What Xerox’s aluminium liquid metal AM offers for supply chain resiliency

It is too easy to look at metal Additive Manufacturing technologies as neatly fitting into a small number of convenient process categories. The risk, in doing so, is that the best solution could be overlooked. One AM process that does not fit into such neat boxes is Xerox's Liquid Metal Jetting. Whilst it falls, broadly, under the ISO/ASTM 52900:2015 category of Material Jetting, it is unique among metal AM processes. Here, Bender Kutub considers where it fits into the drive for supply chain resilience, and explores its market potential. [First published in Metal AM Vol. 8 No. 2, Summer 2022 | 20 minute read | View on Issuu | Download PDF]

Additive Manufacturing gets all the media attention, but is it truly production ready? It’s difficult to say, because there are so many options available on the market, some exaggerated claims made, and no standard ways currently exist to qualify all of the different AM processes. Today, AM accounts for a tiny sliver – less than 1% – of the manufacturing market, and countless government and commercial organisations are investing heavily to identify the right technology platforms to reduce lead times, get to market faster and solve the supply chain crisis through which we are currently living.

While AM will no doubt continue to thrive in niche applications, can it be the game changer everyone hopes for when it comes to supply chain resiliency? After two decades of development, why hasn’t metal AM become more of a mainstream manufacturing consideration?

Simply put, metal Additive Manufacturing is just too expensive to replace conventional processes like high-speed machining, sheet metal forming and casting. Throughput rates are the number one driver of cost and currently most metal AM technologies are just too slow. Raw materials, such as metal powders, are not only costly but can be difficult to procure and challenging to handle. The need for secondary processes to finish parts, such as Hot Isostatic Pressing (HIP), also adds cost to the bottom line. There are many factors, but part cost is just too high to create a compelling case.

Then there is the question of knowledge. Depending on who you ask, the casting industry dates to 3300–4000 BC, so it’s obvious that we’ve learned a few things during that time. AM is still in its infancy, so the tribal knowledge associated with this technology makes it tough to learn and adopt. However, this is evolving, and we are beginning to see more college classrooms introducing metal additive curriculums.

Finally, there is the challenge of qualification. For non-production applications, such as prototypes or some manufacturing aids, AM is an attractive alternative to traditional processes. However, for production parts, spares, and repairs, the industry requires a set of unified standards to reduce the costly one-off qualification needed for each AM technology, and, in many cases, each individual application produced.

Now that we understand the challenges associated with metal AM, it’s time to explore a new technology that aims to bridge these gaps and present new solutions for production-ready, tangible manufacturing solutions. When it comes to supply chain resiliency, speed is the ultimate priority, and the scalability of the technology must be considered for application and usage. For the sake of this paper, scalability is defined by access, throughput, and availability.

