The evolving metal powder marketplace: Total solutions, vertical integrations and start-up innovations

This is a challenging and exciting time for producers of metal powders. Talk of the industrialisation of Additive Manufacturing is everywhere and key pieces of the AM jigsaw such as standards, quality systems and installed production capacity are falling into place. The nature of the companies which are looking to take advantage of the anticipated feast is, however, surprisingly diverse. In this article, Alex Kingsbury and Dayton Horvarth highlight how long-established metal powder giants are adapting to AM and how agile start-ups are carving out niches in the powder marketplace. [First published in Metal AM Vol. 5 No. 4, Winter 2019 | 20 minute read | View on Issuu | Download PDF]

The industrialisation of metal Additive Manufacturing is the topic on everyone’s minds right now; in order to sustain or enhance the current rate of growth, we need to see the continuous manufacturing of certified AM parts. Producing metal AM parts on a continuous basis not only ensures sustainable growth, it also has a market-stabilising effect. A stable market can be a more competitive market and, where demand is met with strong competition on the supply side, there is a market opportunity for the whole supply chain.

It is interesting to review the metal powder market with respect to industrialisation and competitiveness. Metal powders exist within established Powder Metallurgy (PM) supply chains; however, given the unique requirements of AM powders, an AM-specific marketplace for powders and their resultant supply chains has evolved. Metal AM powders are currently niche and expensive products relative to PM powders; this is driven by a number of factors – primarily, the market volume is still very small. Without sufficient scale, metal powder production processes are inefficient, demand is variable and market pricing remains somewhat fluid and inflated as a result.

