The third Munich Technology Conference: The challenge of AM adoption and the inside track on aviation

Now in its third year, the Munich Technology Conference series has achieved a remarkable status in its short history. It is recognised not only for bringing together the most powerful and influential minds in the international AM community, but for engaging them in open and broad-ranging discussions on the future of the industry. It is also an event that unashamedly ‘wears its heart on its sleeve’, having grown from the optimism of MTC1 to MTC2’s call for vital collaboration, and a ‘reality check’ in the face of economic uncertainty at MTC3. Metal AM magazine’s Emily-Jo Hopson reports. [First published in Metal AM Vol. 5 No. 4, Winter 2019 | 35 minute read | View on Issuu | Download PDF]

The third Munich Technology Conference (MTC3), organised by Oerlikon and its partners GE Additive, Siemens, Linde, McKinsey, TÜV SÜD and the Technical University of Munich (TUM), took place in Munich, Germany, from October 8–10, 2019. Since its inaugural outing in 2017, which welcomed around 600 attendees, the Munich Technology Conference series has become one of the most anticipated events in the Additive Manufacturing calendar, with 2019’s event reporting visitor numbers in excess of 1,500 from thirty-two countries. With the title ‘Additive Manufacturing: Accelerating the Industrialization – A Reality Check’, the MTC3 conference programme once again featured a number of prominent speakers from industry, academia and politics for frank and in-depth discussions on the current state of the Additive Manufacturing industry, barriers to full industrialisation, and the strategies which companies can take to help drive it towards this goal.

Welcoming attendees to MTC3, Prof Michael Süss, Chairman of the Board at Oerlikon, stated, “Three years ago, when we started MTC, there was a little less headwind and a little more tailwind. Since 2017, we have seen outstanding achievements which are really widening the scope of Additive Manufacturing. However, innovation is ‘a shy deer’, and when you have an economic crisis ahead – when the top economic powers of the USA and China are imposing taxes on one another, and German cars are seen as a threat to the national security of the USA, then something is not right. Innovation needs an environment where people are proudly and strongly moving forward; where they are ready to invest money in things which may materialise in three, five or ten years down the road. When people see negative indications, they will slow down.”

This notion of cooling market expectations was echoed throughout, but the overall impression given by both the panellists and the audience – polled live at regular intervals via the innovative event app – remained optimistic. AM, like all industries, may face a challenging period in the near future in light of the economic uncertainty which is the result of a looming trade war, but enthusiasm and investment in the industry remain relatively strong.

While the market predictions of 2017, which often forecast 50 or 100% growth in the coming four or five years, have been replaced by somewhat more realistic projections of 10, 15 or 30%, these predictions are still highly positive in the context of a global manufacturing industry which is preparing for a challenging future. As Prof Süss stated, the race to industrialise AM is still ongoing, but, “it is less a sprint now, more a marathon. The companies which were in additive twenty years ago have stayed in additive, kept pace with additive, continued investing in additive, and are not slowing down,” indicating the staying power and sustained development of a technology which has, in some quarters of conventional manufacturing, previously been regarded as a ‘trend’. However, there is work to be done if AM is to shed this reputation and prove itself competitive outside of its relatively small pool of users and niche applications.

“We have very good success in small series,” stated Prof Süss. “Companies like Bugatti and BMW are already using additive parts in production, not just to say they are, but for good reason – but we are not yet industrialised. The takeaway from a conference like this must be what we have done and what we can do to make our goals visible, achievable, and in the end: do it. Not just talking, but executing. The examples we have with the markets we are approaching are not enough; we have had some success, but we can do so much more.”

So, what can the industry do better in order to drive Additive Manufacturing to the next stage of true industrialisation? According to Prof Süss, there are several areas which should be targeted as the industry takes its next steps. “We can team up and make better partnerships, we can team up and show people within the customer base what the benefit of AM is, and we can show society the benefit of AM,” he explained. He also noted that, productivity-wise, Additive Manufacturing remains a long way from where it needs to be. While many Additive Manufacturing systems offer considerable capabilities and power to their users, these strengths are to some extent being wasted by the technology’s currently limited capacity and the progress which is yet to be made on optimising for production, not just in terms of volume but in terms of application development and materials.

