AM Ventures: An insider’s perspective on venture capital for start-ups in Additive Manufacturing

In an industry driven by innovation, start-ups play a vital role in creating the next generation of AM technologies, applications, software solutions and materials. However, only a small percentage of these start-ups will survive, and even fewer will thrive. Arno Held, Chief Venture Officer at AM Ventures Holding GmbH, presents a statistical analysis of start-ups across the AM sector, including success rates, geographic distribution and key areas of focus, and offers his insight into venture capital as it relates to the Additive Manufacturing industry. [First published in Metal AM Vol. 6 No. 1, Spring 2020 | 10 minute read | View on Issuu | Download PDF]

When my long-time mentor Johann Oberhofer and I started AM Ventures, with great support from the Langer family, just five years ago in January 2015, we knew very little of what the world of AM start-ups looked like. I still remember my first day at the desk, in an oversized office on EOS’s Krailling campus, very well. The story of AM Ventures, however, actually began about six months before.

After meeting an inspiring team of young entrepreneurs at a 3D Printing Cluster meet-up in Munich and convincing them to bring some colour to our industry by founding what is today the huge success story of DyeMansion, I realised exactly what I wanted to do with my network, and the technical experience I had built up at EOS over almost seven years: I wanted to found a start-up that helps other start-ups to start up. I pitched the idea to Dr Hans Langer and Johann Oberhofer, who quite liked it, and the rest, as they say, is more or less history.

So, six months later, there I was. Alone in a big office. A desk, a chair and me. And what does a typical representative of Generation Y do when they have to start with a blank sheet of paper? They research the next steps on Google.

I think I spent more than three months doing almost nothing else but researching every start-up that was developing or using Additive Manufacturing technology. I created an archive, collected data and started to compare. I found reports, went to conferences, got introduced to very helpful contacts and eventually found the next start-up to invest in, and then the next, and then the next.

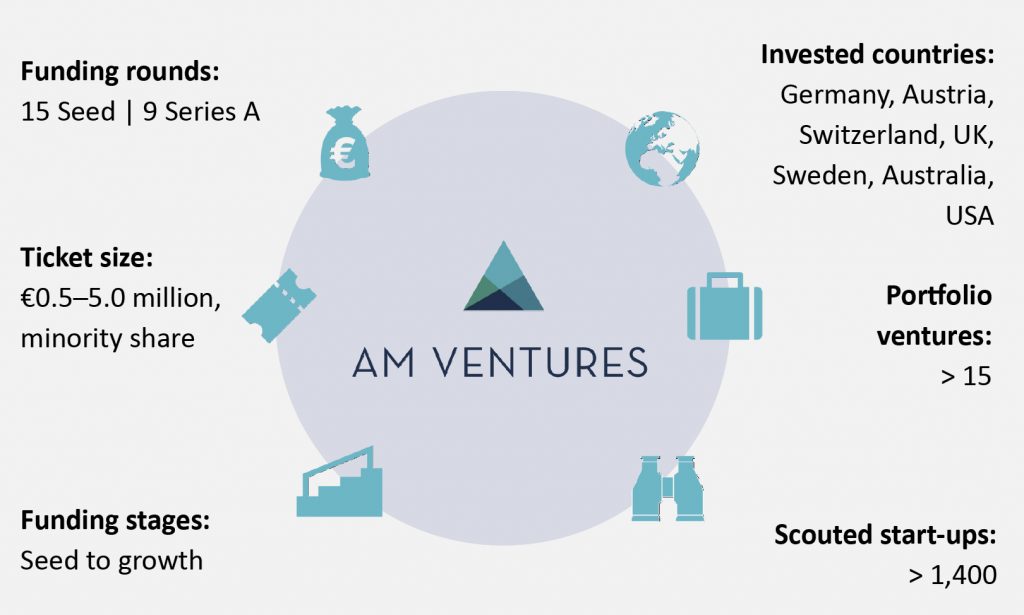

Today, almost exactly five years after we began to build AM Ventures, I am very proud to have built a team of eight highly passionate AM experts that have conducted more than two dozen funding rounds and now manage a portfolio of seventeen start-ups in seven countries. We have always had the feeling that we were building great knowledge with every start-up that was added to the portfolio, but it was only once we decided to build our own database, from which we could extract structured data and customised views, that we truly appreciated what we had created since early 2015.

