Strategies for advancing the automation of metal Additive Manufacturing

In the early days of metal Additive Manufacturing process development, automation was off the radar of machine manufacturers. Technologies created for rapid prototyping simply had no need for it and, until the last decade, few truly anticipated the pace at which Laser Beam Powder Bed Fusion and Binder Jetting have evolved in the race towards the series production of metal parts. In this article, Joseph Kowen reports on how the industry has addressed the challenges of automation so far, and what developments we can expect in the near future. [First published in Metal AM Vol. 6 No. 4, Winter 2020 | 35 minute read | View on Issuu | Download PDF]

Consider this: at Formnext Connect in November 2020, and in the weeks leading up to the event, the Additive Manufacturing industry saw a stream of announcements on the subject of AM part processing, including collaborations and product launches on what could more broadly be described as industrial automation in AM. Siemens, Grenzebach, Ossberger and AZO presented a case study on reducing cost per part through automation in the processing of polymer parts made on EOS machines. HP announced a new post-processing solution for its Jet Fusion 5200 system with AM Solutions. AM Flow, a Dutch startup, raised $4 million in Series A funding to develop end-to-end solutions for AM automation, also mainly for polymer parts, while Solukon launched the SFP 770 automated unpacking system for polymer parts. PostProcess Technologies, meanwhile, announced the development of a patent-pending Variable Acoustic Displacement (VAD) technology for automated polymer powder removal. This is only a partial listing of some of the developments the industry saw in 2020.

What is common to these announcements is that they all involve the automation of stages of the workflow for producing polymer parts. Less widespread during the conference were announcements on innovations and developments in the field of automation for metal AM part production. One news release that might be the exception is Siemens’ collaboration with Sintavia on software automation. It seems that in metal AM, industrialisation and automation is a much harder nut to crack.

This article will catalogue what has been done to advance the automation of metal AM part production, and aims to shed light on what is still missing in the automation picture. We will try to ascertain why this is so, why automation in metal AM is still so elusive, and we’ll report on what some voices in the metal AM industry are saying about automation and how they see its future path. In so doing, we will take a high-altitude view of automation in metal AM. We will not look into the intricacies of individual processes that form part of the automation process chain, such as depowdering or support removal; rather, we will look at the overall automation flow, or, more precisely, the processes and systems that connect the various stations that parts need to traverse on their path from feedstock to functional use, or – in the case of most common metal AM processes – from powder to production part.

Beyond our description of the various issues faced by metal AM automation and their status, we hope that the thoughts and ideas raised here will assist in stimulating broader discussion on the issue and sensitising both the industry and its consumers to the possibilities – and challenges – of automation and industrialisation in metal AM.

No time for automation?

As rapid prototyping technologies developed into Additive Manufacturing solutions, the focus of the industry and its systems providers was squarely on the AM processes themselves. The challenge of producing accurate, repeatable and functional parts, metal or polymer, required a focused technical and intellectual effort. Success was measured by the part itself, so little effort was devoted to the manufacturing context in which individual parts miraculously materialised out of a vat or powder bed. The broader environment and post-processes were left to the customers themselves.

One of the results of this focus was high part cost, as shall be seen. High cost meant that potential uses of metal AM as a production tool were limited to applications that were less cost-sensitive, or where the geometrical advantages of the part made a strong case for using AM, notwithstanding the cost.

The software that serves as a backbone for any attempt at automation has made significant strides in recent years. Tools for processing data, build setup, workflow management and other functions have begun appearing on the market with increasing frequency. The subject of software automation is a topic that deserves dedicated attention, and for this reason is not covered here. It might be said that in the evolution of metal AM, the central nervous system of any automation – the software – has developed, but the body has yet to coalesce around it in any meaningful way.

In the development of metal AM until now, automation was at best an afterthought and, at worst, completely neglected, as machine manufacturers threw most of their resources at the AM process itself.

Metal AM machines – Where is the need?

