Growing momentum and broadening recognition: A status update on the rise of Electron Beam PBF

In the Summer 2020 issue of Metal AM magazine, Joseph Kowen presented a snapshot of the Electron Beam Powder Bed Fusion industry. The conclusion was that the full potential of the technology was, as yet, unrealised, and that PBF-EB had considerably more promise than the level of commercial activity seemed to suggest. Two years later, Kowen returns to the topic to offer an update on the progress of the PBF-EB field over the intervening period. He assesses the growing level of activity to provide an updated estimate on where the technology, and its commercialisation, is headed. [First published in Metal AM Vol. 8 No. 3, Autumn 2022 | 20 minute read | View on Issuu | Download PDF]

In its Summer 2020 issue (Vol. 6 No. 2), Metal AM magazine published an article on the status of Electron Beam Powder Bed Fusion (PBF-EB). With the technology still operating in the shadow of the considerably better known and more commercially active Laser Beam Powder Bed Fusion (PBF-LB) technology, the objective of the article was to take a snapshot of the then current status of PBF-EB and try to shed light on the advantages and prospects of the technology. It tried to explain why it came in a distant second to PBF-LB, despite some of the advantages it held. Finally, the article took a peek into the pipeline of new players and new products that had started entering the market and to understand the potential they saw that prompted them to take the plunge into the world of PBF-EB.

The overall conclusion was that the full potential of PBF-EB was, as yet, unrealised, and that the consensus was that PBF-EB had considerably more promise than the level of commercial activity seemed to suggest. The article speculated as to what the reasons for that unrealised potential might be; the electron beam has been known to science for more than 120 years, longer than the relatively younger laser beam. Work on PBF-EB began not much later than the pioneering work on PBF-LB, but the article estimated that only about 6% of all metal PBF systems were electron beam systems. Why was this?

Two years and a pandemic later, this article will take a look at the latest developments in PBF-EB, track what has transpired since Metal AM magazine’s last PBF-EB review was published, and offer an updated estimate on where the technology and its commercialisation is headed.

