Adrian Keppler on Additive Manufacturing: An insider’s assessment from the outside

Dr Adrian Keppler has been an active participant in the AM industry for close on fifteen years. Based on his past experience as the Managing Director, and later CEO, of EOS GmbH, and his current role on the advisory boards of numerous AM startups, Keppler believes that more can, and should, be done to advance industrial applications of AM. Are the industry’s efforts to develop new technologies without perfecting and industrialising existing technologies holding it back? Should the less exciting work of industrialisation be prioritised over the next shiny technology release? Joseph Kowen interviews Keppler for Metal AM magazine. [First published in Metal AM Vol. 9 No. 2, Summer 2023 | 10 minute read | View on Issuu | Download PDF]

The Wohlers Report, an annual review of the state of the Additive Manufacturing industry that publishes industry growth estimates for 1988 to 2022, suggests that the industry has grown about 20% per year on average during that time period. In many industries, such a healthy growth rate would be an admirable achievement. Newcomers to the AM market are often surprised to learn that the industry is over thirty years old. The overall perception is that AM is a young and dynamic segment, and while the latter is certainly true, the former is not completely accurate.

The report estimates that the total size of the AM industry reached $18 billion by the end of 2022. While that may be a worthy figure in and of itself, it is only 10% of the size of the machine tool market, and a small fraction of the global manufacturing market. Given the relatively small footprint of the industry despite having been around for so long, it is reasonable to question how the industry is really doing. A healthy and honest review of the state of the industry might lead segment players to put its finger on weaknesses that may be holding back growth, and what might be done to mitigate or eliminate them.

Adrian Keppler has had a front row seat in the Additive Manufacturing business for more than a decade, enabling him to observe at close range the development of the industry. Beyond just being an outside observer, he was also an active participant. From 2010 to 2021, he served as Managing Director, and later CEO, of EOS GmbH. As an industry pioneer for both polymer and metal AM, which began its journey in 1989, there are few better examples than EOS of companies whose history reflect the sweep of the industry’s growth in general. Today, EOS remains a leading supplier of Laser Beam Powder Bed Fusion (PBF-LB) technology for both polymers and metals.

Keppler’s tenure at EOS enabled him to witness firsthand the impressive progress of the industry, commercially and technologically. Since leaving EOS, Keppler has continued to advise companies in the AM segment as well as being involved in investments into the space, giving him a good vantage point not only on what has happened in the industry until now, but also on where new entrants are bringing innovative ideas to AM.

Keppler recounts his perceptions of the AM industry when he first entered it. “When I joined EOS, for me it was clear the technology could offer huge value for the end customer. At that time, I believed that the OEMs would understand the potential and would immediately jump into the technology and adopt this new way of manufacturing. Fifteen years later, I have to say I’m a little bit disappointed. The adoption rate has been much slower than expected.”

It would be inaccurate to see Keppler’s sentiment as a pessimistic outlook for the industry, but it does reflect a level of expectation, shared by many, that was not fully met by progress. There is nothing like a little disappointment to trigger some introspection and analysis into why the promise did not match the performance.

Post-COVID, Keppler says, many in the industry thought that the unique circumstances brought about by the pandemic would be a breakthrough event for on-demand manufacturing in an age of disrupted supply chains. Additive Manufacturing proved to be good at supplying specific needs, such as facemasks, nasal swabs, urgent medical device components and spare parts. The case of being able to produce things urgently, and locally, in times of crisis was well proven. When the pandemic was over, however, manufacturers went back to the ‘old’ ways of doing things, relying on conventional manufacturing processes.

AM has scored successes in specific industries such as medical and aerospace, mainly because they are high value, low-volume applications. AM has not managed to penetrate significantly into medium value/higher volume applications such as those in the automotive industry and consumer applications. The advantages of AM are obvious, says Keppler, listing such factors as freedom of design, functional integration combining several components into one, supply chain digitisation, manufacturing flexibility as well as sustainability. Given these convincing arguments for AM, what then are the factors holding the industry back?