The numbers of machines sold into the market give some perspective on the stage of development of the metal AM segment. The Wohlers Report 2020 estimated that 2,327 metal Additive Manufacturing machines were sold in 2019. This number includes machines from all of the metal AM technologies: Powder Bed Fusion (PBF), Binder Jetting (BJT), Metal Material Extrusion (MEX), and Directed Energy Deposition (DED). The Ampower Report 2020 estimates that about 78% of metal AM machines sold in 2019 were either Laser (PBF-LB) or Electron Beam Powder Bed Fusion (PBF-EB) machines, of which more than 90% were PBF-LB. Historically, PBF-LB’s share of the metal AM systems market has been even higher. The Ampower Report estimates that the installed base of all PBF systems is 9,111 machines, or 88% of the installed base of all metal systems from all technologies. It is estimated that of all the PBF systems, PBF-EB only accounts for approximately 500 units, or a little more than 5%.

Given the state of the market now, or, more precisely, where the machines are located, automation is a key issue for PBF. Due to the dominance of PBF-LB over PBF-EB, from a practical point of view, the former is where any consideration of automation must lie. That said, PBF-LB systems are not standardised. While the basic PBF-LB process is similar regardless of the manufacturer, the mechanical design and layout of the machines produced differs. Since there are more than sixty manufacturers of such systems worldwide, there is great variability within the overall PBF-LB market.

But what of technologies poised for future growth? Binder Jetting is a technology where automation could, arguably, play a bigger role. There are only a handful of companies with offerings in the metal BJT space, and their total installed base is a little over 200 machines, according to the Ampower Report. This is a very small footprint, amounting to only about 2% of all metal systems worldwide. However, BJT is a developing area, with large players such as HP and GE, and well-funded startups such as Desktop Metal, making serious movements into this space.

These technologies add to the systems that metal BJT pioneer ExOne has been commercialising for a number of years. The promise of BJT as a future technology for metal AM lies in its cost structure, which offers the possibility to address markets where PBF-LB is not economically feasible. It is here that automation has an important role to play; the lower cost of parts opens up higher quantity applications, such as some automobile applications. Larger quantities make investment in automated processes more attractive. Symbiotically, automation could, therefore, play an important role in the speed of development and penetration of BJT into production applications. The discussion on automation in BJT is based not on its current significance in the AM industry, but on its future.

Another metal technology that should be mentioned is the Material Extrusion of metal filament, also known as Fused Filament Fabrication (FFF) or metal Fused Deposition Modelling (FDM). There has been some development in this segment over the past few years, particularly with machine makers such as Desktop Metal and Markforged, and material suppliers such as BASF. While, theoretically, this technology should also be a candidate for automation, MEX is a vector-based AM process that is slow and has other disadvantages compared to PBF and BJT, such as lack of feature resolution. It is best suited to low-batch production. Since the process is not based on powder, many of the headaches associated with powder handling and removal are avoided.

