Slowly but surely: Industrialising metal Additive Manufacturing the Norwegian way

While the Norwegian market for Additive Manufacturing has long revolved around prototyping and polymer materials, metal Additive Manufacturing has seen rapid development in recent years. This is in large part thanks to the opportunities that the country's oil and gas industry is now seeing in the technology. In this article, Joppe N Christensen considers why it has taken so long to get started with metal AM in Norway and introduces companies and individuals who are now leading the way. [First published in Metal AM Vol. 9 No. 3, Autumn 2023 | 20 minute read | View on Issuu | Download PDF]

After oil was discovered on the Norwegian continental shelf in December 1969, much of the country’s industry has centred around oil and gas; this sector is more than seven times the size of all other industries combined. This is the first and foremost thing that has to be taken into consideration when looking at the development of metal Additive Manufacturing in the country.

As in many other regions, the earliest activities around metal AM were led by academia and research institutions. In Norway, this was towards the end of the 1990s, when the SINTEF, based in Trondheim and one of Europe’s largest independent research organisations, started conducting research into metal Additive Manufacturing. Since then, the academic community in Norway has done a good deal of AM research, and the Research Council of Norway has supported nearly 300 AM projects since 2004 [1].

SINTEF and the Norwegian University of Science and Technology (NTNU), Trondheim, now have a joint AM lab where they actively work on industry-based projects together. The University of Agder, the Mechatronics Innovation Lab (MIL), and the Norwegian Defence Research Establishment (FFI) also focus on metal AM. The latter has produced a report on the current use of the technology, research fronts, and market forecasts up to 2045 [2].

So, if there is a lot of activity in academia, why have manufacturing companies in the country waited until now to embrace metal AM? If we are to find the reason, we must look at the composition of Norwegian industrial companies and what they produce. Here we see many small businesses, 90% of all businesses that produce metal components have fewer than fifty employees [3]. For purposes of comparison, it must be noted that the small businesses that are very active in the oil and gas industry have little to no influence on how the industry actually develops. Most subcontractor companies regularly receive orders with many variants and small series, i.e. mainly piece production, which would speak for the use of AM technology. But why has this technology not become as widespread in Norway as in other European countries?

The answer is that it is actually the oil and gas industry in Norway that has lagged behind, but that is about to change.

Early success with titanium

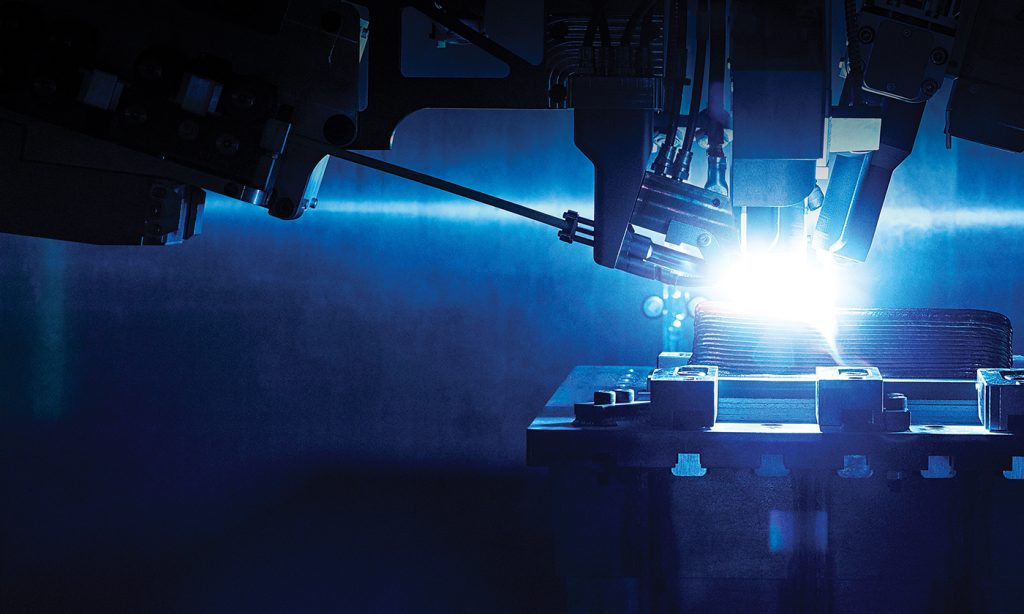

Before we take a deeper look at the Norwegian oil and gas industry, we must mention the industrial success of Norsk Titanium, which clearly stands out in the Norwegian – and global – metal AM landscape. A small team of Norwegian researchers and engineers formed the company in 2004 and, after more than ten years of materials and process research, the company perfected its wire/plasma Direction Energy Deposition (DED) process in which titanium wire is melted in an inert argon atmosphere to quickly and accurately build layers into a near-net shape part that was ready for subsequent machining (Fig. 2).

Through its process, Norsk Titanium opened up the possibility of additively manufactured structural titanium components for the aircraft industry. This is impressive, especially when you know that the aerospace industry has some of the strictest quality requirements. Norsk Titanium has several AM patents and is certified according to AS9100C, AS9100D and NORSOK M-650. Later, the company established production in the USA and, in 2021, Norsk Titanium went public.