PBF-EB basics

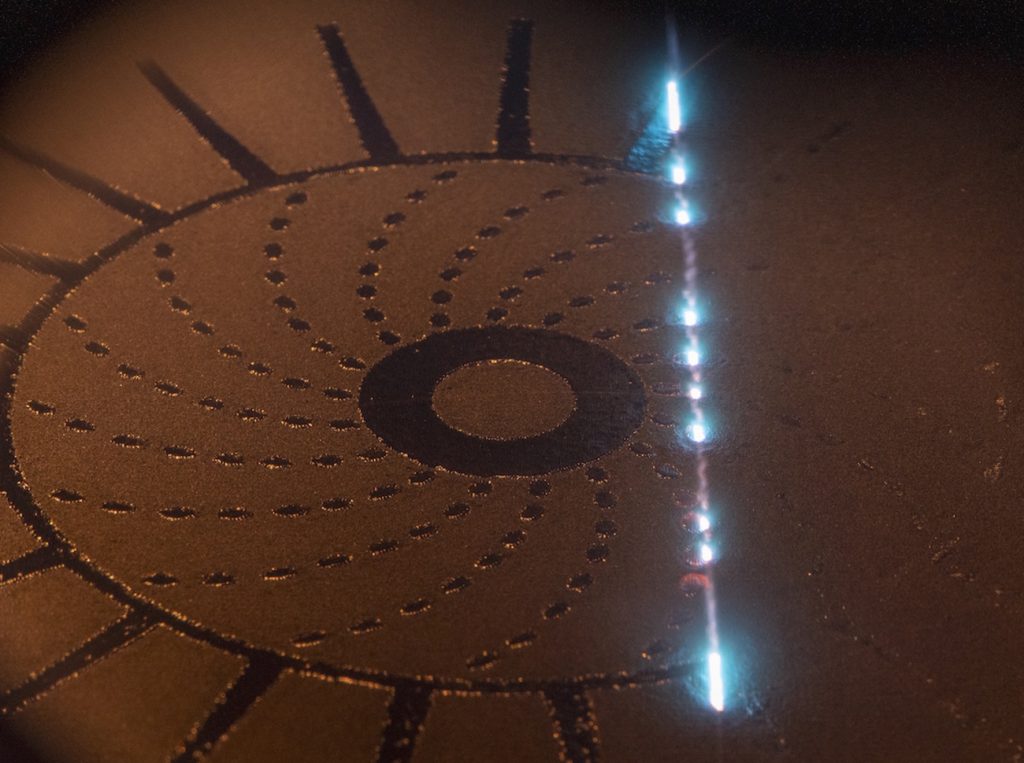

For readers less familiar with PBF-EB, here’s a general description of how it works: PBF-EB is based on the melting of metal powder by exposing it to a beam of electrons. The process starts with the spreading of a thin layer of metal powder on a build plate. The powder is pre-heated by exposing the entire layer to a stream of electrons; this broad exposure of electrons heats the powder to suitably high temperature, based on the material being used. In the case of titanium alloys, the powder is heated to about 800°C.

An electron beam is deflected by an electromagnetic field which transfers energy and selectively fuses parts of the layer by raising the temperature of the pre-heated powder to above the melting point of the material being processed. After melting of the selectively fused parts of the layer is completed, the build platform is lowered and a layer of fresh powder is spread across the build area. This process is repeated for each layer as parts are built up.

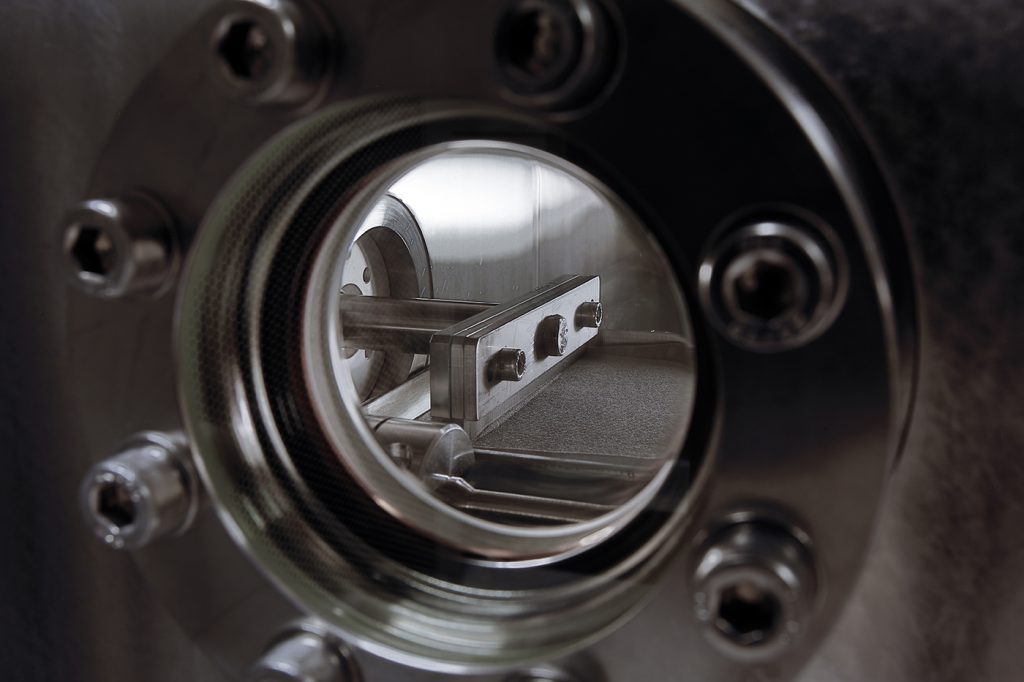

Heated but unfused powder forms a ‘cake’ around the fully fused parts and needs to be removed and recycled in a post-processing step. This is done by mechanically blasting the surrounding cake and removing excess material from internal channels inside the part as necessary.

There are several misconceptions about PBF-EB, which were reviewed in our first PBF-EB status report. Two years on, there is no evidence to suggest that there has been a dramatic sea change in the overall perception of PBF-EB, although there have been some important incremental changes slowly but surely chipping away at PBF-LB’s dominance in the industry’s consciousness. As shall be seen, the growing level of activity in PBF-EB can only have helped to develop a broader understanding that something exciting is happening in this technology. In this article, we’ll try to get a grip on what that is all about.

