Buying time with digital spare parts: Opportunities for metal Additive Manufacturing

Spare parts keep the world turning, and their complex supply chain is an industry in itself, specifically designed to get trains moving, ships sailing, and industry producing. But this is an expensive business, and one driven by calculated risk. Do you reduce your profits by stocking every expensive, highly engineered part that you might need, even though the chances are that most will never be used? Here, Joseph Kowen considers if digital part inventories, in conjunction with metal Additive Manufacturing, can transform how the spare parts supply chain operates. What are the opportunities, and how are early adopters already taking advantage of them? [First published in Metal AM Vol. 7 No. 4, Winter 2021 | 30 minute read | View on Issuu | Download PDF]

The AM industry is always on the lookout for the next big application and observers of the industry are obsessed with the search for applications where AM makes sense. There are relatively few verticals where AM makes a broad, segment-wide business case for its use. The industry which has arguably adopted AM most broadly is dental, although only a small part of that is metal AM. The key characteristic of the dental industry that drives its adoption is the high value of small, custom dental parts. Medical implants have also proven to be a fertile area for metal AM due to the ability to build complicated, lightweight parts that mimic the geometry of the natural structures that they replace. Aerospace also offers some potential, but this is for specialised applications – more space, less aero.

We have all heard of cases where AM has saved the day when reverse-engineered or urgent parts are needed. Often, these stories have been based on opportunity, rather than part of a wider business strategy. Could it be that ‘spare parts by AM’ offer as much potential as any of the most successful AM applications on the market today? What are the parameters for this opportunity? What are the hurdles? And who is doing what? In this article, we’ll attempt to answer some of these questions with an overview of a topic that crosses typical segment lines.

The dream of digital parts warehouse

In March 2021, the world watched the unfolding drama of the giant container ship Ever Given, which became stuck in the middle of the Suez Canal on its way to Europe. Its decks were packed with more than 18,000 containers carrying goods from Asia to markets in Europe and the Americas. To put the blockage in context, nearly 19,000 vessels, carrying an estimated 12% of global trade by volume (excluding oil) traversed the 193 km long canal in 2020. The blockage of the canal had the immediate effect of delaying more than 350 ships on their passage westwards. Lloyd’s List estimated that each day of the blockage was holding up $9.6 billion in trade – $400 million per hour. No logistics and supply chain specialist failed to take note. The effects of supply chain disruptions cause serious economic woes in developed countries, ranging from delays in deliveries of new cars, fourfold increases in shipping costs, and higher fuel costs, to the disappointment of being unable to get holiday gifts delivered on time. Supply chain disruption is an important factor in rising inflation in several key economies.

For years, analysts have pondered the shift of huge swathes of manufacturing capacity to Asia, where high-capacity manufacturers have made significant strides in the production of a seemingly endless range of products at low manufacturing costs with which western countries cannot compete. The strategic implications of that shift were clear, but companies were apparently unable to resist the short-term profit, even though the result was that they would be making their products, or parts of their products, half a world away from the point of need. The strategic risks and environmental costs – to the extent that they were not fully internalised – were brought sharply into focus by the image of a single, giant ship blocking a canal.

The term ‘digital parts warehouse’ is a captivating idea that never fails to excite. The concept of not having to store any physical parts, and producing them only when necessary, is extremely attractive. New parts that have been designed with AM in mind are candidates for a new paradigm in supply chain management. But what about parts that were made years ago, in a pre-AM era, using the conventional manufacturing methods suited to the designs of the day? The potential for easy, on-demand procurement of spare parts from a digital warehouse is one key aspect of the digital parts paradigm, offering its own challenges on the one hand, and exciting opportunities on the other.

The numbers are large

The spare parts manufacturing business is a multi-billion-dollar opportunity worldwide. Various estimates of the size of the market have been calculated; since the spare parts business extends across several vertical segments, an estimate of the size of the market is an amalgam of estimates in each of its segments. As shall be seen, some segments are more relevant for AM than others, and we will focus on them.

French consultancy Theano Advisors (part of Eight Advisory since late 2020) broke down the market for spare parts and came up with a figure, for the AM spares market, of $173 billion, including both metal and polymer parts. The most relevant of the markets surveyed, using figures for 2018, were the petrochemical ($26.9 billion), mining ($10.7 billion), rail ($7 billion) and shipping ($5.9 billion) industries. Together, this totals $50.5 billion. This already large number does not include significant consumer segments that use spare parts, such as the automotive business.