NORSOK

Although Norsk Titanium is a Norwegian success story in metal AM, its output is primarily for the aircraft industry. The majority of industrial activity in Norway, however, is aimed at the oil and gas sector, another industry known for its stringent manufacturing requirements.

In order to supply critical components to the oil and gas sector, suppliers must, among other things, satisfy the requirements set out in NORSOK standards. Since 1994 NORSOK standards have been developed by the Norwegian petroleum industry to ensure sufficient safety, value creation and cost effectiveness for industry development and operation on the Norwegian continental shelf. Furthermore, the standards are intended to replace the oil companies’ individual specifications and serve as references in the authorities’ regulations.

A lot of time, work and industry knowledge goes into these standards and, as such, they may not necessarily reflect the most up-to-date manufacturing processes. It has, therefore, taken many years to develop specifications relating to metal Additive Manufacturing for use in the oil and gas industry.

So far, so good…

Compared to other countries in Europe, the Norwegian AM environment has relatively few industrial metal AM machines. For example, when the German AM contractor FIT AG built a new factory in 2016, it had thirty industrial metal AM machines and just as many industrial polymer ones. Norway, meanwhile, had just two metal AM machines in academia and two in industry. Progress was made, however, with two notable examples of early development.

Tronrud Engineering AS

In 2010, the innovative industrial group Tronrud Engineering AS acquired an EOS M280 metal AM machine, which it used to make parts that it developed and built for its customers. By 2017, the company had really gained momentum and was in series production of its patented and in-house developed titanium silencers. Later, the company went on to invest in an EOS M290 and an EOS Formiga. The company also offers Additive Manufacturing services to third party companies.

Promet AS

The subcontractor Promet AS was the second industrial company to invest in industrial metal AM, getting its SLM Solutions 280 HL in December 2014. Promet has customers almost exclusively within the oil and gas industry and operates 24/7 on piece production using CNC milling and turning machines.

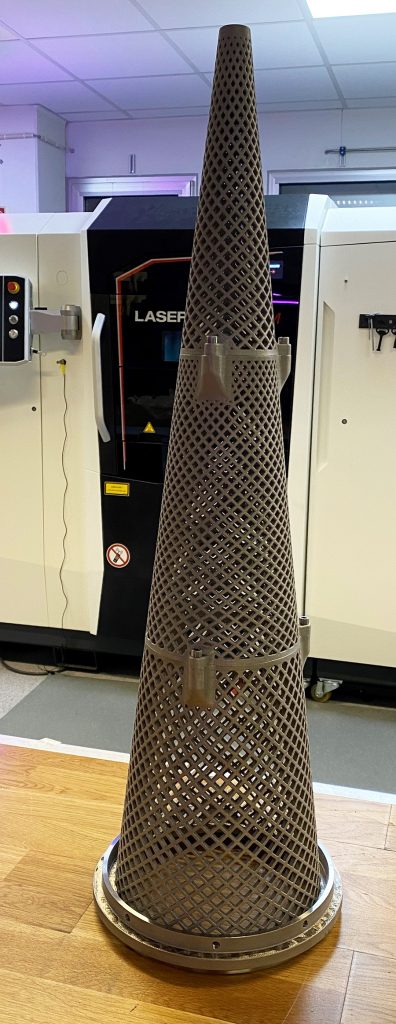

The company, which is based just outside Stavanger, organised an open house in 2015 where professionals from the oil and gas industry and academia met. Promet had many meetings with players in the oil and gas industry – from oil companies to subcontractors – and developed a good relationship with, among others, the University of Stavanger (UiS). The UiS participated in a project led by the industrial company EnergyX which resulted in Norway’s first known downstream tool for cleaning pipes additively manufactured in Inconel 718 (Fig. 3).

This was in 2016, before any AM processes were defined in standards for the oil and gas industry in Norway, so it was the customer, BP, who approved the tool for use in the field. The road ahead for Promet was long, and because NORSOK at this point did not have AM processes for metal defined in standards, there were limited orders from the oil and gas sector. After a few years, the company retired its AM offerings and sold its AM machine.

The breakthrough

In 2015, the magazine Maskinregisteret took the initiative to encourage players in the oil and gas industry to accept metal AM. The Dutch consulting firm Berenschot was invited to lead a project that aimed to demonstrate the value of metal AM for all actors in the value chain, from 3D models to fully-produced, tested, and documented applications.

On September 7, 2016, the AM pilot project started. This was the first project of its kind to invite the entire Norwegian industry, academia, and the public sector to take part in a joint promotion across industrial clusters. Three seminars were held in collaboration with the Norwegian University of Science and Technology and the University of Stavanger. The turnout was good, and the enthusiasm even greater, but after the seminars it was clear that the Norwegian oil and gas industry was not ready for metal Additive Manufacturing.