To miss the opportunity and to waste the competitive advantages offered by both AM technology itself and the ‘tailwind’ of keen interest and investment which surrounds it would be, Prof Süss believes, a criminal act. “But if you want to become part of this ecosystem, then you have to stay speedy, innovative and creative,” he stated. The series of panels and presentations given at MTC3 by forty-nine speakers from industry and academia aimed to help attendees understand how to do just that.

Collaboration as key to industrialisation

Many challenges need to be overcome along and beyond the value chain for Additive Manufacturing to truly industrialise, and to overcome these challenges, industry, politics and science must work closely together. In one expert panel, leading figures from across the AM value chain came together to discuss one of the major themes of MTC3: the importance of collaboration in the development of AM toward broad applications in industry.

Dr Roland Fischer, CEO, Oerlikon Group; Dr Jan Michael Mrosik, COO, Siemens Digital Industries; Dr Christoph Schmitz, Senior Partner at McKinsey; Holger Lindner, CEO Product Service at TÜV SÜD; Francisco Betti, Head of Advanced Manufacturing Industry at the World Economic Forum; and Todd Skare, CTO, Linde, discussed the current status of collaboration in the industry, the challenges of forming effective partnerships, and where and why closer partnerships are needed to drive the industry forward (Fig. 3).

According to Betti, the four main types of collaboration required for the effective industrialisation of AM are:

- Collaboration between companies

- Collaboration within companies

- Collaboration on the academic level between universities, or between companies and universities

- Collaboration between the industry and governments.

Each of the organisations represented within the panel is actively involved in collaborative efforts at various levels of the AM process chain. Oerlikon’s partnerships in AM have been widely publicised, most recently as a founding partner in the Bavarian AM Cluster (see inset box above), and previously in the form of collaborations with companies such as MT Aerospace to accelerate the use of AM in the aerospace and defence market; RUAG Space for the identification of applications in space components; IABG to accelerate the qualification of AM components; Hirtenberger Engineered Surfaces to improve post-processing; United Launch Alliance for the production of metal AM components for the Vulcan Centaur rocket; and Siemens for the provision of digital enterprise solutions.

Siemens has notably partnered with Solukon Maschinenbau GmbH on the co-development of an automated depowdering system, which is now in its beta testing phase, and is working with BeAM on the acceleration of Directed Energy Deposition (DED) technologies, to name just two examples. Linde, also a founding member of the Bavarian AM Cluster, has in the past year announced collaborations with Liebherr-Aerospace to optimise AM aluminium aircraft components, and with Gefertec to investigate the influence of process gas and oxygen on AM builds. The nature of McKinsey, as a management consulting firm, the World Economic Forum as a global public-private cooperation organiser, and TÜV SÜD as a certification provider, means that their activities depend on the industry’s willingness to work collaboratively.

When polled via the event app’s survey feature, 54% of the audience attending the panel responded that they saw the current level of stakeholder collaboration in Additive Manufacturing as satisfactory. However, the majority of panellists disagreed, stating that the current level of collaboration is not deep enough and does not cover enough of the value chain to achieve its goals.

Dr Mrosik noted that while the industry has seen some highly visible collaborations in recent years, current collaborative efforts are simply on too small a scale. “We’re in a situation with AM where, from laboratories and small-sized applications, we need to move into scale. Different things are required for this; it’s required that more material manufacturers, machine builders, machine users and designers have to collaborate together to create close process chains and homogeneous processes in order to scale up and achieve higher efficiency,” he stated. “That’s where all parties need to work much more closely than has happened in the past; there’s where the dissatisfaction is.”

While several initiatives have endeavoured to make this a reality by bringing together large numbers of companies in recent years, with a number of AM networks established, Dr Mrosik voiced the need for this process to be accelerated if the industry is to see results within an acceptable timeframe. But what is holding the industry back from achieving the kind of depth and breadth of collaboration required? According to Lindner, the primary factor which is missing is trust in the Additive Manufacturing process from companies which could potentially benefit from adopting it as a manufacturing technology through partnerships.

“The processes, the materials, the machines and the management are good enough now to produce parts that are at least as good as traditionally manufactured products,” he stated – but due to the comparative newness of the technology, many companies are wary of committing to major partnerships to produce parts which may open them up to failure. “At TÜV SÜD, we hope that based on trust, the ecosystem ‘helpers’ who can collaborate to drive the industrialisation of AM can have the courage to single out good applications – because unless we can find these commercially viable applications, where the products are in use, and demonstrate that not only is AM technology ready, but also AM applications, we will not be able to accelerate.”

