Formnext 2023: Innovations in metal Additive Manufacturing from the industry’s leading international exhibition

When it comes to presenting a review of the world's largest international exhibition for AM, one can go about it in two ways: very broad generalisations about the state of the industry or a more focused review of a handful of noteworthy developments. Given the 859 exhibitors at Formnext 2023, spread over some 54,000 m2, this review by Dr Martin McMahon takes the latter approach, offering broader context where possible. Whilst many more press announcements are covered in the industry news section of this issue, the following report provides an overview of how – and where – AM is evolving and maturing into a credible and dynamic technology. [First published in Metal AM Vol. 9 No. 4, Winter 2023 | 20 minute read | View on Issuu | Download PDF]

This year’s Formnext was perhaps the most eagerly anticipated since the global pandemic. While 2021 saw a fair number of both exhibitors and visitors, attendance was somewhat subdued in the wake of COVID-19. Then, last year, the buzz was back with noticeably higher visitor numbers; still, I’d made the mistake of only attending for the first three days. So, this year, with all four days a certainty, and on the back of announcements by the organisers that they had booked a record number of exhibitors, levels of anticipation were at a maximum.

Industry appetite for this year’s event was fuelled in part by the many press announcements ahead of the event. Whilst some were from the usual suspects, others inspired me to find out more. I’m pleased to report that there were numerous announcements of value at this year’s show.

For me, new hardware and the latest technological developments were always going to be key themes to follow, and I targeted these innovations with great interest. On a broader note, what was noticeable this year was the diminishing dominance of Laser Beam Powder Bed Fusion (PBF-LB) as a result of so many more metal Additive Manufacturing technologies maturing and becoming commercially viable. Electron Beam Powder Bed Fusion (PBF-EB) machines were certainly a lot more prevalent, and there were far more Directed Energy Deposition (DED) machines, both powder- and wire-based, than ever before.

In this last respect, the show very much revealed that the AM world has gone ‘all in’ with robotics, and it occurred to me as I looked for differences between each offering that maybe this could make metal AM feel a lot more familiar to the mainstream traditional manufacturing sector. Why? Simply because multi-axis robot arms have been around for a long time, have been relied upon for some very high precision – or heavy lifting – tasks, and are very much a familiar feature in production welding lines all over the world.

Not to be forgotten were the numerous sinter-based metal AM technologies that take green parts, produced by several types of AM technologies, and then process them via sintering to make parts that are very close to full density. Many in the manufacturing sector have big hopes for sinter-based AM processes, particularly Binder Jetting, to enable them to start high volume manufacturing, and partnerships – such as those between HP and Indo-MIM, the world’s largest MIM producer, (Fig. 2), and HP and Elnik Systems, a leading producer of vacuum sintering furnaces for the MIM industry – give a clear indication of where things are going.

Finally, of course, there’s no metal AM without metal powders and wire, and there was plenty to discover in the world of AM materials. Notable is the growing recognition that sustainability and reducing harmful emissions in the production, usage, and waste handling of metal powders is a key area of responsibility for our sector. This will be covered in more depth in a separate report.

One observation is that there has also been some change within the Additive Manufacturing supply chain. It became clear from this year’s Formnext that materials suppliers are still not sure where they are best positioned in the complete value chain. In most other sectors, materials are supplied to manufacturers to produce parts: rolling mills produce sheet metal, that then some other manufacturer takes to turn into car doors, for example. In Additive Manufacturing, however, we have seen nearly all materials producers at one time or another either directly producing the useable parts, or they have, at the very least, given this a lot of consideration. Speaking to some of these companies, it was clear that some may be struggling to turn that into a profitable business.

Advances in laser-based Additive Manufacturing

Formnext presents the opportunity to discover what’s new and great in the sector, for suppliers to share their vision, and, perhaps, identify where they should be heading next. I don’t think we’ve arrived at a point in time where a user is able to find their ‘dream machine’ in the exhibition halls because so much is still evolving in core metal AM technologies. In PBF-LB, there’s been a flurry of ‘go big’ machine stories over the past year or so, but more broadly there hasn’t been too much to shine a light on in terms of underlying integrated technology. While this statement is broadly true of this year’s show, some interesting developments from nLIGHT and Renishaw, which we will return to, proved that rules always have exceptions.

Others, like One Click Metal, showed off its modular build volumes and new aluminium alloy, whilst Prima Additive bucked the trends by showing its dual-wavelength PBF-LB machines. It also showed different modes in DED, including a special ability to produce thin wall parts. DED, which has always appeared to be waiting in the wings, seemed to have finally stepped onto the stage this year, and the level of integration with robotics was very impressive.

Laser control at nLIGHT

One interesting development for laser-based AM technology was from nLIGHT Inc, showcasing its beam shaping technology, bringing to the market, for the first time, a 1500 W laser beam shaping solution without any complex lens or focusing arrangement at the ‘business end’ of the laser optics. The company has made innovative choices in its use of a ring waveguide around the core of the optical fibre and the way in which the light energy is guided by the fibre itself through manipulation of the properties of the waveguide.