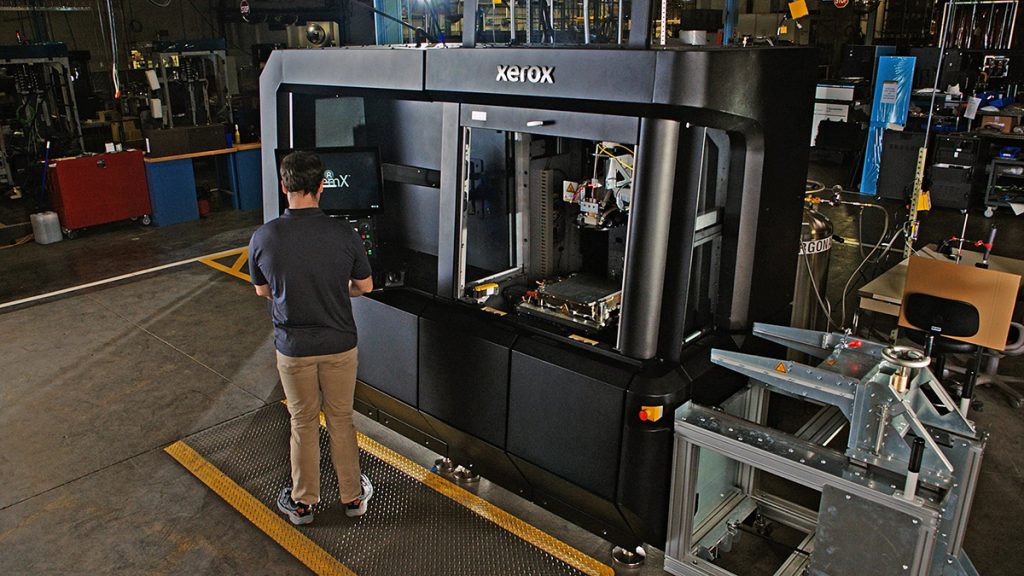

Xerox ElemX Liquid Metal Jetting (LMJ) platform is engineered to bring speed, simplicity and safety to the forefront of metal AM. It is designed as a process that is safer and much easier to implement for operators with varying technical competencies, and deployable for all locations, from airports and military bases to small machine shops. We argue that supply chain resiliency with AM relies on accessibility and, if we’re being honest, a truly distributed and decentralised manufacturing approach that produces parts on-demand, when and where they’re needed.

What is Liquid Metal Jetting?

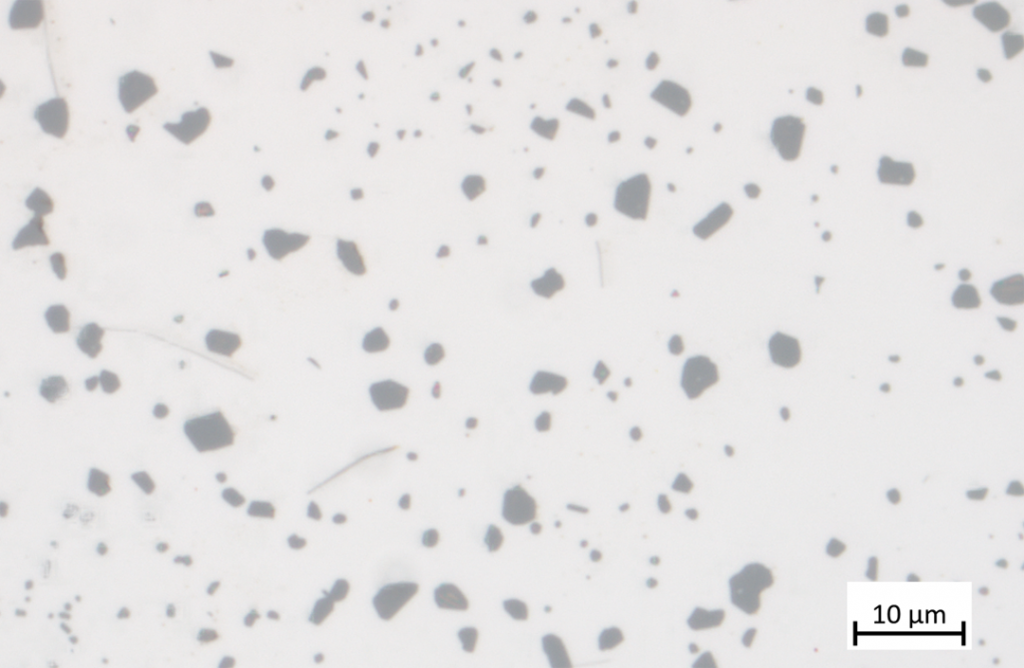

ElemX Liquid Metal Jetting Additive Manufacturing utilises magnetohydrodynamics (MHD) to jet molten metal droplets at a specific rate and a specific mass. This method of Additive Manufacturing was developed by Vader Systems, which was acquired by Xerox in 2019. Since the acquisition, Xerox has matured the technology by leveraging its strong ink jetting expertise to refine the process, enabling the production of casting-like parts, both in properties and in feature capability.

