Metal AM’s journey to industrialisation: Are we there yet? And what does the destination even look like?

Metal Additive Manufacturing is on a long journey, from the early technology concepts of several decades ago to its current usage in a relatively small number of markets with specific, highly-specialised application requirements. If the journey leads to the widespread adoption of metal AM technology by industry, can we ask, 'Are we there yet?' Dr Maximilian Munsch, Dr Eric Wycisk, and Matthias Schmidt-Lehr, from strategy consultancy and AM market analysis specialist AMPOWER, delve into the evolution, current status, and future prospects for the industry, seeking to uncover the true extent of its potential. [First published in Metal AM Vol. 9 No. 2, Summer 2023 | 10 minute read | View on Issuu | Download PDF]

In recent years, many in the metal Additive Manufacturing industry have promised us a world where complex parts can be effortlessly created with just a few clicks. A world where the boundaries of traditional manufacturing technologies are shattered, making way for unprecedented possibilities in both design and production. Metal Additive Manufacturing promised a technological paradigm shift, transforming industries and redefining the way we think about manufacturing. But the burning question is: are we there yet? Has metal Additive Manufacturing delivered on this bold ambition, or is the technology only just starting to reveal its full potential? Have we merely scratched the surface? In this article, we delve into metal AM’s journey, its current status, and future prospects, seeking to uncover the true extent of its capabilities.