Today, we know quite a lot about the world of AM start-ups. Our database currently contains information on more than 1,400 of them. In 2019 alone, we added more than 220 companies, and I cannot imagine that there is another team in our industry that has gathered a comparable amount of data spanning the entire planet. Since we are an investor that is very clearly focused on a specific technology, we are not limited geographically in our areas of engagement. Our current portfolio is distributed across the world, from Austria to Australia, and just one year ago, AM Ventures opened its first branch office in Busan, South Korea, in order to scout the Asian continent.

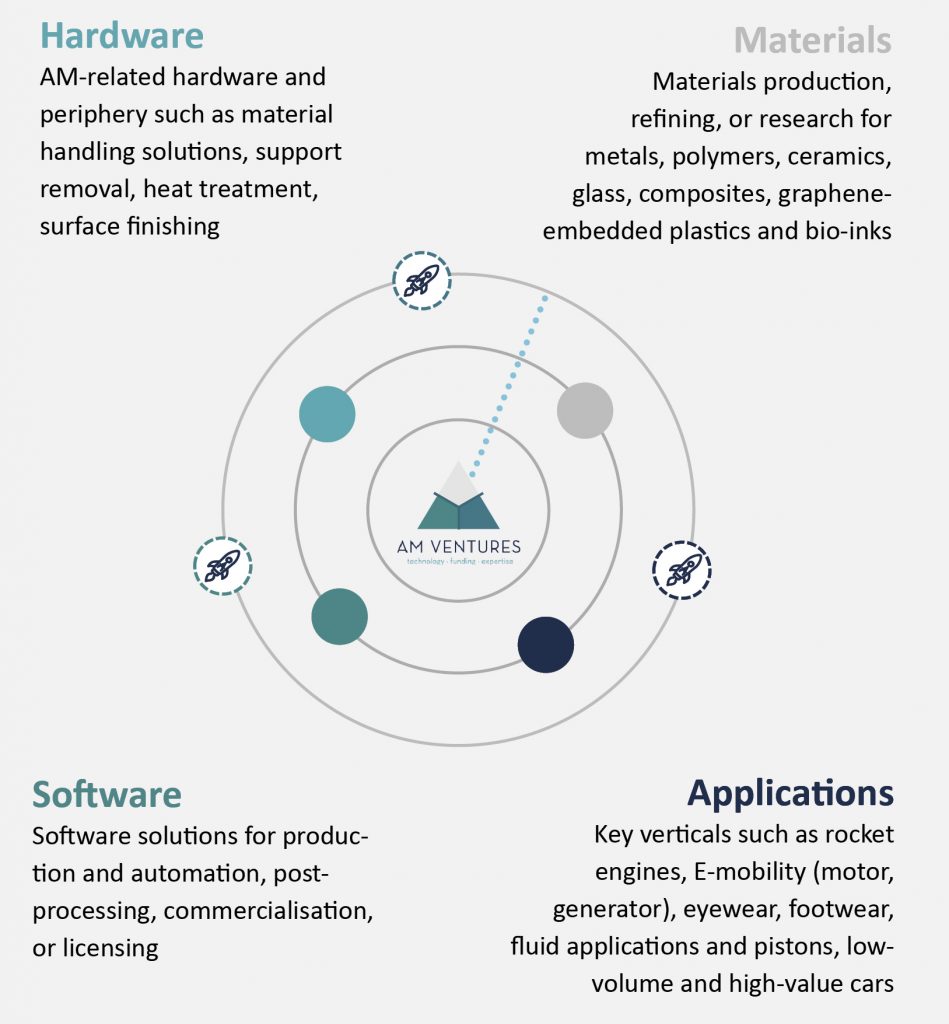

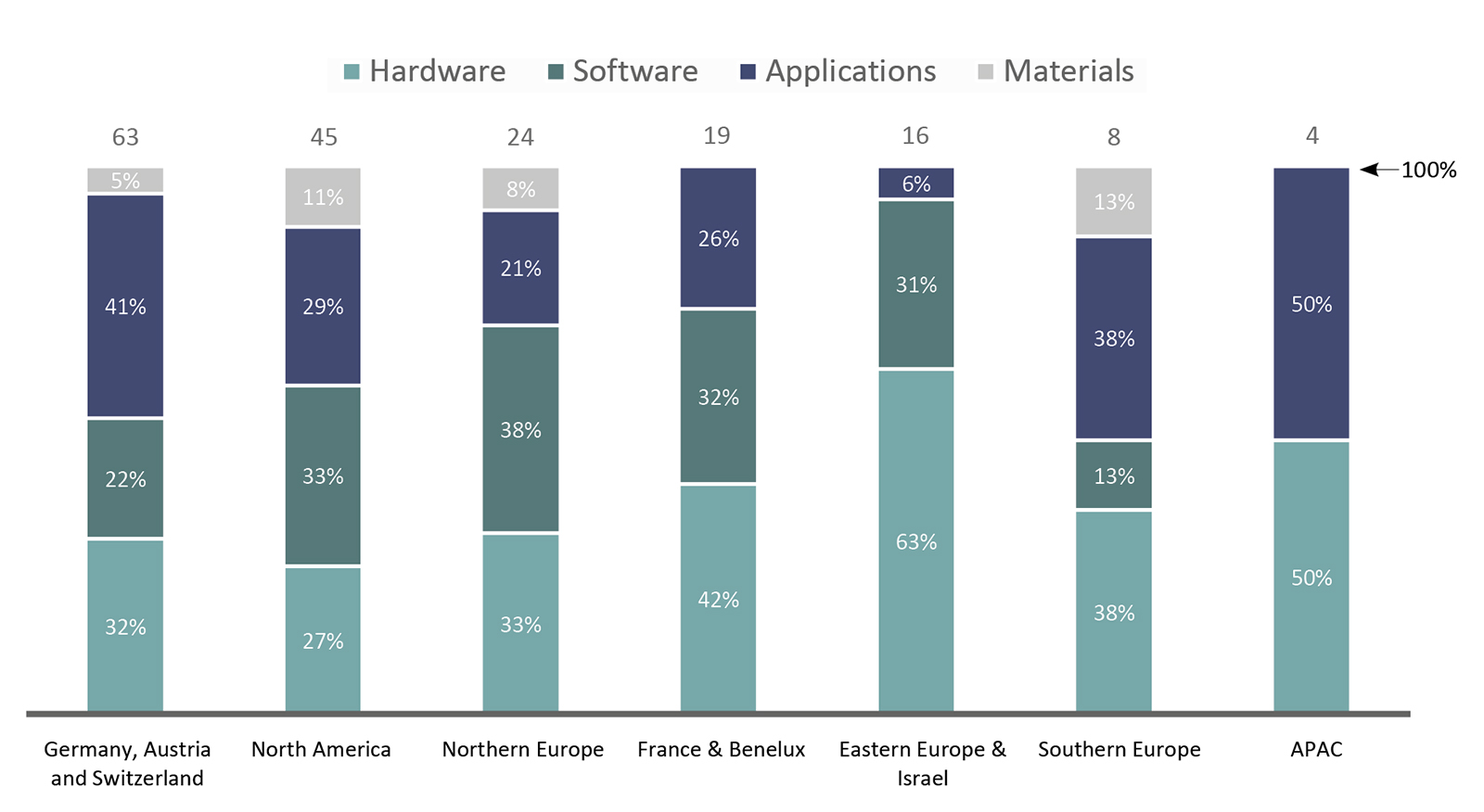

AM Ventures’ general investment focus lies in the industrial side of Additive Manufacturing technology. More specifically, we are looking for start-up teams which are dealing with AM hardware, software, materials and applications. Particularly with regards to relevant materials, we are by no means limited to polymers and metals – even if this is by far the largest field of engagement.