Skare agreed with the panel that while collaboration is ongoing, the applications which are being tackled remain somewhat ‘incremental’, meaning that they are aimed at the development of small-sized applications in which the risk of failure is minimised. “I don’t know if that’s because companies are reticent to open up and let in bigger applications, or because we don’t have those bigger ideas,” he stated.

In order to chase those larger applications and thus bring AM to larger-scale industrialisation, “collaboration across the whole value chain needs to target, as an industry, faster, cheaper production, whatever that may involve,” he explained. “If we want Additive Manufacturing to really take off and be a new industrial revolution, we need to change companies’ evaluation of moving into additive from what is now a long spreadsheet of figures on which optimised Additive Manufacturing costs about the same as conventional manufacturing – for some applications – to a spreadsheet which shows a 20% improvement in cost so that people are driven to dive into it rather than wondering if they should sit on the sidelines and ‘wait and see’. Even within Linde, our ‘spreadsheet’ tells us to wait a little longer. We need cooperation to find that step-change which can move things forward.”

Schmitz took a more positive view, praising the development of large-scale collaborative AM networks over the past three years across the value chain; but, he agreed, the current speed of industrialisation is not satisfactory, and the partnerships which have been established to date must be leveraged effectively in order to accelerate. “The current level of collaboration between members from across the value chain offers a great opportunity to move from today’s polarising ‘tech-forward’ approach, where we develop technologies, to a more ‘application-backward’ approach,” he explained, “and from a networked collaboration system to much more targeted and focused collaborations through which projects are undertaken to deliver and industrialise AM applications… and not get locked in and grounded at our current small-scale applications.”

With so many major organisations so keenly aware of the importance of cooperation for success, why does the status of collaboration still – in the panel’s view – lag behind what is needed to get the AM industry to where it needs to be? Dr Schmitz stated that a major obstacle was the absence of the necessary business models to enable the types of collaboration needed. A dominant dimension to this issue is the cost of funding new business models at the company level, and the difficulty of making the business case for this investment when the returns are yet to be proven. “I personally believe the biggest lever would be to go look for solutions-focused applications and products and then work backwards, and ask what it would take to improve the cost and make a global, full-value chain business case, not only a unit cost case,” he stated. “This dedicated work is very important; we must find a much more targeted approach, which will enable our cooperations to become much more effective and solve issues where business models are concerned.”

Expanding beyond business models, Dr Mrosik introduced the vital importance of a global system of standards for AM from Siemens’ perspective. “The market needs a common denominator in order to collaborate,” he explained. “Additive Manufacturing machines need to be integrated into manufacturing lines and ecosystems, and for this we need common standards. We’ve seen [at Siemens] that once standards are established, collaborations unfold and markets grow, because acceptance grows in the market.”

Asked how trust issues regarding the sharing of intellectual property impact companies’ approach to collaboration, Lindner agreed that there are hurdles to overcome when inviting companies to cooperate with entities which would typically be seen as competitors. However, he stated, “those contentious issues regarding whether it is my data or your data, how much I pay you for using your data, and in exchange how much do I give you back,” are purely internal discussions between players, and do not take into account the human-based engineering which is at the heart of innovation, or the interests of the end customer. “Sometimes, this is used as an excuse to hide behind the complexity of legal issues and competitive emotions; this is about attitude, and should not be seen as a roadblock to collaboration.”

Bringing the panel to a close, Dr Fischer issued a call to action for senior management in the AM industry to ‘step up’ to drive collaborative efforts. “It starts with us,” he stated, “and it’s not only dedicating staff to working groups but also having direct and close contact with other companies in industry. Without regular contact we can’t trigger the right momentum. That’s what I take home, what I keep in mind and what I am getting prepared to do.”

Industries driving AM: Aviation

One of the most fundamental routes to increasing the industrialisation of AM is to consider which markets can best drive demand for AM in its various stages of maturity, and encourage decision-makers within those industries to buy in and engage with the technology. Additive Manufacturing is currently being tested in a wide range of industries, but there remain broad discrepancies in terms of the scale at which industries are willing to engage with the technology. On the path from prototyping and experimentation to mainstream industrial production, some markets have made significantly more progress than others.