Onno Ponfoort, AM manager at Berenschot, wanted to know what was in the way; he had shown what had been achieved in the Netherlands, how difficult could it be to adopt in Norway? Ponfoort was encouraged to create an industrial project just to get a foot in the door and develop an understanding of AM technology in the oil and gas industry. He contacted key players such as the energy company Equinor and the certification and classification company DNV to probe the terrain and get a dialogue going. This resulted in the start of a ‘Joint Industry Project’ (JIP) in January 2018, which aimed to ‘standardise and optimise qualification processes for Additive Manufacturing, reduce the costs and environmental impact of production through the use of AM, and enable the use of AM in relevant design applications in the energy and maritime sectors.’

The project’s consortium included Equinor, BP, Total, Shell, Kongsberg, Aidro, OCAS/ Guaranteed (a spin-off from ArcelorMittal), Ivaldi Group, TechnipFMC, Siemens, Voestalpine, Vallourec, SLM Solutions, Additive Industries, Quintus Technologies, HIPtec, IMI CCI, Advanced Forming Research Centre of the University of Strathclyde, Immensa Lab and Sandvik. This was a breakthrough for the oil and gas industry’s investment in metal AM in Norway and the start of a long journey.

Equinor as a driver of AM

With several AM processes now defined for the oil and gas industry, Equinor could set about exploring exactly why one should produce components by metal Additive Manufacturing. There was a lot of talk about how wonderful the technology was, but were there really any gains to be made? “From Equinor’s perspective, we looked at what AM technology could do for the end users, what we were solving with metal,” stated Brede Lærum, Head of the AM Center of Excellence, the AM venture of Equinor.

Lærum has been a keen promoter of Additive Manufacturing for many years and has a strong profile within the Norwegian AM community. He believes there are several reasons to use the technology, both within and outside of the oil and gas industry. “Additive Manufacturing is a technology that is exclusively based on digital information. Without a 3D model, there is no part. If we follow the digital trail, we soon find out that spare parts, which are very critical in the oil and gas industry and other industries, do not necessarily have to be physical and be stored in a warehouse. We can have digital spare parts and produce them when we need them,” explained Lærum.

He painted a picture in which all actors have digital drawings, which are sent to and from each other as needed, and where everyone can make money from their efforts along the way until the finished part is produced. “If everyone who has a spare parts warehouse starts calculating the costs of having such a facility, they will find out that there are very large sums invested in things that are not in use. With digital warehouses, we can make big gains,” Lærum stated.

He also urged consideration about the environmental impact of unused spare parts and time to market. “Of course, we get a better environmental footprint when we don’t have to ‘overproduce’ spare parts that are never used, but there is another dimension in that we can produce locally. Not only do we save transport costs and environmental emissions, but we get solutions delivered faster to where they are needed most, because AM technology has great advantages in terms of time.”

He continued, “A digital part can be moved in seconds to where the part is needed. Although with today’s technology you have to allow many hours to build a metal component, AM technology is competitive compared to a traditionally produced part when you take into account all the upsides. This bodes well for more sustainability, not only in our industry, but in all other industries as well.”

Lærum added that Equinor is not alone in its AM investment, “We have established a collaborative project with a total of eight energy companies. Our goal is to create an entire ecosystem and develop new methods to extract the benefits from the use of AM technology and digital spare parts warehouses. Furthermore, we want the positive results we achieve together, by using AM technology, to also reach other industries.”

“As I see it, we have four clear advantages when using AM: Firstly, a cost reduction; secondly, a significantly reduced environmental footprint; thirdly, increased delivery security; and, last but not least, local value creation. The latter is important, and will create momentum, because if we can produce locally and sell globally: anything is possible. For example, as with music streamed on Spotify, the whole world will get a boost on several levels, and the biggest perhaps is a sustainability improvement,” Lærum emphasised.

Examples of activity today

FieldMade

In 2016, a start-up company called FieldMade spun out of the Norwegian Defence Research Institute. As the company name suggests, it is about Additive Manufacturing in the field, and, unsurprisingly, the initial focus was on the Norwegian Armed Forces. FieldMade quickly took part in the Norwegian Armed Forces’ field exercises and proved that it was entirely possible to produce spare parts for combat units at sea and on land (Fig. 5).