The newcomers

Let’s start by looking at the new machines and companies that have entered the commercial stage since our last review. Two of these companies were listed as ‘machines in development’ in 2020, while a third was in stealth mode, but has since come out of the shadows and taken healthy steps to position itself as a solid competitor. The common thread binding all three of these newcomers is that they bring with them experience in the use of electron beam technology honed over time in other industries. We’ll look at them in the order in which they first came to the attention of the AM world.

JEOL

JEOL is an established Japanese supplier of precision scientific instruments, including electron microscopes and lithography machines. It has been developing electron beam technology since 1949. The first indication of its interest in applying this knowledge to PBF-EB was its decision to join the Japanese government’s Technology Research Association for Future Additive Manufacturing (TRAFAM) consortium, established to improve the country’s capabilities in AM.

The company’s first commercial AM machine, the JAM-5200EBM, was announced at Formnext in 2021, where the company showed parts produced using its PBF-EB technology, but not the machine itself.

The key features of this offering include a high-temperature process of above 1100°C with a 6 kW electron beam. Its scanning strategy uses a high-speed scan and high-speed focus change which improves both build speed and build quality, the company says. It claims a long-lasting and stable electron beam output needing replacement only after 1,500 or more hours of use. Its features include a reusable heatshield, and a smoke prevention mechanism called e-Shield. Since helium is not used, the company states that the system “has a low CO2 footprint and is more environmentally friendly.” The company offers three materials: Ti6Al4V (Grades 5 & 23), pure copper, and Ni718. Powders can be sourced from third-party suppliers.

Like most systems, the machine produces parts embedded in a ‘cake’ of partially hardened powder which needs to be removed. The company offers a powder recovery system to remove the material surrounding the parts. Less clear is how the cake is removed from internal cavities or channels, a problem common to most of the offerings in the market.

JEOL, like many companies offering new technologies, remains tight-lipped on specific applications for which its technology is being deployed. The number of machines sold has not been published, although the company says that “multiple units have been installed.” These units are in Japan, the company’s home market, although it has begun promoting its machines in Europe and North America through the commercial channel already existing for JEOL’s products.

Wayland Additive

Wayland hit industry headlines in 2019 when it announced that it had secured early-stage venture capital funding of $3.7 million. It has now been through two funding rounds and expects to be self-sufficient in 2023, with plans to raise additional funding in the mid-point of 2023 to scale for growth. The UK company’s electron beam pedigree has its roots in the development of lithography systems for the semiconductor industry, Wayland’s founders having identified the potential of adapting their knowledge of precision electron beam processing to AM.

The company announced its first Calibur3 PBF-EB sale in May 2021, to Canadian energy company Exergy Solutions. The company’s first public showing of its machine took place at Formnext 2021. The first two machines are in a final testing stage before installation at customer sites in Canada and the UK. In April 2022, the company announced a collaboration with EWI under which a Calibur3 machine will be installed at EWI’s Buffalo, New York, facility, where it will be deployed in the development of new materials. In September 2022, the company announced the expansion of its facilities in the UK. This will allow it to produce up to thirty units per annum. The list price of the Calibur3 is £940,000 (approx. $1.05 million based on exchange rates at the end of September 2022). The company is already talking about a new model called Calibur4, which will share some sub-systems with Calibur3, speeding its development.

At the heart of Wayland’s machine is its Neubeam technology. The ‘Neu’ stands for neutralise, as in neutralising the negative charging of the metal powder particles and thereby avoiding the smoke effect, a key challenge in PBF-EB. Wayland offers an open machine architecture, allowing customers to develop processing parameters better suited to new materials and applications. It currently offers titanium and Vibenite 290 and is working with commercial partners to develop pure tungsten processing capabilities.

Another key differentiator for Wayland is the ability to avoid the hard-to-remove caked powder around built parts. This has the potential to simplify the powder removal process, especially for internal channels. Depending on the parts produced, a more loosely caked powder bed might necessitate the addition of support structures to steady the build or to facilitate multi-layer builds or nested parts. All told, the company believes its Neubeam technology offers productivity advantages over competing systems in total part cost.

pro-beam Group

Yet another new entrant that gained experience in electron beam technology in other industries, pro-beam has been a developer of systems and provider of services in the field of electron beam technology since 1974. Based in Germany, the company employs more than 400 and is active in forty countries worldwide. It operates five locations: three in Germany and one each in China and the US. Its main business is the production of electron beam welding systems and the provision of related services, and it reports an annual turnover of over €60 million (approx. $58 million, depending on exchange rates).