Additive Manufacturing’s maturity and scaling the supply chain

Keppler summarises a number of factors that need to be addressed by both users and suppliers. First is a greater maturity of AM technology. Compared to milling, turning, grinding, injection moulding and casting, AM is still at a relatively early stage of technical maturity. Machine reliability and uptime needs to improve, as well as machine consistency and repeatability, in order to ensure the same part quality regardless of the machine on which they were manufactured. In short, in order to increase the number of instances in which the use of AM makes sense, systems must offer greater quality and productivity.

Maturity of the technology plays directly into costs. Reduced uptime, and an increase in scrapped parts that don’t meet quality standards, lead to higher costs. “Part costs are too high,” says Keppler, “and this is hindering a movement to higher volume applications.”

“Many AM machine manufacturers concentrate on the ‘supply’ side, trying to push as many machines into the market as they can,” says Keppler. “These companies should emphasise the ‘demand’ side for AM parts – creating a ‘pull’ from the customer side.”

That means assisting users in identifying the right applications with compelling use cases. The emphasis should be on the business case, not just making ‘cool’ parts. Sometimes ‘boring’ parts make sense for AM too. There are companies in the market that are already helping customers identify AM business cases. Not all companies have this capability inhouse, and until they acquire the know-how they can learn from the experience of others.

“There are only a few companies out there who offer end-to-end services from designing or redesigning the part, support in qualification, validation, part build, post-processing, surface treatment, quality assurance, final assembly,” he observes. “Offering integrated end-to-end solutions is, from my point of view, what is missing.”

“It’s not about just selling the part, it’s about education, enabling licensing models, managed services, build-operate-transfer models. This will help lowering the entry barrier for end customers,” he emphasises. “I strongly believed that if customers are successful, meaning they are earning money using my technology, then they will continue to invest. They will continue to buy material from me, machines from me, services from me.”

If this is the case, then why are system manufacturers not doing more to encourage the development of business cases for more AM parts? “You have to invest – in application engineers and consultants supporting customers and translating their know-how into methodology and training curriculum. It takes time and it costs money. Most of the AM machine OEMs don’t have time because they have to focus on generating revenue, achieving their targets, to fulfil the expectations of their investors quarter by quarter,” Keppler concludes. “These companies focus on their own success. They do not focus on the success of their customers. For me this became obvious over the past year as the industry rebounded from the pandemic, everybody wants to sell and hardly anybody is willing to invest time and effort and money to support end users in speeding up their validation and qualification process for serial parts. But this is a prerequisite to scale the business – for both end user as well as the AM machine OEM.”

The AM supply chain needs to be readied for scale, adds Keppler. It is dominated by smaller sized AM service providers who are – in most cases – ill equipped to scale their AM production. Only a few companies can offer end-to-end solutions, including upstream services like design and qualification support as well as downstream services like post-processing and quality assurance for AM parts.

Compounding the problem, service providers sometimes keep their manufacturing knowledge close to their organisations. Once service providers offer a full range of AM and post-processing-related manufacturing services that will ensure a supply of ready-to-use end parts, more applications will follow. In addition, this will enable them to address the issue of part cost, one of the most significant hurdles impeding a broader adoption of Additive Manufacturing applications. Since a large part of the cost of AM parts is not related to the AM build process, an end-to-end optimisation of the entire manufacturing process is required to increase efficiency, reduce manual interaction and with this significantly reduce cost-per-part.

Designing for Additive Manufacturing and beyond

It is commonly accepted that taking a part that was designed for, say, Metal Injection Moulding or casting, does not necessarily make the part optimal for AM. One has to add value if one is moving to a new technology. It is critical to understand the value drivers for the application. Designing just for AM is not enough, it must be designed for end-to-end manufacturing. “How do I optimise this design in a way that I can produce this part in an efficient way? Keep in mind, it will be a combination of AM and conventional technology. Especially with metal AM, 90% of the parts have to be post-processed, whether it’s milling, grinding, or coating. So, we have to have somebody who is overlooking the entire design manufacturing process and finding the optimum design.”

