What does a decades old metal powder titan bring to Additive Manufacturing? In conversation with Höganäs AB

The metal Additive Manufacturing landscape is filled with ambitious, well-funded startups, all promising a wealth of materials innovation and ambitious value propositions. In contrast to these newcomers, Höganäs AB has been a powerful force in the metal powder market for near eighty years, producing half a million tonnes of metal powder annually. Is there a role for such a titan of Powder Metallurgy in the brave new world of AM? Emily-Jo Hopson-VandenBos spoke to Kennet Almkvist, president, Höganäs Customization Technologies, about what the company brings to the table. [First published in Metal AM Vol. 8 No. 1, Spring 2022 | 40 minute read | View on Issuu | Download PDF]

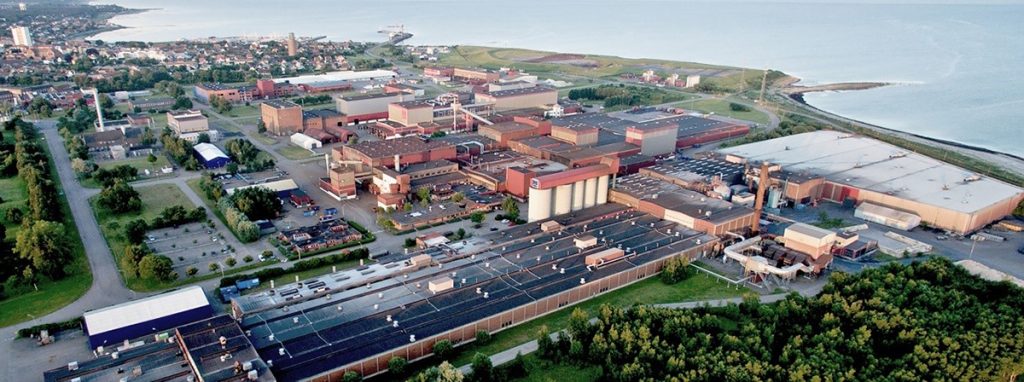

To the wider world of metal powders, Sweden’s Höganäs AB needs little introduction. For newcomers to the world of metal Additive Manufacturing who are unfamiliar with the landscape of metal powder production, however, perhaps some introduction is necessary. Founded in 1797 as a coal mining company in a small Swedish fishing town bearing the same name, Höganäs established its first iron powder production plant to serve the post-war industrial market of 1946 and, in the seventy-six years since, has gone on to become a world market leader for iron and other metal powders, with an annual capacity of 500,000 tonnes.

As of 2022, the company serves 3,000 customers in seventy-five countries and operates sales offices or plants in sixteen, from which it supplies a range of more than 3,500 products, most tailored to its customers’ specific needs. It holds around 800 patents, employs 2,400 staff, and in 2021 reported a full-year turnover of 10,520 MSEK (approx. $1 billion). No exaggeration is necessary: Höganäs is a metal powder titan.

Of course, not all 500,000 tonnes of Höganäs’s capacity is produced for press and sinter Powder Metallurgy (PM). According to the Metal Powder Industries Federation (MPIF), annual worldwide metal powder production exceeds 635,000 tonnes [1] and, based on the latest industry figures published by the European Powder Metallurgy Association (EPMA) and MPIF, press and sinter PM had an annual powder consumption volume of about 450,000 tonnes in 2020 in North America and Europe combined [2, 3]. Höganäs’s markets include the ‘other’ world of metal powder not covered by this magazine’s remit, such as brazing, soil/groundwater remediation, surface coating, water treatment, and other industries, where quality and performance are no less important, but the technology is very different in its markets, design potential and speed of production. Are your morning cornflakes ‘fortified with iron’? If so, there’s a good chance you’re eating Höganäs iron powders. The range of applications for metal powders is vast and we cannot cover it entirely here, but, as an indication of the range of markets served by Höganäs, this should serve to illustrate the company’s versatility, flexibility, and deep understanding of metal powder in all its forms.

Just how important are metal powders to AM?

Why should a reader of Metal AM magazine care about metal powders? Simply put, without high-quality metal powder (and with the exception of a very few wire-based, or solid- or liquid-state technologies), there is no metal Additive Manufacturing. And not just in those technologies which begin with a powder bed (Powder Bed Fusion [PBF], Binder Jetting [BJT]), or in which powder is jetted at high velocities onto a substrate (as in powder-based Directed Energy Deposition [DED]); even those Material Extrusion (MEX)-based technologies which use fused filaments or rods as their feedstock, or Vat Photopolymerisation (VPP) technologies that spread a slurry of metal paste across a build plate, begin with metal powder. It is vital for the metal AM industry that the powders it uses are high quality, standardised, and that metal powder producers have the ability to scale production beyond the small batches which have served much of the industry to date.

Capitalising on a new metal powder market

For metal powder producers, the metal Additive Manufacturing market offers a very attractive proposition. While powder volumes for press and sinter PM have fallen in recent years for a variety of reasons – chief among them a reduction in PM part weight in the automotive industry, with smaller, more efficient internal combustions engines, and a growing electric vehicle sector – the AM market continues to be forecast massive growth; a recent prediction has the total AM market reaching a value of $51 billion by 2030 [4]. Almost every major existing metal powder producer has either already entered, or made plans to enter, the AM powder market.

