formnext 2017: Business perspectives and expectations of the AM industry

The formnext powered by TCT exhibition, held from November 14-17, 2017, in Frankfurt, Germany, featured a parallel four-day conference that addressed a wide range of issues of relevance to the Additive Manufacturing community. Besides technical and application innovations, a whole day of the conference was devoted to business considerations and expectations relating to the future development of the AM industry. In this exclusive report for Metal AM magazine, Dr Georg Schlieper highlights a number of key business-related considerations for the future of the industry. [First published in Metal AM Vol. 4 No. 1, Spring 2018 | 20 minute read | View on Issuu | Download PDF]

Understanding the risks associated with AM start-ups

In his keynote address at formnext 2017, Terry Wohlers, President of international AM consulting firm Wohlers Associates, warned that, in his experience, 90% of all start-ups fail. The reasons for this are diverse, but first and foremost is insufficient demand for a new product or business idea. Often, the market is not ready for or does not accept a proposed new product. Secondly, start-up companies often lack the financial resources to survive a longer lean period, thereby entering into insolvency. Start-ups also often lack sufficient experience in manufacturing technologies and, consequently, the quality of a product may not meet the expectations of the market. Entrepreneurs, stated Wohlers, are well advised to consider these risks thoroughly before embarking on such an adventure.

As far as Additive Manufacturing is concerned, Wohlers stated that design is of prime importance for the success of the technology. “We have just scratched the surface of what bionic design has to offer,” he said. Designing and building a product by AM, however, is just a part of the manufacturing process, a fact that is all too often forgotten. Using the aerospace sector as one example, Wohlers stated that 70% of the total costs in Additive Manufacturing are incurred by pre- and post-processing operations.

Many processing steps such as powder removal, stress relieving heat treatment, removal from the build plate, removal of support structures, surface finishing, machining critical tolerances, surface treatment and inspection are required before a product is finished. An important aspect of AM design is therefore to reduce post-processing costs by, for example, avoiding or minimising the need for supports through intelligent orientation of the part in the build chamber.

Material costs for metal AM products are generally considered very high at the present time. According to Wohlers, these high material prices are usually tolerable for prototyping applications, but for production quantities this may comprise a major proportion of the total build cost and is a major factor in the profitability of AM production. Wohlers commented that he expects substantial price reductions of AM materials in the future.

The human resources challenge

Nick Pearce, Director of Alexander Daniels Global, a personnel recruitment specialist based in the United Kingdom, highlighted factors that should be taken into account when hiring in the AM industry. In an industry such as AM that is undergoing rapid technological change, new jobs are constantly being created which may not have existed a year ago. It can, therefore, be impossible to find applicants with exactly the right training for the job. Instead, an employer should assure themselves that an applicant has a broad technical background and the knowledge to enable them to quickly become involved in a new task. In-depth knowledge in one or two areas relevant to the job may give the applicant an advantage over their competitors.

Pearce also talked about the ‘soft skills’ that employers should identify in order to be successful in the long term. According to Pearce, those companies with the ability to adapt quickly to change will be the most successful. Skills such as complex problem solving, critical thinking, creativity and people management are among those most highly ranked by the World Economic Forum. The speaker explained that many challenges still exist in AM which require further research, for example relating to materials, machines and processes, and the AM industry urgently needs creative problem solvers to tackle these challenges. Such complex problems can only be solved with diverse expert knowledge, including software development, electronics, mechanical engineering, materials science, physics and chemistry. Teamwork is therefore vital for technological advancement. It is the combination of in-depth expert knowledge and soft skills that make a company successful in the long term.

Pearce predicted that in the future, industrial companies will be much smaller and leaner than today, be more flexible to adapt to technological change, react quickly to new customer needs and bring new products and services to market faster. These future companies will tend to form small core teams and draw on the help of an increasing number of freelancers that offer their skills and services to industry. To be large as a business may no longer be regarded as an advantage. Few people will be able to manage huge turnovers in a digital world; this means that recruitment has to change with the changing needs of the industry. In a small core team, the skills of each individual employee will have a greater impact on a company’s success than in a large organisation.