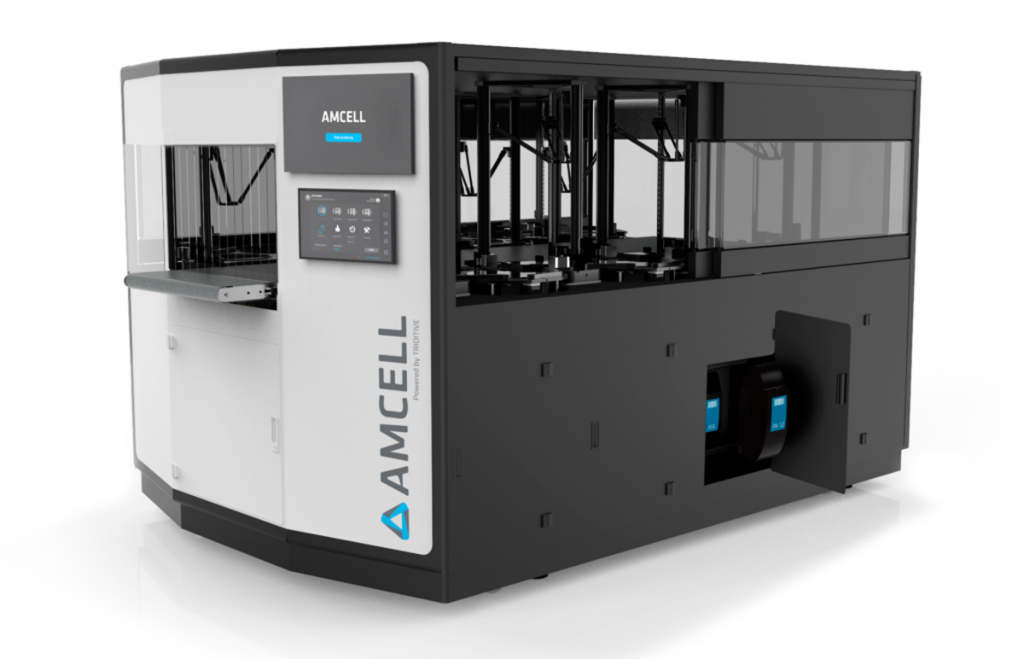

A Spanish company called Triditive is developing an automated system called AMCELL in which a number of extrusion heads produce parts simultaneously and finished parts are automatically extracted from the machine on a conveyor system. It is a platform worthy of note for its dedication to automation, but as a low-batch solution it occupies a place only on the periphery of metal AM.

The process steps

It is worth laying out clearly the process steps of PBF-LB and BJT in order to understand exactly where automation could play a constructive role in making these AM processes more efficient. At the end of the day, an investment in automation must make business sense, so operators of metal AM facilities will, by necessity, need to calculate their savings and return of investment on any automation system.

The term ‘post-processing’ is used frequently in connection with AM. We will use the more generic terms ‘automation’ or ‘process automation’ to describe how the part gets from AM machine to final product, which will also generally include steps that would commonly and accurately be called post-processing. Examples of post-processing would be heat treatment, polishing and shot peening.

It is worth pointing out that each different application, whether for the automotive, aerospace or medical industry, is going to face specific challenges, and this will affect the fine details of any automation solution. The analysis laid out here will, by necessity, be based only on the generic aspects of production process automation.

PBF-LB contains the following main process steps:

- Build process >>

- Cooling >>

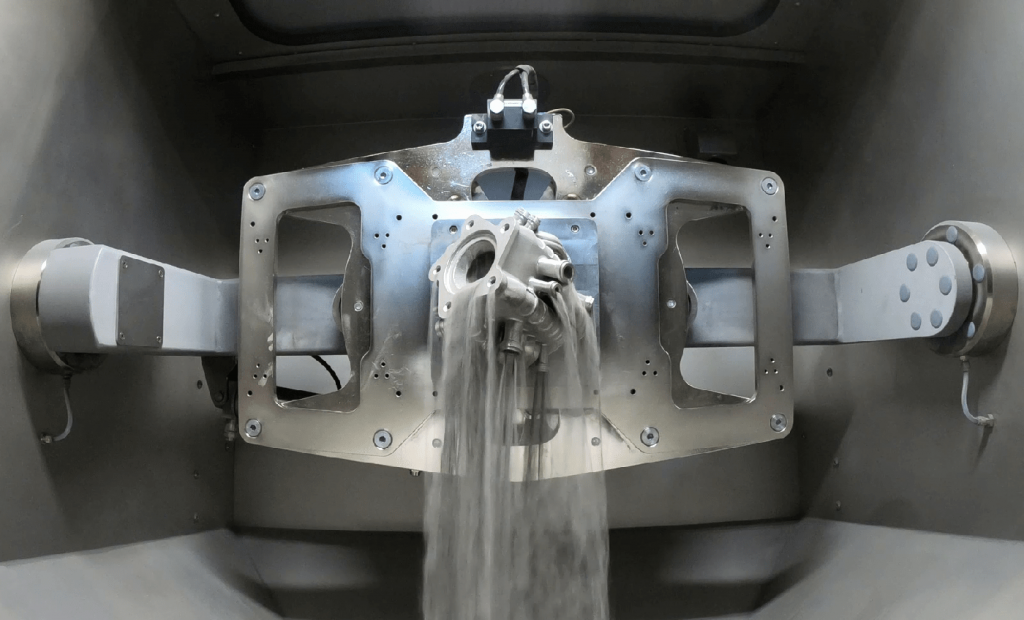

- Unpacking and depowdering >>

- Heat treatment and cooling >>

- Cut from build plate >>

- Support removal >>

- Optional: Hot Isostatic Pressing (HIP) >>

- Surface treatment, depending on application (grinding, polishing, shot peening, milling) >>