Other market studies have estimated the total metal spare parts market at more than $500 billion, a figure which covers all industries, including automotive, but does not make a distinction between those parts which are suitable and not suitable for AM. Airbus estimates that the maintenance, repair and overhaul (MRO) market for aircraft parts of all kinds stood at $60 billion in 2020, though presumably the market has suffered some contraction as the aerospace industry deals with declining travel needs.

While estimates of this kind that show the ‘total addressable market’ for a particular category of products tend to be large, and are designed to impress consumers of the data, especially investors, they do offer some perspective. If we assume that only 5% of the AM-suitable parts market of the target segments from the Theano study represent immediately addressable and economically sensible AM potential, that figure is still large in the world of AM, which Wohlers Associates estimated to be worth $12.7 billion last year. Put another way, if only 5% of the immediate AM potential of spare parts were to be realised, a market of $2.5 billion, that would represent close to 20% of the entire current AM market. If only $500 million of the total spares market (20%) was accessible to metal AM, it would represent a significant part of the metal AM business. Metal AM industry analysts Ampower estimated that the total metal AM market for machines, materials and services in 2020 was about $2.3 billion.

Spares specialists

Before we get too excited by the vast potential that is seemingly a click away, most agree that the path towards unlocking this potential is long and arduous. The battle to additively manufacture spare parts is fought part by part. Notwithstanding the challenges, a few companies are focusing on this segment. They offer expertise in the identification of appropriate parts and in shepherding the process to successful execution. Here is a partial list of some of the companies and organisations addressing this challenge, either as service providers or as an internal corporate function.

Ivaldi

Ivaldi is a young company headquartered in California, USA. Its roots are in Norway, and it also operates an engineering office in Mexico. The company is closely connected to the maritime industry; one of its lead investors is Wilh. Wilhelmsen, a Norwegian shipping company with a presence in ports around the world that services more than 25,000 vessels per year. Ivaldi has more than twenty-five employees.

Under the slogan ‘Send files, not parts’, the company assists customers through three stages of the spare parts manufacturing process: screening, analysis and evaluation of parts to qualify suitable inventory; building and certifying products for digital distribution; and implementation or spare parts manufacture through a global network of pre-certified parts-on-demand manufacturers.

The company is a participant in a Joint Industry Program (JIP) co-funded by the Marine and Port Authority of Singapore, and supported by the National Additive Manufacturing Innovation Cluster (NAMIC), which was established to advance the use of AM to build parts for the maritime industry in Singapore. The JIP consists of fourteen partners, including shipping companies, parts suppliers, and – most significantly – a maritime classification society. Without approval from a classification society, parts cannot be insured for use at sea. The programme plans to advance the possibility of part-family certification, thereby speeding the certification of similar parts in the future. Espen Sivertsen, CEO of Ivaldi, describes the objective of the project as such: “Up until now, certification of critical parts has been very costly and time-consuming because each part has to cover new ground. By working together on key part categories, we aim to remove some of the remaining barriers for mass adoption.”

In addition to the maritime industry, the company is targeting the mining industry due to the overlap in the type of parts used in these industries, such as pumps and valves. The company is collaborating with the Anglo-American mining group in South Africa on applications in the mining segment.

SpareParts 3D

‘Having the right part, in the right place, at the right time, at the right price’ is how SpareParts 3D describes its business. The Paris-based start-up has roots in Singapore, and members of the management team are located in both places. The company’s activities in Singapore connect it to the maritime spare parts business, which, as already noted, has been targeted by the Singapore government through NAMIC, the maritime authority and the Singapore Shipping Association as an important opportunity for the country. The company was a member of the initial Joint Industry Program in the country, which was led by DNV-GL (now known as DNV) and which mapped out opportunities for AM in the maritime industry.

SpareParts 3D offers a number of services relating to the production of spare parts and digital inventory. The Digipart Convert service identifies parts where it makes sense to consider AM as a solution. The company also offers a scanning and engineering service that develops parts from 2D drawings, or reverse engineers a physical part for which no drawings exist. And, finally, the company will produce the part through a network of providers selected and qualified to offer a technically sufficient part at the lowest cost.