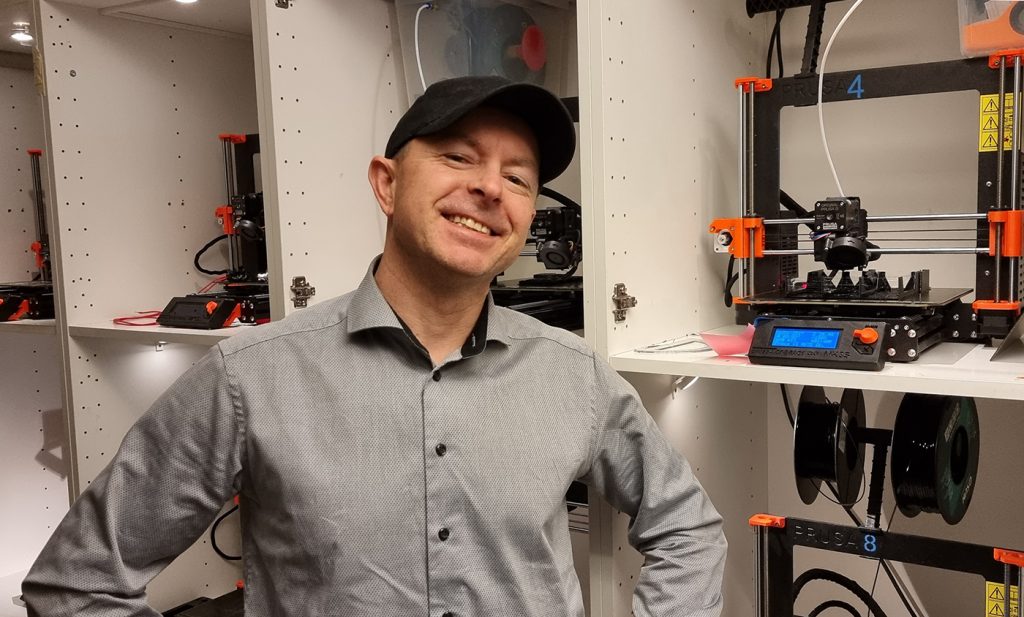

The concept FieldMade works from is a micro-factory in a purpose-built container, called NOMAD, containing all the inputs and machines needed to produce functional parts directly from a finished 3D model, or by reverse engineering using 3D scanning. In the beginning, the company produced polymer parts, but, as its ambitions grew, it aimed to additively manufacture metal parts using a full-scale industrial AM machine.

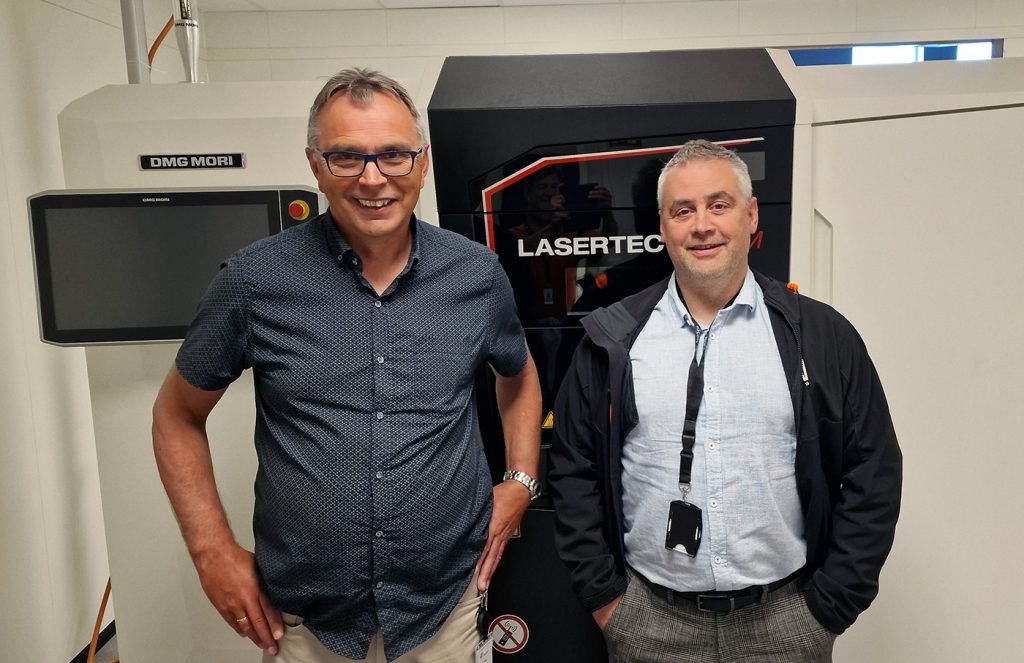

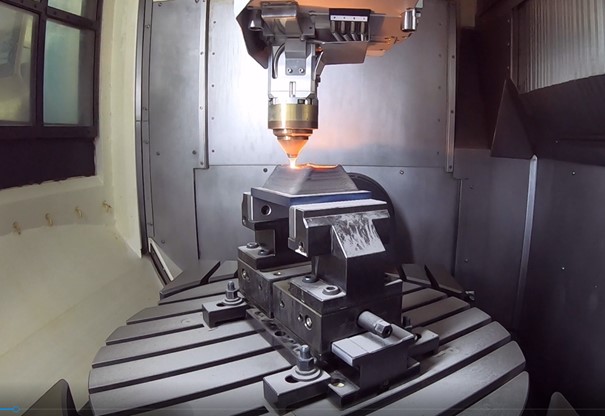

In collaboration with DMG MORI, FieldMade rebuilt a Lasertec 30 to withstand the shaking and vibrations that occur while transporting the container without affecting the quality of the AM parts. Over time, tests with a container on a truck driving off-road have resulted in what is now a well-functioning system for metal AM in the field.

Word spread quickly and FieldMade gained attention both in and outside of Norway. “We received enquiries from NATO and others who wanted to know more, and one of the topics that was discussed early on was IP rights,” stated Christian Duun Norberg, founder of FieldMade and Fieldnode.