This was the first time I’d come across being able to change the radial position of the optical field between two concentric guiding regions in a fibre to control the emerging laser output. nLIGHT neatly demonstrated on its stand how the focused beam can be changed from a small, precise single mode spot to large ring-like patterns up to 3X the diameter, with the extreme benefit of not shifting focus or moving any optics. This allows for 3- to 5-fold increases in build rate with very good control of the melt depth and how the laser power interacts with the powder.

Used in the right way, the company is confident that users are able to produce fully dense (>99.9%) parts with significantly less soot and spatter. Such is the success of this innovation that it lies at the heart of several powder bed machines now on the market and, as displayed at Formnext this year, has been selected to enhance the capabilities of the customised systems offered by AMCM, the sister company of EOS.

However, this wasn’t the only technological advancement that caught my eye from nLIGHT: its ultra-compact multi-laser solution, called modulus (Fig. 3), really made me look twice. Walking onto the nLIGHT stand, I think I can be forgiven for thinking that the four and eight laser modules that were on display were only ‘mock-ups’ of the real thing, such was the compact nature of these units. In fact, the standalone single units were also clearly on display, and yet it has somehow managed to condense down all the necessary controls, cooling, and power requirements to something that is probably only 50% of the equivalent stack of single units.

nLIGHT has also incorporated a clever client-server-based ethernet communications backbone to control the individual lasers, opening up other possibilities in synchronous scan strategies, process monitoring, self-calibration, and diagnostic reporting.

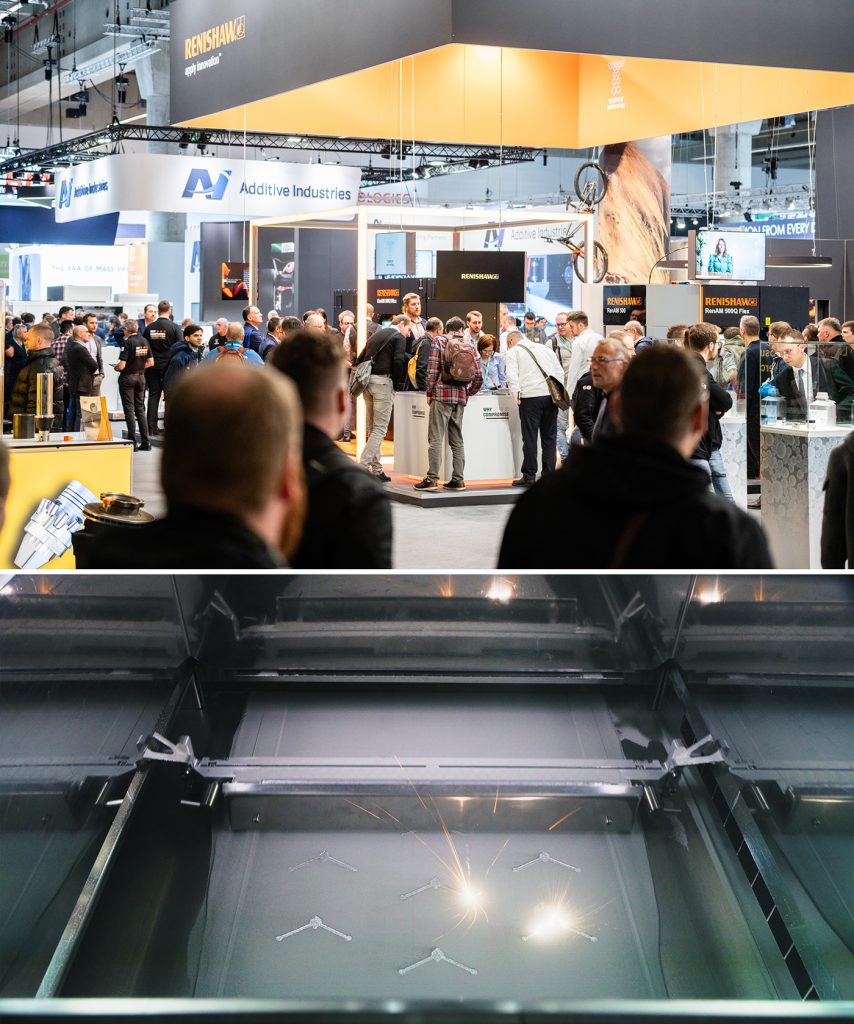

Renishaw’s Tempus

Entering Hall 11 gave me my first surprise, with Renishaw front and centre with its exhibit. Renishaw’s staying power in the Additive Manufacturing industry after a turbulent period for the company was reinforced with this year’s big reveal: the introduction of its Tempus Technology. Having consolidated its product offering around the RenAM 500 platform, it launched the new Ultra version, incorporating the new ‘scan-while-you-wipe’ technology. To many this may not seem to be that big a development, but it’s taken a long time for machine vendors to come around to realising a working solution.

Renishaw equated this to having a fifth laser in the machine, providing up to 25% more productivity. Watching the scanning starting just moments after recoating began, and without the normal delay of having to wait for a complete layer to be deposited, was certainly something to be seen live at the event.