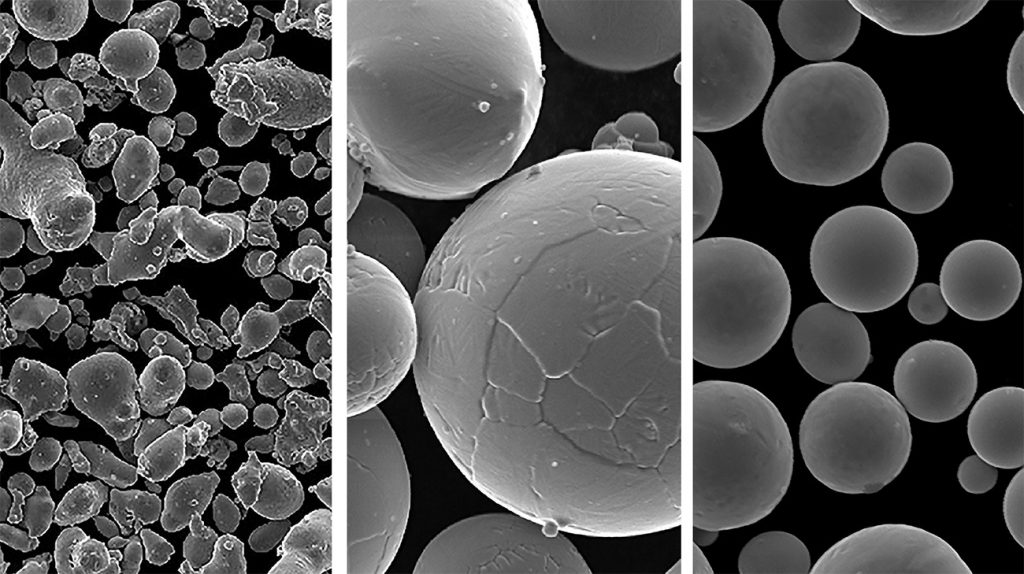

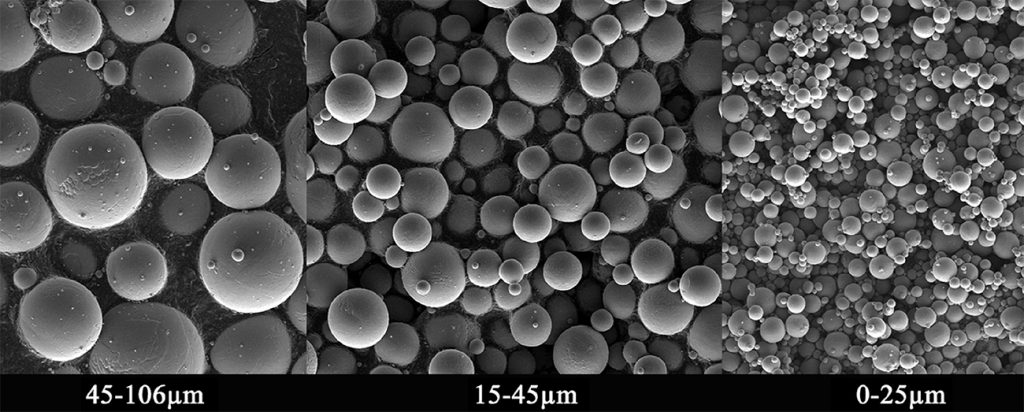

Increasingly, there is an emphasis on speciality atomising equipment to produce dedicated AM powders in order to meet stringent customer requirements around morphology, purity and particle size distribution. In summary, dedicated AM powder production ensures that users receive high-quality product, but means that AM technology cannot leverage the benefits of being aligned to larger and more established supply chains.

In this analysis, we take a closer look at metal powder manufacturers through the lens of investment and transactions. A select number of companies are discussed that highlight how both large players and smaller new entrants are employing different strategies to maintain competitiveness and better serve the AM market. In these relatively early phases of the metal AM market, there are still technical and market challenges that are constraining adoption. As this burgeoning industry progresses towards industrialisation, there are a number of emerging trends apparent that reveal how companies are addressing these challenges while remaining competitive and financially sustainable.

Market trends in metal powders for AM

The rapid rise in metal AM system sales has been met with a corresponding rise in the demand for AM-specific metal powders. Materials companies that were seeing moderate growth in their traditional markets are now targeting this high-growth and high-margin market. The shift has either taken the form of offering existing powder products suitable for AM to the AM market, investing in AM powder capacity, or both. Additionally, companies that were already catering to the AM market have made further significant investments in powder production capacity. With this spate of investment activity occurring, one could be forgiven for thinking that there is currently a significant unmet demand in metal powder for AM. Yet, surveying the number of certified applications currently in the public domain and accounting for many others that are not public knowledge, there seems to be a vast over-capacity for metal AM powders overall, particularly in titanium and nickel alloys.

The effect of this over-capacity is evidenced by decreasing AM powder prices observed over the past five years. Where supply outpaces demand, the market dictates that the price reduces. This reduction is positive for the industry as price reductions lead to lower part cost, and it puts significant pressure on powder manufacturers to remain competitive. As a result, larger companies are making strategic moves to increase market share, often involving the acquisition of AM-specific powder companies or broadening their existing AM portfolio capability. Overall, the trend is to increase vertical integration through internal investment or acquisition, with larger materials companies moving from being materials suppliers to total solution providers.

From powder supplier to total solution providers

Carpenter Technologies

Carpenter Technologies is an established materials provider to many industries that utilise AM and is an active example for strategic initiatives. Carpenter recently made three significant acquisitions of AM-specific companies; Puris LLC in 2017 and CalRAM and LPW Technology in 2018. A new division, Carpenter Additive, was established earlier this year to cater to this growing market.

As Ben Ferrar, Vice-President and General Manager of Carpenter Additive, explained, “The acquisition of LPW was the final piece of the puzzle in Additive Manufacturing capability. Our next step is to put all those assets and knowledge together; in doing so, we will achieve greater operational efficiencies.” Indeed, the establishment of Carpenter Additive is a signal to the AM market that the company has sufficient in-depth experience in AM and is well-positioned to cater to demanding industries.