Challenges included the question of who has the right to produce what, how to verify the 3D models, and, not least, how to create a secure system. “Digitisation is the key to Additive Manufacturing. You can send 3D files anywhere, but there are many factors that come into play and thus the way was open to establish a new company: Fieldnode,” explained Norberg. Fieldnode delivers a digital warehouse ecosystem that allows for the local production of spare parts, thus reducing inventory build-up and improving operational efficiency. The solutions the company delivers also aroused interest in the oil and gas industry. “We have a good collaboration with Equinor, who challenged us by giving us a field assignment. They wanted to see if it was possible for us to demonstrate the technology at the shipyard at Aker Solutions in Stord, Vestland County,” Norberg stated.

Originally, FieldMade was given an agreement that would run from October 2022 to October 2023, but this has now been extended. “Over the course of twelve months, there have been more than 380 unique orders and more than 6,000 manufactured parts, which was far above what was expected, and now Equinor has extended the agreement until May 2024,” added Norberg.

As well as metal parts, FieldMade has promoted mobile AM solutions also in collaboration with the UK’s Mark3D, a large agent for Markforged, in which plastic and composite materials are produced on a ruggedised version of the Markforged Mark Two AM machine.

Additech

On April 26, 2023, the Additive Manufacturing specialist Additech AS received DNV’s Certificate of Qualification as AM manufacturer/facility certification for demonstrating compliance with DNV-ST-B203, making it the first in the world as DNV-qualified BPQ in grade 5 titanium (Ti-6AI-4V) produced by Laser Beam Powder Bed Fusion (PBF-LB).

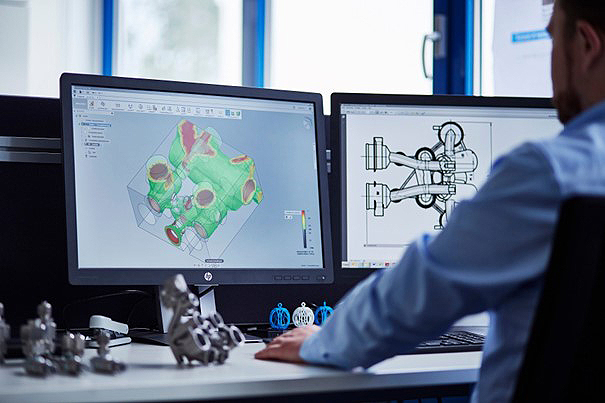

According to Anders Helland, CEO of Additech AS, this certification serves as an indication of the company’s strong position in the Norwegian AM industry for the energy, oil and gas, and maritime sectors. Additech is one of the leaders in industrial AM in Norway and runs training courses for its own staff as well as others who require a higher level of expertise. For this, the company uses CADS Additive’s AM-Studio suite.

“For Additech, as part of the Norwegian catapult programme, which aims to support innovation in small and medium-sized companies in specific areas of the country, education also plays a big role in our company. We see the enormous potential of AM and want to establish our way of thinking about ‘Learning by Doing’ in industry and university,” stated Helland.

Aker Solutions

Aker Solutions and partners Aker BP, F3nice and Additech have taken an important step towards a more circular economy using Additive Manufacturing. A pilot project demonstrated the potential for resource conservation by using scrap in the production processes. The partnership is additively manufacturing pipe hanger protectors for underwater wells, produced with atomised material recycled from Aker Solutions’ workshops in Tranby, Norway.

The job of converting scrap metal into powder suitable for Additive Manufacturing was left to the specialists at F3nice, based in Oslo and near Milan, Italy. F3nice processed the metal scrap and delivered this to Additech, who manufactured the parts. The result of this process was reduced energy consumption, transportation and scrap, contributing to an improved environmental footprint.