What follows are insights into our operations, along with data on the sometimes hard reality of being a technology start-up in the AM world.

Distribution of start-ups across all AM areas

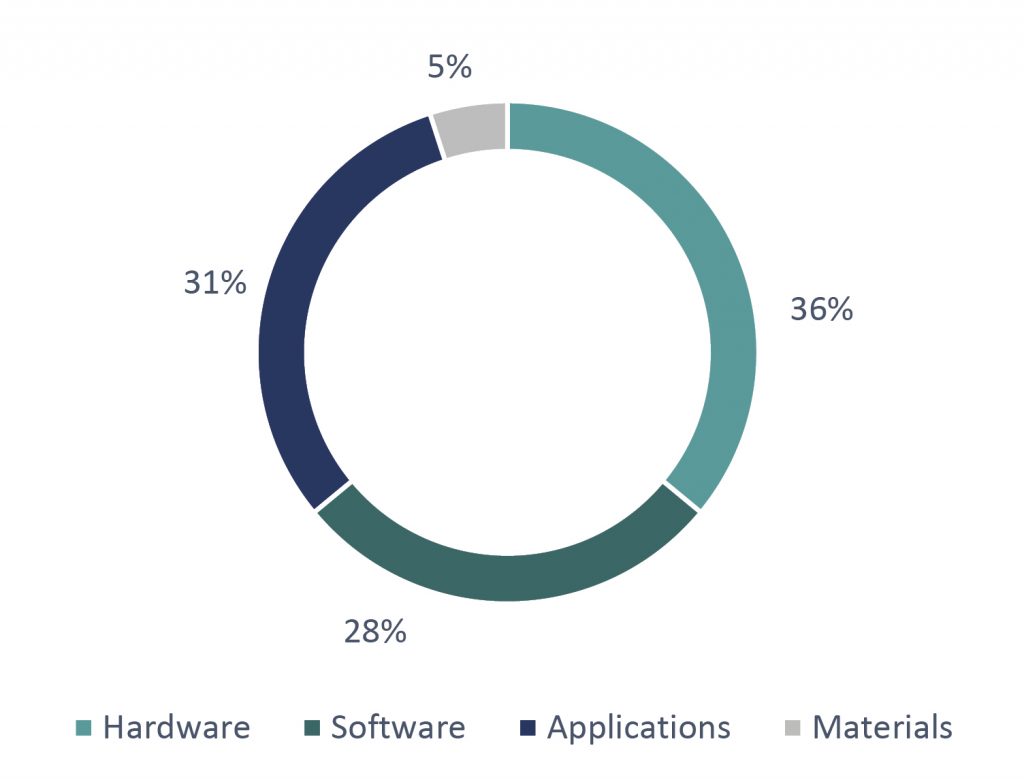

Looking at the distribution of start-ups across our four main AM technology categories, it is nice to see that three of the main categories are similarly sized: hardware, software and applications (Fig. 3).

For us, as Additive Manufacturing enthusiasts and participants in this industry, it is particularly encouraging to see quite a large number of applications in development. This means that our industry as a whole is reaching a level of maturity, that investment in AM-education is finally paying off, and that the technology is finally starting to change the way future products are conceived of, developed and – in the end – manufactured.

The fact that only very few start-ups are dealing with the development of new materials is not very surprising, as this domain is still heavily dominated by machine vendors and – particularly in the polymers business – occupied by very large chemical companies. These two facts alone represent very high entry barriers.