Committing to automation and standardisation

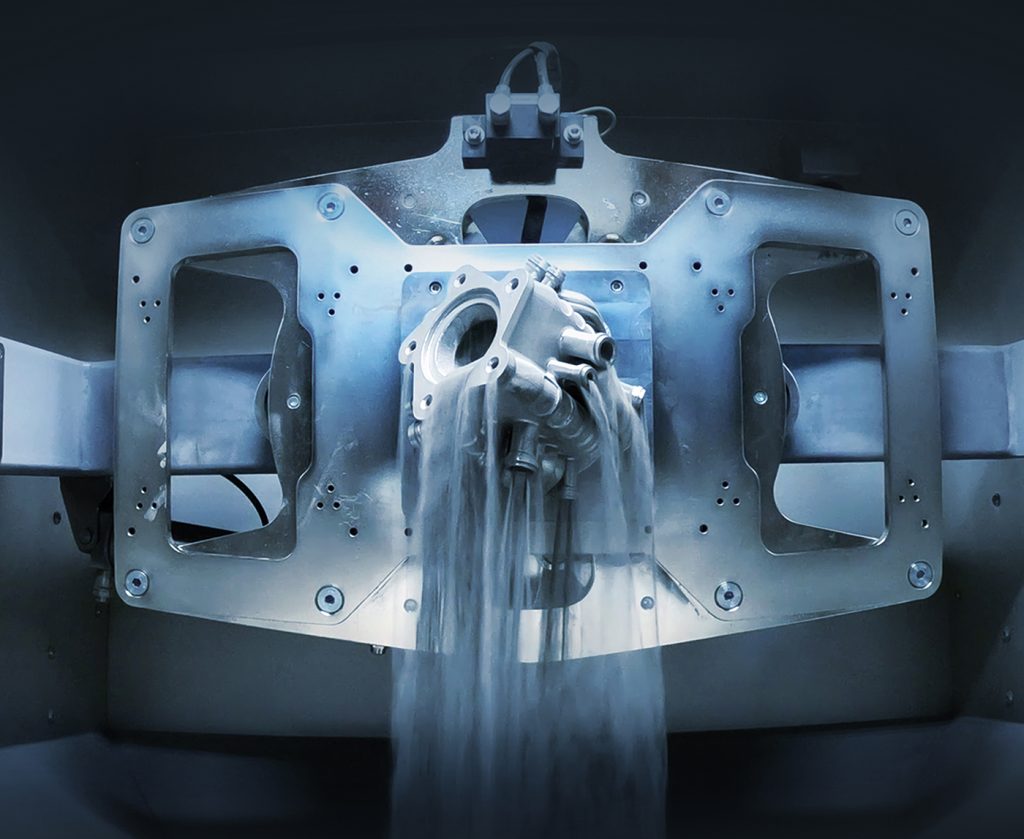

So how will the supply chain be scaled and part costs reduced? Improving automation is a key area that will require attention and investment. Many post-processes such as support removal are archaic by modern industry standards. Post-processing systems will have to be industry 4.0 ready. Automation will reduce costs by making processes more efficient, including the reduction of manual labour. In many cases there will be a shortage of skilled manual labour.

Automation might not just be the cheapest solution – it might, in some cases, be the only solution, explains Keppler. “Some companies are too narrow minded. They focus on their AM process and not on the entire process. So, stepping into the shoes of their customer is, from my point of view, important. Customers need a final part, which requires building and post-processing.” Automation is an essential way to ease the interfaces between the various parts of the manufacturing chain.

Keppler states, “It’s about interfaces. What you want to achieve is an end-to-end part flow and data flow from design to final product. The more interfaces and interruptions you have, the higher the cost of the part will be.” He gives an example: If one has to cut the parts from your plate before you can do CNC milling, it is a manual interaction. This will incur additional cost and it’s a source for additional quality issues. A standard interface defined between the AM machine and the CNC companies, in this example, would help. There are some first initiatives working on the standardisation of interfaces. Today, this flow is fragmented. Industry leaders must step up and say what needs to be done to lower part costs.

Can government or non-governmental bodies play a role? “I’m not a big fan of government projects because normally it requires a lot of documentation. A significant portion of resources are dedicated to documentation and not to working on the solution. I believe it must be for partnerships of companies who are willing to advance this, and who believe in the value of working together to find a solution.”