In this year’s Driving Industries panel, the focus was on aviation, an industry already reaping the advantages of AM in many real-world applications. On the panel were Dr Remedios Carmona, Additive Manufacturing Roadmap Owner at Airbus; Dr Melissa E Orme, Vice President Boeing Additive Manufacturing; Dr Anne Thenaisie, Managing Director Safran Additive Manufacturing; Paula J Hay, Executive Director, Additive Design and Manufacturing at Collins Aerospace; and J D McFarlan III, Vice President Functional Engineering, Lockheed Martin Aeronautics (Fig. 4). Each of these high-level panellists presented case studies in which they offered their market assessments for AM, looking at what role the technology already plays in aviation with a range of success stories, and what can be learnt from these successes to accelerate its serial use.

Airbus

Airbus began using AM approximately ten years ago, primarily for models and tooling. Now, the company uses a number of Additive Manufacturing technologies in both metal and polymer, including Fused Deposition Modelling (FDM) and powder bed fusion of polyamides for non-loaded system and cabin parts, and Electron and Laser Powder Bed Fusion (EB- and L-PBF) using primarily titanium, aluminium and Inconel alloys. Titanium alloys are used for loaded parts, long lead time items and very high added value parts, aluminium for lightweight components in satellites, and Inconel for high-temperature and long lead time applications.

At MTC2, Airbus reported that it was interested in AM, but still at an early stage in its adoption of the technology. The main barriers at the time were the company’s very high part requirements, the lack of mature AM machines and the marginal nature of the business case for AM. “We need to juggle with those three to make business out of additive,” Dr Carmona explained at MTC3. “As of today, we can say that AM machines have improved in reliability, though there is still a lot to do. We have found that powder bed metals have only niche applications, so we will only be using this technology for very specific components. However, we are already in the first stages of serious, industrial production of non-critical parts by powder bed AM.” For this use to expand and target a wider range of Airbus components, Dr Carmona echoed the sentiment seen across many of MTC3’s panels and presentations, stating that performance and competitiveness both need to be improved and that design for AM is key.

Some successful examples of AM parts produced by the company were given. The first was a Venturi duct, a water waste system installed on the A350 as part of a design-to-cost initiative carried out by Airbus. Produced by Airbus-owned STELIA Aerospace in Germany, the Ti6Al4V part was produced using AM to save on recurrent costs. The main lesson which Airbus took away from the development and serialisation of this part for AM, Dr Carmona said, was that industrialising complex parts, or relatively complex parts, such as this makes sense for AM, and provides benefits even if it is a one-to-one part replacement and not an entirely new component.

The next example concerned a Nacelle Anti-ice O-Ring. This device takes hot air from a jet engine and passes it into the Nacelle inlet, preventing icing. Due to its complexity, Airbus faced a number of issues when producing this part using casting, stated Dr Carmona, resulting in a high number of scrapped parts during production. “We resorted to additive mainly as a back-up, but now it’s the baseline, standard solution,” she stated. The part is currently qualified for and flying on the A330NEO, and the company is now carrying out a similar qualification process for the A350 and A320NEO. “Additive has proven to be more competitive and more reliable in terms of production than the cast part,” Dr Carmona added. “Our main lesson here has been that when compared with casting, AM can be highly competitive.”

The final application presented was a door latch shaft designed specifically for Additive Manufacturing in Ti6Al4V and installed on the A350 (Fig. 5). Manufactured in Germany by Airbus Helicopters Donauwörth, the new AM component consolidates ten parts into just one, resulting in production cost savings over 20% and a weight reduction of more than 40%. This part, too, has completed qualification. “Here, the main learning is that the integration of components through Design for AM is the key, and it will continue to be the key for us at Airbus,” Dr Carmona commented.

Collins Aerospace

Hay was enthusiastic about the adoption of AM at Collins Aerospace. Opening her presentation, she stated that thanks to the wide range of parts it produces, from large-scale landing parts to tiny lights and sensors, “Collins Aerospace has huge opportunities to apply additive – to the point where we probably have more parts and ideas than we have people that can even begin to think about them all.” The first example given of a successful AM application at Collins Aerospace was a space housing (Fig. 6), currently in production, followed by a thermal management device, also in production, and an AM heat exchanger (Fig. 7), which is completing development prior to entering production.