The message from Renishaw was that it will continue to concentrate on productivity gains in the mid-range machine sector rather than pursuing any developments that require more lasers or bigger chambers.

Additive Industries

Another company that has experienced quite a few changes in recent years is Additive Industries, but once again it made a good impression on the show floor with its impressive display of an Alfa Romeo F1 car. Like most companies that have entered the AM sector, aerospace has been an important market for Additive Industries, and this will continue to be the case – but perhaps this year there was a clear intention to show that it will also be looking to the automotive industry for its next big push.

The company’s Kartik Rao highlighted partnerships and collaborations with BMW and VW, and how there is a clear intention to use metal AM by these companies for tooling and the production of EV car components, which was very encouraging to hear. The automotive sector has long been a ground where most AM companies have aspired to play, and now it does seem that this is becoming more of a reality. Hence, while the Metal Fab G2 may have been pushed into second place in terms of attention by the F1 car, it did serve to highlight the fact that 250-300 parts per car are produced on the Additive Industries PBF-LB machines.

However, not all parts produced by Sauber Technologies for the Alfa Romeo team are used directly on the car, and pit lane tooling was also on display during the show. One aspect of lightweight structures that really caught my eye was a titanium car jack. It had escaped me previously that each one needs to be customised for each car, and potentially each circuit, and in this case also designed with the pit lane engineers’ usage in mind. Being lighter and easier to manoeuvre under the car makes it safer and less stressful for the technicians in the pit lane. Incorporating the now very familiar mesh structures made for a very good-looking part.

The evolution of Electron Beam Powder Bed Fusion

Despite being in the shadows of Laser Beam Powder Bed Fusion for so many years, from a commercial parts production standpoint Electron Beam Powder Bed Fusion has perhaps been a success for a significantly longer period of time than PBF-LB, particularly when taking into account the production of medical implants. For many years, however, there was only really one player on the block: Arcam, now part of GE Additive. Recently, we have seen a number of new entrants and their collective showing at Formnext made the technology look very impressive.

FreeMelt

FreeMelt is launching its new eMELT-iD compact development machine to bridge the gap between development and full-scale production without changing process parameters. This, it claimed, is because the underlying technology and mode of operation are identical to its larger machine. The company was also very proud about being able to produce crack-free tungsten parts, but it was not alone in this respect; refractory metals were amongst the flavours of the week at Formnext in 2023.

Wayland Additive

UK-based Wayland Additive stated that it is continuing its specific focus on refractory metals, having recently supported customers such as EWI with molybdenum. In addition, the company is now processing Vibenite from VBN Components, thus approaching (almost) impossibly tough tool steels, as well as the previously purely Powder Metallurgy processed stainless steel, CPM420V, to be used in its latest machine shipped to Europe. As the first machine vendor to introduce a targeted charge-neutralising technology into a machine, Wayland has had a very good year since its first machine shipment. Shipping four machines in the past twelve months is impressive, considering Wayland is still a young, modest-sized outfit.

Much of its success in broadening the materials portfolio has been due to the lack of a requirement for a pre-sintering scanning step, which means its development customers have been able to research new applications and parameters in vastly shorter timeframes than previously possible. With Wayland’s support, one customer started from a blank page and was able to achieve a sign-off on a new material and application in just five weeks. I don’t know many who have achieved that, even with the long-established PBF-LB machines.

ProBeam

Stepping on the ProBeam stand, it was particularly gratifying – albeit somewhat unexpected – to see one of the featured parts from the Autumn 2023 issue of Metal AM. A good array of parts from both its PBF-EB and wire DED systems were displayed, the latter being the most impressive with regard to size and diversity. Copper and bi-metallic deposition were featured in the form of what I shall only refer to as a copper-coated ‘doughnut’.

JEOL

JEOL had an impressive display of parts and I found it especially pleasing that it had achieved a qualified install to AMS 7032, the recently published SAE standard for machine qualification for fusion-based machines. It is always good to find out that the effort being put into these international standards is starting to have a positive effect.

GE Additive

The incumbent market leader, GE Additive, with its Arcam machines, has not sat idle and came to this event with a few updates of its own. Having decided that small incremental developments are a safer way to stay the course, the company showed me new scanning strategies enabling really – and I mean really – unsupported parts with huge improvements in down-skin roughness. GE Additive has also been concentrating on new materials developments, including the nickel alloy 247, and, judging from what I saw, it’s hard not to agree that it has made some fine progress.