Nordic Additive Manufacturing

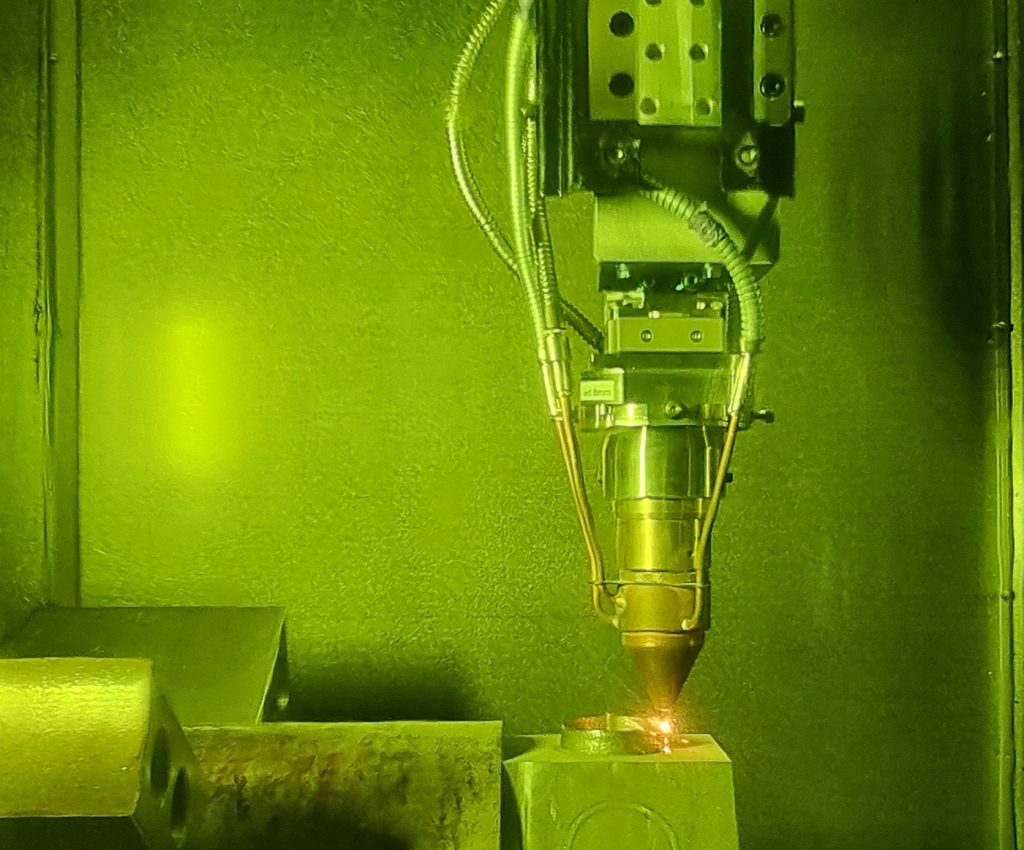

Nordic Additive Manufacturing (NAM) originates from the innovation and industrial environment in Raufoss, in the interior of Norway, and is a leading company in industrial laser-based DED (DED-LB) AM. In close cooperation with Sintef Manufacturing and key customers such as Equinor and Nammo, its production process has now been certified according to DNV and international standards. “With a DNV qualification [on laser-based DED], NAM is the first of its kind in the world and literally sets a new standard in this technology. This puts NAM in a unique position and paves the way internationally,” stated Sture H Sørli, General Manager of NAM.

Årdal Maskinering

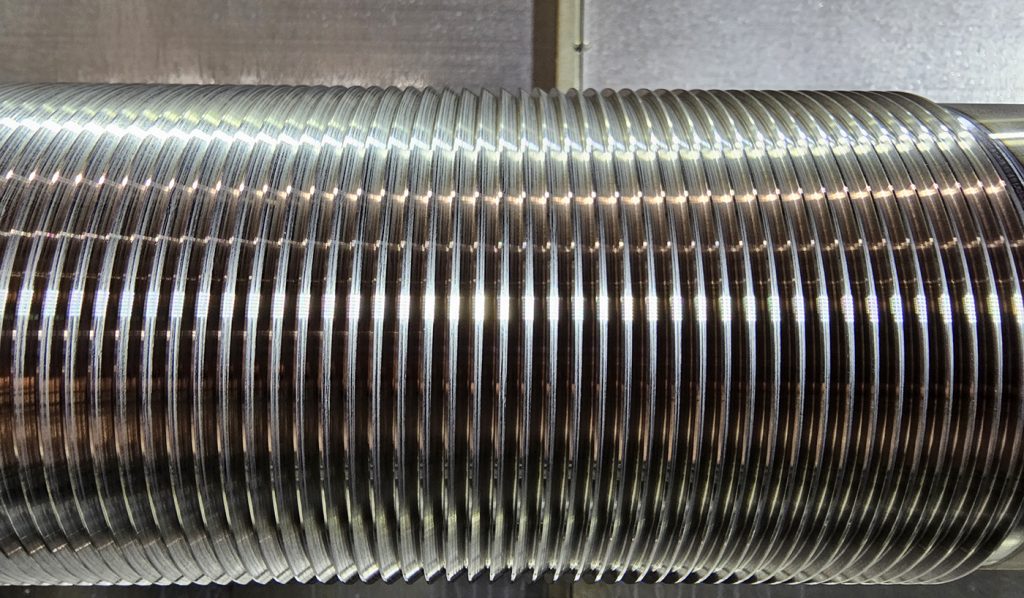

Årdal Maskinering AS, based in Nærbø, in Rogaland, is the first and only company in the world with the Mazak Integrex i500-AM, featuring a 3 m turning length and diameter of 300 mm. This type of machine is large; it weighs 31 tonnes and, in addition to being a five-axis milling-turning centre, it also has the option of laser/powder DED Additive Manufacturing. The machine was delivered in 2020, but its use was delayed until 2022 due to the pandemic. Now, Årdal carries out successful repairs in exotic alloys.

“Among other things, we have received orders from customers where we have repaired broken and worn parts, as well as cast products from China which have not been according to specifications,” explained Frode Hegle, quality and HSE manager at Årdal. “In another assignment, the customer delivered a part of 3,100 mm in length on which a thread was torn. We removed the thread, applied new material, and machined a new thread to specifications. The result was a success and the customer avoided scrapping the part. In this way, they avoid a long delivery time and the possible long transportation of a new part, in addition to reducing material consumption: this is sustainability in practice,” Hegle stated.

