Findings from Wohlers Report 2022: Taking a chance on new technologies and the evolving materials mix

Getting to grips with what is really happening in our industry can be a tricky business. Thankfully market analysis is available from a number of expert sources, with the longest established being the Wohlers Report. Here, Noah Mostow, Olaf Diegel, and Terry Wohlers share insight from the recently published 2022 edition, including an overview of machine sales, the acceptance of a new breed of technology suppliers, the growth of service companies, and the evolving metal AM material mix. [First published in Metal AM Vol. 8 No. 2, Summer 2022 | 10 minute read | View on Issuu | Download PDF]

Metal Additive Manufacturing is relatively new compared to polymer AM, but has seen consistent growth and adoption over the past decade. New applications have developed in the aerospace, automotive, healthcare, and dental industries, to name just a few. Interesting application examples include heat exchangers, fuel nozzles, and tooling with performance-enhancing conformal cooling channels. Over the past twenty-seven years, the annual Wohlers Report has offered insight into the state of the AM industry.

The report comprises quantitative and qualitative analysis of the industry and technology for users, machine manufacturers, and material producers. For Wohlers Report 2022, 117 service providers, 114 AM machine manufacturers, and twenty-nine third-party producers of materials provided information and data on the AM industry. During the data gathering process for Wohlers Report 2022, companies were approached for information about their experiences in the 2021 calendar year.

The information gathered included growth/decline figures, information on sectors adopting AM, and a wide breadth and depth of other detailed information.

For this article, the principal authors of Wohlers Report 2022 have highlighted some of the key takeaways from the report. Among them are the fact that ‘hot’ sales of metal AM machines have cooled to an extent over the past three years. The number of metal powder producers has also grown, while buying trends have shifted.