pro-beam offers welding, hardening, coating and micro-drilling services, and its extensive experience with the job-shop operation of its technology is one of the key differentiators for this company, giving it the experience and confidence to produce robust systems for use by end-users in a demanding market. The decision to enter AM was based on enquiries from existing companies – mainly from the aerospace segment and general engineering – asking about applications in AM. In response, it developed both electron beam DED and PBF-EB machines for industrial use. The company is vertically integrated and builds all of the main components of its machines itself, including the electron gun technology.

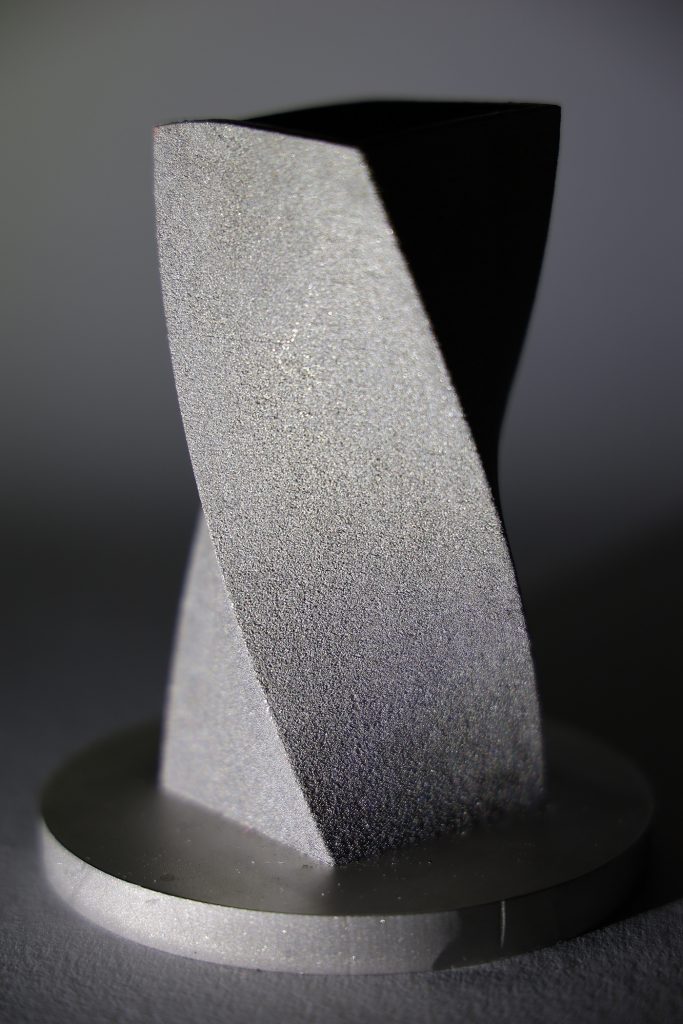

pro-beam first displayed its machine at Formnext 2021. The PB EBM 30S is available with two different build volumes and operates with layer thicknesses of 50–100 µm. The list price of the machine is “above €1 million” (approx. $960,000, depending on exchange rates), which includes its complete parallelisation. A total of nine machines are on the market, four of them with a full specification of features and options.

The machine is capable of processing Ti6Al4V, TiAl, copper and Inconel. However, as an open machine, customers are encouraged to develop alloys to meet their specific needs. For this reason, pro-beam has placed the first machines in universities and in corporate R&D departments for use as development platforms.

The company says that its process stability delivers better quality. Lower electrostatic charging results in less smoke and optimal results at minimum build power. The selective spot strategy, called RainTec, resembles ‘rainfall,’ which the company says stabilises the process. In-process quality inspection is a standard feature of the machine, and ensures the highest possible yield by flagging deficiencies layer-by-layer in real time.

Perhaps the most advanced feature of the machine has been designed to address one of PBF-EB’s weakest features. Since the cooling process can be as long as the build process itself, pro-beam’s approach offers multiple build boxes, called BuildUnits, in the same build environment such that when one build finishes, the next can begin immediately while the first is still cooling down. This parallelisation effectively doubles the capacity of the machine. A third BuildUnit can also be added to make the machine even more efficient, so that two boxes can be in separate stages while the third build begins.