China’s rise

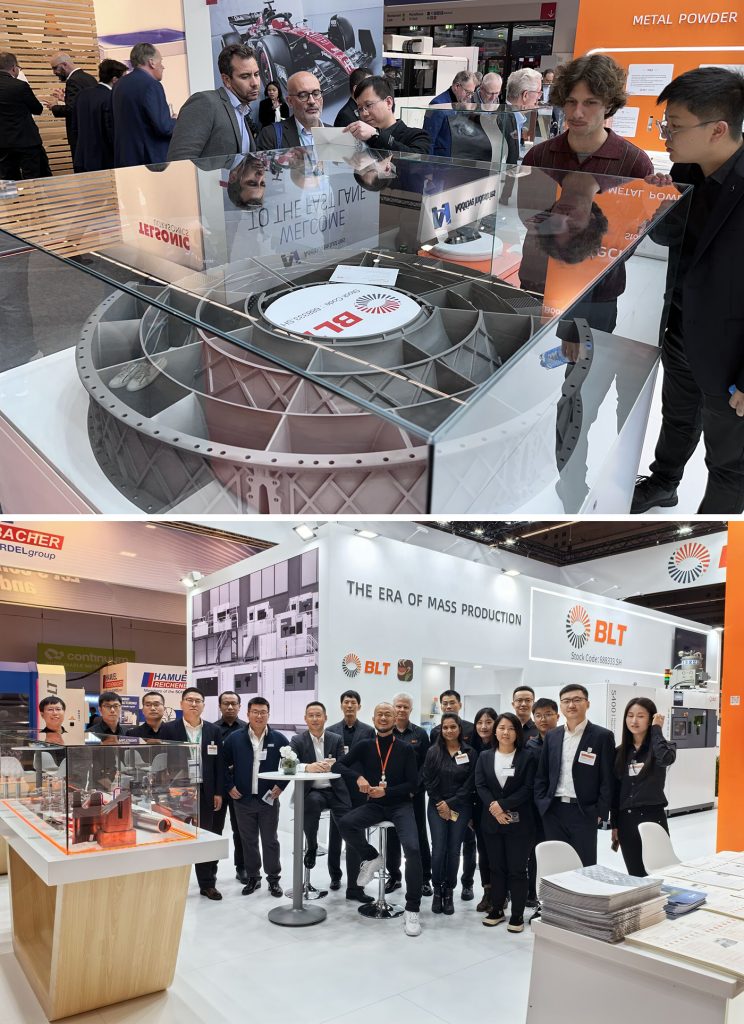

The growing presence of Chinese companies in the Additive Manufacturing sector has not gone unnoticed over the past few years. Companies such as Farsoon, H3D and EPlus3D all had a significant presence at Formnext this year, and there is a clear intention by these companies to expand their presence in the US and Europe.

This year, however, one company stood slightly above the others, and not only because of the size of its stand. Bright Laser Technology’s Sales and Marketing Director for the EMEA region, Slobodan Ilic, made it very clear that the company has had a successful year, both in the domestic and international markets.

Ilic spoke about BLT’s intention to present the full extent of the company’s vertically integrated complete AM value chain at Formnext, from large-scale metal powder production, with an impressive selection of titanium alloys amongst its offering, to the twenty-six laser machine that boasts a footprint of some 11 x 6 x ~8 m, to one of the world’s largest installations of PBF-LB machines inside its own AM contract manufacturing service division.

Casting my mind back to the first time I saw one of BLT’s machines and comparing it to what was on display this year, it was clear that the company had matured into a very serious contender in this field. Its staff at the show were quick to point out that the company believes itself to not only offer the world’s largest selection of these type of metal AM machines, but now also powder- and wire-based DED machines.

BLT hasn’t just been developing these machines on a whim, and announcing a collaboration with automotive giant BMW was clear proof of this, adding to its links with Audi and aerospace sector primes such as Airbus and Safran. Though both the aerospace and medical sectors are very clear target markets for this company, it now has the automotive industry squarely in its sights for future sales in the European arena.

Domestically, it has stated that it continues to work very closely with COMAC in the aerospace sector as well as other primes that have established facilities in the Asia region.

It had a number of very large parts on display, and its ‘marquee’ part was a large titanium aero engine intermediate compressor casing manufactured as a single piece (Fig. 8). At close to 1.5 m in diameter and built on the new twenty-six laser machine, it was certainly quite an imposing sample part on its stand. However, build times of over one hundred hours do raise many questions and, on closer inspection, it was apparent that it has some work to do on scan strategies and making sure all those lasers are properly aligned.

Despite this, nothing should be taken from the fact that it accomplished such an extraordinary feat, and it wasn’t ‘just another’ display rocket engine. Perhaps, the troubling thought that cranked through my mind as I walked away feeling something bordering on dread, was the requirement of between four and five tonnes of titanium alloy powder to fill the machine and complete such a build.

However, this challenge isn’t unique to this large PBF-LB machine alone. I would go as far as to suggest that the jury is still out on predicting the future of all such ultra-large format laser machines. Fortune, as they say, favours the bold!

DED: robots everywhere

Robots and machine integrations were all the rage this year for the DED vendors, and this group of metal AM machines and applications continue to grow at a faster pace than the rest of the sector. I believe this was demonstrated this year more than any other as DED technologies have been easier to integrate into existing machine tool platforms, or enclosures, and the choice of those was already vast.