Metal AM machines level off

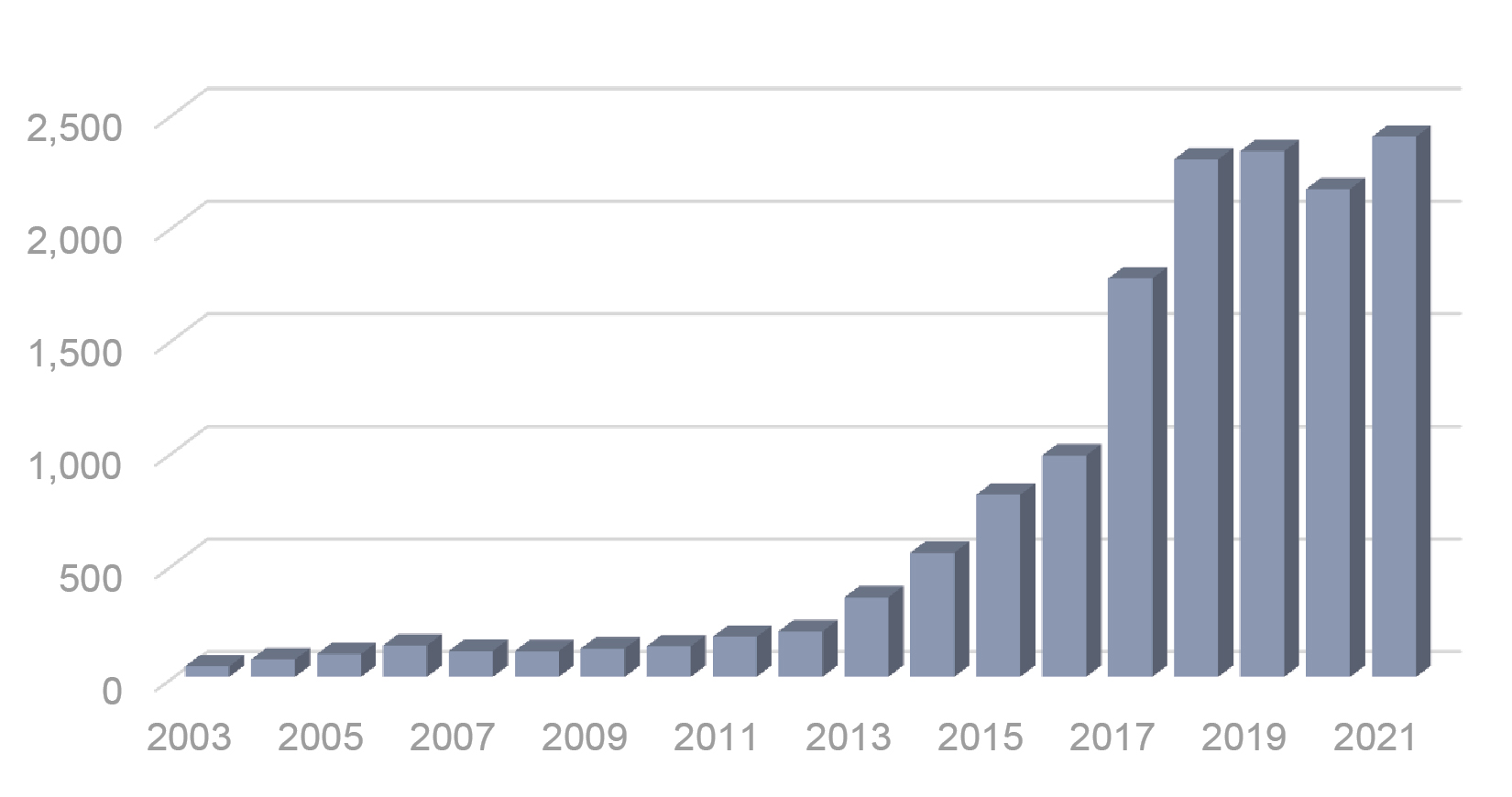

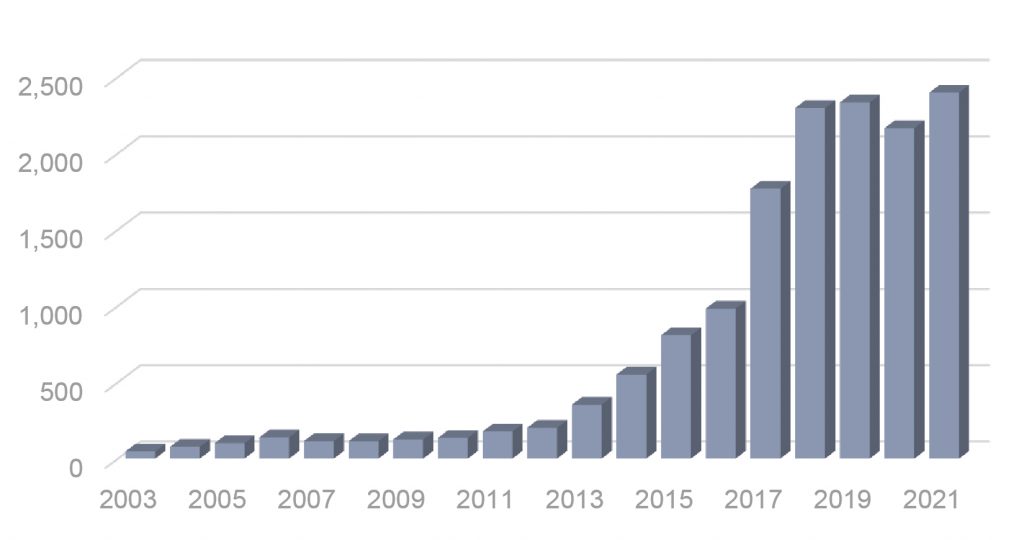

Research for Wohlers Report 2022 indicates that the number of metal AM machines sold every year has plateaued since 2018. Fig. 1 shows the number of such machines sold each year by companies around the world. Wohlers Associates saw a decrease in the number of machines sold in 2020, inevitably due to the impact of the COVID-19 pandemic. However, from 2018 to 2021, the average number of metal AM machines sold has been in the range of 2,350 units per year. The effect of the pandemic may, of course, have continued to impact sales growth 2021.

The metal AM industry is strong and growing, a primary factor driving the development and commercialisation of new metal AM machines. Even so, these efforts do not appear to have contributed to an increase in the number of machines sold. This may well change as the industry continues to rebound and government initiatives focus on creating robust supply chains with the help of AM.