The up-and-comers

Another group of companies had already taken their first baby steps into the market at the time of the previous PBF-EB article. Freemelt already had systems on the market in Europe, while Tada Electric had recently recorded its first installation in Japan. What progress have they made in the past two years since their initial commercial machine sales?

Freemelt AB

Gothenberg, Sweden-based Freemelt AB was founded by early members of the team that developed the Arcam machine. The company has deep roots in the electron beam ecosystem, giving it the perspective to understand not only the key features of PBF-EB, but also which aspects of the technology needed improvement.

The biggest news to come from the company in the past two years was its initial public offering (IPO) in July 2021. The company raised the equivalent of €8.4 million ahead of the IPO, a display of confidence by investors in the potential of PBF-EB. The influx of cash allowed the company to proceed with its development plans for systems, as well as speed up their commercialisation efforts through the establishment of a sales team.

The overall vision of the Freemelt team is based on the idea that the barriers to the development of PBF-EB lie in the paucity of material options available to customers. Material development is a lengthy process, one which requires machines with open build parameters to facilitate material development iterations. As a result, Freemelt came out with the Freemelt ONE, which, by definition, was designed for material development. Its main customers have been academic, government and corporate research facilities. In addition to open settings, the small build volume was designed to ease the material development process by requiring only small quantities of new alloys with which to work.

The second part of the strategy was to make it clear to customers that what they had developed on the Freemelt One could be transitioned into future commercial machines under development by Freemelt with minimum effort and short lead times. The common family lineage in the processes of the development machines and commercial models would, according to the company, overcome one of the key hurdles inhibiting the development of PBF-EB in general.

So what has happened so far to realise the vision of upscaling the Freemelt One into a commercial system? By the time this article is published, the company will have made further details of its future system available. What is already known is that Freemelt is developing an industrial PBF-EB machine that will be called the e-Melt. A pre-series version will be offered to customers for delivery in late 2023. The purpose of the pre-series system is to qualify production of parts using transferred processes developed in Freemelt ONE machines.

Little is known about the machine’s specifications at this stage, but there are indications that it will include a module system and turnaround station that will cut down process time considerably, unlocking a bottleneck in the workflow. This feature will enable greater utilisation of the beam system by allowing a new build to begin before an earlier build has completed its cooling down process.

Tada Electric Company

Tada is a subsidiary of Mitsubishi Electric. It also has a long history of involvement with electron beam technology for welding. It has more than 1,500 electron beam welding systems on the market and has a 30% market share, it says, a pedigree which enabled the company to advance its entry into the AM space. It has been active in electron beam welding for the past fifty years, primarily for the automotive industry. In addition to PBF-EB machines, the company has also developed a Directed Energy Deposition (DED) machine, which is now commercially available.

The company joined the Japanese government’s TRAFAM consortium on AM technology development in 2014. Its first effort was the development of a 600 x 600 x 600 mm system. It soon realised that the market for such a large PBF-EB system was very small, especially in Japan, and decided to apply the knowledge gained in its development to a smaller machine with a 300 x 300 x 380 mm build volume for the broader market appeal. This machine, the EZ300, is currently available for sale in Japan, although some thought is being given to expanding its availability to other markets. The list price of the machine, depending on exchange rates, is about $800,000. The larger machine could still be made available as a viable platform, should there be demand for it.

Many of the small number of Tada machines in the market are being used for experimental purposes at this stage, the objective being to develop AM solutions for materials that cannot be produced by PBF-LB machines. That market is still in its infancy, the company says. New material development is a time-consuming and a resource-demanding task. The company offers titanium and stainless steel 316L, and some initial efforts are underway to start supplying pure copper.

While the technology is not markedly different from other PBF-EB offerings, the company believes that its lengthy experience in highly demanding industries, such as the auto industry, equip it to produce a robust platform for use in AM. Layer thickness is currently 70 µm, but the company thinks that much thinner layers are possible. This opens up the possibility of building detailed parts in larger quantities in a single build, an economically interesting proposition for an appropriate part design.

Caked powder removal is a recognised challenge for Tada, as it is for the entire segment, and it is working to find a way to lower the temperature of the build, which will lessen the strength of the caking effect. Its approach is the development of a mechanical device to lower the temperature, but no further information is currently available.