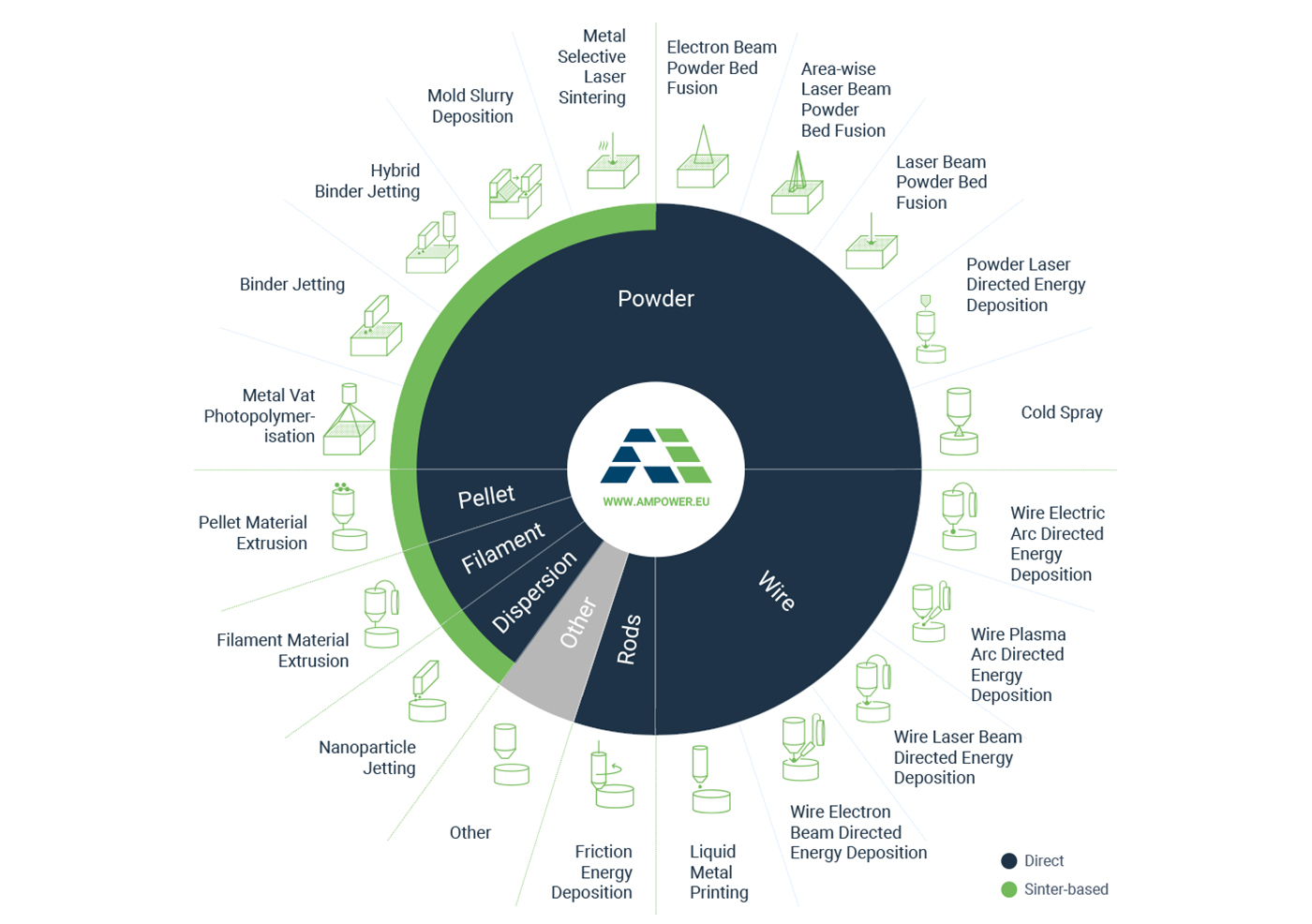

The history of Additive Manufacturing with metal dates back many decades, but it wasn’t until the availability of energy sources capable of melting technical alloys, combined with the advancement of digitisation, that the technology experienced significant progress. The promise of economically manufacturing highly complex components with minimal material usage led to the development of a multitude of metal AM processes. Today, there are essentially twenty different metal AM processes (Fig. 1), distinguished by raw material (powder, wire, etc.), binding mechanism (melting, sintering, etc.), and energy source (laser, electron beam, arc, etc.).

The dominant technology, Powder Bed Fusion (PBF), has been in use for nearly thirty years and has now been adopted by a select few industries as production technology. Several European companies played a crucial role in its development, placing the first research and production machines in industry and universities in the early 2000s. Today, there are over eighty suppliers of PBF equipment worldwide, accounting for more than 80% of globally installed metal AM machines.