Aarbakke

Aarbakke AS, based in Bryne, also in Rogaland, is Norway’s largest machining company with over 300 employees. Here, 70% of the orders are for new parts (i.e. a lot of piece production). Customers are within the oil and gas sector and its speciality is advanced components in exotic alloys, with much in Inconel, super duplex stainless steels and titanium. The company also surface coats products using the same alloys. The experience gained from this activity has led to the company now investing in wire/arc DED.

“We have great faith in DED, which has been defined for the oil and gas industry, and we have good experience with dredging, so now we are working to start up Norway’s first facility, which we have built according to our own specifications,” stated Inge Brigt Aarbakke, Aarbakke’s owner. “As our DED process uses wire, it is more readily available than metal powder, and the process is cheaper than other metal AM processes. In fact, the raw material is cheaper than powder. The build speed is fast, and we believe this will become a leading process both for repairs and for new components within the oil industry.”

Wilhelmsen and ThyssenKrupp

Through a partnership focused on Additive Manufacturing, the Norwegian shipping company Wilhelmsen and the German industrial group ThyssenKrupp aim to transform the supply chain for marine and offshore parts, replacing the existing inefficient and rigid supply chain process with an adapted, on-demand, and more-efficient AM process.

In a digitisation and certification process, parts are produced on demand without having to go through the time-consuming and expensive storage, shipping, and customs and receiving processes. AM changes the status quo of the expensive and time-consuming spare parts business, so that suitable components can be produced close to a vessel’s location with a short lead time.

“The savings from reduced cost, time and environmental footprint provided by Additive Manufacturing, digital inventory and localised production of maritime spare parts are a huge opportunity for our customers to be ahead of their rivals,” explained Hakon Ellekjaer, until recently the Head of Additive Manufacturing at Wilhelmsen and now Chief Commercial Officer at Pelagus 3D, a new ThyssenKrupp Wilhelmsen joint venture.

DNV and Siemens Energy

Norwegian DNV and Swedish Siemens Energy are in the process of taking Additive Manufacturing into the next phase of maturity. Siemens Energy’s experts in Finspång, Sweden, have developed the first generation of the AM Cockpit platform that provides automated, reliable quality control of the metal AM process. For its part, DNV has developed the Independent Quality Monitor (IQM) platform – a customer portal that continuously ensures the quality of digital solutions. By combining these two solutions, DNV can launch a commercial solution for the AM industry which ensures that parts can be easily compared with an ‘approved master print.’ The combination also makes automated and external process certification possible.

Investment in Northern Norway

AM North AS

In the summer of 2023, AM North AS started metal Additive Manufacturing operations in Hammerfest, northern Norway. The city is located at Longitude 70.7°, so the metal AM machine located there is perhaps the most northerly of its kind in the world. The machine that AM North has invested in is a DMG MORI Lasertec 30 Dual SLM with the intention of making parts for the oil and gas industry, but at AM North there is a bigger vision.

“Our location is perfect in several ways. Not only are we physically located in the same building as the spare parts warehouse for the oil and gas production ship, Johan Castberg (Fig. 16), all seagoing customers from outside the oil and gas industry also come to the Polar base. We are talking about fisheries, farming and all other maritime players. We are also close to mining and other industrial activities in the region. In the long term, we will also look beyond the region and the country; we believe in becoming a global player,” explained Jan-Inge Kongsbak, General Manager of AM North.

Industrial AM AS

Industrial AM AS, in Mo i Rana, Nordland, is also staking a claim to become a preferred supplier of industrial metal AM components (Fig. 17). Owned by Momek Robotics, Testpartner and Kunnskapsparken Helgeland, the company’s plan is to develop a complete value chain with 3D scanning, construction, Additive Manufacturing, machining, heat treatment, testing and certification. Industrial AM will collaborate with leading companies and research and development players within modern manufacturing technology and Additive Manufacturing.

Equinor and Aker BP are supporting the establishment of the operation, recognising the need for AM production in Northern Norway. The drivers for this are reducing stock, shorter delivery times, short-distance deliveries, lower CO2 footprints and the benefit of readily available expertise and capacity.

Korall Engineering AS

One of the few companies within AM engineering in Norway is Korall Engineering AS, a design engineering company that is part of StartupLab Bergen, a member of the GCE Ocean Technology Cluster, that uses the latest advanced design optimisation technologies. The company’s team automates product design workflows to reduce engineering and lead times, and redesigns existing industrial products through the use of Artificial Intelligence to reduce material waste, production costs, and environmental impact, whilst increasing efficiency.

The Norwegian Additive Manufacturing Cluster

Norwegian Additive Manufacturing Cluster (NAMC) was established in 2022. It is an association that aims to be the national network for Additive Manufacturing in Norway. The network is open to companies and organisations from all industries, including educational and research institutions. The network seeks to promote the development of an ecosystem and knowledge around AM in Norway, connect relevant stakeholders across industries, and stimulate growth, innovation and new sustainable solutions.

In March 2023, NAMC organised its first conference, hosted by SINTEF and NTNU in Trondheim. The aim of the conference was to present use cases for industrial Additive Manufacturing. As demonstrated, several AM technologies are in the process of gaining a foothold in Norway in sectors such as health, defence, maritime, goods production, and the oil and gas industry. Actors from business, public institutions, and academia participated in the conference. Companies such as Equinor, Wilhelmsen, Ivaldi, Vår Energi, Kongsberg Maritime and Lærdal Medical were among some twenty speakers who explained how they utilise the opportunities inherent in Additive Manufacturing. With 170 participants at the first meeting, its success was evident.