Paul Guillamot is co-founder and CEO of SpareParts 3D. He said that many potential customers initially don’t fully understand the potential of using AM to make spare parts. “In the metals area, most of the use cases involve the shortening of lead times to produce parts that are not available from stock. Even parts that are not too complicated from a design point of view, at first glance, might still take a long time to produce due to multiple processes that might be required, such as part joining or casting.”

In certain industries where equipment needs to last twenty-to-thirty years, such as the oil and gas industry, it has found that in the range of 60% to 70% of the stock of spare parts held by the company is dead stock. This means that these parts have no future commercial potential and cost the company money for each day that they are on the books, taking up space in warehouses without serving any useful purpose. “The lowest figure you will find for the cost of holding inventory is 15% of the value of the stock, although it could be as high as 25%,” explained Guillamot.

SpareParts 3D has developed methods and software tools for assisting companies in identifying which parts make sense for production by AM based on an analysis of a company’s procurement history of those parts.

Replique

Replique is a young start-up company focusing on the spare parts market. Based in Mannheim, Germany, the company currently operates out of BASF’s Chemovator incubator. Not unlike its peers in the AM spare parts space, it is focused on the markets with greatest potential: machinery, mining, oil and gas, agriculture, construction and transportation. By its calculation, the addressable spare parts market in these segments is between $30 and $40 billion, of which it believes at least 6%, or possibly up to 10%, could be additively manufactured.

Replique’s model is to accompany its customers through a process that includes optimising the digital design, which includes converting 2D drawings into 3D designs, or reverse engineering parts for which no digital design is available. This can be a painstaking task. The next stage is a part qualification service, where required. Once the digital files are available, the company will assist in the establishment of a digital inventory which will store the parts, as well as monitor activities at the next stage of the process: production. The company will arrange for manufacturing of the parts through a network of service providers that it has selected and approved. Actual orders are managed by Replique. End customers receive the parts from Replique, which bears ultimate responsibility for assuring technical quality.

Replique already has customers in Germany and France. Many of them use the service for polymer parts, but they are beginning to address the metal AM market, as well. Currently, one of its key metal customers operates in the transportation segment, but cannot be named for reasons of confidentially.

Company founder and CEO Max Siebert noted that in many cases the potential of AM spare parts supply becomes increasingly apparent with each part, as customers come down the learning curve. “Once the ice is broken, customers begin to see the benefits and potential of solving spare parts pain through our service.” A successful part that meets a critical need is an important driver for discovering new potential. Interestingly, they find that smaller organisations are often more open than larger organisations in understanding how AM spare parts can shorten the journey to getting equipment up and running.

Deutsche Bahn

The German railway company commenced its journey in the Additive Manufacturing of spare parts about six years ago. It began modestly, with the manufacturing of a polymer coat hanger for a compartment in a train, but has made significant strides since then and now addresses many different applications in rail transportation. Today, one-third of all AM parts produced for the company are metal.

The pain faced by the maintenance organisation of a railway operator is easy to understand. A train costing millions of Euros that first entered service twenty-five years ago is taken out of service because a critical part is not available. Many ICE trains that entered service in the 1990s are still in operation. Considering only the company’s high-speed trains, of 106 ICE model 1 and 2 trains produced between 1989 and 1997, 103 are still in service. When these trains break down and a replacement part is not available, it could take some time to get them back on the tracks.

Stefanie Brickwede is head of AM at Deutsche Bahn (DB). She explained that DB does not, in general, manufacture AM parts internally, but relies on authorised external providers to produce parts. Not all providers are specified for railway use, and the AM team at DB is responsible for ensuring that standards are met. The bulk of the work of the AM team, which numbers ten internal staff and forty external experts, involves making sure that maintenance facilities all over Germany are supported in their efforts to decide when AM makes sense. The company uses a framework for assessment developed by software company 3YOURMIND, to which it has added its own knowledge and insights. Its efforts are designed to develop a bottom-up approach whereby AM parts offering the greatest savings are located and pursued by the maintenance teams. “Using AM has definitely paid off,” Brickwede stated. “We have produced 25,000 AM parts relating to 250 use cases over the course of the AM programme.”

Going back to the example of the out-of-service train can help us understand the calculus of when it makes sense to use AM. The maintenance team predicted that the stranded train would take nine months to get back into service. Some of the parts were cast, and neither drawings nor patterns for casting were available for equipment that was first produced twenty-five years ago. With the help of AM, however, the company was able to get the train back into service within four months.