- Transferring or shipping for final use

BJT includes the following steps:

- Build process >>

- Placement in curing oven for hardening green parts, depending on process variant >>

- Depowdering >>

- Preparation for debinding and sintering >>

- Debinding and sintering >>

- Optional: HIP >>

- Surface treatment, depending on application (grinding, polishing, shot peening, milling) >>

- Transferring or shipping for final use

The more of these processes that are able to be connected through automation, the better the process and the lower the cost. Practically speaking, the AM automation that we are talking about relates to the earlier stages in the process chain. Once parts are on their way towards surface treatment and finishing, traditional automation processes can be applied, and this ceases to be an AM-exclusive issue.

Metal powder is the starting point in both BJT and PBF-LB. Powder is generally a headache in metal AM, and it needs to be managed. All powders pose health and safety risks. Reactive powders, such as titanium and aluminium, also risk ignition and explosion if not handled under inert conditions, or if particulates are allowed to build up in the factory environment.

A second common element is heat. PBF-LB is a hot build process, and parts are hot to handle and need to be cooled. They generally also require heat treatment. BJT is a cold process to start with, but requires curing and sintering in the downstream.

Automation of the BJT workflow faces a unique challenge not present for PBF-LB. Additively manufactured green parts produced by BJT can be fragile depending on their dimensions, which could make handling them with automatic systems problematic. Automation experts believe that solutions can be found that will handle these parts with the care that is needed to avoid breakage and failed builds. Changes to the design of the part or layout of the parts in the build box could also mitigate losses due to the indelicate handling of green parts.

The makeup of the build could also be a factor. If the build comprises a wide variety of parts, this makes part handling more complicated compared to a build in which all of the parts are identical and arranged in an organised and repeatable way in the build volume. Finally, green part strength may also be enhanced in the future through the development of stronger binders. BJT machine providers are all aware of the value of improving the strength of green parts and the benefits that this would bring for automation.

Factories of the future

Over the past number of years, many of the leading PBF-LB suppliers have presented concepts illustrating how they see the AM ‘factory of the future’. Many have published artistic renderings of these concepts. As far as such factories being built for metal AM, very few of them have so far made it off the drawing board. Here are two that did, as well as a machine manufacturer that has given such significant thought to automation as to be worthy of mention.

NextGenAM

In 2017, three companies got together to establish the NextGenAM project. A collaboration between Premium AEROTEC, Daimler and EOS, NextGenAM was envisioned as a way to demonstrate the feasibility of an automated production cell for metal AM part production in the aerospace and automotive industries. Its members represented some of the most highly regarded names in their industries, each with its own particular commitment to metal AM. Through the project, an automated unit for building aluminium parts was built at Premium AEROTEC’s technology centre in Varel, Germany.

The genesis of the project was not just a desire to demonstrate the technical prowess and industry leadership of its partners, though that may have been one of the motivating factors. An earlier study by the three companies had found that up to 70% of the total cost of an AM part could be attributed to the pre- and post-processing costs; this included downstream processes such as build removal from the machine, build plate transfer, powder removal, support removal and other processes that in many cases required substantial manual labour. With such a high overhead, the companies figured, the total costs of metal AM would remain high, and would discourage all but the highest value or geometrically complex applications.While some costs could be mitigated by smart design with the specific idiosyncrasies of AM processes in mind, using what is referred to as Design for AM (DfAM), they realised that some of the manufacturing process could be streamlined. NextGenAM set out to build a pilot to prove that AM could be made cheaper.

To design and build the automated processes for the project, the members of NextGenAM turned to Grenzebach Maschinenbau GmbH, a company based in Asbach-Bäumenheim/Hamlar, Germany. Grenzebach specialises in automation systems and possesses a wide range of automation tools and technologies, having extensive experience in their implementation for a variety of industrial applications. Grenzebach supplied the automated guided vehicles (AGVs), mechanical design of the automation interfaces, as well as fleet management software for controlling the automation system for transferring, loading and unloading build boxes. As a result of its involvement in NextGenAM, Grenzebach has designated AM as one of its focus markets, and it aims to provide solutions in both metal and polymer AM based on its learning and experience in the AM area.