Survival rates and global distribution

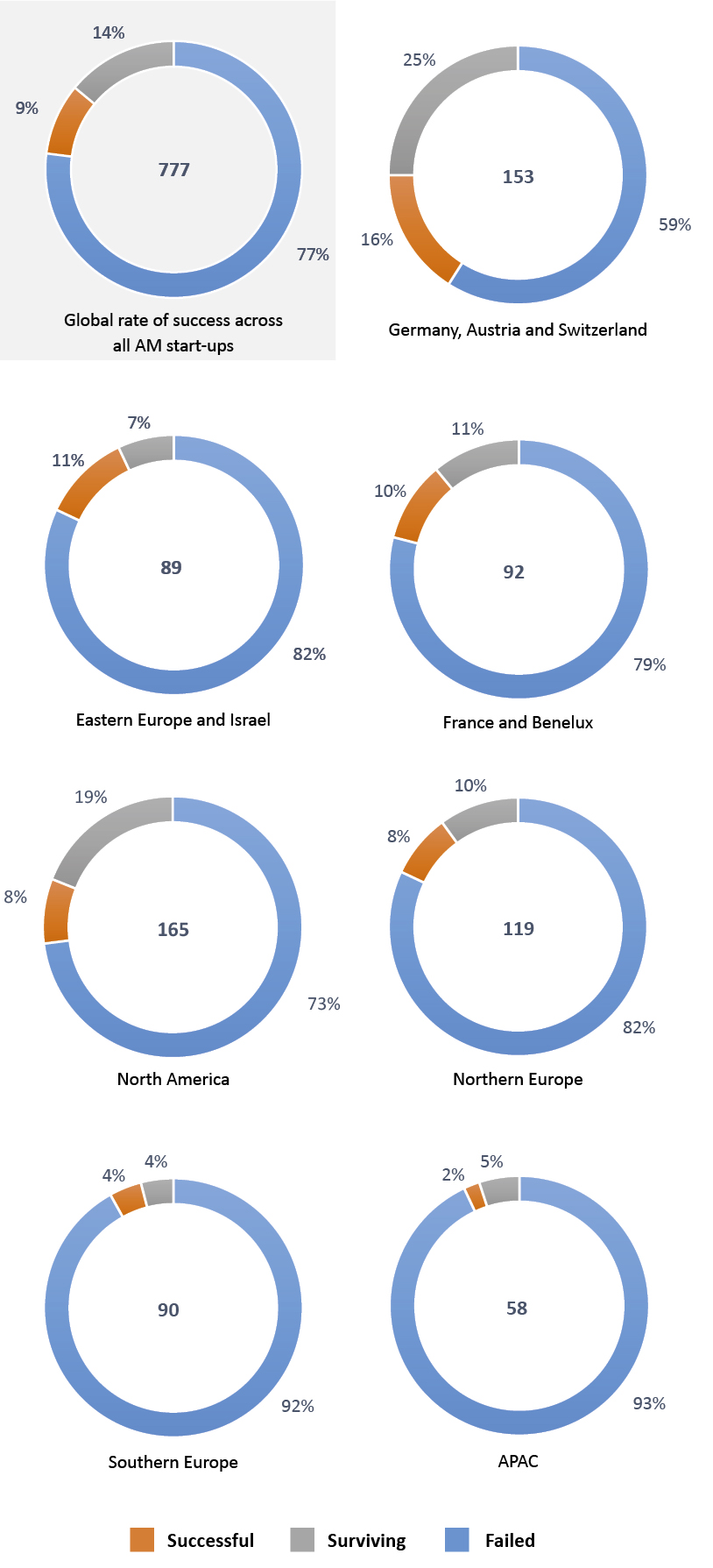

When one looks at a technological segment from a Venture capital perspective, it is always interesting to know what the overall likelihood is for a start-up to succeed. In our world, we define survival as the ability to establish a company and keep it alive at least until a business angel invests, or a so-called ‘seed-round’ of financing can be undertaken. A really successful start-up is defined as one which progresses to raising series A funding with a professional VC investor, or even conducting a so-called ‘exit’ by selling the company to another entity or taking the company public through an IPO.

