An inside perspective on China’s thriving metal Additive Manufacturing industry

A decade ago, the majority of commercial metal Additive Manufacturing machine, materials and application developments took place in Europe and North America. Today, the picture is very different and China in particular has become a leading global player. Clear national strategies, combined with a strong drive to leverage commercial opportunities, have resulted in a powerful and dynamic metal AM industry that is moving rapidly towards self-sufficiency. In this article, Xuesong Pan (Peter), co-founder of China's 3D printing media company Nanjixiong, reports on recent developments. [First published in Metal AM Vol. 9 No. 1, Spring 2023 | 20 minute read | View on Issuu | Download PDF]

Early research in China on Additive Manufacturing began in the 1990s and has been ongoing for thirty years. At first, there were only five universities studying the technology: Tsinghua University, Xi’an Jiaotong University, Beijing University of Aeronautics and Astronautics, Northwestern Polytechnical University, and Huazhong University of Science and Technology. Now, AM has become a ‘sunrise’ industry and an important part of the Made in China 2025 strategy [1]. AM stands out from many traditional manufacturing technologies as a more efficient and sustainable solution.

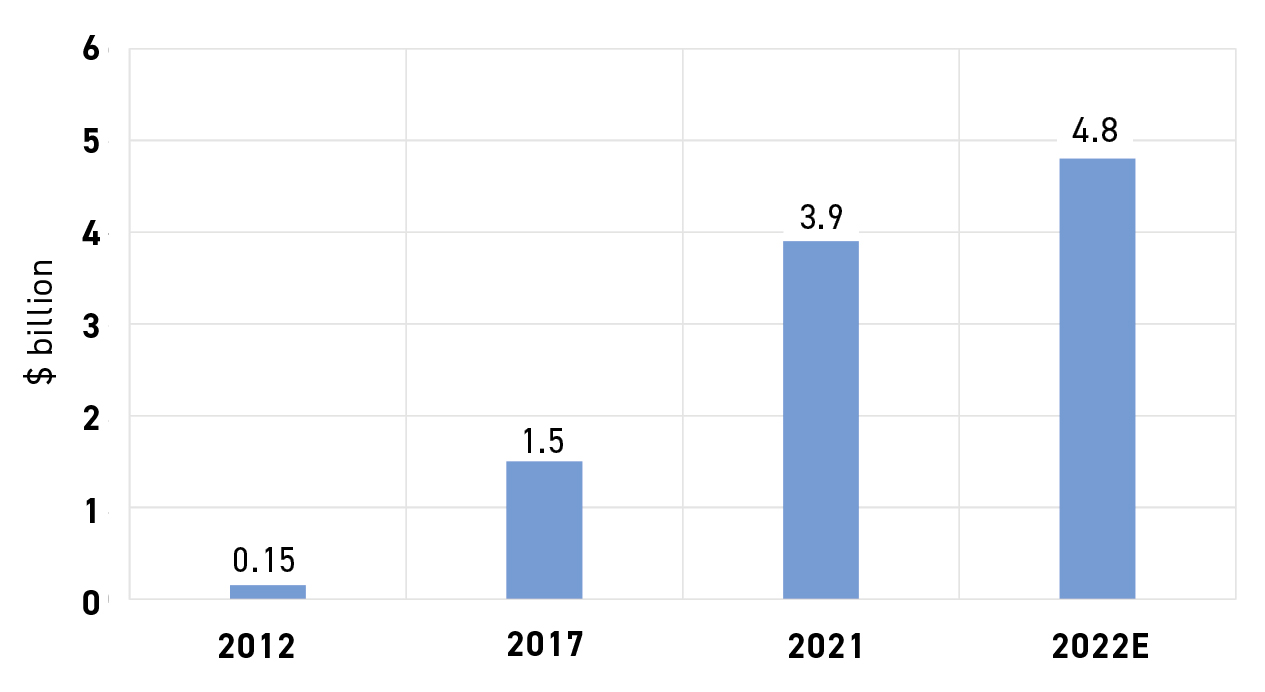

Over the past decade, China’s AM industry has undergone radical changes. According to data published by the Additive Manufacturing Alliance of China [2], the output value of China’s AM industry has grown from $145 million in 2012 to more than $4.8 billion in 2022, with more than 1,000 AM enterprises in the industry chain (Fig. 1). In the world of business, multiple AM machine companies including BLT, Shining 3D and Farsoon have achieved IPO listing. The number of listed companies has grown from one in 2013 to twenty-two in 2022, including the new over-the-counter (OTC) market, and the number of AM companies with revenue over $15 million has increased from three in 2012 to forty-two in 2022.

Metal Additive Manufacturing is a major sector within the rapidly growing AM industry. According to data released in the Wohlers Report 2022, AM machine sales reached $3.417 billion in 2021, of which metal AM machines accounted for 36.1%. The AM materials industry reached $2.598 billion, of which metals accounted for 18.2% [3].

Data collected by China’s AM portal Nanjixiong showed that AM startups in China received $930 million from venture capital funds in 2022, of which $370 million went to metal AM companies, accounting for 40% of the total [4].