An investor’s view of AM

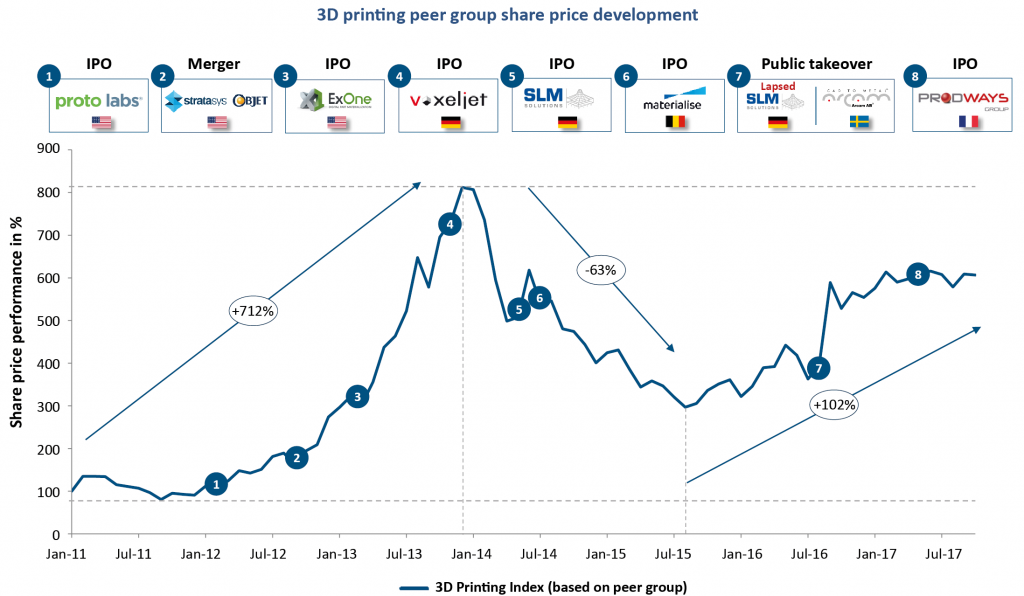

An investor’s view of the metal Additive Manufacturing industry was presented by Gerhard Gleich and Marcel Steidl of Stephens Europe Limited, the European branch of the privately-owned US investment company Stephens, Inc. Stephens investigated the business performance of selected manufacturers of Additive Manufacturing systems and service providers from 2011-2017 (Fig. 3). The steep rise in business performance between 2011 and 2014 was followed by a consolidation period which lasted until mid-2015. Since then, the industry has picked up an organic growth rate. The Wohlers Report 2017 was quoted as stating, “The Additive Manufacturing industry is expected to continue strong growth over the next several years. By 2018, the industry is forecast to reach nearly $9.5bn worldwide.”

The response of the capital markets to the emerging Additive Manufacturing industry was reported to be very positive due to the diversified application of the technology. The aerospace market is considered to be crucial, but it is not the only market. The healthcare, automotive, tool making, robotics, jewellery and consumer goods markets also promise to make AM technology a lasting success. Service providers, it was stated, are well advised not to focus on just one market segment, but to target a solid mix of applications.

The speakers from Stephens referred to a number of investments that have already been made in the AM industry. The biggest was the acquisition of Sweden’s Arcam and Germany’s Concept Laser by the General Electric Company (GE), whose GE Additive division is now a major player in the field of laser and Electron Beam Melting technology, with a wide range of Additive Manufacturing systems. In addition, Swiss technology group Oerlikon invested in citim and the Belgian software provider Materialise acquired the German aluminium casting company ACTech, taking advantage of its experience in the rapid prototyping and post-processing of highly complex metal parts. These acquisitions are an indication of how attractive investments in Additive Manufacturing are today.