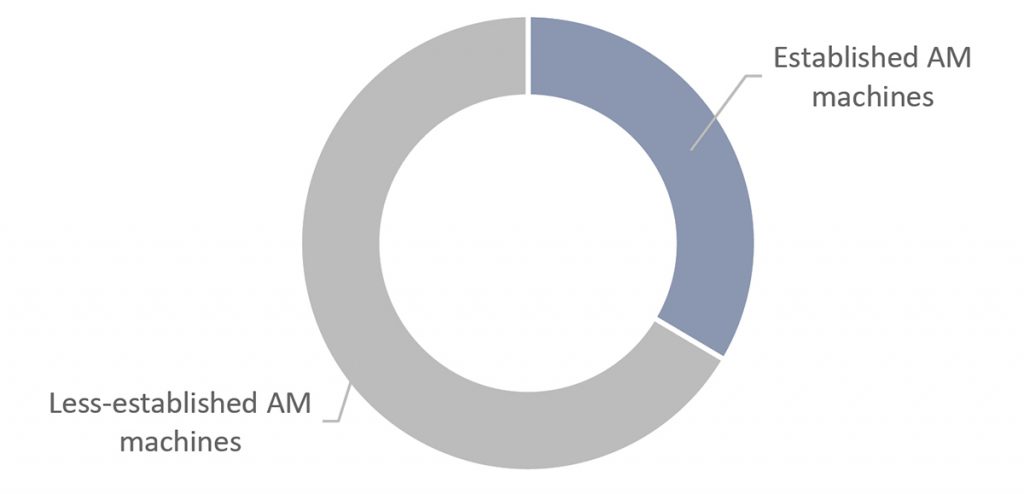

For companies entering the metal AM industry, research for Wohlers Report 2022 shows that many are purchasing machines from less-established machine manufacturers. These machine manufacturers are typically relatively new to the AM industry, and some are startups. Established companies include 3D Systems, EOS, Renishaw, GE Additive, SLM Solutions, and others. Fig. 2 shows the percentage of metal and polymer AM machines purchased from established versus less established machine manufacturers by 117 service providers worldwide.

This is the second consecutive year in which service providers purchased more machines from less-established machine manufacturers. It suggests they are willing to accept some risk by buying less developed platforms. Potential benefits include lower cost machines with features they may not otherwise get if buying a similarly priced alternative from an established manufacturer. Metal AM machines are typically expensive, so buying from new manufacturers shows an increasing level of trust in AM.

Growth is not uniform

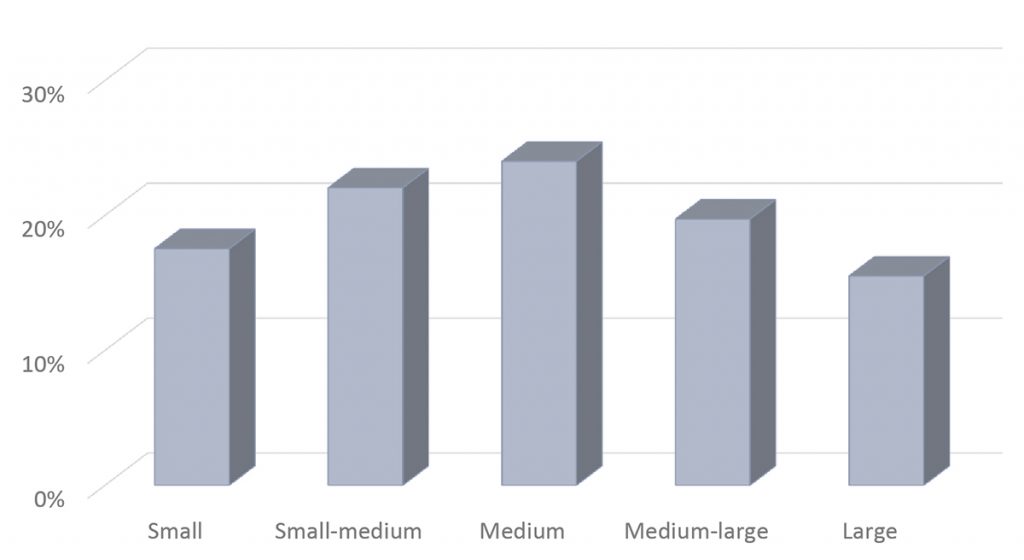

The AM industry is made up of varying sizes of companies. In preparing Wohlers Report 2022 the authors asked companies, for the first time, for the number of employees they have. Focusing specifically on the 117 service providers who responded, the initial hypothesis was that AM service provider growth would be uniform regardless of size. Surprisingly, as seen in Fig. 3, small companies of less than twenty and and large companies greater than 250 grew the least. Medium-sized companies (50–100 employees) had the largest growth average of 24%.