Metal Additive Manufacturing machine manufacturers in China

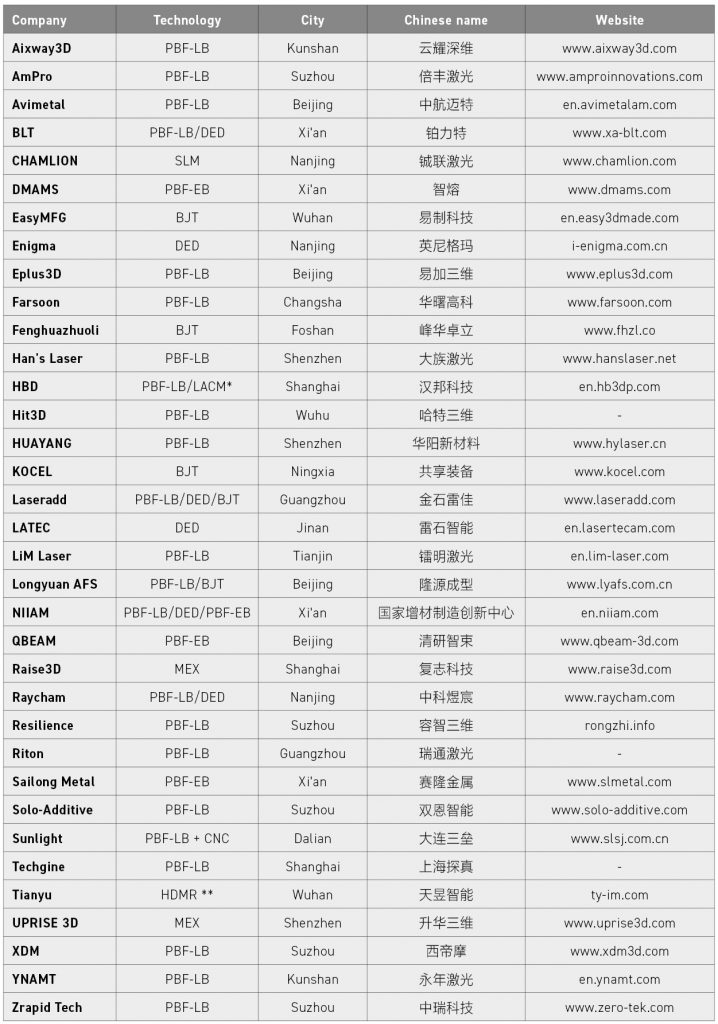

Currently, there are more than sixty Chinese manufacturers developing and producing metal AM machines with technologies such as Laser Beam Powder Bed Fusion (PBF-LB), Electron Beam Powder Bed Fusion (PBF-EB), Directed Energy Deposition (DED), Binder Jetting (BJT), Material Extrusion (MEX)-based technologies and more.

In the domestic market, metal Additive Manufacturing machines produced by Chinese companies are already very competitive when compared to overseas brands. The market for small build size (80–150 mm) metal AM machines is now dominated by China’s domestic producers, whereas imported machine sales are currently very low due to their high cost.

In terms of medium and large size (250–1000 mm) platforms, overseas brands still have some advantages in the Chinese market, namely support-free technology, intelligent process monitoring and operational stability. EOS, SLM Solutions, Trumpf, Desktop Metal, Markforged and HP are examples of companies that are selling metal AM machines in China, benefitting from their reputation in the global market. The domestic Chinese market has not yet reached self-sufficiency; foreign companies still have market space.

In the range of compact-size AM machines, multiple domestic laser suppliers are being used to reduce machine costs. Solutions from companies such as Han’s Laser and Raycus have been used in dental metal AM machines in particular. However, the core components of high-end metal Additive Manufacturing machines still need to be purchased from international companies such as IPG and Scanlab.

In the large-to-extra-large build-size machine market, Chinese manufacturers can provide competitive machine solutions as well as efficient local support. Product customisation is also available, such as custom build size requirements. BLT, Farsoon, YNAMT, XDM, Eplus 3D, LiM Laser and Huayang offer PBF-LB AM machines with a build size of over 1 m and with up to twelve lasers. Raycham and TSC can provide powder-based DED machines with a build size greater than 4 m.

Chinese machine manufacturers have been expanding their overseas markets to provide global customers with cost-efficient but high-performance metal AM solutions. Farsoon Technologies was the first company to establish regional operations in Europe and the United States. Led by a widely respected AM veteran, Farsoon’s global technical teams now work with a growing number of industry-leading partners.

With more Additive Manufacturing machines from Chinese brands available in the global market, sales numbers as of the end of 2022 show clear growth. Among the small–medium platform Additive Manufacturing machine market, Chamlion has delivered 1,000 metal AM machines, mainly for dental; Riton has reached 700 units for dental installed worldwide; HBD has also shipped 700 units and sold to more than twenty countries. For the medium–large platform metal systems, Farsoon has sold more than 400 medium-to-large frame metal AM machines worldwide, with more than ten industrialised customers installing more than ten systems each.

In the Chinese market, BJT is still in its early stage of development. However, HP and Desktop Metal (incorporating ExOne) are in the lead, and domestic companies such as Longyuan AFS, Fenghua Zhuoli, Kocel and EasyMFG have already launched machines. This technology is expected to become a mainstream manufacturing process for high-volume metal parts production. Once BJT is accepted by international OEMs for volume applications, these companies will lock in machines and materials, just as Adidas has with polymer AM running shoes using Carbon’s machines and materials. Table 1 shows a partial list of Chinese metal AM machine producers.