NAMC is exhibiting at the Nordic partner pavilion at Formnext 2023 in Frankfurt. “We will strive for a good partnership both at the AM Summit collaboration and the Formnext exhibition and establish a long-term mutually valuable collaboration. In any case, we have a couple of good stories to share on the programme,” stated Jan Tore Usken, the Head of Norwegian AM.

AMMA: the Additive Manufacturing for Military Applications conference

AMMA – Additive Manufacturing for Military Applications – is an annual event organised by the Norwegian Defence Research Establishment. AMMA 2023, which takes place on November 3, is the seventh event in the series. Its aim is to offer a platform for the presentation of recent R&D advances in Additive Manufacturing, and to bring together professionals from the armed forces, state, defence, R&D, industry and academia.

Numerisk Bruker Forening

Over the past few years, trade associations, educational organisations, and companies in the various regions have also organised gatherings and seminars to make all players in the industry aware of the potential within AM. Numerisk Bruker Forening (Norwegian CNC user group) includes AM presentations in its User Meetings.

Norsk Industri

Norsk Industri, the Federation of Norwegian Industries, is active through its Forum for machining and Additive Manufacturing and, in March 2023, Norsk Industri and Offshore Norway organised a dialogue meeting on Additive Manufacturing in future supply chains in the energy sector. The event took place at Vår Energi in Stavanger; 100 people attended.

The elephant in the room: education

Ever since the world began to try to ‘industrialise’ metal AM, there has been a critical need to train and educate enough – and the right – personnel to utilise AM’s potential. Whilst this challenge is universal, some countries are more ahead of the game than others. In Norway, we have lagged behind.

Now that the oil and gas industry has opened up to metal Additive Manufacturing, the problem is a shortage of specialists trained in Additive Manufacturing. Customers in the oil and gas industry have few specialists in AM who know how to order metal parts, and the individual companies who offer industrial AM as a service struggle with recruiting designers and operators. Many metal AM projects start with either reverse engineering or the transfer of traditional technology to AM. There is a long way to go before true Design for AM (DfAM) becomes ‘general knowledge.’

Although there is no educational course on AM from a vocational school, college or university which can give any form of qualification, there are several initiatives from individual actors. Below are some examples:

Mechatronics Innovation Lab (MIL) was established with the aim of increasing companies’ competitiveness through the use and understanding of new technology. Through involvement and grants from private business and the public sector, MIL has built up Norway’s largest and strongest technology lab. This collaboration between industry, academia, and the public sector has made MIL today a technological hub of international standard.

MIL offers technology, test equipment and expertise for innovation in mechatronics and associated disciplines, such as robotics, sensors, autonomy, Artificial Intelligence, virtual reality, and industrial Additive Manufacturing in all types of materials. As a partner in the Future Materials catapult, MIL participates with equipment and expertise in materials development.

MIL is part of the national infrastructure for innovation, pilot testing, experimental development of industrial products, systems, and services for introduction into the market.

In line with what MIL offers in Grimstad, in Southern Norway, the Norwegian Technology Catapult Center (MTCN) in Raufoss offers additive and hybrid manufacturing with DED technology, which is now available through the Catapult. Here, companies can get help to further develop, simulate, and test the production line before starting full-scale production on their own premises.

Steinar Killi, professor at the School of Architecture and Design in Oslo (AHO), has written the book ‘Additive Manufacturing: Design, Methods, and Processes’ in English (Fig. 22). This is a textbook for graduate students in design, engineering, computer science, marketing, technology, and for those who are not students but are curious about what Additive Manufacturing can offer.

Several AM machine manufacturers also offer training in AM to designers, production managers, operators and business managers, which most of the Norwegian buyers of metal AM machines have made use of.

Conclusion

Despite the fact that academia in Norway was an early adopter of metal AM, it took a relatively long time to establish the technology on an industrial basis. The oil and gas industry, which is so strong in the country, sets the conditions for how components are to be manufactured; without guidelines for producing approved and certified parts with metal AM, it is no wonder that the investments were delayed.

The fact that there are now several AM processes defined for the oil and gas industry means that the industry has really invested in metal Additive Manufacturing. New AM centres are being planned in several locations in the country.

The fact that a separate AM association has been put in place contributes to all the actors in the AM environment in Norway getting faster development on several levels. Cooperation across industry clusters often leads to positive synergies.

The few unique examples presented in this article demonstrate that the industry in Norway invests where there is both need and opportunity. Only time will tell whether Norway can be a major player on the world stage of Additive Manufacturing.

Author

John Petter Næss Christensen

Editor, Maskinregisteret

References

[1] https://prosjektbanken.forskningsradet.no/en/explore/statistics?Kilde=FORISS&distribution=Ar&chart=bar&calcType=funding&Sprak=no&sortBy=score&sortOrder=desc&resultCount=30&offset=0&Fritekt=Additiv+ manufacture