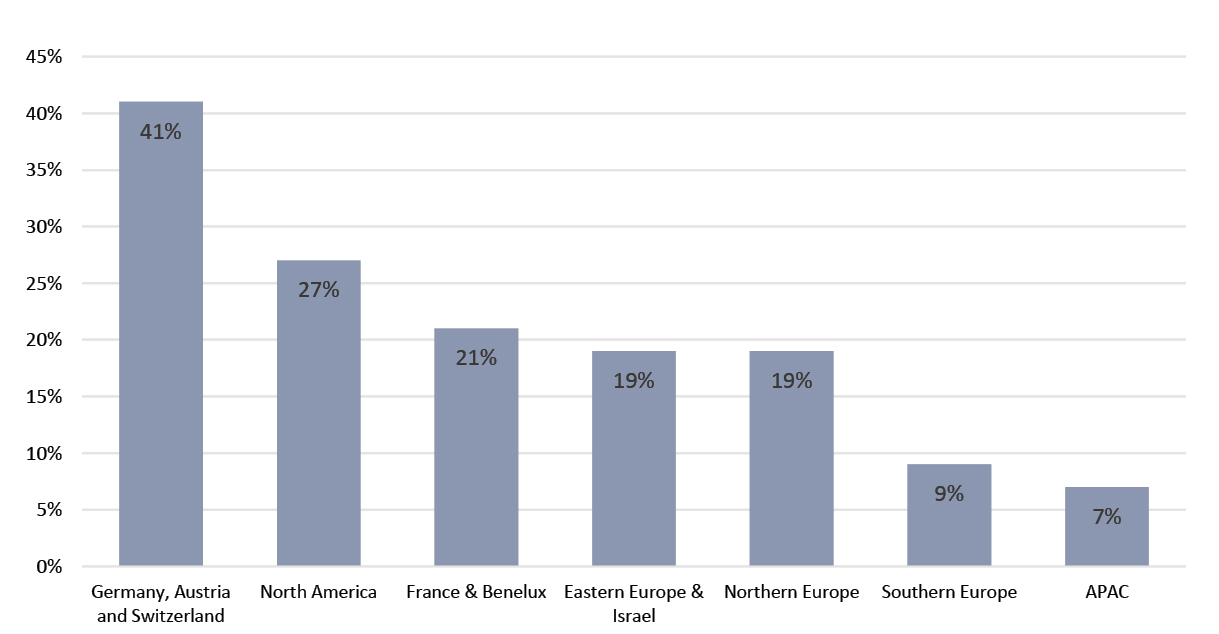

Our research has shown that, across all countries and technical categories over the past five years, AM start-ups had a mere 23% likelihood of survival (Fig. 4, top left). This number might be quite interesting information for a general first contact. However, it only starts to become valuable once one starts looking into the more specific distribution of survival rates across geographical regions and technical categories.

From a geographic perspective, there are two global areas which stand out in terms of the numbers of AM start-ups that they have produced over the past five years. Northern Europe (represented by the UK, Denmark, Sweden, Norway and Finland), the so-called DACH-region (Germany, Austria and Switzerland), and North America have each produced far more than one hundred AM start-ups between 2015 and 2019.

What especially stands out is the extremely high survival rate of start-ups in German-speaking Europe. This fact can be explained by two facts: firstly, a very strong technical infrastructure is in place, with world-leading industrial players who can help incubate and accelerate start-ups as pilot customers and development partners; and secondly, a very risk-averse culture exists in these three countries.

On the one hand, this leads to a much smaller number of start-ups founded per capita, but on the other hand it increases the likelihood of success for those who find the courage to found their own start-ups. In English-speaking cultures, where failure is much more accepted and the entrepreneurial spirit is more wide-spread, the decision to start a company is taken much quicker.