Metal Additive Manufacturing material producers

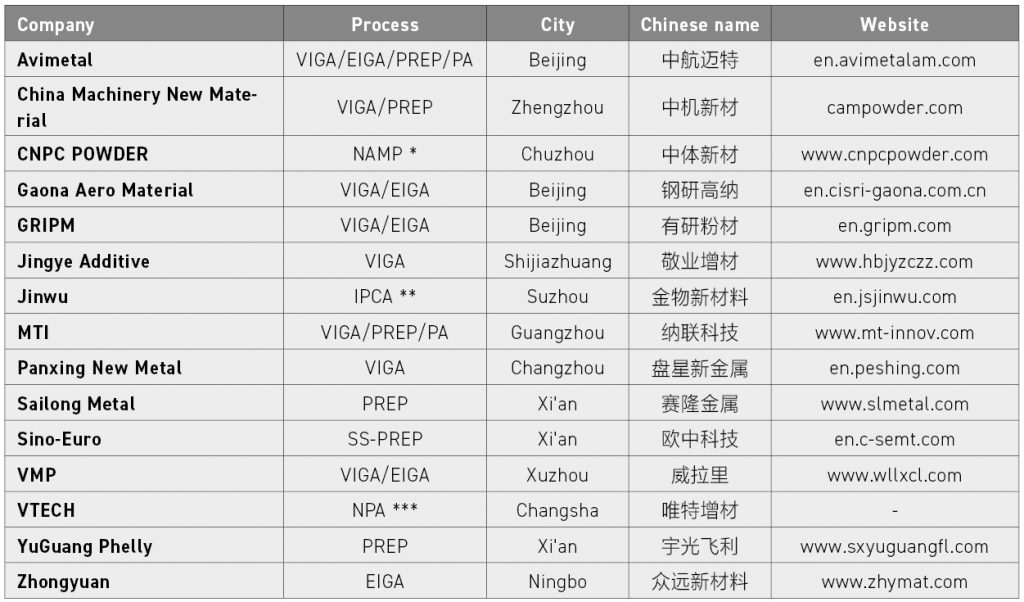

There are more than fifty metal AM material manufacturers in China that offer various metal powder options such as titanium alloys, high-temperature alloys, stainless steels, CoCr alloys, nickel base alloys, tool steels, aluminium alloys, copper alloys, etc., as well as wire materials. These materials can meet most application requirements. The performance of metal powders produced by Chinese companies is comparable to imported powders, but at a lower cost.

By the end of 2022, Avimetal had built twenty-five metal powder atomisation lines offering more than 200 types of spherical powder products, including high-temperature alloys, titanium alloys and aluminium alloys. It has provided more than 2,500 tons of high quality metal AM and surface coating powders to domestic and international customers.

VMP has fifteen metal powder atomisation lines, including ten vacuum induction melting and inert gas atomisation (VIGA) production lines and five EIGA production lines, with an annual production capacity of over 1,000 tonnes of AM metal powders. Its average revenue growth rate in the past three years has reached 99.33%.

Panxing New Metal has ten VIGA production lines, with an annual production capacity of over 1,000 tonnes of high-quality powder such as titanium alloys and high-temperature alloys, which are widely used in AM, Metal Injection Moulding, surface treatment and other fields. Jinwu has ten sets of self-developed Induction Heating and Plasma Melting Combined Atomisation (IPCA) powder production equipment and powder post-treatment equipment to ensure an annual output of 300 tonnes of titanium alloy spherical powder. Table 2 presents a partial list of metal Additive Manufacturing materials producers.

Metal Additive Manufacturing service providers

There are now more than fifty metal AM service providers in China that manufacture parts for customers using either their own technology or purchased metal AM machines. They typically target specific fields such as aerospace, medical, dental, automotive, mould tooling, energy, etc. They can provide a full range of services according to a customer’s needs, from design through to simulation and topology optimisation, production and post-processing.