Safety-relevant parts are not outside the ambit of the work of the AM team, although engineering and certification can take time. One such part, produced by a wire-arc Directed Energy Deposition (DED) process, is part of the train positioning hardware that prevents the train from leaning too far into curves at speed (see box).

DB’s leadership has inspired a number of other railway operators to add AM as a tool for maintenance operations. In addition to her responsibilities as AM leader at DB, Brickwede also leads an industry group call Mobility Goes Additive, in which no fewer than eight railway operators in Europe are members.

Military applications

No overview of the AM spare parts area would be complete without touching on what military organisations are doing in this area. Since the military values factors such as uptime and battle readiness with a non-commercial perspective, the cost factor that would play an important role in a commercial enterprise’s outlook is severely blunted, if not eliminated completely. Military equipment – whether aircraft, motorised vehicles or naval vessels – that cannot operate because of a delay in obtaining a critical part have to be replaced with working equipment to maintain defence readiness. Added to this, military bodies generally operate equipment that is decades old. The legendary B-52 bomber, for example, first took to the skies in 1952, and is expected to remain in service for some years to come. Currently, seventy-eight of the aircraft are still in service. Finally, while safety is always a concern, regulation of commercial products is often more stringent than for military equipment, meaning that there may be fewer hurdles in the adoption of AM parts for military use.

Funding has started to flow to support the development of AM for the military, as leaders have begun to realise the importance of AM in general, and in spare-parts manufacture in particular. Most recently, in November 2021, Florida International University received $22.9 million from the US Army over five years to advance AM for military applications.

The French armed services have also been active in developing a decentralised model for spare parts manufacture using AM. Centrally maintained files are sent securely to remote locations to be additively manufactured locally, even in areas of deployment. The French Land Forces contracted French blockchain company Vistory to safeguard the digital transfer of parts for local production.

The cost of inventory

Costs for carrying inventory are a silent, but potentially critical, factor weighing heavily on a company’s overall business. Out of a desire to offer an optimal service level for customers, services managers and salesmen often push for a safety inventory of spare parts that exacts a cost that they may not be fully aware of. Their incentive is to keep customers happy almost at all costs. The financial management of the company has a different incentive, saving costs and increasing profitability, that is at odds with customer-facing functions in the company.

There are four main cost components to carrying inventory. The largest component is capital cost, which means the cost of money, and interest on that cost, invested in the parts held in inventory. ‘Inventory service costs’ include factors such as administrative costs and insurance for maintaining the inventory. The larger the desire, or the regulatory requirements, for maintaining spare parts, the higher the service cost. Carrying inventory comes with risk, called the ‘stock risk cost.’ This cost includes factors such as reduction of inventory for reasons other than sale, misplacement, theft and physical damage that could befall the items in inventory. And, finally, there are storage space costs, including rent, transportation and other costs related to the physical maintenance of the inventoried parts. In the best of all possible cases, the annual costs together amount to 15% of the value of the stock. In the case of large metal parts of the kind that serve the industries representing the highest potential for AM, spare part costs are in most cases going to be higher, and could reach as much as 25% of the value of the stock. As has already been noted, rail, shipping and oil & gas are industries in which the expected life cycle of equipment is at least twenty years.

The stock level and cost is exacerbated for another reason, as well; the expected demand for a particular part could be a low number every year, and so the burden of carrying parts in stock is even more acutely felt. If we add to this a common practice of minimum order quantities, dead stock and carrying costs could be even higher. By way of example, imagine that the minimum order quantity of a part is ten pieces, and the expected demand is only two parts per year, which takes into account a ‘customer satisfaction’ cushion. The real demand could be one part per year. The minimum order represents optimistically five years of stock, and there is a possibility that part of it is going to end up dead. Add to that the carrying cost of the stock over the entire period. There could be some situations where it might make business sense to scrap part of the minimum order on the day that it is supplied, although few organisations would have the courage to do that. The result is warehouses laden with parts that might never be used.

Taking the example a step further, another thought to consider is that if circumstances dictate that you have to buy ten times more stock than you actually need, due to the reality of minimum orders, then it implies that the manufacturing cost of the AM part could be ten times more than a conventionally produced but unneeded part, and you will still come out ahead. This simple example might not be entirely accurate in all cases, but one can easily understand how the cost of AM part production, which for series production might be too high for to be economically viable, is a reduced factor in the context of spare parts. Put another way: High costs of metal AM are less likely to be the disqualifying factor for spare parts than for new parts.