According to Stephens, the main criteria for investors in the Additive Manufacturing industry are businesses with experience in industrial applications, innovative customer groups and a strong growth potential. Specifically, AM service providers should have a solid background knowledge in metal powders and Additive Manufacturing processes, have integrated pre- and post-processing facilities, and a strong historic growth rate as well as attractive future growth potential. They should have a diversified customer base including the key sectors of AM applications. The aerospace sector is regarded as highly relevant since AM components can offer significant cost savings through weight reduction.

Stephens strongly believes in the future prosperity of the AM industry worldwide. Commenting on the adoption of metal AM technologies, Gleich stated that this is expected to increase thanks to price reductions and easier accessibility in the years to come. The range of alloys offered by the AM industry will continue to be extended, leading to new AM designs and stimulating further market growth. Production quantities will inevitably increase in the future thanks to productivity increases and new low-cost AM technologies. Therefore, Gleich concluded, “Additive Manufacturing will stay on top of the strategic agendas of industrial conglomerates worldwide.”

Aerospace, medical and industrial applications are most attractive

Frederik Klöckner, Technology Manager at KEX Knowledge Exchange AG, a provider of technology and market information based in Aachen, Germany, considered if in the future AM technology will play a significant role in industrial manufacturing, approaching the issue both from a technological and a market perspective.