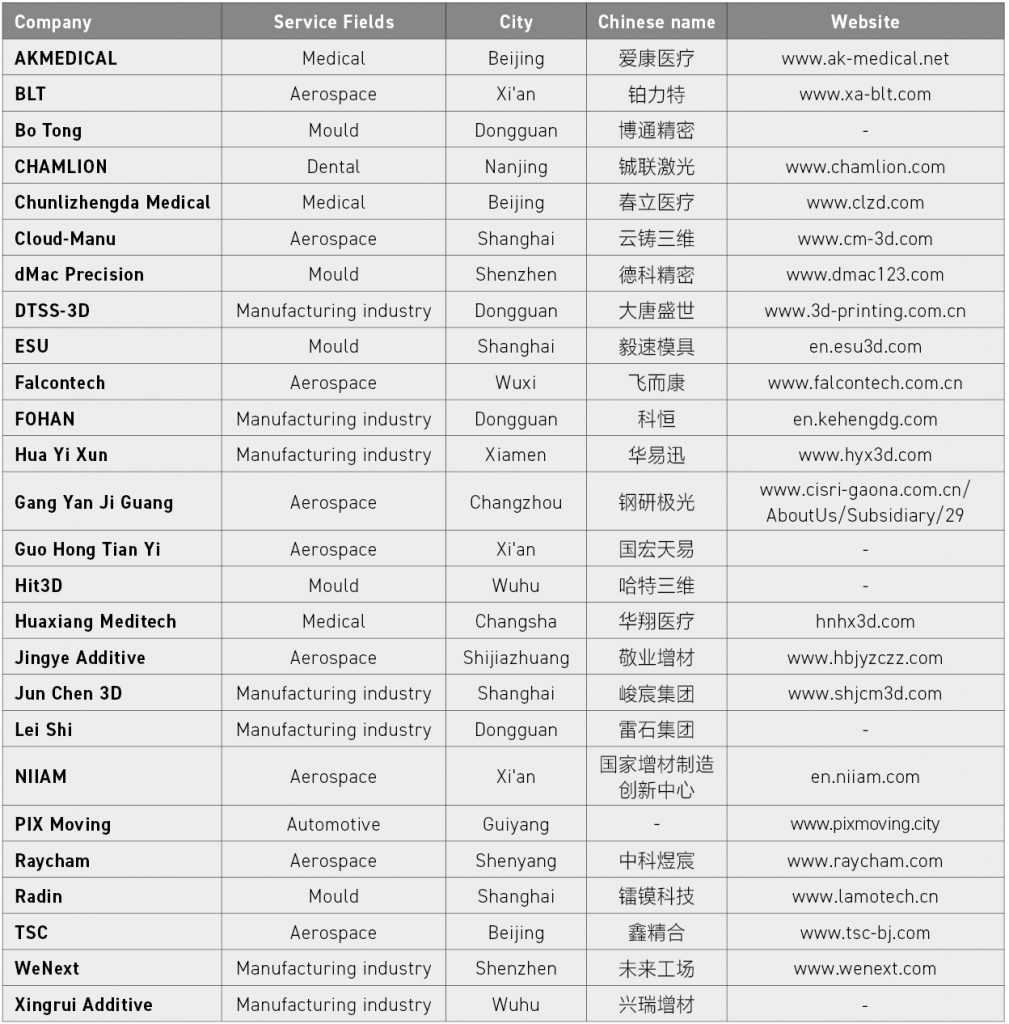

Currently, BLT has more than 270 metal AM machines installed for R&D and contract manufacturing services. TSC has more than 100 AM machines, which can cope with the demand for metal AM parts from numerous industries. Falcontech, Jingye Additive, Aerospace Additive Technology and Gang Yan Ji Guang are planning to install more than 100 metal AM machines each to meet their growth strategies. Table 3 presents a partial list of metal AM service providers in China.

Government support for China’s Additive Manufacturing industry

Since 2018, the Chinese government has enhanced its support for advanced technology development and prioritised the purchase of domestic machines and raw materials. This has been a boon for the development of China’s metal Additive Manufacturing industry, promoting the sale of domestically produced machines and powders.

In May 2022, China’s Ministry of Science and Technology launched its National Key R&D Programme, the ‘14th Five-Year Plan,’ and the key project declaration guide ‘Additive Manufacturing and Laser Manufacturing.’ This key project supports four categories:

- Extrusion technology and frontier AM technology

- Core components in AM machines

- Key technology and equipment

- Typical industry application and practice

All of these are cutting-edge areas in the field of AM. Simultaneously, Guangdong Province launched its own key R&D programme, ‘Laser and Additive Manufacturing,’ to support the development of the AM industry in the region.

In terms of AM standards, an ‘Action Plan of Leading the Development of Additive Manufacturing by Standards (2020–2022)’ was jointly issued by six ministries and departments of China in 2020, including the Standardization Administration of China and the Ministry of Industry and Information Technology [5]. In October 2021, an international standard for AM, led by Chinese industry members, ‘ISO/IEC23510:2021 Information technology — Additive Manufacturing and scanning — Framework for an Additive Manufacturing Service Platform (AMSP),’ was officially released [6]. Currently, more than thirty national standards for AM have been implemented.

Markets and applications

Aerospace remains the largest application market for metal Additive Manufacturing in China, followed by medical, moulds and tooling, dental, heat exchangers, education, energy and automotive. As a major manufacturing country, China’s GDP reached $18 trillion in 2022; this means there is access to a vast local market for AM technologies.

Aerospace

According to data released in the Blue Book of China Aerospace Scientific and Technology Activities (2022) [7], China’s space industry ranked first in the world in 2021 for launches, with fifty-five taking place. In 2022, sixty-four space launches took place over the year. The rapid growth of China’s space industry is driving the demand for metal AM. It is expected that China will implement nearly seventy space launches in 2023, of which the China Association for Science and Technology (CAST) plans to schedule more than sixty space launches and launch more than 200 spacecraft/satellites.

To meet the needs of the space industry, in addition to the private companies developing metal AM machines, China’s Aerospace Science and Technology Corporation (CASC) has developed metal AM machines at a number of its branches and successfully used them in the space field.

Meanwhile, China’s aviation industry is developing rapidly. In December 2022, China Eastern Airlines took delivery of the world’s first domestic C919 large passenger aircraft. This delivery means that China has completed the whole process of design, trial production, testing, test flight, certification, production and delivery of a large passenger aircraft, with metal Additive Manufacturing technology being used in the development of the C919. By the end of 2022, a total of 1,035 orders from thirty-two customers have been received for the C919.