Given this reality, the promise of on-demand spare parts might be an even more interesting option than it appears at first glance. The companies serving the AM spares market report that companies get more excited over time as the benefits of a digital spare parts inventory become clearer.

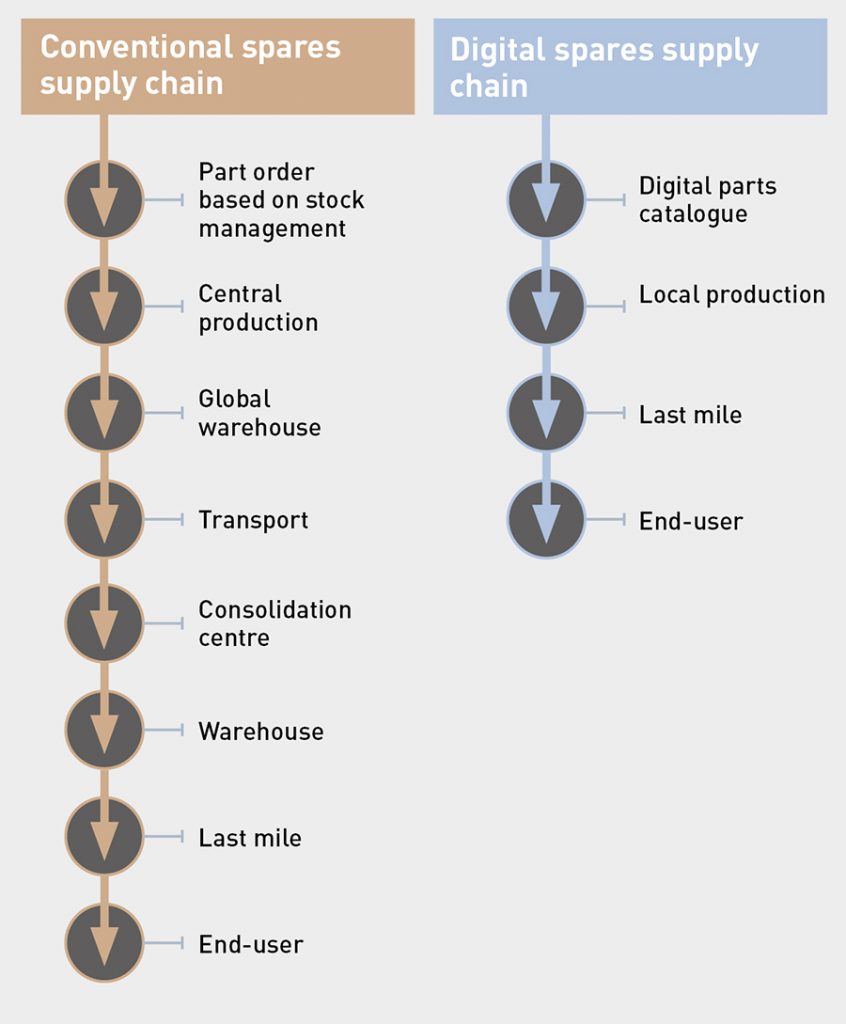

To fully appreciate the simplicity of an on-demand digital supply chain, it is instructive to break down the stages a conventional supply chain and compare it to the digital alternative. Fig. 5 illustrates this. The benefits of a digital supply chain for appropriate parts in suitable industries: lower total cost, shorter time to supply, lower environmental impact, which all leads to higher customer satisfaction.

Insights and what we have learned

The metal spare parts market represents a significant opportunity for metal AM. Since metal products are generally designed to last many years, they often form key elements of equipment or systems that have been around for many years, for which no spare parts – or, in many cases, even digital designs – exist. The process of identifying suitable parts, and reverse engineering a legacy part to create a digital design, is long and painstaking. Certifying the design and meeting regulatory standards in a particular industry add yet another layer of time-consuming complexity to the task of translating potential to parts.

The Additive Manufacturing of spare parts, like all AM applications, does not make sense in all cases. Success with additive spare parts manufacture begins with a bottom-up identification of a part with a good business case. Technically complex parts might not be the best candidates for a successful spare part business case. Identification of suitable cases is as much about the logistics, supply chain and purchasing functions in an organisation as it is about the engineering function.