Höganäs made its first entry into metal AM in 2012, when it began exploring the potential in leveraging the company’s knowledge of metal powders and sintering in relation to metal Additive Manufacturing technologies. In 2017, it purchased Metasphere Technology, a developer of plasma atomisation technologies for carbides and ceramics. The same year, the company launched Digital Metal’s binder jet AM machines onto the market. In 2018, it announced the acquisition of H.C. Starck’s Surface Technology, Advanced Ceramic & Metal Powders (STC); Fredrik Emilson, Höganäs’s group president and CEO, stated that the acquisition would offer the group access to new markets and product groups within surface coating and Additive Manufacturing, and enable “the building of another strong segment in Höganäs’s business, next to metal powder for pressed and sintered components.”

Also in 2018, the company announced the formation of a new product area to meet growing market demand within Additive Manufacturing and Metal Injection Moulding (MIM). The new venture, Customization Technologies (Fig. 2), is now part of Höganäs’s Industrial business area and covers the entire value chain for AM and MIM, from application development and technology support to market development and global sales. Soon after, it expanded its Johnstown facility in Pennsylvania, USA, for the production of metal powders for Additive Manufacturing and other technologies, and began constructing a new atomising unit at its facility in Laufenberg, Germany, for the production of high-purity metal powders for AM, sold globally under the trademark Amperprint®.

This new Vacuum Induction Gas Atomiser (VIGA) unit went into operation in 2020 and was added to the already present fleet of the existing three VIGA units. At the time, the company stated that the VIGA launch served as a blueprint for further planned conversion and expansion measures in Laufenburg. The plant was certified to ISO 9100 in June 2021, and the Johnstown facility expanded its capacity for high-alloy products in August 2021 with the completion of a fine powder atomisation building. This is to name just some items from a larger list of Höganäs’s activities in metal AM in the decade since 2012; clearly, the company has every intention to claim its place as a giant in the comparatively new realm of metal powders for AM.

As is the case with any new field, new metal powder producers hoping to specialise in the production of powders for AM have emerged alongside established giants like Höganäs. The industry news circuit has seen regular announcements regarding research spin-outs, expensive new facilities, atomiser commissions, and, in general, the establishment of large metal powder production plants in anticipation of the coming boom in demand for AM powders. Competition to control the metal powder market may be the hottest it has been in decades.

Why AM?

Höganäs’ background in Powder Metallurgy has been to supply powders for press and sinter PM, an industry which is currently seeing conventional part volumes fall as a result of the decline of the internal combustion engine (ICE) in automotive, previously the biggest consumer of PM parts by weight globally. Many suppliers and service providers across the PM supply chain are, as a result, seeking to diversify their portfolios away from automotive and, in some cases, away from press and sinter PM altogether. To what extent have the challenges ahead for press and sinter PM part volumes played into Höganäs’s decision to pursue the AM market more actively? According to Almkvist, one need only look to the company’s history to see that its move into AM has little to do with a fall in PM order volumes, but is simply in line with its corporate philosophy – to identify and pursue new technologies and markets as they arise.

“Höganäs has lived through multiple disruptive business changes for its more than 200 years,” he stated. “Our continuous business success is based on our long-term vision and the very forward thinking of our great people. Höganäs’s company culture is all about our willingness to question the status quo by asking, ‘so, what did you do today to change tomorrow?’ This company culture, paired with our in-depth industrial experience as well as financially strong background, gives us the opportunity to undergo certain transformations once or twice a century.”

“This situation is no different,” he continued. “AM was identified as one of the future growth legs of the company well before the electrification wave began and while PM demands were still rising. Resources were allocated, products developed, and acquisitions completed even while ICE engine demands were still increasing. It is true that we expect all growth areas in the organisation to rise, so our long-term vision and strategy is working out as we had envisioned.”

So, while many companies are rushing to replace the income lost from a declining market for press and sinter PM parts (and thus powders), Höganäs’s decision to take a slice of the AM pie goes back much further; rather than being based on a forecast slowdown in its traditional markets, it is based on what Höganäs believes is the inherent value proposition of AM, not as a replacement market, but as a high-value addition.

“We form our company strategy based on what we, as Höganäs, want to be and what role we feel we should play in the market, looking ahead to a horizon ten, twenty and fifty-plus years from now. We do so while well composed, evaluating facts and projections, typically many years before we have seen any indications of underlying weakness in any other core markets.” As an example, Almkvist pointed to the company’s soft magnetic products for e-motor applications, which entered development in the 1980s – long before the electrification of the automotive industry began. “Our assessment of the value proposition of AM is certainly appealing,” he added, “and we aim not only to cut a slice of the pie for ourselves, but to actively assist in growing that pie for all market players, just as we do in the PM market.”

Indeed, it’s impossible to ignore the value proposition AM might offer to material producers if industry forecasts are correct. Whether they are accurate, and when the demand for metal powders for AM will be large enough to support the capacity for AM powder production globally, is among the most discussed topics on the show floor of any industry event, and the current overcapacity for metal powders has no doubt given some would-be powder producers pause about joining an already crowded market segment. I asked Almkvist how confident Höganäs is in the pace of AM’s industrialisation and the corresponding growth in demand for AM metal powder at high volumes; as a huge company, for whom the phrase ‘high volumes of metal powder’ must have a different definition than it does for many smaller powder producers, when does a company like Höganäs expect AM market demand to support powder producers of its size and volume capacity?