The NextGenAM project concluded in May 2019. Its findings suggest that for some parts the manufacturing cost could be reduced by up to 50% using the automated production line, compared to currently available metal AM systems. The collaborators were quoted as saying that the AM production line was automated from beginning to end, meaning that no manual work was required at any stage of the process, from data preparation and central powder supply through to the AM build process itself, and including heat treatment, quality assurance and separation of the components from the build platform.

Dr Adrian Keppler, then EOS CEO, stated during the project, “The NextGenAM project has provided a very tangible demonstration of how industrial 3D printing can be used cost-effectively in series production as part of an automated process chain. In combination with the possibilities for digitalisation as used here, the pilot plant represents nothing less than a milestone along the way to digital manufacturing.”

Jasmin Eichler, Head of Research Future Technologies at Daimler AG, offered this insight: “With this collaborative pre-development project, we are taking a significant step towards achieving cost-effectiveness in metal 3D printing throughout the process chain. The project lays the cornerstone for the future realisation of larger quantities in the automotive series production process.”

With the curtain having come down on this project, industry sources note that a real project based on the pilot has yet to be implemented elsewhere. There are a number of possible reasons for this, but the two main ones – related to each other – are cost and the need to modify or add hardware to facilitate the automated work flow.

Hyprocell

The Hyprocell project was established in 2017, with the objective of developing and demonstrating a multiprocess production cell concept, employing laser-based manufacturing, and implementing the concept in a real environment (pilot facilities) by manufacturing real parts in order to measure the benefits. The project was funded by The European Union (EU)’s Horizon 2020 programme and managed by Lortek, a private Spanish manufacturing research organisation. The target industrial sectors for the project were power generation, aerospace and general manufacturing.

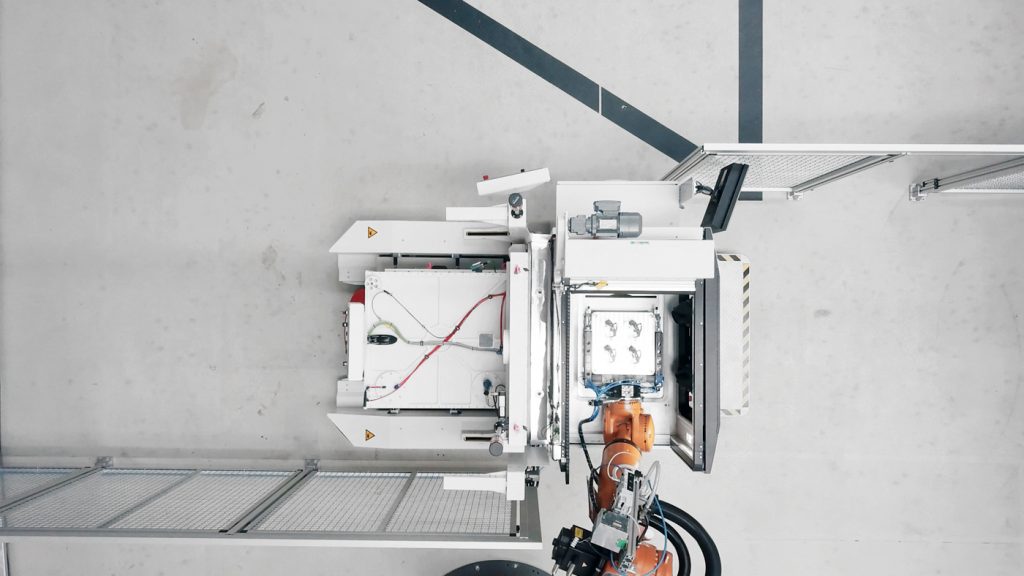

The AM part of the pilot was built at Poly-Shape’s facility in Marseille, France. Poly-Shape was later acquired by French system manufacturer AddUp in 2018. The pilot included the following operating stations: A large PBF-LB machine (AddCreator, from Portuguese machine maker Adira); a depowdering system (SFM-AT800, from German depowdering specialist Solukon); and a milling centre (Haas 3-axis VF-2). Movement of build trays between the different stations was performed by a robot (Erowa ERD 500).