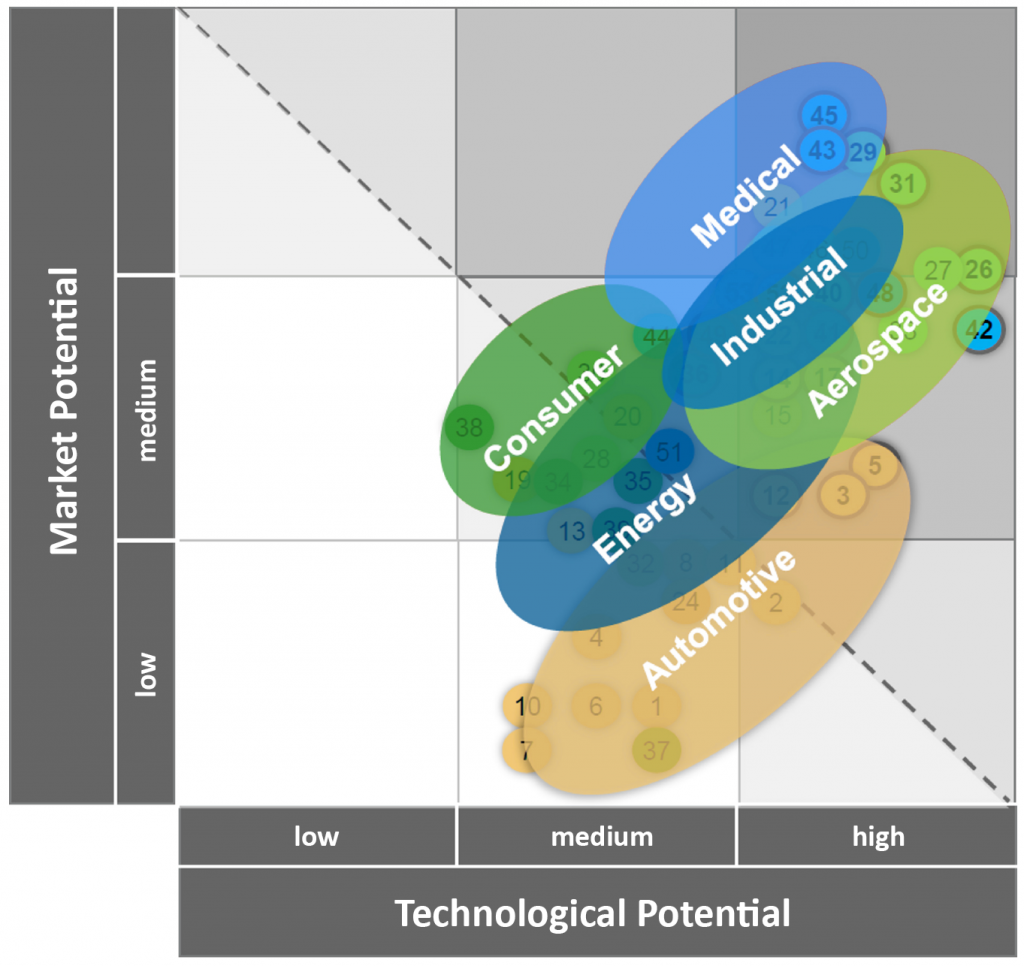

The results of a study based on a large consortium of industrial partners and research institutes are summarised in Fig. 5. The consortium identified aerospace, medical and industrial applications as being technically demanding and also having a high market potential. This combination was considered advantageous because the customer benefit of technically demanding products is great enough to allow for pricing that both covers costs and allows for adequate profits.

The automotive sector, although technically demanding, was only classified as having a low-to-medium market potential, mainly because it is primarily a high-volume market where the margins per unit are usually small. Consumer and energy applications were judged as having a medium market potential and their technological potential was also allocated in the medium range.

More specifically, the study shows that the aerospace market benefits most from AM technology through material and weight savings as well as an increase in product performance. Industrial applications benefit from cost reductions for parts with very low production volumes and where a product has a very short time to market. The medical sector, it was stated, profits from the ability to produce individualised products at reduced costs. These benefits, it was suggested, may also offer attractive opportunities for manufacturers of consumer products. The energy sector benefits from better product performance, reduced costs and shorter time to market, and for the automotive industry, short time to market is also attractive.

KEX expects that many applications that are still uneconomical today will have become attractive for AM technology by 2020 thanks to reduced material and manufacturing costs. The break-even point will shift towards lower values because of technical advancements and market development. Therefore, the initial question regarding the future role of AM technology in relation to other manufacturing technologies was clearly affirmed because, “AM enhances what is feasible with manufacturing technology today and complements the current manufacturing technology landscape.”

Ways to systematically identify AM products

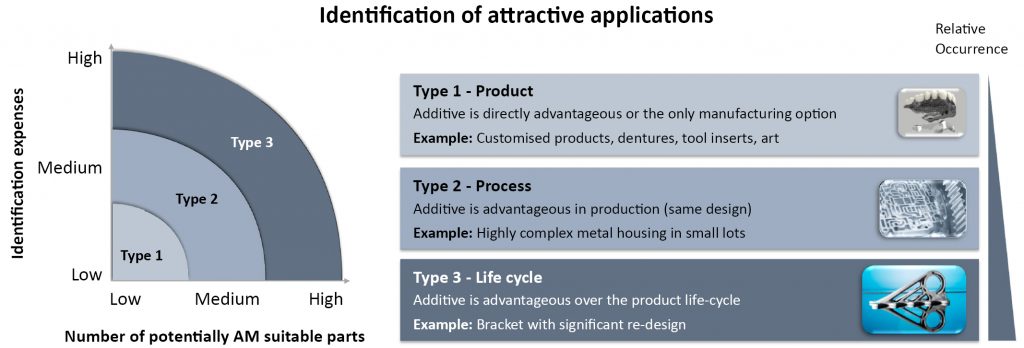

KEX also studied a method by which products that are suitable for AM can be systematically identified. Klöckner distinguished between three types of products (Fig. 6). Where AM offers an obvious advantage or where it is the only feasible manufacturing process, products were classified as type 1. Examples include customised parts such as medical implants, dentures, tool inserts with conformal cooling channels, works of art and jewellery. It is relatively easy to identify these products, but the number of applications is limited.

Products whose design is basically unchanged but are so complex that AM is an advantageous manufacturing technology, such as complex metal housings, were defined as type 2. The effort required to identify these parts, as well as the potential number of suitable products, was considered higher.