An insider’s perspective on Venture capital in AM

At AM Ventures, our typical investment target is a very early stage start-up. A team of passionate entrepreneurs with a diverse set of technical, commercial and financial skills makes a perfect match for us. The field of business in which the start-up operates should be within the industrial side of Additive Manufacturing – for example a new type of hardware or software, a unique material or an AM-based application. Two points of advice for a start-up to become attractive for investors would be to firstly focus on your core competence, and do not try to do everything by yourselves. There are great partners for everything out there; especially for the development and manufacturing of machines. Secondly, know exactly where you are making a difference and build on this. High-tech investors do not like copycats.

As to the question of whether a company should ‘go it alone’ or seek an investor, a key consideration is that – aside from the fact that developing scalable industrial technology requires a lot of great talent and costs a lot of money – in a digitised and globalised world, those who can convince the most customers, quicker than their competitors, win. Building up global sales networks, hiring experienced talents and finding the right key partners requires not only a lot of money, but also the right strategic advisors. Of course, you can also build a network on your own and earn the money to scale your company by yourself, but the right VC will help you with both in a small fraction of time.

In our discussions with start-ups, we are hardly ever faced with the concern that accepting VC funding is in some way ‘giving away control’. Most entrepreneurs take the VC route because they deliberately want to give parts of the company to people who bring them value. It’s nothing else but aligning interests and giving something for a return in the form of very specific technological know-how or an unmatched network within an industry. But do not be too generous with the shares you give away; there is no more expensive capital than equity, and many deals have failed because certain angel investors or advisors received too many shares too early in the company’s life.

An industry still hungry for innovation

Despite the growing maturity of the AM industry, we at AM Ventures believe that there is a continuing appetite for new process technologies and we have all been impressed by the wide variety of hardware concepts that have emerged over the past year and a half: we see new ways of exposure and recoating, we see the rebirth of Cold Spray, and it is great to see how new hardware enables new materials to be processed, which again results in new applications being developed. Although we have already been doing this for five years, I feel as though we have only just scratched the surface of start-ups in our industry.

Examples of impressive metal AM start-ups

One example of a very successful applications-focused start-up is Australia’s Conflux Technology, run by a team of former Formula 1 engineers masterminded by Michael Fuller, which decided to revolutionise thermal management systems by developing highly-complex heat exchangers. These use geometries which dramatically outperform their conventionally designed and manufactured counterparts, not only in terms of efficiency but also weight, volume and lead time. Conflux was seed funded just three years ago by AM Ventures and is today a global player, supplying the biggest names in aerospace, oil & gas, motorsport and industry with its highly innovative and patent protected solutions (Fig. 7).