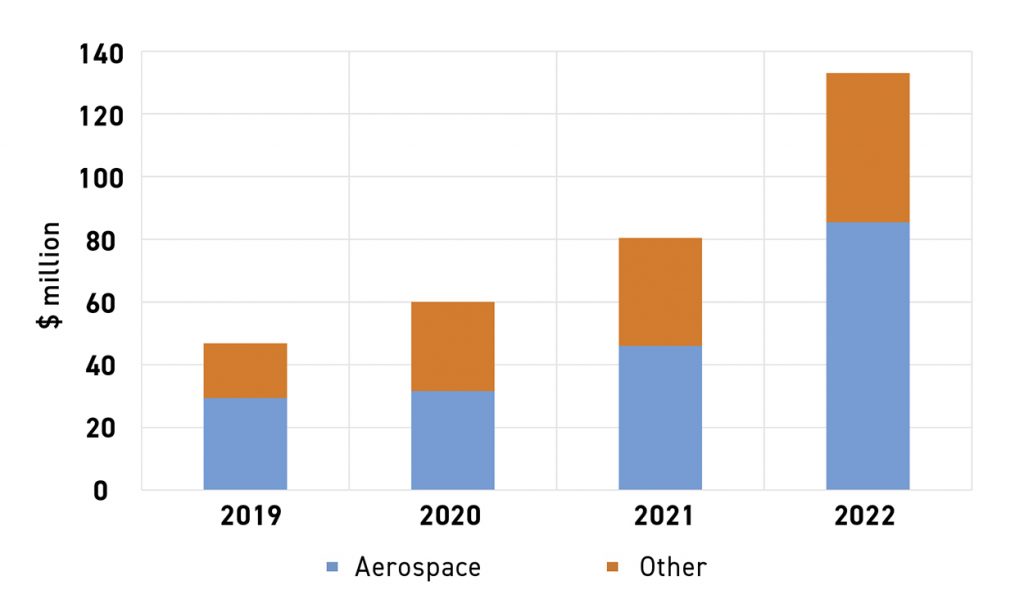

China’s aerospace industry is, therefore, driving the development of AM, with metal AM parts moving from the validation phase to series production. One of the beneficiaries is the metal AM machine and services vendor BLT, whose revenue reached $133 million in 2022, a significant 66.48% increase from $80 million in 2021. Aerospace accounted for 64.29% of BLT’s revenue from January to June 2022 (Fig. 3). Currently, with a market value of about $2.53 billion, BLT ranks first among the publicly traded AM companies worldwide.

Among the metal Additive Manufacturing application cases disclosed by BLT is the manufacture of a satellite adapter (Fig. 4). The adapter for a hydrazine bottle – a storage container for fuel for satellite propulsion – connects the bottle to the satellite structure and is, thus, a key load-bearing part of the propulsion system. The cost of launching satellites can reach tens of thousands of dollars per kilogram, so weight reduction of components in the satellite is extremely important.

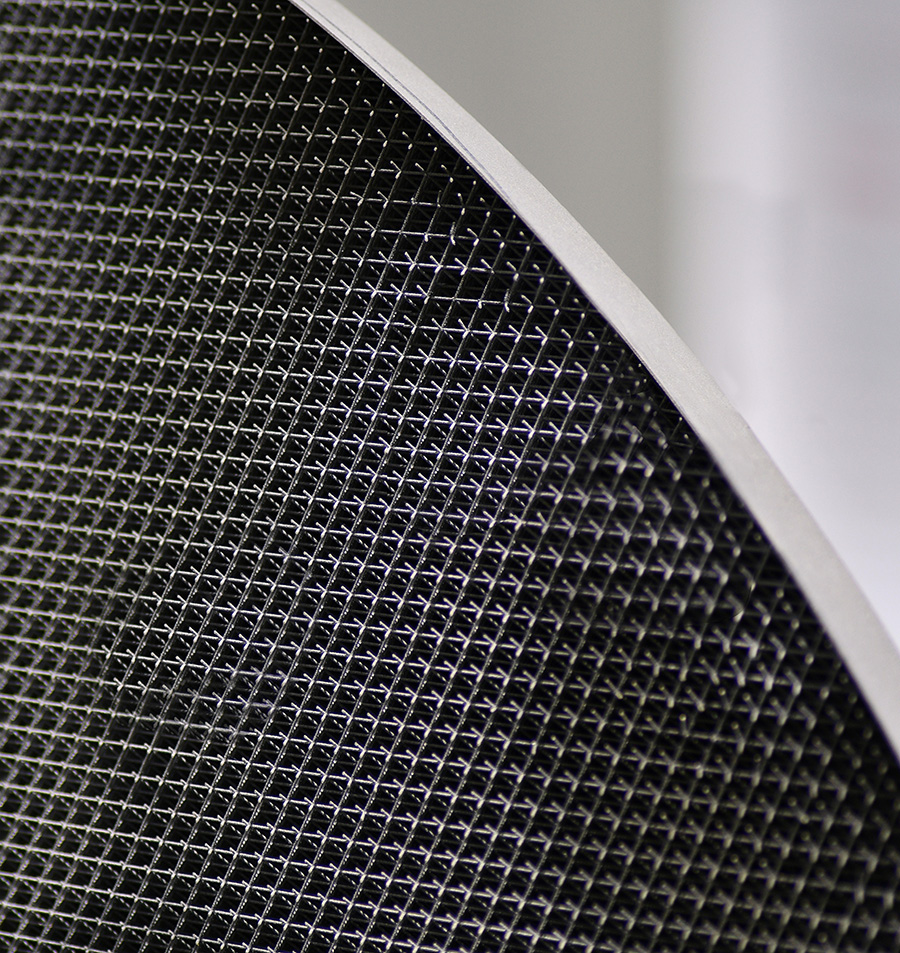

The bracket incorporates a lightweight structure internal lattices and an external skin. It was produced using the BLT-S600 PBF-LB machine, which has a maximum build size of 600 x 600 x 600 mm (Fig. 5). Compared to conventional forging and casting processes, the product’s design for, and production by, AM in aluminium resulted in an overall weight reduction of over 60%.