Ferrar’s biggest concern is that non-quality driven suppliers are entering the market without an understanding of AM-specific requirements. The establishment of an Emerging Technology Centre in Athens, Alabama, USA, sees Carpenter deepening its understanding of end user requirements and furthering a vertical integration strategy by moving down the value chain.

Oerlikon

Another company making strategic acquisitions in metal AM is the Swiss-headquartered Oerlikon. Rather than being a strictly materials-focused company, Oerlikon has had a history of acquiring and developing technology applications. The acquisition of Sulzer Metco in 2014 established Oerlikon as a global provider of surface solutions.

With substantial R&D capability and experience with powdered metals and advanced materials, Oerlikon’s move into AM was both logical and swift. Oerlikon’s customer relationships from other PM markets and technology applications were successfully leveraged for this ease of access to the AM market. Additional acquisitions, such as citim GmbH, Scoperta Inc. and DiSanto Technology Inc., plus significant investments in powder production and an AM R&D and production facility in 2017 have cemented its position.

It is clear that the company has a very strategic focus on metal AM as a growth market, particularly as it divests itself of lower margin, lower growth assets. “Oerlikon sees Additive Manufacturing as the next industrial revolution. With our capabilities in powders and coatings, we saw that we could enter the AM field with an end-to-end service offering,” commented Dr Sven Hicken, Head of Oerlikon’s AM Business Unit. “We can take a customer’s idea or vision and make that a reality. We can integrate the entire value chain for a customer, which simplifies their production significantly.”

Sandvik

Swedish-based Sandvik AB began its corporate life more than 150 years ago in steel production. This materials technology business core has led to the development and evolution of new business divisions in cutting tools as well as technical solutions for the mining and construction industries. With more than forty years of accumulated experience in gas atomisation, Sandvik was an early supplier of metal powders to industries such as Metal Injection Moulding and was a key powder supplier from the earliest days of metal AM.

From 2014, Additive Manufacturing was used internally in Sandvik’s Machining Solutions division, however the strength of combining both the materials and technology AM areas to better cater to external markets became obvious and, in early 2019, Sandvik integrated its metal powder business into its AM division; this now sits in the Materials Technology business unit. In an interesting twist, it was announced that the Materials Technology business unit would undergo an internal separation from the parent Sandvik Group and would prepare for a possible separate listing in Q2 2020. This was followed by the announcement that Sandvik would be acquiring a significant stake in AM service provider BEAMIT SpA.

With seeming perfect timing, just three months later Sandvik opened a new titanium powder production facility, expanding its AM powders offering to include all major alloy groups for AM. “The Additive Manufacturing sector is developing fast, and there is a need for AM-specialist-partners with the advanced skills and resources required to help industrial customers develop and launch their AM programs,” says Kristian Egeberg, President of Sandvik Additive Manufacturing. “Sandvik and BEAMIT have leading capabilities across the whole AM value-chain and can enable companies to accelerate this development.”

Vertical integration in every direction

Creating AM-specific divisions is an increasing trend and makes the most sense where acquisitions and investments can be streamlined under one banner. The formation of GE Additive was hardly surprising following GE’s acquisition of Arcam AB and Concept Laser in 2016. The Arcam acquisition included AP&C, a manufacturer of AM-specific powders. Combining both machine sales and powder sales under one brand meant that GE Additive could stimulate market demand in machines by pricing the materials accordingly.

Another AM-specific division was formed in GKN Powder Metallurgy; GKN Additive just this year integrated its materials and components business under one brand. This unification again echoes the powder-to-product business line specific to AM that many others are adopting. However, unlike GE Additive, GKN combines materials and component manufacturing rather than materials and machines, exemplified by the company’s recent acquisition of Forecast 3D.