The cost of time is an important element in the assessment of the economic viability of building a spare part using AM, and economic loss should also be factored into the calculation. Some parts can be justified for production by AM based purely on cost, and this is especially true if minimum order quantities are a factor, or if tooling must be made for producing castings. Equipment downtime can cause economic loss that dwarfs the cost of making the spare part, as in the case of mining, rail, shipping or oil and gas operations, but these non-budgetary items need to be appreciated and considered by functions in an organisation with a holistic view of the business, and not a purely cash-driven analysis of the parts replacement alone.

Companies specialising in spare parts identification and production are starting to emerge. Not all organisations, particular medium-size enterprises, will have the resources or the knowledge to develop an AM spare parts strategy internally, and would do well to consult with experts who have accumulated know-how in spare parts production by AM. Even accounting for the cost and profit of the external expertise, in suitable cases there will be clear economic viability for engaging experts who are already making their way down the learning curve.

For the spare parts specialists, focusing on the verticals with the richest potential will offer the best chance of success. While each part is a project unto itself, learning-curve efficiencies will begin to kick in as the spares segment develops. In addition, we can expect a certain degree of software automation to emerge in areas like business case analysis of historical spare parts usage, and even in the conversion of 2D designs to 3D. We can expect the costs of 3D scanning to continue to decrease.

The spare parts segment is not without its challenges, but an analysis of the numbers and the potential suggests that it will grow at a lively pace, driven by improvements and reduced costs in metal AM processes, and encouraged by increased understanding of the risks of complicated supply chains, greater environmental awareness and the willingness to internalise externalities in economic analyses of business cases. Watch this space.

Author

Joseph Kowen is an industry analyst and consultant who has been involved in rapid prototyping and Additive Manufacturing since 1999. He is a principal of Intelligent AM, a consultancy on Additive Manufacturing serving the business and financial communities.

Joseph Kowen

Intelligent AM

Tel: +972 54 531 1547

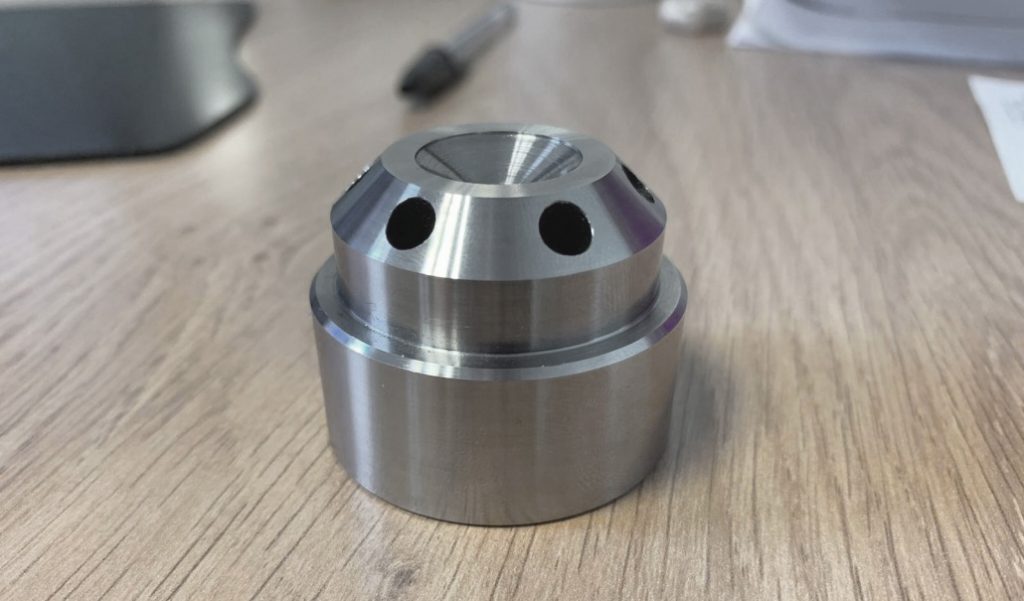

Impeller for mining equipment

This 316L impeller for a pump used in mining equipment was produced using PBF-LB for Ivaldi for a customer in South Africa. The part weighs 1.4 kg, measures 165 x 165 x 19 mm, and has internal features which would have been difficult and expensive to machine.

