising in the business of Additive Manufacturing.

Joseph Kowen,

Intelligent AM

Tel: +972 54 531 1547

[email protected]

www.Intelligent-AM.com