Finally, most other parts which may benefit from AM technology were categorised as type 3 products. These were defined as parts for which the total benefit over the product lifecycle is in favour of AM technology, even though the initial cost of AM production is higher than for conventional manufacturing technologies.

The advantage of AM technology in these latter cases can only be exploited with an expensive redesign of the product. A well-known example used by KEX was a titanium bracket redesigned by Airbus Industries specifically for Additive Manufacturing, which entered series production on a commercial aircraft in mid-2017. In this case the benefit over the lifecycle is in weight saving. Often, the redesign process requires designers to rethink the function of a whole system of components in order to find the optimal solution.

Klöckner predicted that design for AM technology will become a core competence of design engineers and that the progressive diversification of AM technologies will stimulate market growth by encouraging the development of new AM applications.

Results of a global survey by Ernst & Young

Stefana Karevska, Senior Manager at global accountancy firm Ernst & Young GmbH, Mannheim, Germany, considered the question, “What has to be done to bring Additive Manufacturing to the breakthrough point where it is a serial production technique?”

To answer this, Karevska firstly analysed the structure of the AM market. On the demand side, she allocated industrial companies, manufacturing companies, service providers and consumers as the end users of AM equipment and products. The supply side consists of AM system manufacturers, raw material suppliers (primarily metal powder producers), software developers and service providers. The demand side is most important for the analysis, Karevska said, since changes on the supply side are driven by demand.

Ernst & Young conducted a global survey of 900 companies in twelve countries and evaluated the awareness and expectations of their executives with respect to Additive Manufacturing, in order to find out how the AM industry could best serve their expectations. Karevska pointed out that emerging new technologies are faced with a relatively small group of ‘early adopters’ who are enthusiastic about the potential options and fascinated by the technology itself.

In the survey, the size of this group was determined to be 4% of all respondents. On the other hand, the survey identified a majority of pragmatic, sometimes sceptical players who are mindful of the risks and will not accept the new technology at any cost. Between the two groups there is a gap that has to be closed before the new technology can substantially increase its level of adoption. However, a remarkable interest in AM was identified, with 11% of the interviewed already having begun to test AM technology in one way or other. This group is not yet convinced of the technology, but chances are that they will reach that point in the foreseeable future.

Progress required in AM technology

Karevska further discussed some of the activities required by the AM industry to improve acceptance of the technology. She concluded that the choice of AM materials is still very limited as compared to other manufacturing technologies and that the material costs of AM metal alloys are still too high. This is regarded as a major barrier on the way to a wider acceptance of the technology. A similar challenge is the price of AM equipment, which was rated too high by 40% of the surveyed companies.

Karevska called on AM system manufacturers to strive for substantial cost reductions in both materials and machinery and stated that she already believed she could see some movement in the market. The standardisation of AM processes, including post-processing, was also recognised as an important backbone of acceptance. Karevska said that there is a lack of software for the integration of AM technology in the supply chain of the manufacturing industry. Finally, the AM knowledge base is still insufficient in many industrial sectors. Many companies do not introduce AM products because their engineers simply do not know enough about the process. Although universities have started to include Additive Manufacturing in their curricula, it will take time for this knowledge to be spread in the industry.

According to Karevska, service providers play a key role in the further development of the AM industry because they provide the link between system manufacturers and end users. For companies with little or no experience, service providers are the first point of contact and the fastest way to adopt the technology. Service providers will also be used to produce spare parts on demand in a short period of time. In conclusion, it was stated that AM technology is expected to support and profit from the trend towards greater flexibility in industrial manufacturing.

Factors affecting the decision to adopt AM technology

A master’s thesis in Business Administration was presented by Luuk Nollet of the University of Twente in the Netherlands. Nollet’s goal was to understand the main factors influencing the adoption decisions of executives in industrial companies with regards to Additive Manufacturing. His survey was based on ten companies in the Netherlands, five so-called ‘adopters’ who have a positive attitude towards AM and five ‘non-adopters’ who were sceptical and refused to invest in AM equipment. Nollet admitted that this was not a representative survey and was focused on potential investors in AM equipment, but the results give some insight into how these types of decisions are made.