It struck me that there’s little need to convince people of DED technology’s robustness or capabilities, and even the most unfamiliar amongst us can look at any one of these machines and instantly equate them to welding, especially the more dominant wire arc DED variant. This did make it a little more difficult to try and establish the major differences between them, and I have to confess given the limited time to look at any of them my first impression was that there was a lot of similarity. By this I certainly don’t mean that there wasn’t a lot of capability on display – far from it. My impression is that wire arc DED, through its adaptation of existing welding technologies, was shown to be well ahead of PBF processes with respect to in-process monitoring.

Software capabilities for operating the equipment, creating tool paths, and monitoring the build process were all potential key differentiators this year, but there wasn’t really the right opportunity to see these in action. All the DED machines at the show fell loosely into one of three categories: either standalone wire arc DED; laser/powder and laser/wire DED; or integrated hybrid machines that offered post- or in-process machining capabilities.

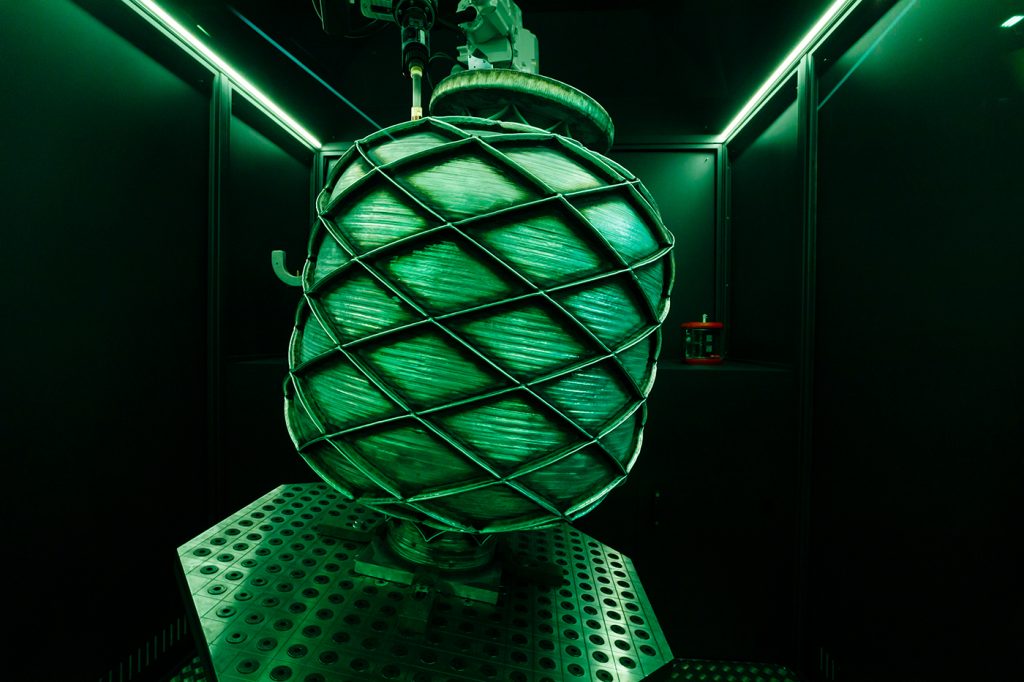

MX3D

From the company that brought us Amsterdam’s famous metal additively manufactured bridge, this year MX3D’s stand featured a 63 kg aluminium pressure vessel built on its M1 machine (Fig. 9). The vessel showed just how DED machines can be used not only to build, but also to augment parts. The demonstration part was first built as the main vessel, and then subsequently reinforced with the external ribbing structures. Unfortunately, the larger MX machine was only there in concept, but a partially built bronze propeller left little to the imagination in terms of the overall size capability of the machine that was previously announced at the Formnext Forum in Austin, Texas.