Commenting on the biggest lesson she had taken away from the development of these three applications, Hay stated that, “While the technology was certainly challenging in each of these parts, I’m not sure it was the biggest challenge we had. We have amazing engineers, and if we give them a tough problem, they will figure out how to solve it. But if they don’t have an organisation which is going to support and help them to do that, and apply this new technology, it’s really hard.”

So, what can the AM industry do to encourage organisations to provide this support? “If you don’t have leadership buy-in, it’s never going to happen,” Hay explained. “You need to talk to them, get them involved, and change their mindset to ‘how is additive going to solve my customer problem or my business problem?’” The key here is to educate leadership about the benefits and business models of AM and dispel some of the negative myths surrounding it, while being honest about the challenges posed by its adoption and the lead time required to bring new AM applications to fruition. “There are so many people in the chain who could say no,” explained Hay, “and you have to get them involved to make them say yes.”

The next major challenge Hay noted was the often spoken of skills gap in the AM industry. Primarily due to the newness for the technology and lack of AM-specific qualifications available, the pool from which companies can hire staff with the relevant proficiencies in AM processes, design, software, materials and more is comparatively small. Even where staff with these proficiencies can be found, experience has taught Hay that the path to integrate them into a company’s wider talent base may not be easy.

“We have a very experienced engineering population in the aerospace industry who’ve lived through many painful stories,” she explained, “but they aren’t used to additive, they don’t think additive and they’re not trained in additive.” When new, additive-focused engineers join the company, their excitement is not often met with enthusiasm, or willingness to experiment with what is seen as an untested technology.

On the importance of collaboration as one of the most important drivers for the industrialisation of AM, Hay’s belief is simple – no company can do it all alone. For example, she said, “every one of us is probably spending money right now to characterise all the major materials on every major machine from every different powder manufacturer. That’s a lot of money – and a lot of repeated money.” However, if organisations can identify and pursue partnerships which offer a win-win for both parties, masses of repeated, cost-ineffective research might be eliminated. Where issues of trust and intellectual property arise, Hay believes that companies need to be realistic and honest about what ‘counts’ as IP and what doesn’t. “Just because you’ve invested in something doesn’t make it critical IP that’s going to be a competitive discriminator for you. Find people that you can work with, start small, try things, and go from there.”