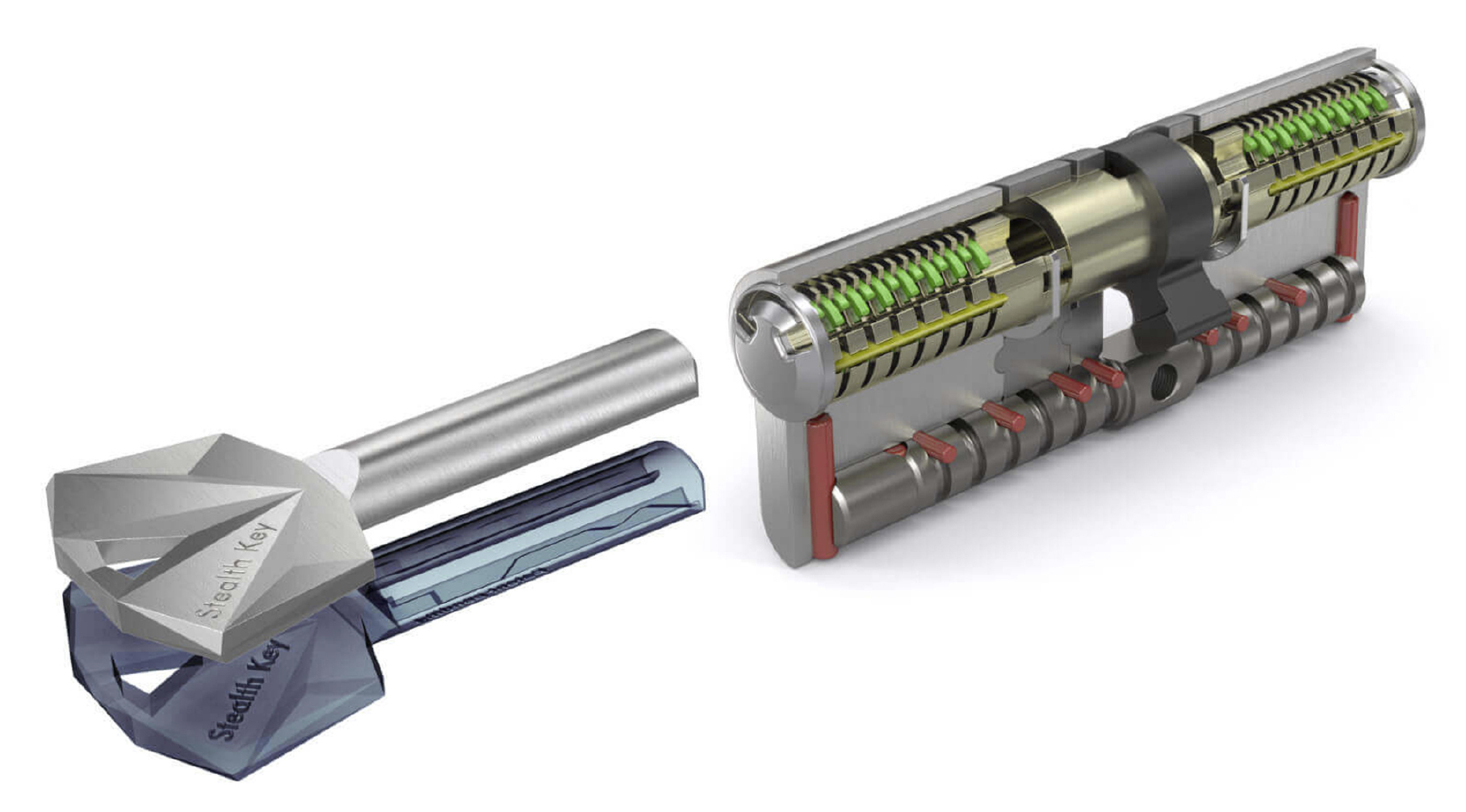

Metal Additive Manufacturing, however, is not only a technology which is gaining market acceptance in the industrial world. Even super-high-volume consumer applications such as keys for residential housing are becoming viable and even strongly improved through AM. A perfect example of this is Alejandro Ojeda, who founded Urban Alps, a Swiss-based start-up that has reinvented the design of the key and, as a consequence, also locks (Fig. 8).

The company’s AM-derived solution is not only copy-proof, but more durable and even more cost-efficient, because of AM’s design freedoms. That this company, in which AM Ventures has no investment, is making so many waves in such as large and mature industry, is exactly the reason why people at AM Ventures love to work in AM.

Conclusion

All in all, the world of Additive Manufacturing-related start-ups is booming as it has never done before. New hardware concepts are promising significantly higher productivity rates, and making new materials processable. Very well educated and highly creative engineering teams are continuing to develop new applications based on Design for Additive Manufacturing (DfAM), which will strongly boost the acceptance of our industry. It is on the established machine vendors and the advanced industrial users of our beloved technology to pave the way into the future by establishing quality standards and infrastructural interfaces in order to accelerate this adoption. If this can be established in the years to come, we will all witness how AM technology is going to enable batteries to last longer, vehicles to consume less fuel, and implants to heal faster.

Author

Arno Held

Chief Venture Officer

AM Ventures Holding GmbH

Petersbrunner Str. 1b

82319 Starnberg

Germany