GE Additive’s Arcam: The leader in PBF-EB

No overview of the segment would be complete without a close look at what the industry leader in PBF-EB technology is doing. GE Additive’s Arcam division is not just any leader; it is a leader in a big way, with an atypical dominance of the segment that has few equals in any other area of AM, or, for that matter, in most other product segments. With more than 300 of its machines installed worldwide, its footprint eclipses – almost by an order of magnitude – the combined efforts of all the other competitors in the market. So how has GE Additive been spending its time over the past two years?

Although accurate, it would be taking an easy and overly simplistic cheap shot to say that the company launched no new systems in the last two years. On closer examination, a number of important efforts are being undertaken by the industry leader to broaden the usage of the technology within the parameters of the current hardware. This shows a recognition that no significant changes in performance will spring from a new machine without concurrent developments in the materials available for processing. It recently published a white paper prepared in conjunction with the UK’s National Centre for Additive Manufacturing in which it discusses in broad terms new applications based on new materials tailored for use in PBF-EB. The white paper states, “Today, over eighty alloys that have already been used with EBM in the academic world and in industry could be developed further for commercial applications.”

Even so, the GE Additive Arcam team estimates that productivity has increased in the range of 30% over what was on offer two years ago, and, while the model numbers of the machines have not changed, the team unofficially shared that its current Spectra machines, the flagships of the product line, could now be considered ‘Spectra version 1.2’ compared to version 1.0 at launch.

GE Additive also speaks very clearly about the need for industrialisation of the technology. By this, it means that PBF-EB OEMs must strive for robust systems that offer industrial levels of reliability. While the need for stable and reliable machines might be an obvious strategy for all manufacturers, industrialisation is a mindset at GE Additive, and is based on the realisation that the success of PBF-EB lies in serial production, where repeatability is the difference between viable and non-viable AM applications.

A more tangible expression of the need for greater industrialisation is the PRS30, a powder recovery system for semi-automated removal of the powder cake launched by GE Additive in 2021. The company is also working hard to improve the conditions for caked powder removal through optimised electron scanning and process improvements.

The GE Additive Arcam team points out that a successful application does not have to be a highly sophisticated part from an advanced industry. A simpler part where geometry could provide valuable advantages, such as energy savings, could well justify the expense of making a part by AM. As the leader in the PBF-EB space, GE Additive’s recent white paper could be seen as a call to action not just for the company itself, but for the entire PBF-EB ecosystem.

About speed and cost

The overall competitiveness of PBF-EB technologies is, of course, closely related to the throughput of the machines. The relevant parameter is total manufacturing cost (including post-processing) and not just the actual build time which would be derived from efficiencies in the electron scanning and powder recoating process. PBF-EB machine makers are understandably careful to avoid declaring a machine speed for a full-height build. At best, they will provide a high and low range, which does not reveal much – other than the best-case figure being many long hours.

The oldest truism in AM is to say that machine performance is ‘part-dependent,’ and PBF-EB is no different. This is especially true when one considers post-processing time. All but one of the suppliers produce a cake that requires removal using a powder recovery system, which could be manual or partially automated. Two companies, GE Additive and JEOL, offer powder recovery systems that provide some level of automation. Even so, removal of the cake from hard-to-access cavities and channels still needs to be performed manually. Parts with more internal channels will take longer to clean. The material being used can also affect the post-processing time. Copper will be quicker than titanium, for example. ‘Design for post-processing’ could reduce the time to remove the cake by avoiding angles that complicate the process.

GE Additive published a white paper, mentioned in our original article, that showed the cost advantages of PBF-EB over PBF-LB. The basis was ‘cost per part,’ meaning that the design and size of the part being produced greatly affected the cost. A build containing many small parts would offer a vastly different cost profile than a build containing a few larger parts, emphasising again the part-design dependency of the costing. Among the process drivers of the cost advantage, the study revealed several factors: easier build preparation and part nesting, if no support structures were required; reduced need for heat treatment; and less complicated support removal.