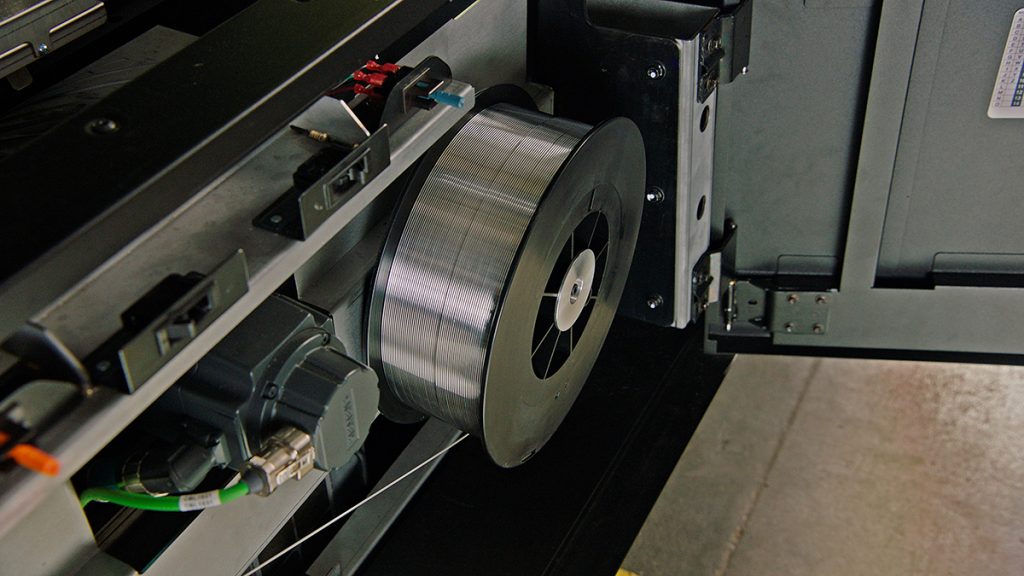

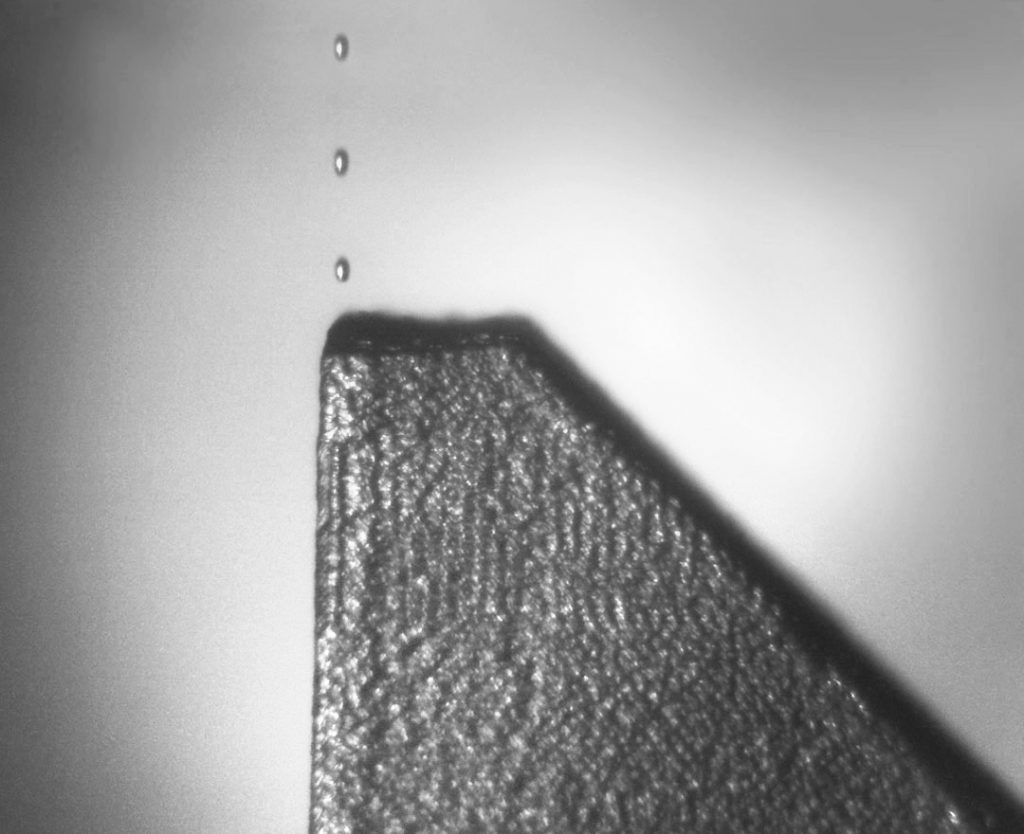

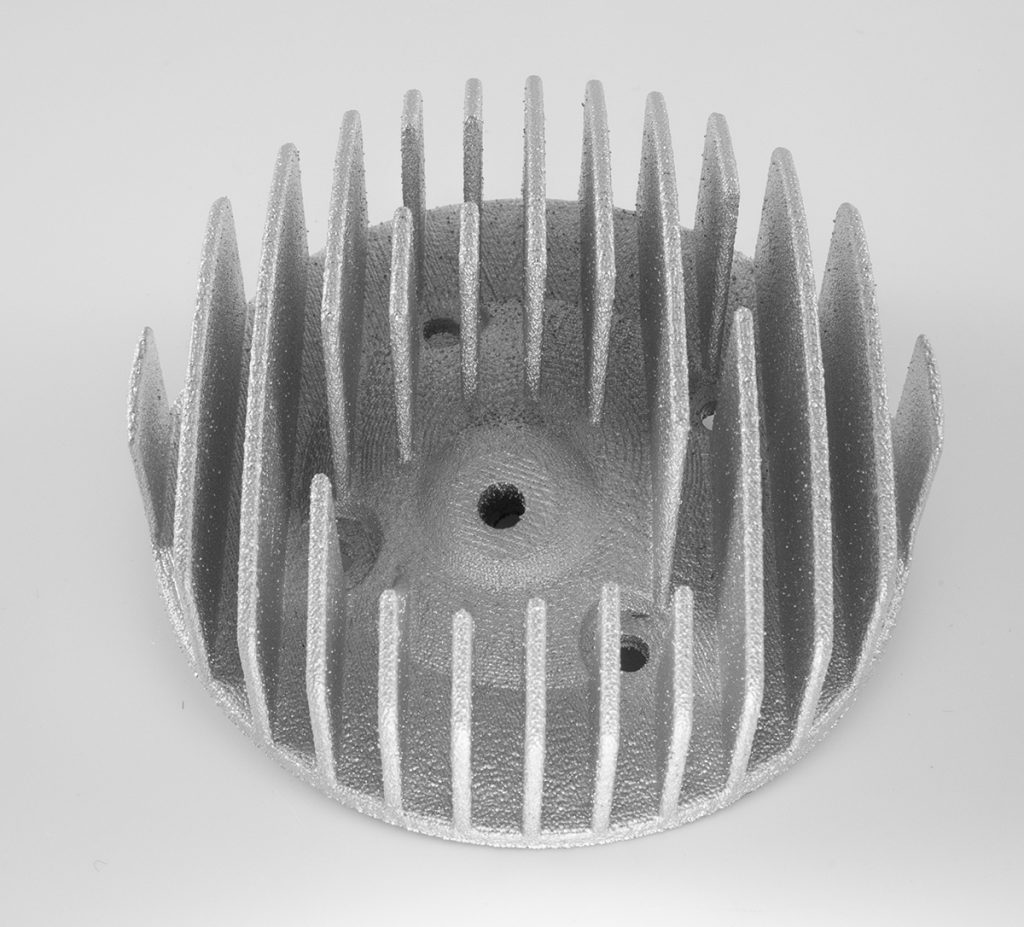

Widely available aluminium welding wire is the primary feedstock for the ElemX (Fig. 2). The wire is fed into the machine and up to the jet nozzle, which converts the wire into a molten pool through induction heating. The nozzle assembly consists of multiple parts, including a one-piece upper and lower pump. Using MHD Lorenz forces, the molten metal is jetted through the nozzle (lower pump) and deposited in precise, sequential droplets onto a heated build plate (Fig. 3). The placement of each droplet is predetermined by a toolpath which is generated from the ElemX Slicer software. Each droplet solidifies when deposited, overlapping with the previous droplet to create a solid line of material.

The overall process is relatively simple and straightforward; however, the true art of the process is in being able to place droplets exactly where you want them, when you want them and with a very precise mass. The thermal dynamics between the part and the drops are critical. In order to achieve the desired mechanical properties and feature resolution, the droplets and layers being formed must adhere in the right thermal processing window. The combination of these elements results in a technology capable of producing parts with attractive part attributes at high throughputs.

Time to first part vs part complexity: a look at competing AM processes

In the metal AM industry, there is a wide range of technologies, all with different pros and cons when it comes to the value of parts that are produced. Evaluation typically includes throughput, design freedom, alloy availability and cost, ease of use, and safety. One can spend endless amounts of time generating comparisons between the exhaustive lists of metrics and extrapolate many different conclusions on why one technology is superior to the other. Our intent here is not to replicate that work, but instead to take a lens using a couple of key metrics to help highlight where Liquid Metal Jetting sits in the metal AM landscape.