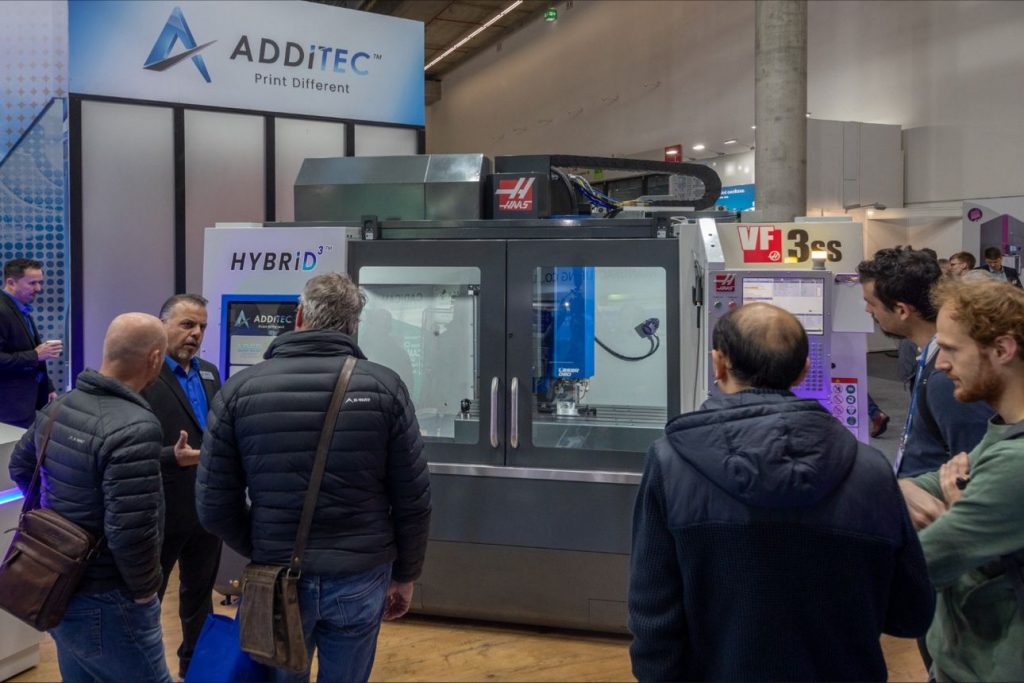

ADDiTEC

While ADDiTEC is no stranger to the DED process, the company managed to breathe life back into the Liquid Metal Printing machine developed by Vader Systems and then sold to Xerox before being killed off last year. ADDiTEC’s path has been to integrate it into a Haas machining system along with its own DED technology, then launching the package as the HYBRiD3 (Fig. 10). This unique metal AM capability still only works with low melting point alloys, such as the aluminium alloys on display, but is the only machine to combine two different AM technologies into a hybrid machine tool solution.

The company also happens to have one of the better-named machines on the market with the wire DED AMDROiD. Whilst not quite as mobile as the name might imply (it is designed to be shifted around by a forklift truck), it’s still more impressive in that regard than the commonly seen solutions in 6.1 m shipping containers.

MetalWorm

The accolade for perhaps the quirkiest name in the sector has to go to MetalWorm. It was the first time I’d come across this Turkish supplier, and, on the whole, its solution looked like a solid machine. Aside from the impressive choice of integrated arc welding technology, and with any of the usual industrial robot arms, another first for me was the use of vibration in the build platform to try and control microstructure during solidification. This is one area I’ve pondered many times where DED is concerned, given the very complex nature of welded microstructures. The use of vibrating build platforms certainly has given me food for thought. One other lasting impression was that, by the nature of its software and reporting, it seemed that the company has really understood all that goes into controlling a good weld, and they have carried that into the AM world in a familiar way.

DMG Mori

While DMG Mori, as expected, arrived with a lot to show in terms of choice of equipment, the thing that struck me most was a co-deposited bi-metallic valve housing. It demonstrated the true advantage of DED over PBF in a very recognisable, neatly machine-finished engineering component (Fig. 11). This type of part is what the world needs to see and understand most about AM: its versatility.

Hwacheon

A newcomer to the event, Hwacheon’s laser-DED machine didn’t seem to hold any real surprises, but it is always good to see another respected machine tool manufacturer enter the AM sector with a practical system that is free of hype. The DMX 07 being promoted at the show is best described as ‘big and boxy,’ but there is also something appealing about its simplistic lines. The machine is just one of a range of machines that the company has spent a number of years developing.

Oscar PLT

Lastly, if enthusiasm could be bottled then there’d be a challenge to contain that of the small team from Oscar PLT who are doing clever things with wire DED using multiple lasers from nLIGHT. Whilst an obvious shoe-in for AM, the company chose to highlight its strengths and expertise in repair applications. AM doesn’t always have to be about making expensive parts, and Oscar PLT very cleverly explained the value of protecting the investment of existing expensive parts. I saw how the team can work with relatively fine details using thin wires but, at the same time, minimising heat input damage to whatever the workpiece or underlying material. Having up to six lasers positioned around its deposition head, each with beam shaping capabilities, means its PROFOCUS machine is capable of reaching and repairing some very complex geometries.

Overall, I think the tide has changed for DED and there’s a level of ease in deploying these solutions compared to PBF machines. DED solutions are intrinsically confined to working with more simple designed parts, and, therefore, I believe that they don’t tend to over-stretch the imagination of experienced design and production engineers. They also offer greater freedom of integration and deployability, allowing existing owners of capital equipment an upgrade route rather than all out new capex requirement. This was all well demonstrated this year at Formnext.

Sinter-based AM

Where one would traditionally have expected to see crowds of people at Formnext is the Desktop Metal stand. This year it was somewhat of a surprise to realise that the company was only represented by distributors. Another company with a flag firmly in the ground of the Binder Jetting space is GE Additive. Whilst there were no major customer announcements or product updates from GE Additive, conversations with the Binder Jetting team suggested that good progress is being made with industrial partners. Markforged, who acquired Digital Metal’s Binder Jetting technology, also kept things low key. It would be a mistake to take the above as a sign that Binder Jetting has stalled, but the technology saw a distinctly lower profile this year than in previous.

Where others were quiet, HP, whose big metals push last year really did create a lot of buzz around the exhibition, continued to impress with industrial case studies from the likes of VW, Schneider Electric, John Deere, Lumenium (Fig. 12), and Domin. The latter showed that HP has successfully transitioned its technology into a production process for the mass market. The announcements to pursue materials development with Sandvik, supplying systems to yet another MIM producer – Indo-MIM – following its work with early development partners Parmatech and GKN Powder Metallurgy, and its partnership with furnace maker Elnik Systems, underlined its determination to keep expanding on the successes of recent years.