That being said, machine throughput could still be a game changer. With the introduction of multi-laser PBF-LB machines, the question frequently asked is whether these new machines, containing up to twelve lasers, may have tilted the balance in favour of PBF-LB. The short answer is that, as of now, there is no evidence published that would definitively show that a twelve laser PBF-LB machine’s increased throughput would be enough to eclipse the benefits of PBF-EB based on the factors described above. As expected, PBF-EB machine suppliers point to the high cost of the new generation of muti-laser systems, not to mention the complexity of ensuring calibration and alignment of the lasers to ensure seamless parts. In time, more data will become available. One thing will still be true, though. Part design and the application being manufactured will play a big role in determining which technology makes most sense.

Also of note are new laser-based technologies that have been announced but which are not yet commercially launched. Seurat’s Area Printing technology is one. Vulcan Forms has announced a laser-based process that it claims is many times more productive than current PBF-LB systems. Even if the promise of these new technologies is realised, PBF-EB will still have advantages in its ability to manufacture parts made of materials less suited to lasers, or completely allergic to them.

What does this all mean?

Two years on, what can we say about the state of PBF-EB? We cannot say that there has been an explosion of commercial adoption of new technologies or applications, new machines, or even significant commercial success of new players in this space. Perhaps a reasonable expectation two years ago was that the companies standing on the side looking in would have made more progress by now. We usually measure success with quantifiable metrics such as machine sales; that is an easy method of measurement, but falls short of measuring less tangible aspects of industry growth and development.

Putting GE Additive Arcam aside for a moment, a rough estimate of the aggregate sales of all of the other PBF-EB suppliers over the past two years, for which exact machine sales are not published, would perhaps get us to between forty and fifty systems. We could ascribe this relatively slow rate of growth to the pandemic, but evidence would suggest that other factors may be the dominant ones at play here.

What we can say is that the number of suppliers of the technology has grown. New money has flowed into the space, suggesting that investors or companies have a positive view of PBF-EB’s potential. While investors are not always right, investments are not usually made without a positive opinion from the industry professionals that investors typically rely upon while doing their diligence. In some ways, investments can be seen as a high-stakes opinion poll.

We can also see that companies with long electron beam experience are applying deep knowledge to this area. This has two ramifications: first, that basic knowledge of the core technologies will play a part in assuring that the development trajectory will be fed by real industry experience, especially on subjects that often escape attention in other AM technologies, such as robust system engineering, an industrial view, and quality; second, that a number of the companies entering this space do not rely on PBF-EB machine sales for their survival, meaning that they have the privilege to take a long view and make educated decisions on what is needed to produce long-term success for these products.

On the technical level, the most encouraging trend is the recognition that materials will open up new applications. Since material development is a long-term endeavour, the willingness of machine manufacturers to open up their machines to new materials and build parameters is proof that the future of PBF-EB is promising, and progressing, even if this journey will not be completed in a day.

There are two sides to a competitive analysis of PBF-EB. Inward-facing competitive analysis reveals a healthy ecosystem of players in PBF-EB, who are supplying creative and competitive energies and generating a critical mass of interest, as we have seen in this article. There is enough competitive tension, by most measures, but at the same time not too much of it. A degree of healthy competition is sufficient to create a mutually reinforcing confidence in the future, and is critical when developing new and relatively untested technologies. Outward-facing competitive analysis assesses how the technology is faring relative to its alternatives. It is difficult to predict exactly what new metal AM technologies might be around the corner; in this article, we have mentioned two that have just moved into view after development in labs and research centres outside of the limelight. There may be others in the works beneath the surface.

No matter, because physics comes to the rescue. The unique physics-driven advantages of electron beam will ensure that some materials, and the applications based on them, can only be produced by PBF-EB. Reflective aluminium alloys and pure copper are examples of this, as are crack-prone materials. The high-temperature vacuum build environment, and the deep penetration of the beam, lie at the centre of PBF-EB, and the advantages that they produce are not going anywhere soon. Both inbound and outbound competitive outlooks are promising.

Then there is the industrialisation vector. We are seeing the start of solutions that address productivity beyond the parameters of the build process itself. These solutions, such as the multiple build box and transfer/exchange solutions mentioned in this article, take effort and resources to develop, and might add to the price for consumers, but, in the long run, the success of manufacturing applications will be correlated to overall process productivity. The higher capital cost of equipment is not significant when it delivers greater productivity, resulting in an increase in economically attractive applications. Spread over the lifetime of the equipment, a higher capital cost is negligible when juxtaposed with the benefits that could accrue from an application that might not otherwise have seen the light of day.