The functions of persons involved in the decision-making process are firstly the initiator, i.e. the person who has a problem that they hope to solve with the new technology and who starts the decision-making process. The influencer strategically evaluates possible alternatives to solve the problem. The gatekeeper controls access to information for the influencers. The decider has the authority to make the final decision for or against the new technology, and the purchaser acquires the technology. The user finally consumes and uses the product.

Nollet found that decisions regarding innovation are influenced by technological, organisational and environmental factors. Technological factors include the capabilities, complexity and compatibility of the technology. Organisational factors are the resources and skills within the company and environmental factors are determined by the supply and market environment in which the company operates, its business partners, competition, suppliers and so on.

Adopters usually believed that AM technology was in alignment with their business and often underestimated the complexity of the process. Non-adopters, meanwhile, had a typically negative perception of the technology. A major investment in AM technology should be based on a cost-benefit analysis, and Nollet believed that it is very difficult to prove that an investment is profitable. For the adopters, therefore, the positive decision was based mainly on a gut feeling, rather than on a sound business plan illustrating a proper return of investment. The anticipated benefit to the ‘image’ of the company could also be an argument in favour of the technology. One adopter replied, “My most important reason was that I wanted something new for my company. How do I get attention as a company? And then it is more a commercial factor than a technical one.”

In an organisational context, a positive decision appeared more probable if the decision maker was free to decide without having to consult shareholders. If the decision maker was also the initiator, it positively influenced the decision to adopt. If the influencer was also the decision maker, the decision was probably negative because the business case was most important and the case could not be made for certain that the technology was profitable. In the case of one non-adopter, there was at least one individual who was enthusiastic about the technology, but had to ask for permission and was unable to present a positive business case.

The opportunities for market development were regarded as the most important environmental factor in favour of or against the technology, both for adopters and non-adopters. The growing demand from customers for metal AM products, as well as competitors who had already invested in AM, exerted pressure on the companies to adopt the technology. Nollet concluded that adopters are often visionary leaders who have the power to decide, but run the risk of underestimating the complexity and neglecting the economics of AM. Non-adopters are cautious managers with internal investment guidelines who are looking to reduce the risk of the investment. It was concluded that a gradual entry into the technology through the use of service providers is one way in which companies can develop the market and gain experience before making a major investment decision on their own.

Standards for metal Additive Manufacturing

The existence of industrial standards is a reliable indication of a mature technology. The Association of German Engineers (Verein Deutscher Ingenieure – VDI) embarked on the development of industrial standards for Additive Manufacturing at an early stage and Dr Erik Marquardt presented the activities of VDI in this area.

The first standards of the series VDI 3405 were published as early as 2013. Since then, VDI has followed the progress of AM technology and continuously updated the VDI 3405 standards series. The standards published to-date include recommended testing procedures for AM products, design rules, powder characterisation and material data sheets for selected materials. Further standards in progress are more material data sheets, a standard for Powder Bed Fusion, user safety of laser beam melting systems and legal aspects of Additive Manufacturing.

Conclusion

In light of the examples and knowledge offered by these presentations, it can be concluded that Additive Manufacturing technology is on track to becoming an integral part of industrial manufacturing processes, particularly in the aerospace industry where it has already gained a strong foothold. We are already seeing a remarkable increase in the speed of industrial AM systems thanks to multi-laser technology, improvements in quality systems, an increasing number of producers and service providers, and a steady move towards the automation of AM processes.

Some of the challenges highlighted in this report represent the inevitable growing pains associated with a new technology, but what is abundantly clear is that there is a huge desire amongst all stakeholders in the industry, from materials and equipment suppliers to producers and end-users, to respond quickly to these challenges and drive the technology’s capabilities to new heights

Author

Dr Georg Schlieper

Harscheidweg 89

D-45149 Essen

Germany

Tel: +49 201 712098

Email: [email protected]