Another application example from BLT is the copper AM nozzle shown in Fig. 6. BLT’s design team successfully solved the problems associated with processing copper, such as the low absorption rate, high forming difficulty, low processing efficiency and the challenge to control microstructure. The inner and outer walls of the part are designed with fifty cooling channels. Thanks to the integration of these complex cooling channels, the cooling surface area is increased, so the cooling efficiency of the engine is greatly improved and the design can be more compact and lighter. This large number of cooling channels can only be manufactured by PBF-LB technology.

The large-format metal AM machine market is also benefitting from the rapid increase in China’s commercial rocket launch activities. Following US-based spacecraft manufacturer SpaceX, Deep Blue Aerospace was the second company in the world to succeed in all low-altitude engineering tests of reusable liquid oxygen kerosene rockets. In 2022, this Chinese commercial rocket manufacturer used metal AM to engineer and produce key components using Farsoon’s large-format metal system FS621M, with a build envelope size of 620 x 620 x 1100 mm.

In the same year, Deep Blue Aerospace enhanced its batch production of single-piece, large-sized rocket engine combustion chambers (Fig. 7) using Farsoon’s FS621M (Fig. 8). The additively manufactured Inconel combustion chamber measures 780 mm in height and 550 mm in diameter. Major challenges included the size of the build, function integration and detail resolution. AM enabled many innovations, including a consolidated design and light-weight lattice structures. Other features, such as complex geometries with many hundreds of internal cooling ribs and channels, have improved the combustion efficiency of the rocket engine. The FS621M also allows for the economical production of oversized aerospace parts with a design–validation cycle accelerated by 80% compared to conventional manufacturing processes.

Dental

China is the world’s largest global denture manufacturing base; 60–70% of the world’s dentures come from China. The dental industry is also one of the industries where AM technology is widely used. Metal AM is mainly used to produce dentures and brackets, and AM technology is well suited for dentistry because the shape of each denture is unique (Fig. 9). The denture industry uses mainly small-platform metal AM machines, with build sizes generally ranging from 80–150 mm, and the materials processed are mainly CoCr alloy, and pure titanium.

Because the dental manufacturing industry is highly cost sensitive, the denture market is dominated by Chinese AM machine manufacturers due to the significantly lower machine prices. Representative companies are Chamlion, HBD, Riton Laser, Profeta, etc. Among these companies, Chamlion focuses on full-process digital manufacturing for dentistry with established ‘cloud factories’ around the world (Fig. 10). Its digital service platform provides both denture model design, as well as semi-finished and finished AM services.

Chamlion has a digital design team of more than 100 designers, which can provide 3D model design services for dental crowns, brackets, invisaligners and other products, and can handle tens of thousands of orders at the same time.

Customers send task requirements through the cloud platform, designers design 3D models online and the cloud platform assigns builds to the optimal cloud factory to complete the production and, finally, the products are delivered to users through global logistics. If customers need to build a semi-finished denture, it can be delivered twenty-four hours from order placement via the cloud platform. Chamlion has achieved full digitalisation of denture processing.

Chamlion’s products and services are exported to more than fifty countries around the world. It has successfully established more than 200 cloud factories, producing 80,000 dental crowns and 8,000 movable brackets per day. It provides denture products for thirty million people worldwide.