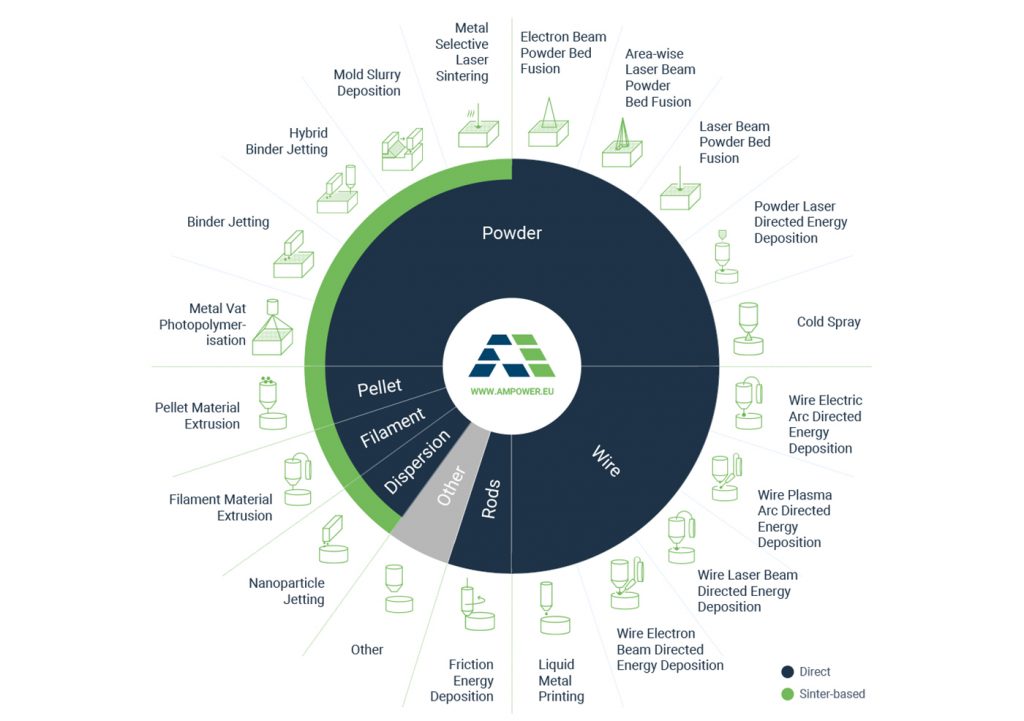

During the 2010s, the metal AM market experienced rapid growth due in part to technological advancements, the intense qualification work of the early adopters, and significant media attention. Many machine suppliers saw annual revenue growth rates of 50% or more, and the market capitalisation of companies reached its peak between 2012 and 2015, a level that many have not surpassed since. After this hype period, market growth slowed to around 20% annually. While the market was initially driven by the growth of machine manufacturers, today metal powder suppliers and AM component producers contribute a significant portion.

From a user perspective, the motivations behind the purchase of metal AM machines have significantly shifted from back then versus now. In the 2000s and early 2010s, some invested in AM capacity out of fear that this technology would replace established processes like machining. Companies didn’t want to miss out on the predicted manufacturing revolution. However, an understanding of where real value could be achieved through AM was often lacking, resulting in inefficient or underutilised technology. Even today, many metal AM machines installed at companies see very low utilisation.

The unfulfilled hype surrounding metal AM in the 2010s can be attributed to underestimating the implementation effort required, among other things. Users were promised a machine with a digital process chain that would enable easy, seamless, and waste-free manufacturing. It was claimed or assumed that ‘everything’ and ‘all geometries’ could be produced. However, users soon realised that there were significant learning curves to overcome during implementation and that AM is not economically viable in all application fields.

Further obstacles arose when AM technology attempted to transition from R&D to production. The reliability of machines often posed challenges and led to disappointment. Additionally, regulatory hurdles emerged in industries like aerospace and healthcare, where equipment qualification and process validation are necessary. In these high-value sectors, product failure has severe consequences, requiring extensive testing and safeguards beforehand. Due to limited experience with the technology and industry immaturity, in terms of procedures and standards, companies attempted to apply guidelines or standards that were only partially applicable. Furthermore, unexpected internal resistance from stakeholders surfaced as they were hesitant to take on the risks associated with the adoption of a new technology, preferring to stick with what had been proven to work.

However, the primary reason for the delayed implementation was a lack of widespread knowledge about the capabilities and limitations of AM technologies. Only when AM is applied in the right areas can it generate value that leads to acceptance and lasting establishment. The initial phases in many companies were often challenging and required time in order to demonstrate the advantages that AM has to offer.

Where is metal Additive Manufacturing now?

The phase of rapid expansion has cooled down, but we continue to see strong growth in the industry. Based on our AMPOWER Report data, the revenue generated by metal AM machines, feedstock, and part manufacturing services currently stands at around €3 billion, with a projected steady growth of approximately 26% over the next five years (Fig. 2). While the overall market for metal Additive Manufacturing is still considered niche compared to other production tools, it is a niche that is experiencing strong expansion, with growth rates up to ten times higher than conventional metal manufacturing processes.