The need for organisational commitment

Many companies are still probing the advantages of AM. “It is not just a question of buying a new manufacturing tool – it is about transforming companies into a more flexible, customer oriented, digital enabled organisation,” emphasises Keppler. AM efforts in organisations often occur without top management’s active involvement, from the bottom up. Additive Manufacturing can be transformational for companies and will require a different way of thinking throughout the organisation, including through facilitation from the top.

“You have to drive these topics top down and not bottom up. Moving from a technical view to a strategic view is mission critical if you want to see a broader adoption in these companies. It will need an openness and strong management support to evaluate shifting from analogue to digital manufacturing, from centralised to decentralised production, from mass products to more customised products, from physical to digital spare parts.” If AM is adopted as part of a strategic plan, industry will see strong growth in applications, a significant uptake in AM service business, as well as demand for systems and materials.

Even if senior management is involved, at the end of the day decisions will be driven by business impact. Profits are in many cases calculated on a short-term basis. The challenge is for management to see the broader strategic question.

Future growth

Where does Keppler see the metal Additive Manufacturing market headed? “I definitely see that we will have a much wider range of metal processing technologies in the future. Today, 80 or 90% is laser-based. This is where it all started. It’s obvious that many companies follow this path and try to increase productivity by adding more and more lasers, which I believe is not the right way going forward. That said, PBF-LB is the perfect fit with this high value, low volume application we are targeting today.”

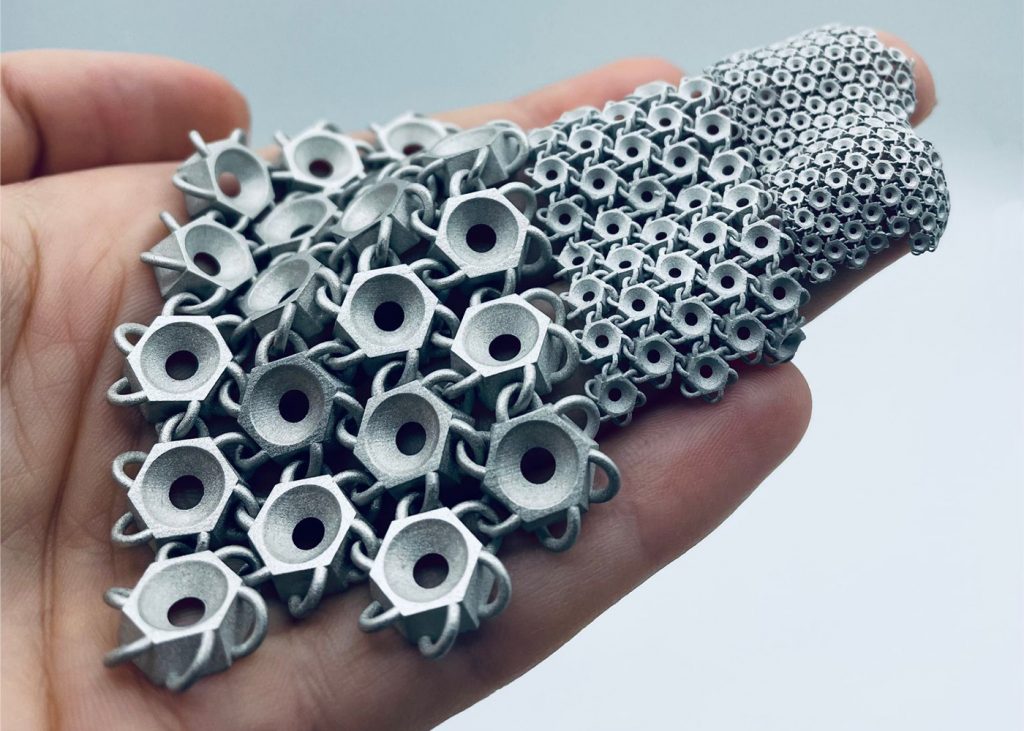

“The output required for today’s applications are high-quality components, high density and good mechanical properties. But the growth will not come from aero engines or industrial gas turbines. It may come from automotive, or maybe general industrial applications such as heat management equipment or tooling. For many of these applications, 95% or higher density is good enough. And this is definitely something which metal Binder Jetting [BJT] or other sinter-based metal AM technologies such as Vat Photopolymerisation [VPP] can achieve. We will also see stronger uptake for larger spare parts made by Directed Energy Deposition [DED], repairs, and so on,” says Keppler. But these processes should be ready for automation, he adds.