In a separate example, one company covering all aspects of the value chain is Swedish-based Höganäs Group. Through its Digital Metal subsidiary, Höganäs is a machine OEM and service provider that leverages the company’s core PM materials business expertise and powder supply further down the value chain. Continuing the trend for AM-specific metal powder atomisation, Höganäs has recently begun construction of a new atomisation plant for AM powders.

Powder production technologies

It is more than coincidence that AP&C as well as two other plasma-based powder manufacturers, Pyrogenesis and Tekna, are based in Canada. Plasma-based technology is extremely energy intensive and Quebec is home to some of the lowest cost electricity in North America. Interestingly, both Pyrogenesis and Tekna have developed plasma-based powder production systems, initially focusing on the development of the hardware, but each has successively entered into powder production for AM. It is clear that to move further down the value chain while taking advantage of competitively-priced electricity boosts profitability.

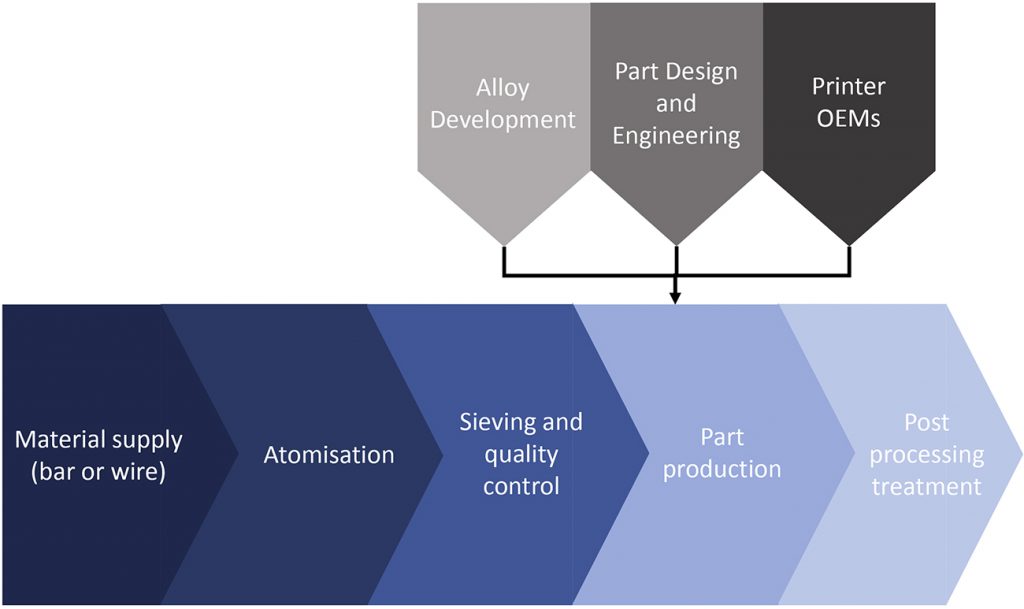

Of all the AM powders, titanium is one of the most technically challenging materials to produce, but it also offers the most opportunity. Titanium powder production technologies only accept a bar or wire feedstock, which precludes the usual practice of remelting coarse and otherwise unsaleable size fractions. Therefore, there is room for technical innovation in titanium specifically; this explains why many suppliers of titanium powders claim to produce ‘ultra-fine’ or ‘MIM cut’ powders. These suppliers are aiming to align their available particle size distribution with AM demand to improve internal powder production economics.

Debate and research is now emerging around AM powder specification that suggests relaxing stringent requirements and instead focusing on optimal processability in a powder bed. This sentiment opens up an opportunity for alternative atomisation technologies. Edmar Allitsch, Managing Partner at AM Ventures Holding GmbH, states, “Current atomisation methods are not a good fit for AM technology. Ultimately there will be a new technology, this is one of the missing pieces we need to resolve.” Many others share Allitsch’s view and there are a number of new providers entering the market claiming to address the issue of yield for metal AM technologies. Some of these leverage existing technologies or are refining conventional technology further, while others are developing new production methods altogether.