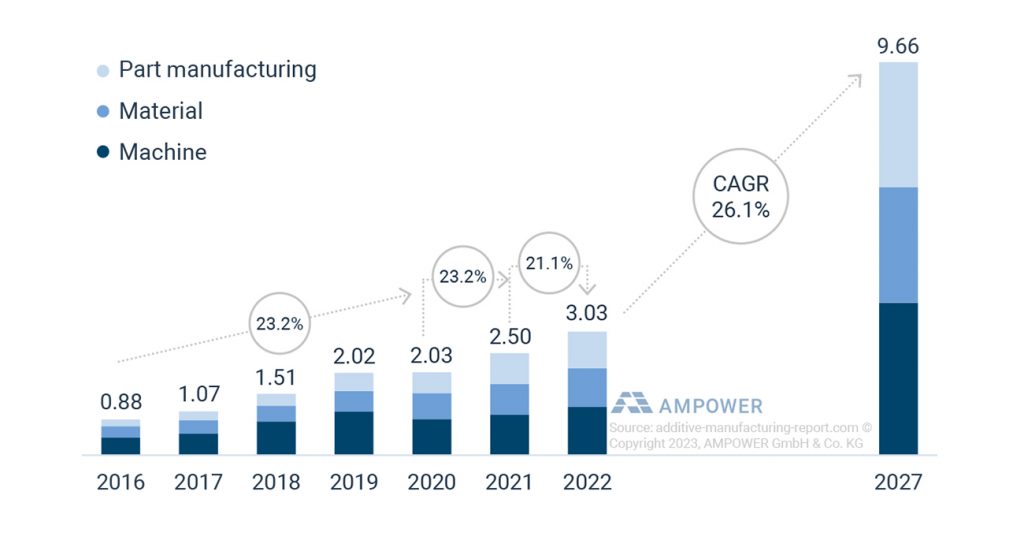

To assess where we are with Additive Manufacturing, we like to consider two indicators: the maturity of AM technologies and their adoption rate within the industry. These indicators vary significantly among different metal AM technologies. Some technologies have become essential in certain production chains, while others are still in their early stages, offering tremendous potential for cost-effective production in the future. There are also technologies that occupy a niche position today and are likely to continue doing so in the future.

AMPOWER has developed a model to characterise the maturity level of Additive Manufacturing technology based on two indices: the Industrialisation Maturity Index and the Technology Maturity Index. These indices describe and compare the capabilities and adoption rates of various AM technologies in an industrial environment (Fig. 3).

The Technology Maturity Index evaluates process capability, machine reliability and availability, and implemented quality control measures. The Industrialisation Index assesses the installed base of machines, supply chain, material availability, available public knowledge and research, and the standardisation of each individual technology. Each category is weighted according to its specific importance. Typically, technological maturity increases first, followed by industrialisation.

In recent years, many metal AM technologies have made significant transitions from research to initial industrial applications. However, only the PBF technologies with laser (PBF-LB) and electron beam (PBF-EB)are widely used in industrial settings. We estimate that, currently, there is an installed base of around 14,000 machines, with over 1,500 additional PBF machines added each year. With increasing industrial requirements, the machines are becoming more diverse. Machine size has significantly evolved to allow the building of parts up to 1.5 m in length, with the ability to utilise multiple lasers.

Many industries have now recognised the value of metal Additive Manufacturing. By leveraging manufacturing technology, product geometry, and materials, these industries have created unique components that can lead to performance improvements and cost savings in production or over the lifetime of a component’s use. As a result, some industries have developed products specifically for Additive Manufacturing and have seamlessly integrated the technology into their production processes.

A good indicator of the success of AM technology in a particular area is whether the build process itself is used in the marketing. In industries where an AM process has a viable business case and is generating profits, the marketing message is primarily focused on the improved properties, performance or functionality of the components produced, rather than on the intricacies of the build process; the technical details behind a process move to the background.

Where is metal AM headed?

Many discussions surrounding AM focus on sustainability through resource efficiency and optimised component design. The emphasis on functionality, weight savings, and feedstock recycling holds potential for saving valuable resources across various industries in the future. Additionally, the development of new materials specifically designed for AM will enable innovations such as mechanical stability at high temperatures, performance of electrical components, or higher efficiencies in heat exchangers. However, despite these noble goals of achieving a more sustainable future, the ultimate objective for suppliers and users of metal AM technology remains simple: to generate profit.

For many suppliers, growth has been the primary goal to achieve critical mass and enable profitable operations. Still today, numerous companies in the AM industry, both young and established, rely on investments to finance their operations due to a lack of profitability. Hence, we anticipate increased market consolidation among participants in the metal AM industry to achieve the necessary scale. Moreover, there is a growing risk of displacement in the largest segment of metal AM technology, specifically the PBF-LB sector. Currently, there are over seventy technology providers whose machines share similar characteristics and often do not offer clear differentiation from a customer’s perspective. Additionally, advancements in larger format ‘area-wise’ Powder Bed Fusion technologies are being closely observed as they have the potential to render today’s PBF technology outdated.