The careful conclusion that we can draw from this overview is that progress in PBF-EB is measured but real, though there is much left to be done. The technology and its industrialisation are on track, but the game is long. When the next periodic assessment is made, expect to see progress again.

Author

Joseph Kowen is an industry analyst and consultant who has been involved in rapid prototyping and Additive Manufacturing since 1999. He is an Associate Consultant at Wohlers Associates, part of ASTM International’s AM Center of Excellence.

Tel: +972 54 531 1547

www.linkedin.com/in/joseph-kowen-a5129b3/

PBF-EB activity in China: Tianjin Qingyan Zhishu Technology Co., Ltd. (Qbeam) and Xi’an Sailong Metal Materials Co., Ltd. (Sailong)

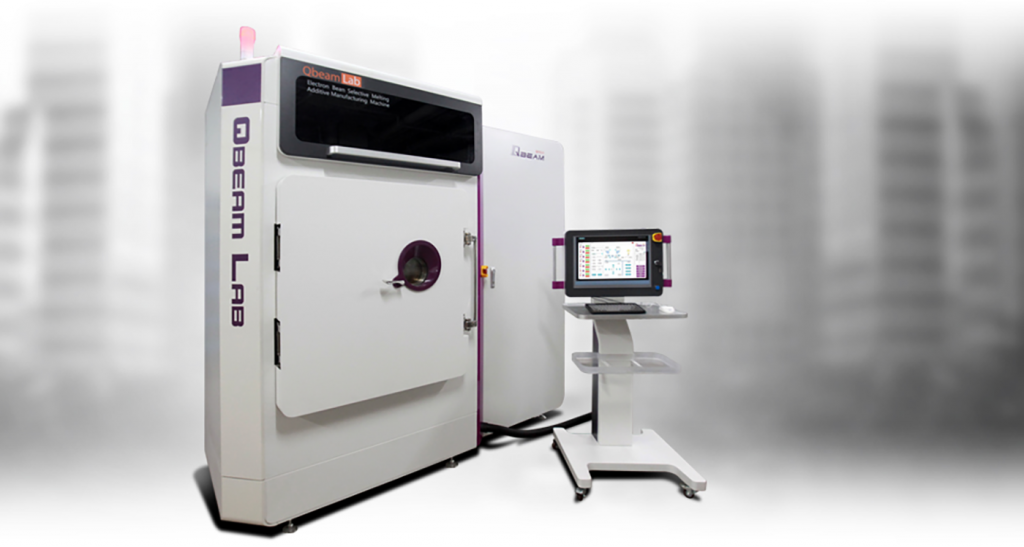

Two companies, covered in our last overview, are active in the PBF-EB space in China. Tianjin Qingyan Zhishu Technology Co., Ltd. (Qbeam) is a Chinese company based in Tianjin, which in the past offered three machines in two build volumes. The development team comes out of Tsinghua University. The company has not been very active outside of China, a fact exacerbated by the pandemic in recent years.

Reports in the Chinese media indicate that, in August 2022, the company launched a new system called the G350, which is apparently equipped with the industry’s first double electron gun. It is not known if the company continues to sell its earlier systems. Information on the G350 has not been verified officially by the company.

Xi’an Sailong Metal Materials Co., Ltd. (Sailong) offers two systems, one for aerospace and one for medical applications. There does not appear to have been any change in the machine specifications since we last reported on the company, and it does not appear to be active in selling machines out of China. In 2022, the company announced the start of an international AM parts service which includes parts made on its PBF-EB machines.

With the pandemic making the promotion and sale of new systems outside of China more difficult, the Chinese PBF-EB industry is instead devoting efforts to the development of standards for its machines. In June 2022, China’s National Standardization Technical Committee for Special Machining Machine Tools (SAC/TC161) organised a national standards project seminar on ‘General Technical Conditions for Electron Beam Selective Melting Additive Manufacturing Machine Tools’ in Tianjin.

According to industry reports, the event was attended by representatives of twenty companies and research bodies. The chairman of the committee stated that standards were needed on the one hand due to the complexity of PBF-EB machines, and on the other hand due to the high potential of the technology.