The workflow is as follows: The robot transfers the produced part inside a specially designed dustbox to a dedicated depowdering station. Any remaining powder is removed from the part and safely captured, thus diminishing release of powder into the factory environment. The part is then transferred by the robot to a milling centre in order to bring the part’s surface to the required quality. The dimensional accuracy of the part is controlled by a measuring machine performing automated 3D scanning. The part handling system is connected to a robotic storage and loading station for loading and extracting the finished parts using a pallet system. The pallets are stored in a rack magazine.

Juan Carlos Pereira Falcón, a Senior Researcher in metal Additive Manufacturing at Lortek and leader of the Hyprocell project, stated that the team was pleased with the findings of the pilot and with the integration of its various elements, especially the flexibility available to integrate existing machines into the system in a modular way. On the down side, the expense of the system, especially with the use of a very large PBF-LB machine with a long build cycle, meant that they were unable to find a use case that made economic sense. It would have been better, he added, to have a number of smaller systems being serviced by the single robot and depowdering system.

MetalFAB1, Additive Industries

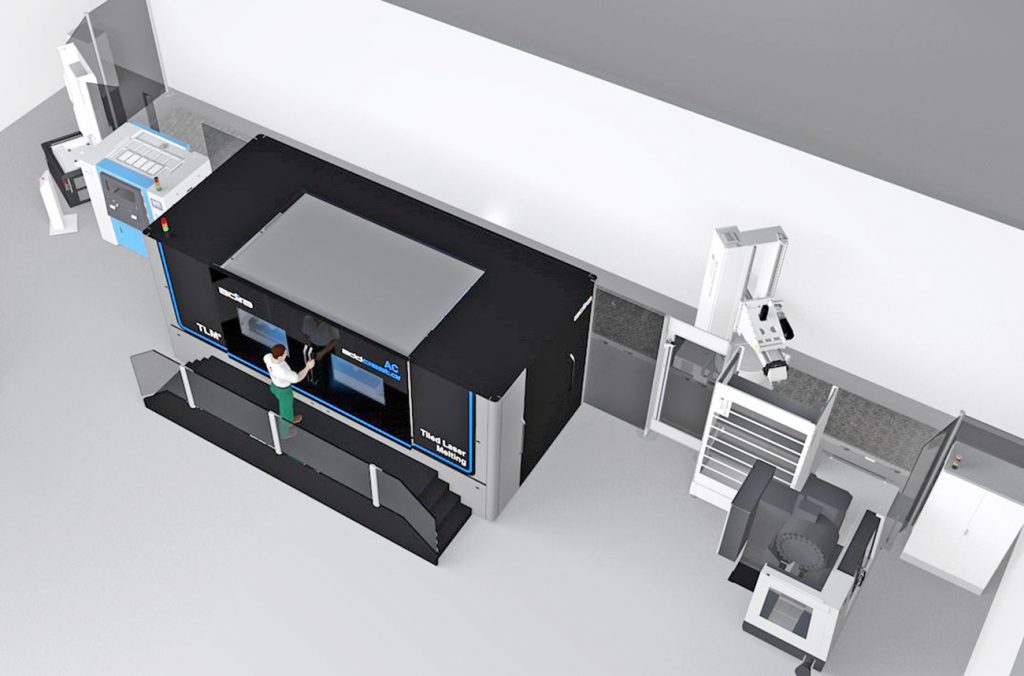

One PBF-LB supplier has made automation part of its basic design concept. Dutch company Additive Industries, Eindhoven, includes automated features as modules within its system offering, the MetalFAB1. The basic system includes a bulk powder removal device, although it lacks the ability to remove powder trapped inside internal channels. In late 2017, the company launched an optional in-line product removal module that cuts the built part off the base plate and prepares the plate for the next build. Using the MetalFAB1, build plates are automatically loaded from a storage unit, and an exchange module allows the removal of finished plates from the system. The system is expandable and can include multiple ‘cores’ or build units. An integrated heat treatment unit is also available.

In November 2020, the company announced the MetalFAB-600, its latest system, due for commercial release in 2021. Not much is known about the MetalFAB-600 at this stage, but according to the company, the new model builds upon the knowledge and experience gained with the MetalFAB1 in terms of robustness and the automation of key production processes. The company claims that this automation will include a focus on powder handling, alignment and calibration.