Start-ups push the boundaries

Technology entrepreneurs may understandably be deterred from entering the metal powder marketplace, given the increasingly crowded corporate landscape in materials, the technical requirements around powder specificity for AM and the lengthy qualification procedures for most additively manufactured parts. Additionally, start-up financing otherwise achieved through venture capital is averse to materials and hardware-dependent technologies due to long and capital-intensive development timelines.

Despite these factors, start-ups focused on metal powder production and alloy development are doing everything in their power to fundraise, innovate and redefine the industry status quo. It is these small groups that can efficiently drive technologies into today’s niche market opportunities not worthwhile for larger companies to pursue. As a result, start-ups are better indicators than large companies for emerging technology trends and identifying tomorrow’s mainstream market opportunities, when it comes to rapidly growing technology industries such as AM.

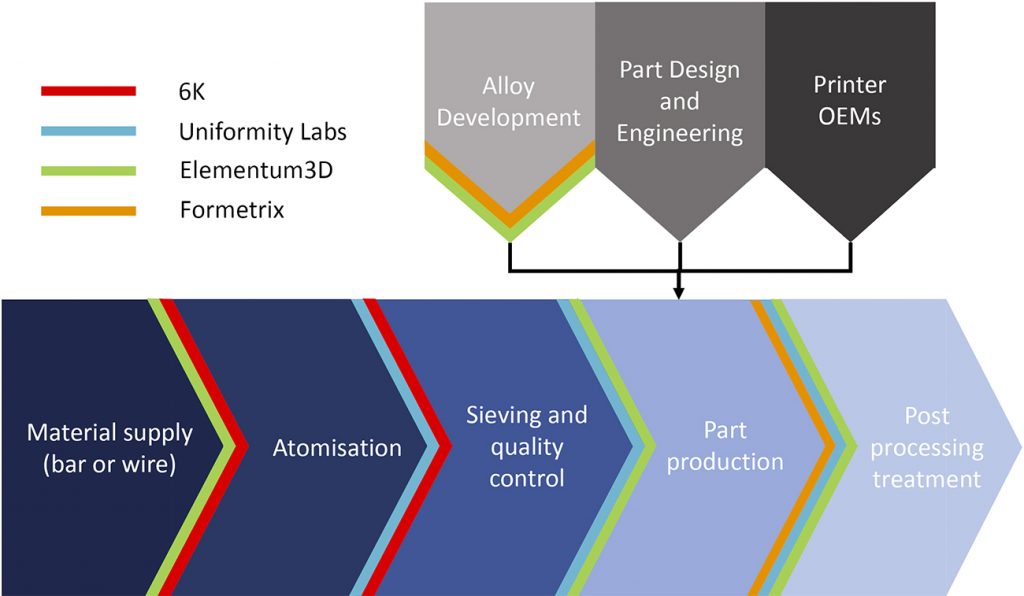

The industry’s interest in materials, software and post-processing continues to increase, but metal powder start-ups still represent a portion of AM start-ups overall. High margins and comparatively low volumes may sound attractive in a recurring revenue business model, but the technical requirements and powder performance guarantees in the AM metal powder industry do not offer any encouragement to would-be founders. Each metal powder start-up interviewed has a unique value proposition and a sophisticated approach to value chain positioning (Fig. 6).

6K

6K, formerly known as Amastan Technologies, is a powder producer that has developed a microwave-based plasma process that produces the more common AM powders, such as Inconel and titanium alloys, as well as custom alloys. The company’s UniMelt process does not fall under classic atomisation technologies and, as such, claims higher tap density and flowability powders without voids or satellite particles.

Aaron Bent, 6K’s CEO, states that, “We can have the highest quality powder but at competitive cost with what plasma or gas atomisation suppliers offer.” He also claims that the UniMelt technology sets itself apart with the ability to utilise input streams from machining by-products such as millings and turnings to produce AM powders. Bent further noted that, “We want to provide powders that give parts better integrity, while utilising feedstock derived from sustainable sources.”