Incus

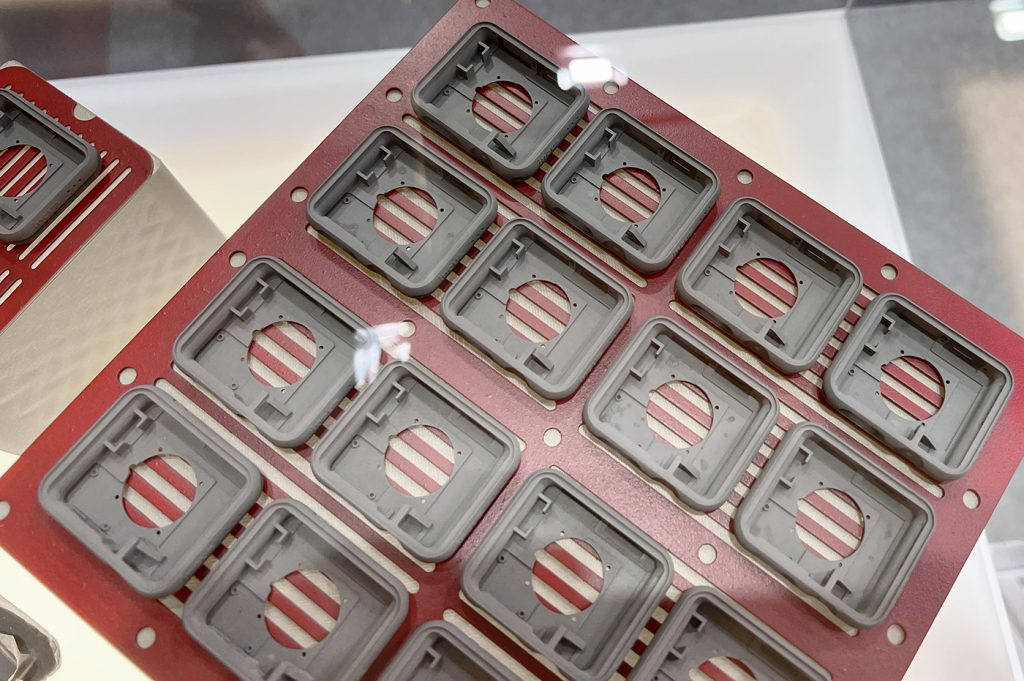

I was told rather excitedly that I should go and see the parts on display on the Incus stand and I have to say I wasn’t disappointed after making my way through the crowds to get there. Already known for the lab-scale machine Hammer Lab35, the big release for the event was the machine aimed at higher-volume production: the Hammer Pro40. Here I saw parts that were so fine and detailed it was almost impossible to believe that they had been made via Additive Manufacturing and not something else like Metal Injection Moulding (Fig, 13).

It was, therefore, of no great surprise that Indo-MIM announced that it will be investing in a Hammer Lab35 system. The machines themselves don’t have anything exceptionally new inside them as the underlying technology that has made it possible to achieve this is its Digital Light Processing (DLP) engine, previously developed by Lithoz and coming under the Vat Photopolymerisation (VPP) AM process category. The DLP engine has a pixel resolution of a few tens of microns, and it is this that dictates how small the machines can go when manufacturing parts.

Speaking with the team on the stand, I found out that both machines work with many different metals, all of which are widely available because they rely on commonly sourced MIM-grade powders. This may be a great advantage in the AM sector, since qualification of these alloys has already taken place, and the final sintering step to consolidate the net shape parts has itself already been approved by many industries. Furthermore, it was good to learn that the feedstock materials are all fully reuseable, since all non-polymerised material can simply be recycled. This ability eliminates waste, another aim for the rest of the metal AM sector.

The company had a wide array of very intricate parts on display with as-processed surface finishes not seen elsewhere in this sector, and – other than the obvious debinding and sintering steps – virtually no other post-processing. Parts are all built without any support structures because its process relies on the solid none-polymerised material to support whatever is being made.

Kennametal

Since I love finding cool metal AM parts, there was just one that stole the show for me: the incredibly heavy tungsten carbide drill bit part made with Binder Jetting technology by Kennametal, which developed all of the materials, process and post-processing themselves. Try as I might, I couldn’t lift the piece off the bench!

Innovations in Additive Manufacturing materials

Setting aside any discoveries on sustainability (particularly in respect of metal powders) to a future article, there were a significant number of newer alloys being marketed this year. The supply chain has taken up the task of delivering a greater selection of useful alloys, and, for the first time, I noticed that steels were being promoted far more this year. There was also a far greater choice for aluminium.

Sandvik, with a new corporate brand, announced two key collaborations – with Dyndrite and HP – and stated that it is also seeking a further expansion of its powder production capabilities in the coming year. Whilst it was impossible to speak with all powder producers, conversations with representatives from the likes of Pometon, Indo-MIM, Atomising Systems Limited, and M4P all indicated a growing realisation that material diversity will be key to the future success of metal AM. Generally speaking, all suppliers include the grades with which we are by now very familiar, and many, including Indo-MIM, have declared new production capacity specifically for the AM sector.