Tool and mould

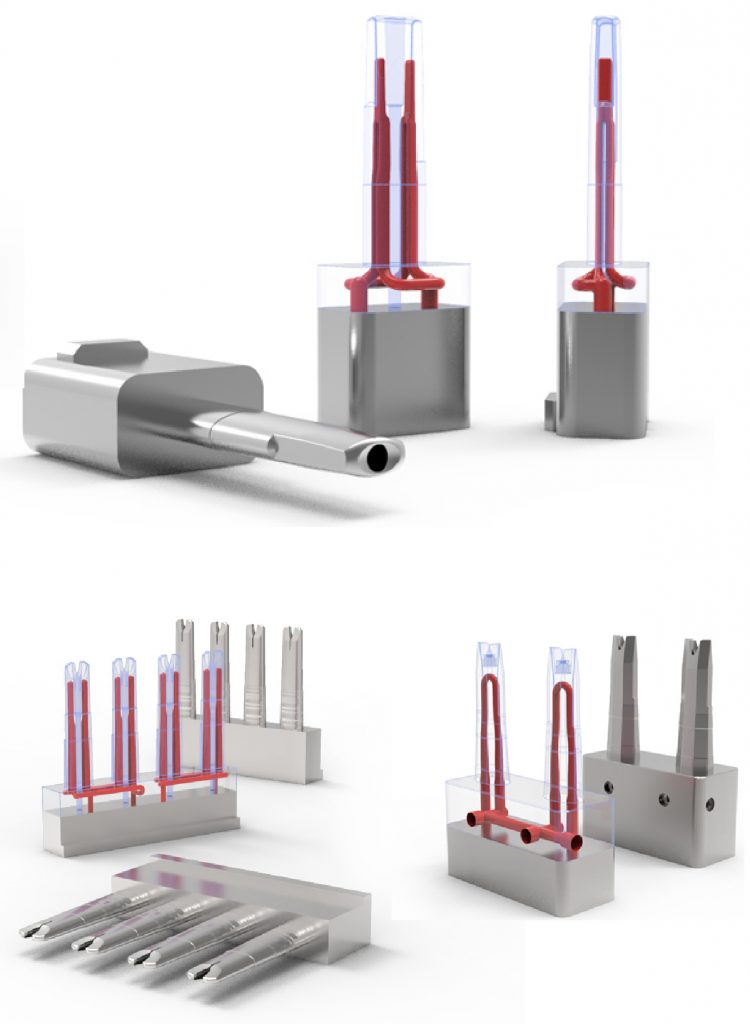

The tool and mould market is also an important application area for AM technology. The market size of China’s tool and mould industry reached $43 billion in 2022. Metal AM technology is generally used for the manufacture of injection moulds with conformal cooling channels. Key representative enterprises in this field are Shanghai Radin, Shenzhen dMac Precision, Anhui Hit3D and Dongguan Borton Precision, although this is not an exhaustive list.

Dongguan Borton Precision is a service provider focusing on AM solutions for moulds and offers a full set of processes from cooling channel design and mould flow simulation to AM, heat treatment and post-finishing to help customers achieve a seamless transition from an idea to a complete product.

Borton Precision applies Farsoon’s metal AM solutions to various types of plastic moulds, die-casting moulds, silicone rubber moulds, clamping fixtures and other products, and has purchased five Farsoon machines. Its main business is to additively manufacture vaping moulds. Previously, traditional moulds faced problems such as difficult moulding, long cycle times and low efficiency. Metal AM has greatly improved the cooling ability of injection moulded parts. An additively manufactured mould with conformal cooling channels can reduce the cooling blind spot, allow faster and better heat dissipation, and significantly improve the injection moulding efficiency and product finish, thus improving the yield rate of finished products. At present, the production efficiency of vaping moulds produced by Borton Precision using Farsoon’s metal AM machines has increased by 60% (Fig. 11).

Automotive

According to data released by the China Association of Automobile Manufacturers, 26.864 million vehicles were sold in China in 2022, including 6.887 million new energy vehicles (defined as battery electric vehicles (EV), plug-in hybrid vehicles (PHEV) and fuel cell electric vehicles (FCEV)) [8]. AM technology plays an important role in the development of new vehicles, but due to the high cost of PBF-LB metal AM technology, large-scale manufacturing in the automotive sector is not economically viable at present. However, the automotive market is one of the most promising markets for AM in the future. China’s mid-to-high end automotive market is still dominated by Mercedes-Benz, BMW and Audi, but local brands such as BYD, Hong Qi, NIO and Li Auto are also launching mid-to-high end models.

In 2021, Changchun-based FAW Group, one of the largest Chinese automotive original equipment manufacturers, selling 3.2 million vehicles in 2022, purchased a FS421M-2 dual-laser system from Farsoon Technologies. This is a representative example of a large-platform metal AM machine installed for the automotive industry in China. Although the end-application of metal AM in FAW Group is confidential, this investment will help build the internal closed-loop AM expertise for new product innovation, design and development.

A use case that is publicly available is from Ascension Design, a Chinese design firm. They produced a practical, usable AM two-piece titanium wheel in 2021 that passed performance tests to national standards, meeting the performance conditions and requirements for road use, and has been delivered to the first customers (Fig. 12).

The size of the wheel is 20 in. The outer ring is made of carbon fibre, and the inner ring is additively manufactured in titanium alloy in one piece using a 600 mm build chamber, four-laser PBF-LB machine from BLT. The diameter of the additively manufactured part is 500 mm, and the weight of a single wheel is 10 kg, a reduction of 40% compared to the conventional wheel. AM can realise the customisation of wheels, meet the customised needs of different customers and create unique shapes that cannot be achieved by traditional manufacturing methods.

PBF-LB applications in automotive are now focused on small-batch production, high-end edition customisation and high added-value aftermarket parts. There is still huge potential for expanded production capability when the manufacturing cost of PBF-LB comes down.

BJT AM technology is expected to be used for mass manufacturing of automotive parts. In addition, high-efficiency AM technologies such as Seurat Technologies’ area AM method are expected to be used for the future manufacturing of automotive parts.

Medical

With a population of 1.4 billion, China has a huge medical market. The application of AM technology in the medical field has moved from first-tier cities to fourth-tier cities and has played a key role in challenging surgeries. Metal AM technology is mainly used to produce implants, including titanium alloys, tantalum and so on (Fig. 13). Representative companies include AKMEDICAL, Chunlizhengda Medical and Huaxiang Group. Among them, AKMEDICAL is building implants using PBF-EB technology, whereas Huaxiang Group is promoting the use of PBF-LB technology to produce implants in China.

In 2021, a porous titanium spine fusion cage was developed by Huaxiang Group, and The First Affiliated Hospital of University of South China received official approval from the National Medical Products Administration (NMPA) to use Farsoon PBF-LB technology to manufacture orthopaedic implants. These were the first approved orthopaedic implants built by metal PBF-LB technology in China. In February 2022, Huaxiang Group received another category 3 NMPA clearance for its porous titanium interspinal fusion cages. In February 2023, a tantalum metal interspinal fusion cage from Huaxiang was also approved by NMPA, offering excellent material biocompatibility and elastic modulus for future applications (Fig. 14).