As companies grow larger, they become more bureaucratic with structures that can make them slower to react and innovate. When reviewing the number of new products introduced each year by large companies, they are roughly the same number as for a company of 20-100 people in size. It is all too easy for large companies to be hindered in the development process by bigger teams and additional bureaucracy, limiting their ability to move quickly.

Growing powder product lines

For metal Powder Bed Fusion (PBF) in particular, powder production can be expected to grow in step with the number of machines sold. As of May 2022, Wohlers Associates was tracking sixty-nine active third-party producers of metal powders. This excludes AM machine manufacturers selling their own branded powder. By comparison, Wohlers Associates was tracking forty-six producers in 2018.

A growing number of producers of metal powders is good for the industry. Competition often brings new or more efficient ways of producing quality powders while lowering prices. Currently, the cost of powders for metal AM can be many times higher than a similar metal produced for conventional manufacturing.

One surprising finding from Wohlers Report 2022 is the shift in the types of alloys that are profitable among service providers. Fig. 4 shows the most profitable materials in 2020 and 2021, according to service providers. In 2021, 17-4PH stainless steel saw the largest growth as the most profitable material.

In the two charts, nickel alloys include Inconel 625 and 718. The growth in nickel alloys may be attributed in part to the aerospace industry, which has been adopting this material for launch vehicles. For example, Launcher, a California startup, is using the material to produce propellant tanks. Other specialised alloys not shown in the chart include copper alloys, with one example being copper-chromium-niobium, classified as GRCop-42 by NASA, and developed specifically for aerospace applications.

Post-processing costs

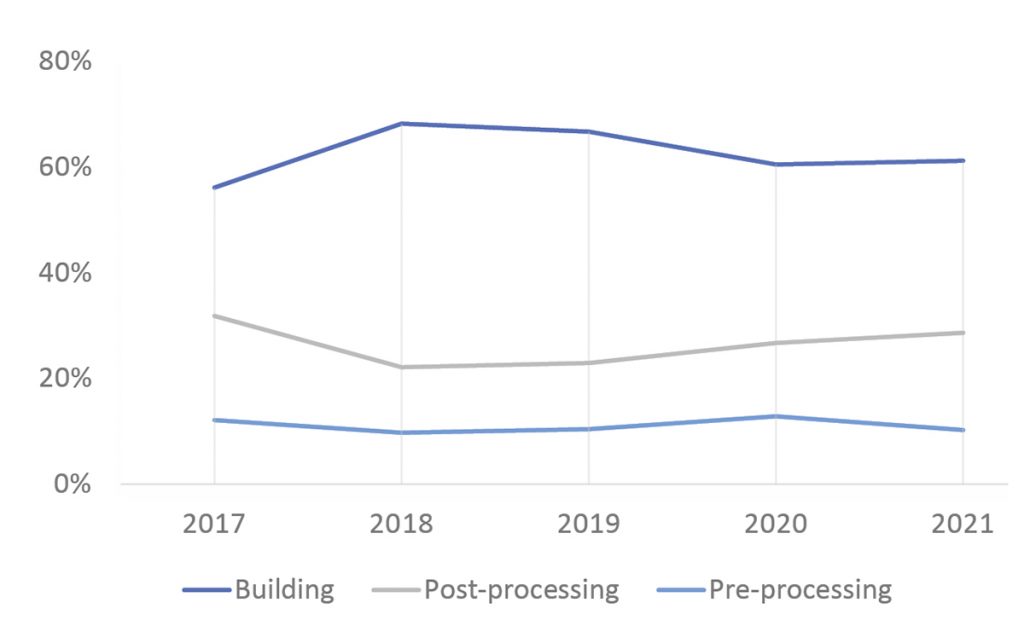

Post-processing represents the steps taken after the completion of an AM build to achieve the desired final properties and tolerances. This includes powder/support material removal, heat treatment, machining, and surface finishing. Wohlers Associates has been tracking the breakdown of how much companies spend on pre- and post-processing as well as the building of parts. Fig. 5 shows the historical trend of metal AM since 2017.