It was M4P, however, who really stood out from the crowd with perhaps the widest selection of commercially available steel grade powders targeted just at AM. As the largest group of engineering materials, I’m convinced that this is a move in the right direction for the industry and no doubt we’ll see more suppliers realise this as well. Reassuringly, all of the above companies stated their readiness to experiment and develop different grades of steel when the need arises.

Not wishing to completely ignore sustainability in the materials supply sector, some familiar names were actively promoting this topic. Tekna, for instance, committed part of its exhibition stand to the theme of recycling and sustainability. I also discovered that EOS, though it is not a powder producer itself, will be pursuing changes to its powder specifications in 2024. Starting with the AlSi10Mg alloy powder, it will require its suppliers to reduce their carbon footprint by including at least 30% recycled materials in the feedstock. It claimed at the show that this will result in a 25% reduction in CO2 emissions.

There are a growing number of smaller companies that have taken advantage of the opportunities presented by sustainability. This year, Amazemet, 6K Inc, and Continuum were all showing the path forward. Continuum spoke about its go-to-market strategy for the Greyhound M2P system and its stated aim to use 100% recycled feedstock materials in powder production.

Whilst on a similar scale to other European companies, Amazemet is coming out of Poland with its interesting ultrasonic rePOWDER atomisation technology, and Continuum has stayed on the path of traditional gas atomisation. If Continuum is a new name to you, it was to me too – however, I learned that it relaunched as a new business just a week or so prior to Formnext. Previously known as Molyworks Materials Corporation, it was perhaps the first company to have emerged solely for the circular economy of metal powder production back in 2015.

Others worth a mention are Elementum 3D, which has joined the Dyndrite parameter consortium, and said it has been able to greatly improve the ability to build with its RAM powders at much lower unsupported build angles, and with thinner wall features (Fig. 15). It used the Dyndrite platform to dramatically reduce the time to develop the parameters for a PBF-LB machines.

Fehrmann Materials took a brave leap on powder pricing, addressing the cost barrier to adopting AM, saying it was about to cut the cost of its high strength aluminium alloy AlMgty.

Finally, I just couldn’t leave this part of the review without mentioning Fehrmann’s MatGPT™ materials tool, putting AI to work in helping to resolve problems in the development of new alloys for Additive Manufacturing. It was claiming some extraordinary early successes with the software; I can’t wait to be able to play with this.

Post-processing continues to grow

When it comes to the post-processing of metal AM parts there is an ever-growing number of market entrants, most of which feature some form of automated depowdering or a transport mechanism for a piece to flow through the end-to-end production process.

There were plenty of suppliers present at this year’s event, which made it quite difficult to spot anything more innovative than the rest. That’s why I was pleased to stumble across a recent start-up Holdson, from the UK, bringing its patent-pending surface finishing technique to Formnext (Fig. 16). Seeing its process as dynamic electrochemical finishing, with machine learning to enhance the fluid dynamics within the process, it was certainly something I’ve never come across before, even if others may claim that it is very similar to commonly found electrochemical machining (ECM).

What made this technology stand out more was specifically addressing environmental concerns. Many will know that electrochemical processing often involves acid electrolytes, but that is not the case here, making it a lot less harmful to the environment. Holdson has included recyclable consumables and is claiming reduced energy consumption compared to other systems on the market. Its stated aim was that it wants its entire process to be sustainable, minimising the environmental impact of metal finishing.

Targeting the industrial end of the AM sector, Holdson has already secured good working relationships with the likes of Cummins Turbo Technologies and Wayland Additive and has processed some challenging materials such as tungsten. My walk-away conclusion was that this really might be one of those technologies that opens up several Additive Manufacturing applications – particularly where non-line of sight finishing could be advantageous.

Closing the show

Whilst the organisers were happy to announce a record number of exhibitors, there was a sense that many companies had down-sized their attendance. There were far fewer mega-stands, and, in some cases, participation had diminished to counter-top displays on shared regional exhibition pavilions. There is no doubt that industry consolidation has played a role, yet at the same time a stream of new companies hoping to make their mark helps the industry, and Formnext, to continue to feel like a dynamic place to be.

It was clear that many companies had been thinking long and hard about marketing budgets before they turned up this year. Even those that had substantial stands had reduced numbers of staff manning this year than at previous events. Did this seem to matter? Well, from my impression, not at all. The halls were busy, the talks and presentations were all well-attended, and, knowing how difficult it was to pin people down due to their own busy schedules, it would seem that the majority still had more than enough to occupy themselves throughout the event. To conclude this report – which of course could not possibly cover all innovations at the show, I’ll use a phrase that perhaps makes more sense in Additive Manufacturing than any other sector: from here, it’s onwards and upwards.

Author

Dr Martin McMahon

Technical Consultant,

Metal AM magazine, and founder of M A M Solutions.

[email protected]