Safran Additive Manufacturing

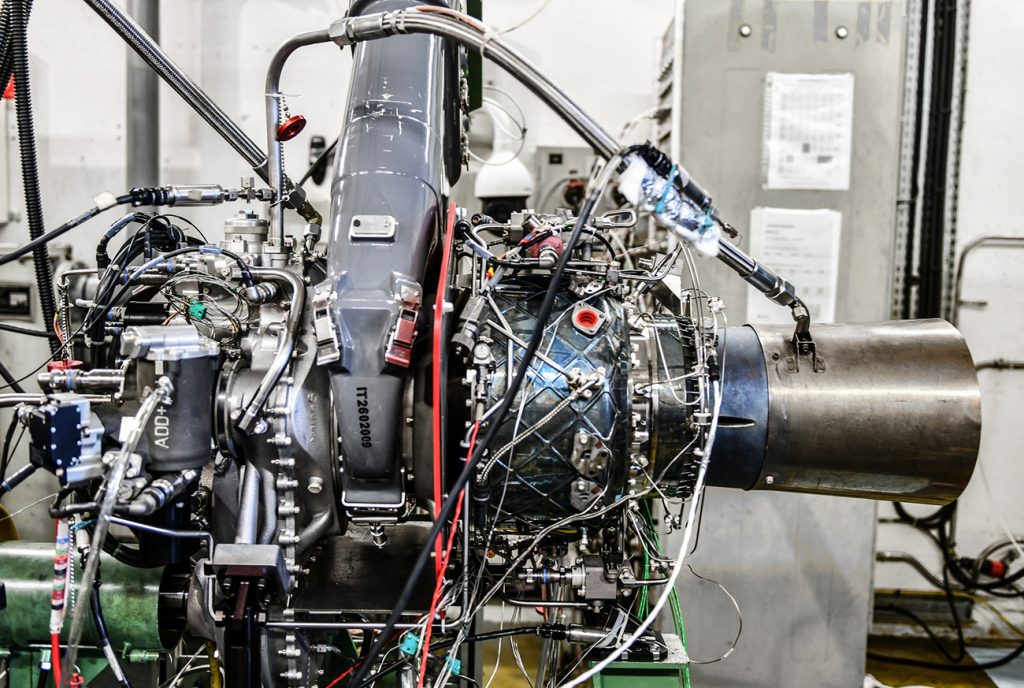

Created five years ago, Safran Additive Manufacturing sits within Safran Tech, the research wing of Safran, whose innovations and capabilities are shared across the group’s varied companies. The business’s efforts to take advantage of the full benefits of AM have been highly publicised, and include a number of projects focused on driving the acceptance and industrialisation of AM in aviation, and the implementation of AM parts in real world applications. At the Paris Air Show in June this year, Safran Group unveiled the Add+ engine, a concept demonstrator featuring almost 30% AM components (Fig. 9).

When Safran acquired its first AM system in 2008, stated Dr Thenaisie, the company’s goal was simply to use AM to replace cast parts with long lead times. In addition to this, it is now working on AM as a repair solution and for the production of spare parts on demand, but the main aim across all its AM projects is still to achieve sensible mass reduction on complicated parts. The company began with a single EOS machine, on which it prototyped parts such as static vanes, primarily in nickel-based alloys. With the production of prototype parts on this first system having proved successful, further machines were added, along with peripheral equipment. “Adding in-house equipment allowed us to get good specification on powders,” Dr Thenaisie explained. “We were also able to specify procedures for repeatability, maintaining consistency across machines.”

While at the start of its AM journey, Safran’s AM production was limited to one or two key materials and primarily to Inconel 718, Dr Thenaisie noted that a major shift as the technology moves further toward production readiness has been the need to add many more alloys to suit the demands of customers. “Our customers have applications which require new materials,” she stated. “If a customer says to us, ‘yes, Inconel 718 is fine, but I would like titanium,’ or ‘I need high-temperature material’, then we have to make sure the design office has the materials it needs, but we must also reduce the quantity of new materials that we use. Every time we test a new material for fatigue, for tensile strength, carry out temperature testing, etc, we are actually doing several millions of euros of work.”

The key to reducing these costs, Dr Thenaisie explained, is to encourage standardisation within the company, as well as forward-thinking materials development. “We have to find ways for our design office to work with data that already exists and ensure they are not creating a new material where an existing alloy might suffice. And if we need to design a new material, we must make sure that it covers the future needs of our customers, or we will have to design new materials every year.”

A positive takeaway from Safran’s experience in AM has been that while the AM process poses unique challenges, and the qualification of AM parts can be lengthy due to the increased level of scrutiny placed on parts produced by new production technologies, Safran has proven that Laser Powder Bed Fusion Additive Manufacturing can have better repeatability than casting. “There remain some issues for the advancement of AM to production,” she concluded. “Beyond issues of standardisation and qualification, there are the issues to solve regarding part quality and reliable part inspection. The manufacturing cost is also high; standardisation can help to decrease it. The industry still has to gain the experience and confidence to use AM more widely, but we are in the ‘trust zone’ now – we have passed the ‘hype zone’, and we are convinced that Additive Manufacturing is a solution we can use.”

Lockheed Martin

Lockheed Martin began rapid prototyping with stereolithography UV cross-linked resin AM in 1988 and adopted metal Additive Manufacturing in 2002, when it used DED to produce what it believes were the first additively manufactured titanium parts ever flown on a fighter jet, installed on its F-16. In 2011, the Juno spacecraft launched carrying what the company further believes were the first additively manufactured parts ever to fly in space; L-PBF-produced titanium brackets used to hold a wave guide.

McFarlan outlined two more recent applications which evidence how the adoption of Additive Manufacturing has benefitted Lockheed Martin. The company recently began using L-PBF to produce spare titanium fittings for a climate control console in the F-22 fighter jet, replacing the corrosion-prone aluminium fittings it had previously used. The use of AM titanium reduced lead times – each replacement fitting now takes just four hours to build – and solved the issue of corrosion. However, certification of the fittings for use took six months, with the end result being that only two out of three proposed parts were approved for Additive Manufacturing. “While the production of these AM parts is very quick and reduces our lead time significantly, it is very hard to get them into service,” McFarlan stated.