The truth about metal AM technology is that there is no one-size-fits-all solution. To understand where Xerox LMJ technology stands in the metal AM landscape, we examine time to first part vs part complexity. When looking at various methods for cost modelling, throughput is one of the highest – if not the highest – lever to pull to determine the true production cost per part. Simply put, the higher the throughput, the lower the cost is to produce the part. Additionally, the time it takes to produce the first part is a critical indicator for the reaction time a process has when subjected to an unforeseen demand for a one-off spare part in a time-critical situation.

Next, part complexity is key in determining the size of the addressable application space a process can meet. Part complexity is perhaps one of the biggest levers in determining the technical feasibility of a process for a specific application. When coupled with feature resolution, part complexity can provide a really good indicator if you can use the part directly after it’s been built, or if you need to do some sort of post machining to achieve the desired end-part.

Powder Bed Fusion (PBF)

Powder Bed Fusion machines are the most widely adopted metal AM technologies in the industry. High part complexity and resolution, moderate throughput rates, and high-performance materials enable engineers to use this technology for a variety of applications. However, Laser Beam Powder Bed Fusion (PBF-LB) can quickly become costly when high throughput rates require multi-laser machines. Additionally, PBF-LB still requires significant post-processing steps, from build plate and support removal to thermal processing, machining and, where necessary, Hot Isostatic Pressing.

Cold Spray

Cold Spray has one of the highest throughput rates compared to other AM technologies. Often, Cold Spray OEMs claim the ability to produce parts in minutes, which, in many cases, is not an understatement. This makes CS technology very attractive and an ideal candidate for lower cost, less critical spare parts applications. The limitation of Cold Spray is the part complexity and feature resolution that can be achieved in an ‘as-built’ part. Parts produced using Cold Spray technology are most often considered to be ‘near-net shape’, particularly for complex and intricate geometries.

Directed Energy Deposition (DED)

Directed Energy Deposition is a process in which focused thermal energy is used to fuse materials, either powder or wire, by melting as they are being deposited. The energy source can be laser, electron beam or plasma arc. As with Cold Spray, part complexity and feature resolution that can be achieved from an ‘as-built’ part are limiting factors, however the process’s speed, cost and ability to build at large scale are resulting in high levels of interest.

Binder Jetting (BJT)

Binder Jetting is one of the fastest metal AM technologies for the production of high volumes of small parts. Part complexity and resolution enable intricate and complex geometries. For moderately high volumes of small parts, BJT is an ideal technology – however, the sintering and shrinkage challenges the technology brings make it a poor choice for one-offs or medium-to-larger sized parts.

Material Extrusion (MEX)

Material Extrusion, using filaments or pellets containing a combination of metal powders and polymeric binders, can produce feature resolution and geometry complexity to satisfy a large application space, though it does not reach the complexities and resolutions achievable with Binder Jetting and PBF. The primary limitation for this type of technology is in the post-processing steps required to achieve the final part. Similar to Binder Jetting, the MEX of metal-containing feedstocks requires additional debinding and sintering steps, which may limit throughput as well as delivery time.

Liquid Metal Jetting

LMJ occupies an interesting spot in the AM portfolio when looked at through the lens of time to first part and part complexity. It exists in a similar realm as Cold Spray and DED in that it is high on the ‘time to first part’ scale and lower on the part complexity scale. The throughput is considerably higher than metal MEX, which begs the question: How does LMJ achieve this?

The key lies in the total time to part in hand. In its purist form, the LMJ process has the highest build time to overall throughput ratios of any technology considered. That means most of the overall throughput time for the LMJ process is actual build time, or material deposition time. When the build is finished, the part and plate are removed while still at temperature and rapidly cooled in a water tank. The part then ‘pops’ from the build plate, while simultaneously being cooled to a temperature that can be easily managed. The part is then ready for use.