Many would assume that with time, and an increased understanding of the process, combined with advancing technology, the cost of post-processing would decline. It has not. The increasing cost could be due to additional requirements in the aerospace, defence, healthcare and energy sectors. The removal of powder and support material and the need for high-quality surfaces add to the expense.

As more automation methods and hardware solutions enter the market, we may see the cost of post-processing decline for some applications. This would be a welcomed change, especially as production quantities increase. A reduction of manual labour while increasing standardisation could help more than anything.

Increase in investments

Wohlers Report 2022 tracks companies that receive funding, whether through private or public investments. In 2021, metal AM companies including 3D Metalforge and Freemelt raised millions of dollars in initial public offerings. Titomic, an Australian company, raised $6.6 million through a secondary offering on the Australian stock exchange. A large player within AM’s aerospace sector, Velo3D, raised $274 million by going public through a merger with a special purpose acquisition company (SPAC) and a private investment in a public entity.

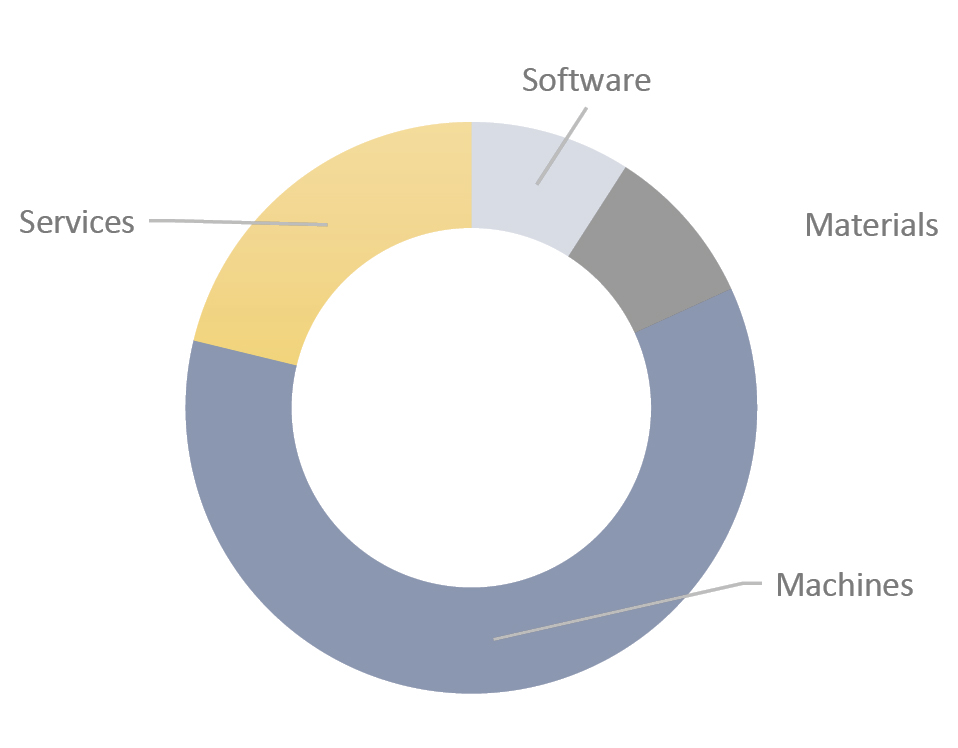

The investments in the wider AM industry include AM machines, services, software, and materials. Fig. 6 shows that AM machines accounted for the most investment by far. The AM industry will benefit the most if all four areas receive strong investment and development over the coming years.

Conclusion

The metal AM industry continues to develop impressively. Even so, it faces challenges, such as reducing costs and increasing adoption in the automotive sector. New companies entering the metal AM market see the opportunities but also understand that they face fierce competition. The technology produces parts that create opportunities that were previously impractical or impossible. Investments in AM continue to expand, with an interesting number of companies going public in 2021. With so much activity and compelling use cases, Wohlers Associates sees a great future for metal AM.

Contact

Noah Mostow, Olaf Diegel, and Terry Wohlers

Wohlers Associates, powered by ASTM International