Visions for the future

A number of metal AM machine providers have committed to automation at one level or another, though at this stage mostly verbally. A number of cases are discussed here. They represent a sampling, and by no means an exhaustive list, of everything that metal AM companies are doing in the area of automation, but they are illustrative of a desire within the industry to tackle the issue.

With the exception of the two pilots that have already been described, there are not many examples of automated systems that have been put into practice. Some customers have invested in parts of the process, such as depowdering systems, but these tasks are in most cases not connected to either upstream or downstream steps.

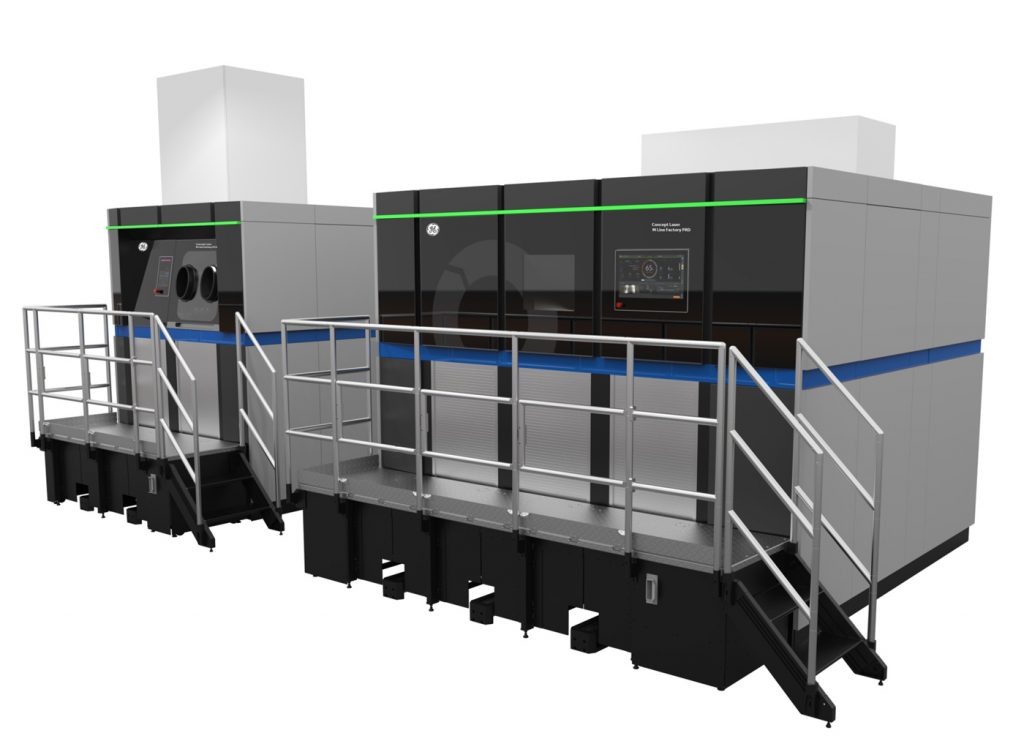

GE Additive

GE’s newest systems, including the GE Additive Concept Laser M LINE, are automated in terms of the loading and unloading of the build module. This enables faster changeover times, which maximises machine up time. Maybe more importantly, it eliminates operator exposure to powder and makes operation safer.

The key hurdles that GE Additive sees in the workflow that require mitigation in any automated system are: the manipulation and storage of all the relevant files and data, in significant amounts, and from different tools; powder handling from receipt through to recycling, where there are often differing reuse strategies, and questions about what percentage of virgin powder to add into the mix; and depowdering and support removal, which pose many challenges. These are important process steps that automated systems will need to address.

Chris Schuppe, General Manager, Engineering & Technology at GE Additive explained the company’s view of automation: “Automation will ultimately drive costs down for the overall process, which should improve the business case, and that will ultimately lead to further adoption and higher volume applications.”

Farsoon Technologies

Farsoon Technologies is a Chinese company with roots in the early days of the development of laser sintering in the US. It initially focused on polymers, but has moved into metal AM in the past few years. The company made headlines recently when it announced a deal with Chinese aerospace company Falcontech for the supply of fifty metal AM machines, as part of an investment that is covered in more detail elsewhere in this issue.