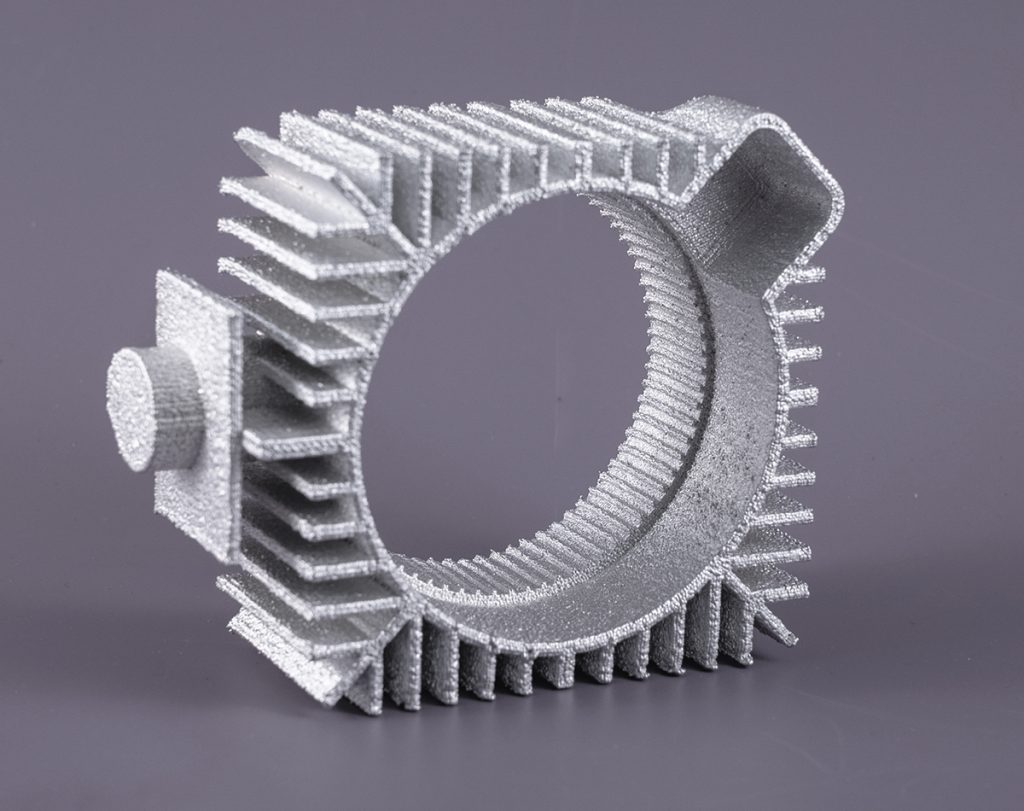

What about the final part resolution? Although the part resolution and achievable complexity of LMJ pales in comparison to PBF, it is still considerably better than that offered by Cold Spray and DED. The best analogy to the output of the LMJ machine is a sandcast. This means that the LMJ process, in the as-built resolution, presents a viable solution for a considerable application space without the need for secondary machining. Taking this into account, we can more clearly see LMJ’s space in the metal AM landscape: as a technology with the ability to provide reasonably high throughput while maintaining enough feature resolution and complexity to satisfy a sizable application space.

LMJ as a supply chain solution

So where do we see a need for a high throughput, medium resolution solution that can produce cost-effective parts in a short amount of time, with minimal secondary processing? Besides the obvious – prototyping, manufacturing aids, and pre-sampling – it is the spares and repairs market.

LMJ is well-suited for spare parts that are typically made using sand casting, which makes it a highly applicable option to solve the supply chain challenge, thanks to its functionality and immediacy. The lead time for sand cast replacement spares is notoriously long. Utilising LMJ over sand casting can generate lead time savings of up to 98%, or hours instead of weeks, and cost savings for one-off parts of between 85–95%.

The ‘elephant in the room’ in all of these calculations is the current global macroeconomic state of industrial manufacturing. It is estimated that 94% of Fortune 1000 companies experienced supply chain disruptions during the COVID-19 pandemic. 75% of companies have seen a negative or strongly negative impact on their business, and 55% of companies plan on downgrading their growth projections based solely on supply chain disruptions. The pain felt by industrial manufacturing in all industries – from aerospace and defence to automotive, heavy equipment to oil & gas – is centred around supply chain disruptions, leading to equipment downtime, unhappy customers, and an overall reduction in productivity. This not only caused a temporary setback for these industries, but contributed to wider economic damage that is expected to get worse before it gets better.