“Höganäs is the market leader for metal powders, producing 500,000 tonnes per year, and therefore ‘volume’ – or, better, ‘scale’ – has a very specific meaning for us,” he explained. In terms of the potential for growth in industrial demand for AM metal powders, he stated, “AM in industrial use has developed within the last decade in an impressive way. Beginning as an experimental manufacturing method for early adopters, it has found application in almost all industry segments worldwide. Maybe someone’s expectations were even more demanding regarding the technological breakthrough, but enabling wide adoption, successful qualification and industrialisation takes time. We believe and foresee a double-digit growth for the market volume, but this is not just driven by our manufacturing capacities. It goes hand-in-hand with the success of our customers – technically and commercially. We have a joint responsibility to enable and support especially non-AM experienced tier-1s/OEMs for growing the entire ecosystem, rather than competing against single market shares.”

What does Höganäs bring to the table?

“We do not see Höganäs as just ‘old’,” Almkvist explained, when asked what it is about Höganäs that sets it apart from its younger competitors. “We see us as a company which has lived through multiple disruptive business changes for its more than 200 years, driven by our responsibility to our employees and the community we are living in. Over the centuries, we have formed our DNA, which is all about transformation, invention, collaboration, scale and joined success from an entire industry perspective. One of our aims for AM is to address our evolutional deep expertise in metal powders and its wide applications within industry, gained on all continents across decades of experience. Especially the important knowledge which we have learned by being the top tier and large-scale supplier for the PM automotive industry (Fig. 4), which will help AM and its users to industrialise quicker.”

This is key. As a company, Höganäs has experienced the industrialisation of a new metal powder-based production technology before, from its early rise to the present day, most importantly as one of the first suppliers to the press and sinter PM industry. For decades, Höganäs has supported PM part producers as they supplied the ever-changing and evolving automotive industry, from the peak of PM part consumption to its current challenges. “There is no other company worldwide who is producing, handling and bringing more metal powders into industrial use than we do,” stated Almkvist. “This is the foundation of our strength and will be the source of our reliable joint success in metal AM.”

Of course, it’s been quite some time since the PM industry could be described as ‘rapidly changing’ or ‘emerging’, and the modern Höganäs is exponentially larger and more complex than the Höganäs that supported PM part manufacturers in their early days. When competing against agile startups, still establishing their company structure, do huge companies like Höganäs still have the speed and agility to respond to a rapidly changing, emerging market like this one? According to Almkvist, “Höganäs is actually more in the ‘Goldilocks zone’ for company size, in that we are large enough that we have substantial operations and resources all across the globe, but small enough that it is possible and very common to know each other. It is ideal in this way, as you have camaraderie and comfort no matter where you sit in the organisation, but still feel that you have substantial resources supporting you.”

“In addition, the AM group in particular is a highly specialised global team, which can independently act as a centralised business unit under the umbrella of the Product Area Customization Technologies within the Höganäs Group, reporting directly to the CEO,” he added. “As a result, we can offer coordinated support even for our multinational customers, by almost ‘mirroring’ the customer structure and setting up interfaces wherever on the planet they may add value.”

A key tenet of Höganäs’s business philosophy is ‘Ease of Access,’ and the company has stated its ambition to become a one-stop source for any metal powder need in future. I asked Almkvist how Höganäs plans to service this statement. The world of metal powders is vast and the needs of metal powder-based manufacturing continually changing and developing as time passes and industries evolve. Does the company plan to build its own expertise to the extent that it can produce any metal powder, or will it be necessary to acquire other companies, or incorporate powder reselling into its business model?

“Because every customer in the world should have easy accessibility to a broad product portfolio, we are continuously leveraging our regional and operational footprint, as well as looking into new atomisation technologies,” Almkvist stated. “This is also the reason why Höganäs has a variety of powder atomisation technologies in-house, such as Inert Gas Atomisation (IGA), Vacuum Inert Gas Atomisation (VIGA), Plasma Atomisation (PA) and Water Atomisation (WA).” As one example of the company’s drive to develop its own alloys to suit every industry need, he raised the company’s high-strength aluminium alloy for AM, developed in-house and set for launch this year. “Development [of this alloy] started more than two years ago, when we even did not have Al-base materials within our standard AM portfolio,” he explained. “This shows our engagement and interest in adjacent material classes, which were then integrated into our deep solution-based offerings.”

Almkvist further noted that Höganäs’s strong collaborations and partnerships with industry, driven by extensive engagement in scientific and industrial networks, is a great support for its short time-to-market strategy for new products.

From ‘conventional’ powders to highly specialised materials

For many material producers turning their attention to the AM powder market, something of a learning curve is inherent, as a new form of powder producing technology – namely gas atomisation – must be understood and implemented before any financial gains can be made. Even prior to its entry into the world of AM in 2012, however, Höganäs had already amassed several decades of experience in gas atomisation. “Höganäs has produced and delivered large volumes of gas atomised powders out of our plant in Ath, Belgium, into various markets for more than forty years,” stated Almkvist. “At that facility, we operate an entire fleet of gas atomisers.” At the facility, Höganäs produces cost-efficient AM powders, such as low-alloy steels suitable for the automotive industry.