Will newer processes address the part cost issue? The promise of these technologies is supposed to be lower part costs. “I visited a MIM company that is using Binder Jetting and VPP. It’s unbelievable what they are doing – what parts they can produce. Very small, high detail resolution, perfect surfaces. But their expertise is in the sintering process, which is the most critical step in sinter-based Additive Manufacturing. It is always a mistake that we focus on one part of the process and forget about the rest.”

And what is the direction of PBF-LB? “Everybody wants to go bigger and faster. Some new companies are trying to move from point and line exposure to more of an area exposure, which allows them to be significantly faster. And this makes sense because I don’t believe that adding additional lasers, going from four to eight to sixteen and more, will be the answer.” Paradoxically, the rush to add more lasers might be having a negative effect on the industrialisation of existing systems. New system development means less attention to perfecting and fine tuning existing platforms to bring them to a required level of maturity. New, more complicated products will have their own teething problems. In addition, new platforms mean revalidation and requalification, which is a time consuming and cost intensive process.

Keppler also urges people not to underestimate the critical role of materials in AM processes. “Material is important. Many years ago, everybody told me that materials are a commodity. No, materials are not just a commodity. If you have the right material with the right properties, you can increase the speed of your builds significantly. In addition, you can minimise the scrap rate of waste material.”

Investments cool

Keppler is realistic about the current level of investment into AM. “The willingness to invest into AM has cooled down significantly. This partly has to do with AM itself because we have seen some less successful ventures enter the market. A lot of companies are burning a lot of money and they have significantly overpromised and underdelivered. The industry is ready for strong consolidation.”

In conclusion

Adrian Keppler’s journey through the industrial end of Additive Manufacturing makes his observations especially worthy of consideration. Sitting on the outside offering criticism to those on the inside is a relatively easy proposition, and so hearing the opinions of someone who has spent considerable time on the inside of one of the industry’s most significant players has added weight. In some ways, questioning by an industry insider of the segment’s performance entails a degree of self-reflection on decisions made and opportunities not taken.

Through Keppler’s eyes AM is a work in progress, despite great strides taken and successes achieved. The collection of processes and technologies known as AM have demonstrated notable promise that is waiting to be realised. With some exceptions, applications of AM lack the maturity to fulfil the promise. Like a good wine, maturity cannot be achieved overnight, but there are things that can be done to speed up the maturation process. Some of those things are technical, such as improvements in machine reliability. Others are decisions and resource allocations within our control.

A holistic view of AM as a group of manufacturing methods complementary to, and on par in importance with, other conventional manufacturing technologies, must be backed up by efforts to ensure that getting to a final part using AM covers more than the AM process alone. Until parts are designed to exploit the potential of AM, and optimised for post-processing, and until the transitions between steps in the process chain are connected through efficient automation, AM will be hobbled by slower growth and fewer business cases that make sense.

Success breeds success, and industrialisation of AM will occur if there are enough successes to justify investments in the hardware, software and materials needed to get there. While technological progress will not stop, and new technologies will continue to be developed, perfecting AM processes will require more effort. The sooner we adopt an industrial end-to-end view of Additive Manufacturing, the sooner the industry will see a diversification of uses for AM, leading to the growth that the industry desires and the success its inventors deserve.

Contact

Adrian Keppler

AM Scalation / H&Z Management Consulting

[email protected]

https://hz.group/home

Author

Joseph Kowen is an industry analyst and consultant who has been involved in Additive Manufacturing since 1999. He is an Associate Consultant at Wohlers Associates, part of ASTM International’s AM Center of Excellence.

Tel: +972 54 531 1547

www.linkedin.com/in/joseph-kowen-a5129b3/

Download Metal AM magazine