According to Ivaldi, the use of Additive Manufacturing to produce this semi-critical spare part resulted in an average per unit saving of $1,500, and reduced the lead time from ninety days to just six. By producing a single spare part as needed, the company was able to reduce its minimum order quantity from nineteen parts to just one, and estimated a yearly savings potential in the production of its spare parts by AM of $1.2 million.

Further, the shipping distance from the point of manufacturing to the point of need was reduced by 10,000 km; the total carbon dioxide equivalent (CO2e) saving in producing this spare by AM was calculated at 80 kg.

Selecting appropriate spare parts

In 2020, Brazilian chemical company Braskem selected SpareParts 3D to assist it in implementing AM for its spare parts programme. Headquartered in São Paulo, the company is Latin America’s largest petrochemical company. The company contracted SpareParts 3D to identify which parts in a large inventory could be suitable candidates for AM. The company had identified a number of problems, risks and costs in its spare parts management: long lead times for critical parts, obsolescence of parts, and high inventory costs due to minimum order quantities.

SpareParts 3D’s approach was to process a large dataset obtained from Braskem’s ERP system to identify and analyse a subset of 15,000 parts that could be manufactured by AM. The analysis considered parameters such as part value, minimum order quantities and historical lead times for producing replacement parts.

SpareParts 3D says that selecting the correct parts is the key to a successful AM spare parts strategy, explaining that many companies make the mistake of selecting the most complicated parts from an engineering point of view. In most cases, such a part will not provide a business case for AM, and companies can become frustrated with the process. The most suitable parts are generally those that answer commercial needs and not technological needs, such as the needed production frequency and lead times. For this reason, parts should be reviewed through the prism of the purchasing history of the part, and not only through the eyes of the engineering team.

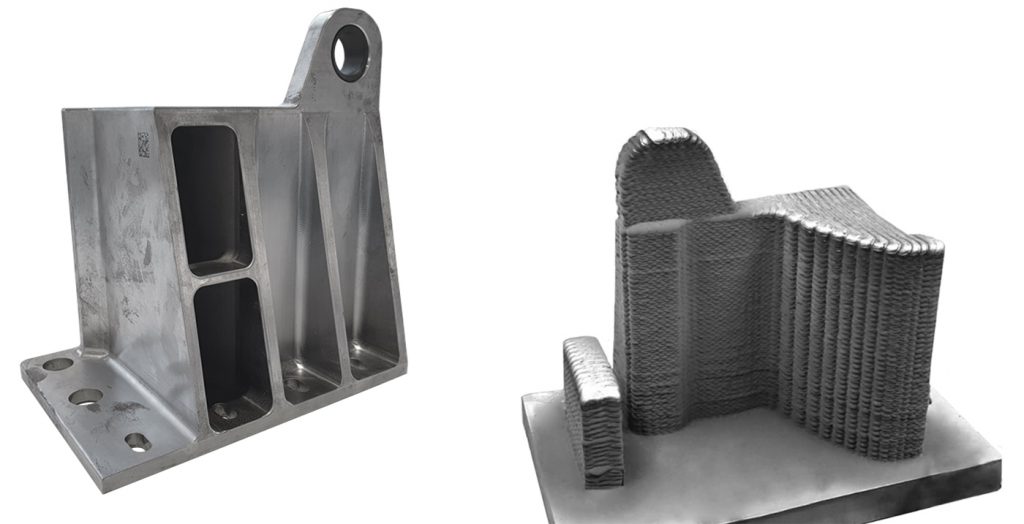

Secondary roll stop component for trains

This secondary roll stop component, a heavy steel part attached to the underside of each passenger car on model 1 and 2 Deutsche Bahn ICE trains to limit their lateral play, was produced using wire arc DED Additive Manufacturing. It is a safety-relevant part that originally went into operation in 1989. Due to its design and function, the part does not usually require replacement, and, as a result, spares for the part are not held in stock.

In the case in question, the secondary roll stop incurred damage which resulted in the ICE train being withdrawn from service, incurring an immediate need to replace the part. Due to high manufacturing costs, long lead times and a minimum order quantity on a part that is rarely needed, it was decided to manufacture the part using AM, in this case by wire arc DED Additive Manufacturing. The part measures 22 x 31 x 33 cm, was produced in 100NiMoCr, and weighs 27 kg. It was tested and qualified for use by TÜV-SÜD. The outcome was a reduction in lead time of six months, and a total cost reduction on the manufacture of the spare part.