Expanding its gas atomisation expertise was one of the driving factors for the company’s acquisition of H.C. Starck’s STC business. At the time of the acquisition, STC employed close to 400 people, mainly in Germany, where it had two production units serving a primarily European customer base. STC brought Höganäs access to new markets and product groups within the premium segment for surface coating and Additive Manufacturing, but, perhaps more importantly, the acquisition brought with it expertise in even more specialised metal powder atomisation technology.

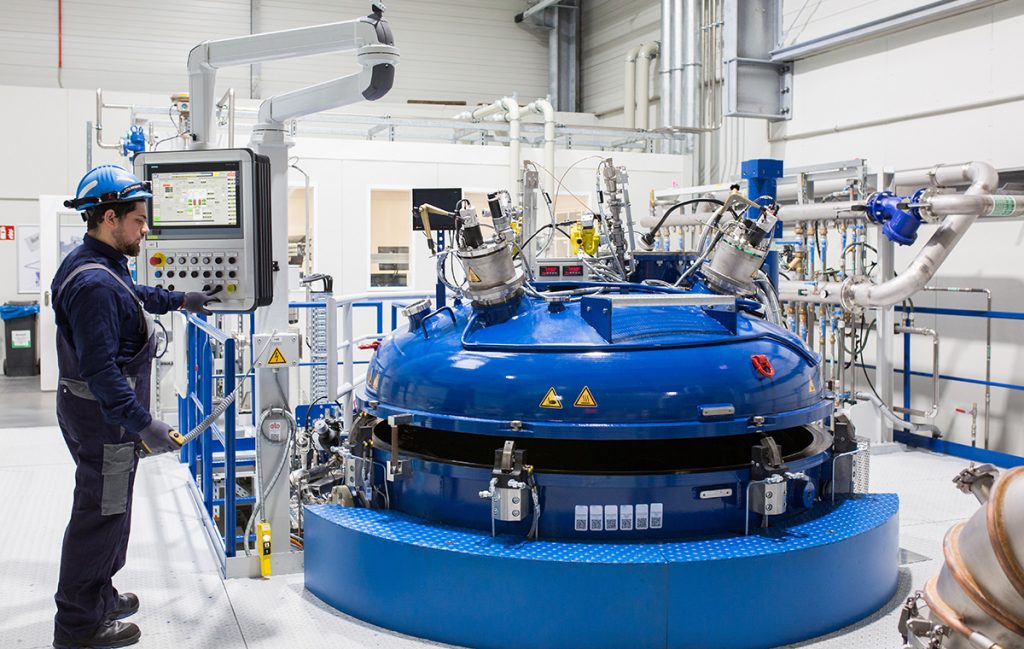

“After the acquisition of H.C. Starck’s division of surface technology in 2018, we were able to expand our powder production capabilities towards Vacuum Inert Gas Atomisation,” explained Almkvist. “This benefited our in-depth operational experience while intensifying our engagement within the AM powder production arena.”

The company now operates a fleet of VIGA systems in Laufenberg, Germany (Fig. 6). “Here, we produce our highest quality AM powder grades for various industry segments, as well as for the most demanding applications,” said Almkvist. “Germany was from early on and still is an important and internationally recognised AM technology hub, which has helped us form strong partnerships and grow the AM business. We invested in a new state-of-the-art VIGA atomiser in 2020 and have already ordered an additional larger unit (operational soon) for our German production centre.”

Outside of Europe, the company benefits from a global supply network for gas atomised powders, which has enabled it to form further strong business relationships in APAC and the Americas. The next step in building its atomised powder capacity, according to Almkvist, will be “leveraging additional capabilities as we do in Johnstown [Pennsylvania, USA], where we are in the final steps of commissioning our Fine Powder Atomisation (FPA) plant for addressing tech areas such as Binder Jetting and Metal Injection Moulding.”

FPA is a water atomisation technology which can be advantageous in the production of metal powders for binder jet AM and MIM, which do not always require gas atomised powders. As a relative, if very promising, newcomer to the AM technology marketplace, BJT is a technology just starting to gain market penetration with the material offering currently available. I asked Almkvist whether he believed the cost benefits of adding water atomisation into this mix outweighed the added complexity of introducing yet another powder offering into the marketplace?

“We believe that it is the opposite of adding complexity,” he explained. “By ‘adding’ valuable alternatives, we are broadening the solution toolkit for the industry. Any new technology competes in the early stages against established technologies; this could be based on performance, usability as well as the customer’s total cost solution. Our Fine Powder Plant in Johnstown, US, is not just an addition of ‘another’ water atomiser for us, it is a highly engineered production process for optimised and tailored powder solutions for Binder Jetting and Metal Injection Moulding.”

“Höganäs has a long-term expertise in the PM industry and in-depth experience in sinter-based technologies using water atomised powders,” he added. “We are leveraging this key knowledge towards binder jet technology.”