Metal Additive Manufacturing research activities in China

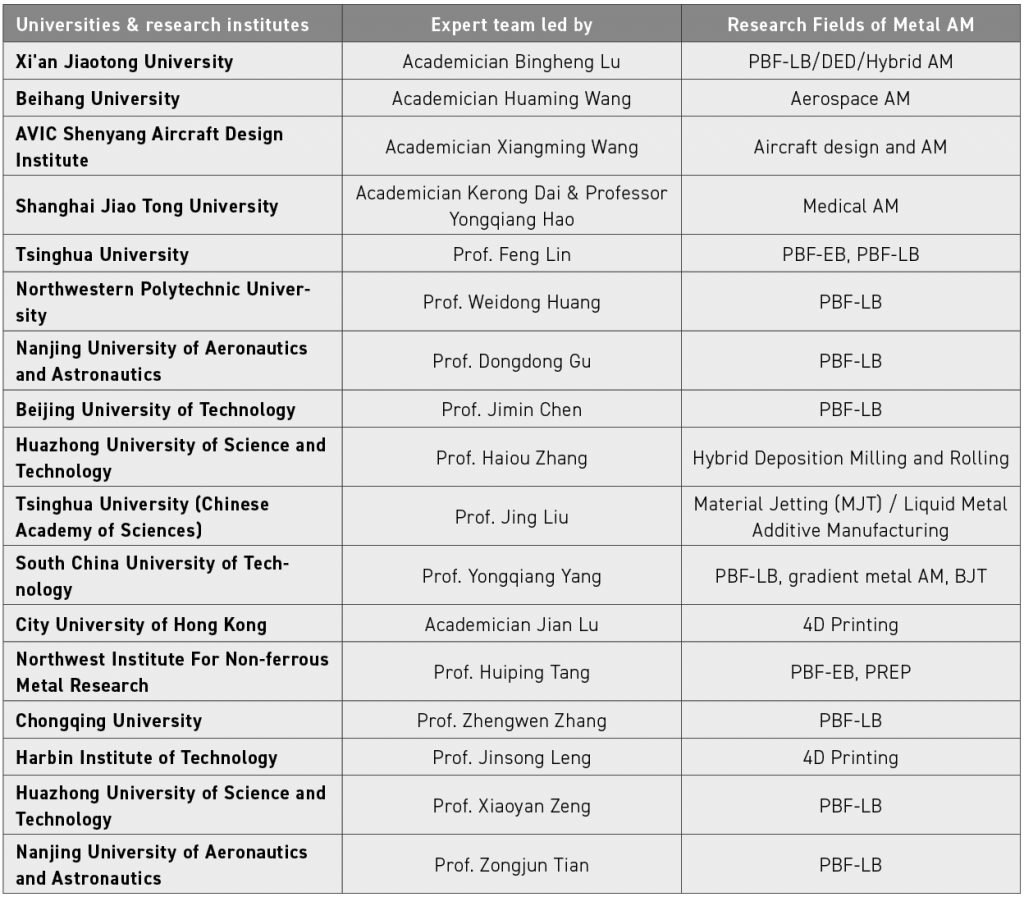

Currently, scientific experts, including nearly twenty teams from more than fifty AM laboratories in universities and research institutes, are working in metal AM research. Table 4 shows a partial list of China’s metal AM expert teams.

In 2022, the professional journal Chinese Journal of Mechanical Engineering: Additive Manufacturing Frontiers (CJME:AMF) was founded by Chinese and French AM experts and launched on ScienceDirect, an important event in the field of Chinese AM research. This international industrial journal focuses on AM and related technologies and is supervised by CAST and sponsored by the Chinese Mechanical Engineering Society. The editor-in-chief is Bingheng Lu, Director of National AM Innovation Center, Director of the National Engineering Research Center for AM at Xi’an Jiaotong University and Academician of Chinese Academy of Engineering. The co-editor-in-chief is Alain Bernard, member of the French Academy of Engineering and Ecole Centrale de Nantes.

Summary

It is hoped that this article comprehensively presents the current development status of China’s metal AM industry, mainstream metal AM companies, Chinese government policies and attitudes towards the AM industry, application areas and cases of metal AM technology in the Chinese market, along with basic information on domestic metal AM research teams.

Without doubt, metal AM in China has advanced significantly over the past five years and there is every expectation that its potential will be leveraged by a wider range of manufacturing industries.

Author

Xuesong Pan (Peter)

Co-founder of professional Chinese 3D printing media company Nanjixiong

Acknowledgments

Special thanks to Ms. Chenlu Fang for her help in reviewing this article.

References

[1] http://english.www.gov.cn/state_council/ministries/2017/10/12/content_281475904600274.htm

[2] www.amac-china.com/col/col15/index.html

[3] Wohlers Report 2022, www.wohlersassociates.com

[4] Nanjixiong, www.nanjixiong.com

[5] www.sac.gov.cn/sacen/Features/202009/t20200928_346916.htm

[6] ISO/IEC23510:2021 Information technology — 3D printing and scanning — Framework for an Additive Manufacturing Service Platform

[7] Blue Book of China Aerospace Scientific and Technology Activities (2022)

[8] China Association of Automobile Manufacturers, http://en.caam.org.cn