6K recently purchased a titanium recycling operation, in part for a consistent supply of material. In addition to the titanium alloy and Inconel product launches expected later in 2019, 6K’s system can synthesise cathode and anode battery materials, which make up the company’s second primary market vertical. With claims that border on powder production perfection amidst an abundance of machined scrap titanium availability, 6K believes that it can drastically improve metal powder economics in the near future.

Uniformity Labs

Uniformity Labs is a California-based metal AM solutions provider that has a proprietary process for powder densification for use with new, recycled or reconditioned materials that enables its core value proposition: powders that dramatically improve metal AM parts and decrease build times. The company’s algorithmically-determined powder distributions are not necessarily spherical, nor do they phase separate, while exhibiting extremely high bulk density and maintaining flowability requirements.

To address the market effectively, build parameters are developed in-house on various name-brand Laser Powder Bed Fusion (L-PBF) systems and in collaboration with various industrial and aerospace customers. The company’s claims include triple the throughput on standard L-PBF systems with improved mechanical properties using their parameters and powders; initial results for sintered steel Binder Jetting parts suggest single digit shrinkage rates at 99%+ sintered density.

Adam Hopkins, CEO, views the company’s near-term revenue as coming from part production and powder sales with a focus on Inconel, aluminium and steel alloys. When asked about metal AM powder economics, he remarked that, “There are two fundamental problems for L-PBF and they don’t include materials or material cost; the printers aren’t fast enough and they require a PhD-level operator to run reliably. You need to enable more applications on the thousands of slow L-PBF machines out there by speeding them up and facilitating printing of in-spec parts.” Uniformity Labs hopes to enable a step change in machine economics as the market driver for its unique powder products and build parameters.

Elementum 3D

Whereas 6K aims to perfect spherical powders as a product and Uniformity Labs aims to improve the L-PBF process in conjunction with different powders, other start-ups are focusing on AM-processable alloy development to expand the limited options in AM. Elementum 3D is a metal alloy developer for L-PBF applications that works directly with machine manufacturers, powder manufacturers and end users to deliver better performing and unique alloy powders.

Developing new alloys on multiple name-brand L-PBF systems begins with sourcing atomised powders that are then modified physically and chemically by Elementum 3D. During AM builds, these modified powders undergo what the company calls a Reactive Additive Manufacturing (RAM) process that allows a finished ceramic-containing metal alloy to form. The company’s powders notably increase printer throughput and offer matched or improved combinations of mechanical properties when compared with available AM alloys.

The leading products available are 2, 6 and 7-series aluminium alloy analogues containing 2% or less ceramic, with nickel superalloys and certain tool steels expected in the near future. When asked about specific alloy growth for metal powders in AM, Jacob Nuechterlein, CEO and Founder of Elementum 3D, sees a major opportunity for aluminium alloys in replacement parts, especially since the company’s 6-series aluminium builds parts twice as fast as the more commonly available aluminium-silicon-magnesium AM alloys. Through materials development and custom build parameters, Elementum 3D’s powder products help users match traditionally manufactured aluminium specifications with an added economic incentive. If this formula can be replicated in other materials, L-PBF’s applicability expands in breadth of applications while increasing powder demand and reducing built part costs.

Formetrix

While Elementum 3D’s initial focus is on high-strength aluminium, a Massachusetts-based start-up called Formetrix is focusing on AM tool steel development using multiple L-PBF printer brands. Harald Lemke, Chief Commercial Officer at Formetrix, described the company as downstream from the powder manufacturers, but leveraging contract manufacturing capacity in order to supply the company’s higher performance tool steel powders.

He noted that L-PBF has not had any traditional tool steels that can be readily additively manufactured, leaving users with alloys such as M300 maraging steel. With tooling as the logical middle ground between prototyping and production applications, Formetrix has developed AM tool steel powders and formulated build parameters to deliver performance in applications such as automotive tooling.