The AM powder portfolio

Already, Höganäs offers a considerable range of metal powders for AM. To list every powder in Höganäs’s AM materials portfolio would turn this article into a catalogue, but, to illustrate the progress Höganäs has already made toward a diverse offering of advanced AM products, some of the materials available are listed below.

Nickel-base alloys

Some of the more popular nickel-base superalloys produced by Höganäs are Haynes® 282® and Amperprint® alloys 625, 718 and 939. These alloys are used for a wide range of demanding Additive Manufacturing applications, made possible by their high strength at high temperatures and good corrosion resistance properties in extreme environments. According to Höganäs, aircraft gas turbines, steam turbine power plants and nuclear power systems are just a few of the demanding applications where nickel alloys are typically used. Both of its AM metal powder series and Amperprint atomised metal powders have been engineered for the specific requirements of AM.

Cobalt-base alloys

Höganäs’s Amperprint cobalt-chrome alloys can be applied in biomedical applications, as well as being suitable for demanding high-temperature applications such as aero engines. These alloys are characterised by exceptional mechanical properties, as well as high corrosion and temperature resistance.

Steel alloys

Höganäs describes steels as the ‘true workhorse’ of the metal AM industry – as, indeed, they are in most industries. The good availability and the cost effectiveness of iron makes steel and steel alloys a popular choice in automotive for the production of construction and wear-resistant components. Tool steels, which combine high hardness, wear and temperature resistance are used to produce moulds, stamps and cutting tools across a range of industries. Austenitic and duplex stainless steels have found many applications in the oil and gas industry. Several grades of precipitation hardening steels are developed and used in the aerospace industry. Höganäs offers a wide range of steel-based metal powders, including in its AM and Amperprint series, covering a wide range of industrial demands in terms of cost, properties and standardisation levels, including stainless steels, construction steels and tool steels.

Titanium, aluminium & copper

A range of products based on these elements are just being introduced to the company’s portfolio, and market introduction began in March 2022.

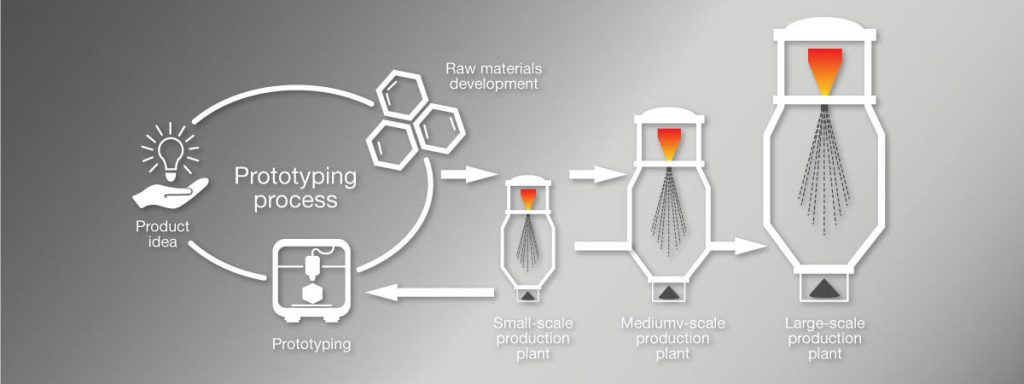

Customer-specific material development

Drawing on its decades of expertise in the development of metal powders to support the needs of real industrial production, Höganäs offers customer-specific material development to its metal Additive Manufacturing customers. Based on collaboration and discussion with customers, the company is able to tailor powder particle size distribution (PSD), morphology and chemical composition to its customers’ needs, produce small-scale batches for research, development and prototyping using its small-scale production plant, then ramp up production to its mid- and large-scale atomisers when the customer is ready to move into medium- or industrial-scale production (Fig. 8).

Because the company’s plants are identical and highly standardised in terms of technology, Höganäs states that it is easy to ramp up production from small to medium to large scale as demand increases. This enables consistently high quality standards, identical morphology and consistent PSD in combination with fully optimised production processes, avoiding the bottlenecks that can challenge a new production process as it attempts to scale for volume. It also minimises the risk management for our customers using our products that are produced in interchangeable atomising units.

Quality, consistency and standardisation

A key area of development to enable the wider industrialisation of AM is the standardisation of materials and processes. For a new technology, this greatly enhances trust and confidence amongst end-users – perhaps most visibly in safety-critical, high-value industries such as aerospace and medical, but eventual standardisation will be required by all end-users; even luxury goods makers stand to lose money if a part fails. As a long-time supplier of metal powders to press and sinter part manufacturers for the automotive industry, Höganäs is no stranger to standardised, quality-controlled production, but how does the company guarantee consistency and standards in this new market? Is AM still something of a ‘wild west’ for manufacturing, or is it now well-controlled and understood?

“We follow strict manufacturing process protocols under our numerous certifications (various ISOs, AS9100, IATF, etc) and in conjunction with our established Höganäs quality management system worldwide,” explained Almkvist. “Our decades-long experience in atomisation and the supply of our powders to various markets with application-critical performance requirements has enabled us to further develop streamlined and highly controlled processes for advanced, consistent and reliable metal powder solutions from batch-to-batch, month-to-month and year-after-year. This is absolutely key for us and our customer’s success journey.”