The second application example was Lockheed Martin’s use of Sciaky’s large-scale Electron Beam Additive Manufacturing (EBAM) technology to produce satellite propellant tanks which would conventionally be made by die forging, resulting in a significant lead time reduction from eighteen to six months. The 116 cm (46 in) diameter vessels are produced in Ti6Al4V, and are now fully qualified and ready to fly on the GPS III satellite upon its launch.

Boeing Additive Manufacturing

Boeing has been involved in Additive Manufacturing for two decades, primarily in the areas of polymer AM and tooling applications. The company has twenty AM sites worldwide, and currently has over 70,000 AM parts flying in aircraft and spacecraft. While the majority of these are polymer, many metal parts are also in service, with the company’s first flying metal AM part having been produced in 2001. Most recently, in August this year, the company launched its metal additively manufactured AMOS 17 aft command horn antenna on the SpaceX Dragon, a cargo spacecraft.

Speaking on the formation of Boeing Additive Manufacturing in 2017, Dr Orme stated, “Our aim is to position Boeing as the leader in Additive Manufacturing. Boeing AM is an enabler for the Boeing enterprise – meaning all the units of Boeing, including commercial aircraft, defence and space, global services, etc – to insert additive into their programmes to create and own the intelligence of AM, taking advantage of the high-value aspects of AM, while developing a workflow practice that enables repeatable quality and the creation of transferable data across the AM supply chain.”

One advantage Boeing has in its efforts to industrialise AM, Orme stated, is its core culture of intracompany collaboration. The new Boeing Additive Manufacturing Intelligence Centre, currently under development, will work closely with the group’s global network of fabrication and innovation centres on the development of intellectual property and the digital aspects of the AM value chain, as well as drawing data from the group’s research and technology activities. “We are trying to drive commonality through industry standards,” she explained. “Boeing is a company which has been entrenched in its own standards for a long time, but we are working to change this. We are also trying to improve efficiencies overall and by doing this, we hope to become the global industrial champions in AM.”

Boeing is currently working closely with Oerlikon to develop standard materials and processes for metal Additive Manufacturing. The companies’ five-year agreement, announced in February 2018, is initially focused on the creation of standardised titanium L-PBF processes, ensuring parts produced by this method meet the requirements of the USA’s Federal Aviation Administration and Department of Defence.

Conclusion

In a whitepaper published following the close of MTC3, Prof Süss expressed his belief that Additive Manufacturing is “on the home stretch” in the race to industrialise. The panel discussions and presentations given in Munich this October seem to reflect this, with frank commentary on the challenges still faced by the industry being paired with positive case studies of successful applications, and a general sense that Additive Manufacturing, for all its challenges, is very much on the right track.

One theme to reoccur more than any other throughout the two days’ discussions and presentations was collaboration, which must be regarded as a necessity if the industry is to tackle the challenges that remain. That is reflected in this report, not only in the collaboration panel, but throughout. The form collaborations can take may vary, ranging from partnerships between companies on the AM value chain to enhance production workflows, to intra-company partnerships between departments, to academic partnerships with universities and research institutes, to collaborative efforts between commercial and government organisations to drive standards development. Regardless of the kind of partnership, it is clear from the discussions at MTC3, and the development of the industry over the past twelve months, that the most productive and efficient way in which companies can tackle the challenges of AM industrialisation is by working together.

In light of a seemingly constant flow of technological and applications developments, it can be easy to overlook the comparative youth of AM as a technology compared to its competitors. Consider that casting was developed in Ancient Egypt, and continues to be optimised and evolved to this day, and the twenty-to-thirty years AM has been in development seems very little time. Even modern CNC machining technology took forty-to-fifty years to reach its current state of widespread industrial adoption. Commentary around the industrialisation of AM can appear frustrated by its ‘slow’ progress, but the fact is that AM is making comparatively rapid headway.

MTC3 promised, and delivered, a ‘reality check’ on the progress of AM’s industrialisation. But while the phrase carries negative connotations, in this case, the results of the reality check are good. AM’s progress toward industrialisation has, in the past few years, been extremely positive; market predictions remain strong against a backdrop of a slowing global economy; the steps required to reach true industrialisation are well understood and being taken; and AM is industrialising at a faster rate than many of its predecessors.

Author

Emily-Jo Hopson

Deputy Editor and Features Writer

Metal AM magazine

[email protected]