For users, the goal of the journey remains the same: to create value with AM technology that ultimately leads to lower manufacturing costs or higher profit margins. However, the distance to reach this goal varies significantly from industry to industry. The healthcare sector is at the forefront, integrating metal AM as an established alternative for production and successfully bringing products like bone replacement implants and dental restorations to market for over a decade.

Other industries, such as aerospace, defence, and energy, are currently experiencing enthusiasm about the possibilities arising from increasingly larger machines, new materials, and maturing software tools. These industries are progressing rapidly, taking leaps in their development cycles. While the civil aviation sector is currently stagnant, partly still due to the impact of the COVID-19 pandemic, it is expected to witness a boost in AM technology adoption when new programmes for the next generation of aircraft are launched. Extensive research and development efforts over the past decade combined with AM training of the engineering staff have laid the foundation for targeted use in redesigning components and functions, followed by production and quality assurance methods.

In the automotive sector, metal AM has been a challenging topic for several years. While considerable success can be noted from motorsport and high-performance cars, large series of low- to mid-end models lack metal AM applications. Some OEMs have even scaled back their efforts. The high expectations placed on sinter-based technology have not yet been confirmed. However, there are also ongoing efforts by OEMs, as well as some tier 1 and tier 2 suppliers, to make metal AM competitive despite immense cost pressures. The aim is to introduce new materials and optimisation strategies fitting the requirements of the automotive industry.

Players in the industrial verticals have significant potential to utilise metal AM for production tools or general engineering components. However, many in this sector are still not fully aware that they are on this journey. For example, adoption in fields such as heavy industries, shipbuilding, and rail is varied, with many only recently starting to explore AM, with one barrier being the large dimensions of the parts required and the high material deposition rates that are necessary.

From an investor’s perspective, the sought-after destination is achieving exponential growth at the right time – the ‘hockey stick’. Currently, the metal AM market is considered a niche one, but it is a rapidly growing niche with past annual revenue growth rates of 20% and similar projections for the coming years. Will it take a technological breakthrough such as the area-wise PBF technology to create yet another paradigm shift? Will this lead to such a hockey stick effect for the industry? Current data predicts a continuous growth at considerably high levels in the years to come.

How far can metal Additive Manufacturing go?

One important aspect to consider on our journey is the distance we can travel. In the case of the metal Additive Manufacturing market, this can be determined by examining the total addressable market and the potential coverage through AM technology.

Naturally, metal AM competes with other production technologies. The added value it offers, such as functional integration, performance, and the elimination of tools, is ultimately translated into a metric enabling comparison: costs per unit size (e.g. € per kg). This allows for comparisons with other technologies and enables an objective decision to be made with regards to the choice of manufacturing method during the design phase. By plotting the production cost against material consumption, we can estimate an addressable market depending on the cost per unit. Additionally, the adoption rate can be assessed by comparing this estimate with the current feedstock consumption of AM materials.

For instance, in aluminium AM applications, the production cost of components is approximately €250 to €300 per kg. According to data from the AMPOWER Report, around 600 tons of feedstock are currently consumed annually in powder, rod, or other forms. This represents an adoption rate of only 0.02% of the addressable market, which currently stands at around 3,000,000 tons.

In the future, technological progress will lead to increased productivity and simultaneous cost reduction. This will expand the potential addressable market. By generating a scenario that accounts for potential AM productivity improvements by the year 2030, we can anticipate a reduction in cost to between €100 and €200 per kg. At this stage, AM will enter broader competition with machining, investment casting, and to some extent, sand casting. Therefore, it is expected that the addressable market for metal AM and aluminium materials will double to 6,000,000 tons by 2030 (Fig. 4).