Regarding where the rest of the AM industry sits on its path to standardisation, he stated, “AM’s industrialisation has developed impressively within the last decade, but [the level of standardisation] depends entirely on where a company is in its AM adoption cycle. Some users already have decades of experience with AM production and have found their sweet spot using AM, others are in a pseudo-industrialised stage, while others are really experimenting, learning on the fly, and, in some ways, they are a bit more ‘wild west’ as you described it.”

“But this will definitely change over time,” he added. “We all – as an AM community – learned within recent years that this technology has to adapt in evolutional steps rather than looking for quick, disruptive revolution in all industry segments. Our combined focus on qualification and industrialisation for targeting a technological breakthrough by enabling the targeting of industrial segments is key for growing the pie.”

Sustainability and ‘making more with less’

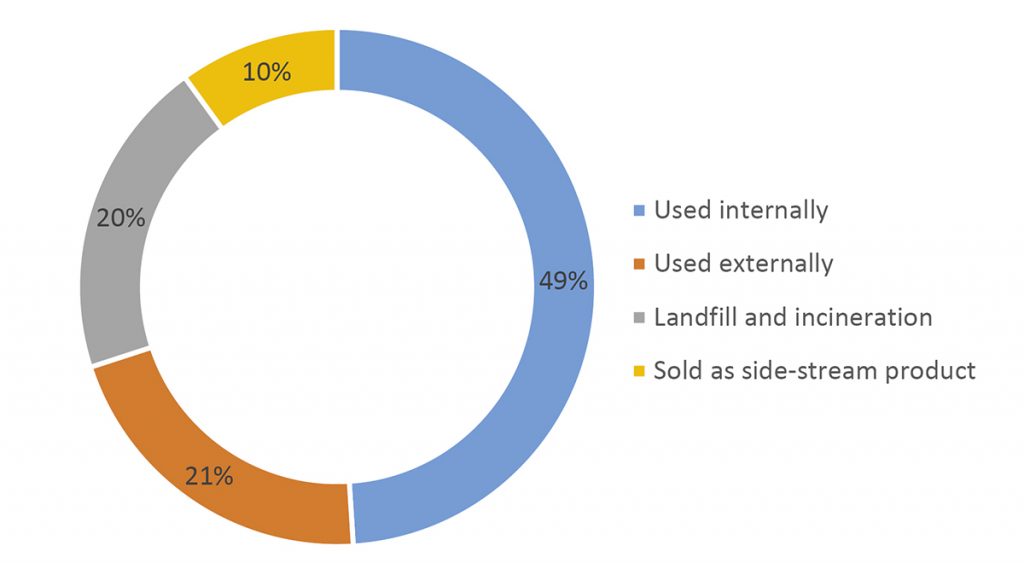

For many years, a focus of Höganäs has been the sustainability of its business, processes, materials and wider industry. Since 2010, the company has achieved an 8.1% energy reduction and reports that it has saved 30,400 tonnes of CO2 emissions by using electricity from renewable sources. Further, 80% of its process residuals are diverted from disposal (Fig. 9). A key phrase which appears again and again across company literature and presentations is at the core of its philosophy as a sustainability-minded materials producer: “Inspire industry to make more with less.”

As a relatively new manufacturing technology, developed in an environmentally conscious era and capable of producing whole parts with the very minimum of material waste, AM has the opportunity to approach its entire value chain with sustainability in mind. A number of organisations and networks seek to ensure that the industry takes full advantage of this opportunity, perhaps chief among them the Additive Manufacturing Green Trade Alliance (AMGTA), a non-commercial, unaffiliated organisation established by Sintavia in 2019 with the aim of promoting the environmental benefits of AM over traditional methods of manufacturing. Höganäs joined the AMGTA early this year as a founding member, as well as establishing a partnership with Sweden’s Piab AB which aims to advance automated powder management methods for binder jet and PBF-LB Additive Manufacturing, with the goal to increase the sustainability and efficiency of the processes.

Discussing Höganäs’s perspective on sustainability in AM and how the group is dealing with this facet of its metal powder production, and its day-to-day running, Almkvist stated, “Sustainability is and has always been a crucial part of our company. It is our sustainable business practices, always evaluating applications and use cases for secondary raw material streams and increasing material efficiency overall, which allowed Höganäs to develop ‘metal powder solutions that help industries make more with less.’ Therefore, we are already recognised as frontrunners in sustainability within the metal powder industry, which we intend to maintain and even further enhance.”

“We are also more broadly publishing our activities within the Höganäs annual sustainability report and have employed a full-time sustainability team for many years,” he added. “Höganäs has also committed to and joined the ‘Science Based Targets initiative’ for driving the corporate climate roadmap towards zero impact by 2045 at the latest. We have even investigated accelerated scenarios for becoming net-zero sooner in conjunction with all our related downstream and upstream processes worldwide.”

The company’s primary metal AM powder production centre in Laufenberg is already fully hydroelectric, Almkvist explained, powered by the Rhine river. Its Ath plant draws power from a solar panel park (Fig. 11). In addition, all of the company’s powder manufacturing processes are already carbon neutral or close to neutral. “We are currently working on all other indirect emissions occurring from sources beyond our control, which are based on sourced materials and consumables.”