The reaction to this tide of uncertainty has been an all-hands-on-deck push by executive leadership in these industries to identify disruptive ways to derisk their supply chains. They cannot continue to operate as they previously have, because the impact on their business is too high. This, in turn, has created an opportunity to invest in new technologies that can benefit supply chain resiliency, such as AM. It is no exaggeration to say that companies will sink or swim depending on the actions taken now.

Why aluminium?

Now that we have identified LMJ as an ideal candidate for a supply chain spare parts solution, it is worth taking a look at what materials are most attractive for the LMJ process. Metal AM has traditionally found a lot of success processing high-strength alloys such as titanium, Inconel, and stainless steels. This can be tied back, in large part, to the application spaces that metal AM has been successful in, which are high-value, high-performance lightweighting applications, where one-off solutions are needed, and performance is prized over cost. However, if we now open the application space up to lower-value applications, where cost and schedule are critical, we can identify a major unexploited opportunity in the form of aluminium alloys.

The aluminium spare parts market was estimated at $92.2 billion in 2020 and forecast to grow at 4.4% CAGR between 2020 and 2027. Coupled with the supply chain disruptions of the past couple of years, there is huge potential for metal AM to address aluminium spare parts supply chain disruptions. A closer look at these numbers unveils large application spaces for aluminium spares across industry segments. The aerospace and defence MRO market is expected to grow at CAGR of 4.7% from 2020 to 2025, reaching $95.6 billion.

Metal AM applications in this segment continue to move away from prototyping and jigs and fixtures, with an estimated 73% of applications to be end-use parts and spares by 2025. The aluminium spare parts market in the automotive industry is also expected to grow at a steady 4.1% CAGR from 2020 through 2030. The biggest application space for aluminium in this segment is cast parts, including applications such as heat exchangers, valves, brackets, and general engine components. The spares market for industrial heavy equipment is expected to grow from $85 billion in 2020 to $111 billion by 2027, with aluminium comprising the second highest material volumes at 23% of the total material consumed. Application spaces in the heavy equipment segment include valves, electronic enclosures, heat sinks, brackets and motor/spindle casings.

Adoption factors for distributed manufacturing

The are several reasons why industrial manufacturers have not already adopted AM into their supply chain. One relatively common barrier is a lack of knowledge of what’s possible with technology and where it can be applied. The first question companies must ask when it comes to transitioning a part to AM is “Can I additively manufacture it?” Quickly followed by “Should I additively manufacture it?”

The first question must consider the technical feasibility of the application, and this is the first gate in evaluating a new manufacturing solution. Design parameters must be met for the part to be considered. Once this gate is passed, the next logical step is to determine what time, quality, or cost benefits come with AM. If AM can make the part quickly, at the lowest cost, and still meet the technical criteria necessary, then it is the clear winner. Unfortunately, it’s never that easy.

Additional factors include ease of use and safety. If a technology is difficult to use and requires a lot of training with a high degree of process expertise, it will struggle to gain adoption, particularly in a distributed manufacturing model. Furthermore, the solution needs to be safe and deployable in a variety of industrial and non-industrial environments. While PBF continues to be the unquestioned leader in the metal AM space, the safety and facility requirements it brings with it limit it from full-scale adoption.

If we now look back at the AM landscapes and start to evaluate the different technologies against these criteria, we can see LMJ arise as a clear front runner. The technology has a reasonable application space, with good as-built design properties, which answers the question of ‘Can I additively manufacture it?’ The throughput possible answers the cost and time question of “Should I additively manufacture it?” and the lack of secondary processing and powders answers the questions of ease of use and safety. When we go from practice to practical, we find ourselves asking instead, ‘Can liquid metal jetting solve supply chain challenges?’

What does the future of LMJ look like?

The future of LMJ looks promising: with this technology, onsite manufacturing of spares on-demand looks more realistic than ever. Checking the simplicity and safety boxes makes this a technology worth considering for a wide range of applications. Regarded as one of the most scalable technologies, aluminium LMJ is highly attractive because of its throughput and deployability. But (and there is always a but) Liquid Metal Jetting is first generation technology, and nothing is perfect first time. At Xerox Elem Additive, we are not naïve to this, but we are certainly excited about the potential. Already adopted by several contract manufacturers and industrial users, the ElemX is quickly advancing into more and more applications.

Author

Bender Kutub

ElemX Product Manager

[email protected]