When comparing the size of the future addressable market with the feedstock consumption predictions from the AMPOWER Report, significant growth in the adoption rate for many alloys becomes evident for the 2030 scenario. On one hand, we expect feedstock consumption to increase annually between 20% and 40%, depending on the alloy group. On the other hand, the addressable market doubles due to the aforementioned technological progress. By combining these projections we can predict that between 40% and 60% of the addressable market for titanium, nickel, and cobalt-chrome alloys will be produced using AM by 2030, bringing us closer to our journey’s destination (Fig. 5).

The substantial growth in the adoption rate for these alloys is not a coincidence. They have already found numerous applications in various industries, and their success will lead to even faster adoption. Industries such as medical, aerospace, and energy have been relying on AM technology for many years, benefitting greatly from the temperature stability, toughness, or biocompatibility provided by these alloys.Other metal alloy groups, however, are projected to have a lower adoption rate by 2030. Steel alloys are expected to reach approximately 10% to 15%, while for aluminium, the relative adoption rate is expected to increase eightfold. Nevertheless, even with this increase, only a fraction of the potential market will be addressed.

When will metal AM finally arrive?

So, when will we reach our destination? Two conditions have to be met to reach a desired state of series production with AM technology.

- A reliable level of technology maturity

The technology must reach a reliable level of maturity, with incremental leaps of innovations becoming smaller. For PBF-LB machines we are gradually approaching this level of maturity. It can be observed that currently-available PBF-LB machines have minimal differences between them. In the past five years, there have been smaller steps of innovation, such as the transition from two to four (and more) laser beams. However, maintaining this condition is an ongoing challenge. Innovative companies have been expanding their machine portfolios, doubling the build volume and tripling the number of lasers in a short time. Why is this point crucial? Companies require a certain level of predictability when using AM as a production technology. Once a technology is qualified, it should not become obsolete within a year. Furthermore, in the coming years, identical machines must be available for scaling and replacement, especially when long-term delivery obligations exist for parts like turbine components. - Sufficient successful applications need to demonstrate AM’s success

The first series applications must generate sufficient data and instil confidence among customers as well as generate revenue. Companies like MTU Aero Engines, General Electric, Siemens Energy, LIMA, and Stryker have done pioneering work with their initial serial applications, taking significant risks. It takes several years for these companies and their competitors to fully undergo the technological shift in new programs, leading to real scaling effects. However, in certain industries we now see these risks bearing fruit with more and more applications being shifted to AM production. The dental, medical, aerospace, defence and energy sectors are, especially, utilising AM as the new ‘go-to’ production technology.

Keeping both the Maturity Index and adoption rate in mind, we believe that PBF technology for high value alloys such as CoCr, Ni and Ti will become ‘fully grown’ in the next five to seven years. In order to establish itself alongside casting and machining for steel and aluminium alloys, additional innovation leaps will be needed to significantly reduce costs and increase productivity. With ongoing developments, such as area-wise PBF-LB, these leaps can be seen on the horizon, however long-lasting adoption and qualification processes push the final destination further in the future.

The same is true for other metal AM technologies. While some technologies will become obsolete in the near future, or lead a niche existence, other technologies, such as Binder Jetting and Wire Arc DED, will still have to go through the lengthy education, adoption and qualification process that PBF went through in the past fifteen years. The first serial applications are currently hitting the market, yet the final destination is at least another ten years ahead.

In conclusion, while there are still challenges to overcome, the progress made so far and the growing confidence in AM technologies indicate that we are steadily advancing towards our destination. With ongoing advancements, increasing adoption in various industries, and the trust gained through successful applications, we can look forward to a future where AM plays a significant role in manufacturing processes.

So, are we there yet? Not quite, but soon!

Authors

Dr Maximilian Munsch

[email protected]

Dr Eric Wycisk

Matthias Schmidt-Lehr

AMPOWER GmbH & Co. KG

Alstertor 13

20095 Hamburg

Germany

For more information on the AMPOWER Report 2023 visit

https://additive-manufacturing-report.com

Download Metal AM magazine