“All this contributes to our sustainable AM activities, offerings and services as well, where we define our efforts in relation to a key tenet of our AM value proposition – ‘every particle counts.’ Here, we are actively developing material handling solutions to help our customers industrialise, which is a crucial step for AM to reach mass adoption,” he continued. “We are leveraging our long-term expertise handling large-volume markets such as PM. This gives us and our customer a glimpse into where the AM industry has to move in the following years. For example: using large-scale packaging solutions rather than single polymer bottles, in conjunction with automated powder handling equipment. We are also working with some customers already on recycling concepts to not only reduce cost, but reduce the environmental impact of metal AM powders by enabling secondary raw material streams.”

Supporting the development of AM to ensure market growth

As a leading producer of metal powders for press and sinter PM, Höganäs has a long history in researching and developing new applications for the technology and has been a major champion of the process in high-value, high-volume sectors like automotive. On its Powder Technologies homepage, the company states, “Our vision is to make metal powder technology the first choice by helping customers and end-users to utilise the inherent ‘power’ of metal powders.” These efforts to increase PM’s visibility to automotive part makers and end-users are visible across Höganäs’s online network of resources. One such example is the company’s AutoExplorer, which highlights efficiency-increasing applications for press and sinter PM in gasoline/diesel cars. This interactive tool allows users to view the components of a modern vehicle, piece by piece, identifying those for which press and sinter PM is ideally suited (refer back to Fig. 4 for example parts from AutoExplorer). Through its Customer Development Centre, Höganäs provides a platform for cross-functional work with different companies and competencies to develop applications that work across all steps of the PM value chain, from idea to finished product.

Based on this well-established approach to the market, heavily promoting the technologies for which it provides the materials, Höganäs would seem to be an ideal materials partner for a burgeoning new field such as metal AM. So how involved is Höganäs in developing new applications for AM?

“For PM, it is a necessity for us to develop new applications together with our customers to be able to secure, as well as further address, new markets for press and sinter technology for growing the business space,” Almkvist stated. “In AM, we are following a similar approach and working internally as well as externally together with our customers. These activities are enabled by collaboration or putting a development agreement in place, where we support customers in selected industry segments such as aerospace, automotive, dental, energy, tooling and others. Since AM is a relatively young manufacturing technology, development is not only based on new applications; some developments are based on industrialised powder handling solutions, sustainable material circularity or new AM technologies.”

As with any new technology, a large part of the challenge of industrialisation is in education. Much has been said of the skills gap for AM, and, to date, the education system does not provide AM training on the scale necessary to support industry growth. As such, much of the responsibility to provide training in AM and its associated skills falls to companies along the value chain. So, how does Höganäs plan to support those customers who are new to AM and whose staff may not have much familiarity with metal powders, in understanding this new area?

“During the past years, Höganäs has developed competency and capability in all aspects of the AM value chain addressing the ‘ease of use’ principle, starting from requirement engineering/alloy development, through to optimised/sustainable production, through to application engineering/printing/post-processing and beyond,” said Almkvist. “Our aim as top-of-the-mind solution provider is to enable the visions of our customers even if they do not have a printer. The scope of this may vary for each customer or application, and we will approach it similarly to how we did it in the PM world for decades. We will educate them on the process options and materials and offer the ability to produce proof of concept parts for test/qualification. We do not intend to become a parts producer, as we consider that the domain of our customer base, but we can support them in connecting with trusted manufacturing partners to produce parts in serial production using the powder-based AM solution they developed together with us.”

Education plays a major role in industrialisation, as Höganäs has known for many years, as one of the key educators driving awareness of press and sinter PM and the vast potential of metal powder. Now, the company is expanding this focus on promotion through education to include AM and its end uses. In September, the company joined the Connactive project to help develop new automotive electric drive concepts based on the use of metal powders. Established in 2019, Connactive brings companies together with the goal of fostering innovation and is currently focused on the production of an enhanced-efficiency motor using AM-enabled technology and dedicated material solutions. As part of the project, Höganäs’s metal powders were used in Connactive’s Dual Drive System, a powersplit planetary gearset and matching RX II unit, in combination with a high-torque AX motor and highly integrated electronics. Leveraging the abilities of partner companies Dontyne Gears, Moteg and Vishay, the Dual Drive System was brought from blueprint to series production standard prototype within six months.

The long-term view on AM’s metal powder marketplace

Twenty years ago, the number of metal powder producers in the world could have filled a page at most. Now, this is a rapidly swelling market with a number of new players emerging year by year with new claims as to their powder’s quality, sustainability, and suitability for AM processing. As is common across the AM value chain, this is an attractive space for startups and a great deal have popped up over the past few years, as well as spin-outs from larger companies, universities and research organisations. Suddenly, the list of metal powder producers globally is quite long. So, where does Höganäs, one of few experienced elders in the marketplace, see this going? Is the inevitable conclusion market consolidation as the industry matures, or is a wide and varied metal powder production ecosystem of value to the industry?