The company’s first material, L-40®, is being used for aluminium die cast and hot forming tooling as well as compression dies. Near-term value for the company will stem from delivering performance powders that match or exceed traditional tooling grades in applications that already benefit from L-PBF design freedom and turnaround times.

Start-up investment

Collectively, the four metal powder start-ups discussed here have raised more than $64 million in equity capital from institutional and private investors since 2015. There is no set formula for successfully raising start-up funding; however, summarising the value propositions for these four companies does illustrate certain similarities. Improved part performance is present in all four, while reduced build times and, by association, lower part costs are represented in three of them. All four companies leverage existing atomisation capacity or materials sources and focus on materials, process and/or application development. Each company’s value proposition is intended to establish and increase demand for its metal powders in pursuit of stable and long-term recurring revenue.

Even if the scaling economics do not compare with software technologies, recent strategic acquisitions by corporates such as Carpenter, GE and Oerlikon have not gone unnoticed by informed investors. Expect significantly more funding to follow these companies, as they grow and scale production capacity and product lines and continue to expand into new applications and industries.

New technologies, traditional materials

Many of the latest OEM entrants in the metal AM market are looking to ease the high level of materials specification faced by the industry, enabling lower cost material from existing supply chains to be utilised in their systems. Larry Lyons, Desktop Metal’s VP of Product, agrees. “It’s harder and slower to go down the cost curve when you are trying to establish a new technology with a small market. This limits adoption and industrialisation,” he explained. “Tapping into the press and sinter and MIM supply chains was our approach for this reason.”

For HP Inc., material choices are driven by risk-reduction as well as cost-reduction. Tim Weber, Global Head 3D Metals for HP, states, “So far we have been working with readily available MIM cuts. We encourage people to stick with something off the shelf; not only do you have the powder, you also have the sintering recipe.”

While working within existing supply chains will reduce cost-per-part, the industrial offerings from both Desktop Metal and HP are not yet widely available. As a result, their implications for the materials supply chain are yet to be observed. With maturity, these new systems will necessarily dictate their own design rules and protocols; powder specification naturally flows from that process. So while leveraging existing supply chains is a sensible approach to reducing materials price and therefore part cost, increasing powder specificity may drive the prices of even standard PM materials up. It is too early to tell where the powder price equilibrium will settle for Binder Jetting technologies.

Where’s it all going?

In the materials landscape, we are seeing many companies, both large and small, orient and organise around Additive Manufacturing technology. There is strong optimism and confidence in the growth potential of the metal AM market. Financing is flowing to support internal investments, acquisitions and early stage companies.

This support comes despite a comparatively small volume of production parts and against a backdrop of decreasing powder prices. As a result, the focus for all companies is on refining their competitive advantage. For larger companies, increased competitiveness is achieved through vertical integration and leveraging market power, whereas, for smaller companies, this means honing a value proposition that favours lower part cost without compromising quality.

With the machine OEM technology landscape moving quickly, materials producers, both large and small, must be agile in capturing new opportunities. New entrants in Binder Jetting technology are changing the powder requirements for metal AM parts, which is changing the conversations materials suppliers are having with customers.

One thing is certain, all companies supplying to the metal AM market accept that success is a function of perseverance, commitment to quality and persistent innovation. Investments are being made not based on hype, but on the conviction that the metal AM market has a long-term growth prospect and that now is the time to start positioning for that growth.

Futurist Roy Amara aptly summarises this sentiment when he says, “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” While market volumes may be small now, continuing innovation in all aspects of the value chain and increased competition are driving down costs and setting the stage for new market opportunities across all industries.

Authors

Alex Kingsbury

[email protected]

www.rmit.edu.au

Dayton T Horvath

[email protected]

www.newcap.com

www.additiveexecutive.com