“A wide and varied metal powder production ecosystem is of course of value, both in material options and scale, but this will not be a market where anyone with an atomiser will enjoy a nice slice of the pie,” Almkvist explained. “We believe that in the coming years certainly some market consolidation will occur, but also, many of the smaller newcomers will struggle unless they are capable to present a truly differentiated product offering. At this stage, machine OEMs for the AM process themselves are still working on making more robust products in conjunction with addressing new materials, so in many cases the end-users are still very much trying to limit any variables within the entire process chain. As consequence, they tend to work with suppliers they know and trust who have a product that is qualified and has demonstrated proofed performance. We at Höganäs are investigating alternative/new powder manufacturing processes and are strategically down selecting potential candidates.”

“It is not new that various metal powder manufacturing technologies with different TRL are known within the technical community,” he added. “Some of the technology principles on offer were already scientifically investigated years ago but were either not ready for scale-up or certain product did not find the right fit-to-market.”

Within the busy metal powder marketplace, another key issue is price. Currently, it would be fair to state that metal Additive Manufacturing has a reputation as an expensive manufacturing solution. Whether this reputation is entirely fair or not, it is partially down to material cost – highly specialised, gas atomised metal powders for AM cost significantly more than the metal powders used in press and sinter PM, and much more than many of the materials used in traditional, subtractive manufacturing technologies. As a result, many discussions around material development and metal powder production for the AM market focus on the need to reduce material costs – or adjust AM processes to enable the processing of cheaper materials – in order to make the AM business case viable for all part makers, not just those in extremely high-value industries such as aerospace and medical.

I asked Almkvist what Höganäs’s long-term view is on pricing for AM powders. Will powder prices drop enough to tilt the scales toward viable business plans for part makers in the near future? Where can people in the planning stage of applications, which may be five years down the line, expect the pricing of atomised metal powders to be in 2027?

“This is not the first time that we’ve heard this question as a powder supplier,” Almkvist stated. “Of course, it is true there are economies of scale to be realised, but that isn’t the whole picture. A significant reduction in costs will not be achieved by volume increases alone; it will require deep investigation into what powder characteristics (chemistry, PSD, morphology, etc) are truly necessary to produce the desired product. This will require cooperation between powder producers, machine producers and the customers making the parts.”

In Almkvist’s opinion, however, the role of material cost in holding back AM’s industrialisation has been somewhat exaggerated. “Powder costs are only one (small) piece of the puzzle, as in PBF-LB, for example, the material costs can be ~10-20% on average of the total production cost,” he stated. “The reason it gets so much attention is because it is a visible line item. Increasing the layer thickness or other methods to turn up productivity in the AM process or reduce downstream post-processing requirements would have a much larger and more immediate impact on total part cost than simply reducing the powder cost.”

“As an exercise to illustrate this,” he added, “look at one of your cost models for a programme five years out and bring the powder cost to $0. Is your problem entirely solved? Likely not.”

Conclusion: growing the pie

Höganäs is a company that began at the explosion of industry and has ridden (and sometimes helped steer) the waves of industrial progress for two centuries. As metal AM continues to grow, this is a company which is sure to thrive along with it, while maintaining the traditional base that has given it one of the deepest wells of knowledge in the metal powder industry.

Much discussion of the advanced metal powder marketplace, by the nature of business, focuses on the rush for market shares; who will win the largest slice of the pie? In speaking to Almkvist, however, it is clear that this is not Höganäs’s biggest concern – the company already produces 500,000 tonnes of metal powder a year, after all, and serves a large portion of the metal powder manufacturing world. Höganäs can afford to choose carefully what future it invests in, to the benefit of its business, its community, and the metal powder industry at large.

“We believe in and are fascinated by AM technology and wish to deeply express our willingness to support the AM industry with our decades of experience in metal powders,” Almkvist concluded. “In the end, we have to find a way to grow the pie, rather than competing for single market shares, since AM is competing against other, well-established manufacturing process technologies.”

The message is clear: why expend resources on the fight over slices of a small pie, when you can invest them to make the pie bigger? To mix our metaphors, a rising tide lifts all boats – and a larger pie feeds more mouths. Competition is inherent to business, but so too is collaboration inherent to progress, and to Höganäs, until metal AM is in a position for true industrialisation, progress must come first.

Contact

Henrik Jarl

Director of Marketing Communications

Höganäs AB, Sweden

[email protected]

Author

Emily-Jo Hopson-VandenBos

Deputy Group Editor & Features Writer

Metal AM magazine

[email protected]

References

[1] Powder Metallurgy Fact Sheet, Metal Powder Industries Federation (MPIF) (https://www.mpif.org/Resources/IndustryFacts.aspx)

[2] Overview of the Status and Trends in the European PM Industry, presented by Ralf Carlström at the Euro PM2020 Virtual Congress, October 5–7, 2020, European Powder Metallurgy Association (EPMA)

[3] State of the PM Industry in North America—2020, Dean Howard, PMT, president, Metal Powder Industries Federation (MPIF), published July 2020 (https://www.mpif.org/News/FocusPM/TabId/979/ArtMID/3883/ArticleID/362/State-of-the-PM-Industry-in-North-America%E2%80%942020.aspx)

[4] AM market forecast to reach $51 billion by 2030, published April 8, 2021, Metal AM, based on data from Lux Research, Boston, Massachusetts, USA

(https://www.metal-am.com/am-market-forecast-to-reach-51-billion-by-2030/)