The company has a clear vision for how it sees automation in the future of metal AM. Don Xu, Global Business Group Director, explained that machine manufacturers will have to work much more closely with their customers to customise their machines to fit in with the customer’s production line and application requirements. Standard machines have been sold off the shelf to date, but that will have to change in order to get maximum value for the technology, and this applies to automation as well.

In fact, Farsoon has worked with Falcontech to customise aspects of the machines it is supplying, especially with regards to powder supply and recycling. As a supplier of both metal and polymer PBF machines, it was interesting to hear that Xu believes that metal part production may be easier to automate than the production of polymer parts, since metal parts are stronger.

Automation is squarely on the company’s radar and is a key direction for the future, although it is not quite ready yet. Xu emphasises that no one company will be able to address the automation challenge: it will have to be a collaboration between the customer, the AM machine supplier and automation specialists. Today, the focus is on automation of the powder supply, but in the future, the automated transfer of parts will also be accomplished. It was with automation in mind that the company partnered recently with Siemens, in order to be better prepared for the challenges ahead.

Materials Solutions (a Siemens business)

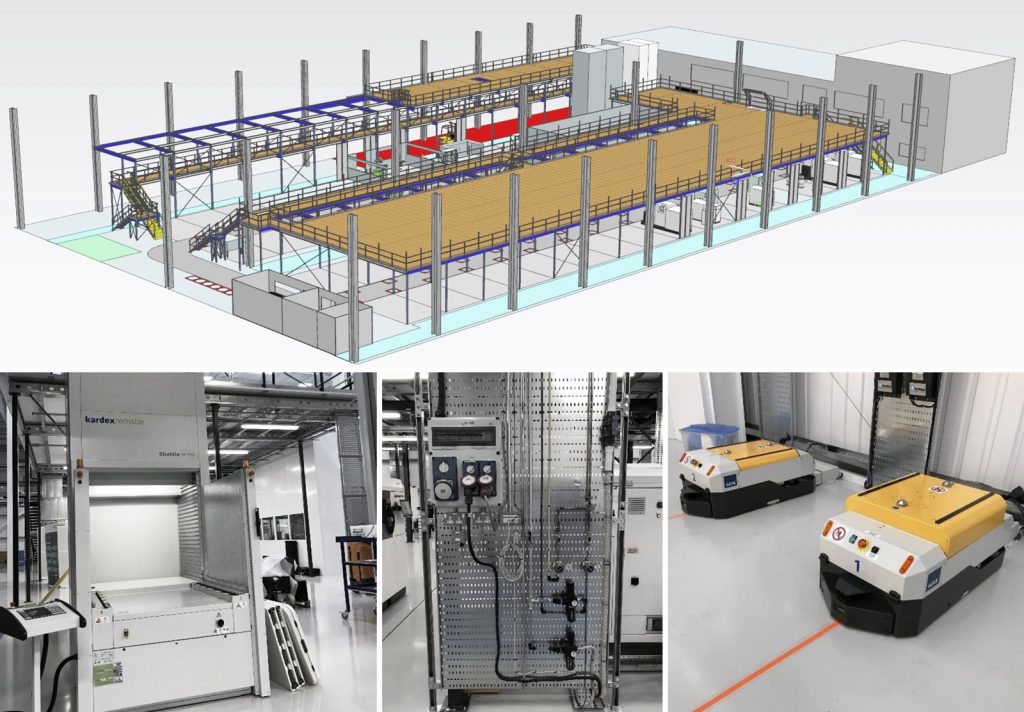

Materials Solutions is a leading AM service provider that specialises in metal AM and addresses the aerospace, automotive, tooling and power generation segments. In 2016, Siemens acquired a majority interest in the company, and, in 2019, acquired the balance to make it a wholly-owned subsidiary. Siemens adopted the strategy of industrialising PBF-LB at the facility. To pursue this objective, a €30 million investment was made into the company, involving a move to a new 4,500 m2 production facility outside Worcester, UK.

The target is to have up to fifty AM machines, a digitalised production facility and production and post-processing capabilities under one roof. The facility is one of the largest metal AM facilities in the industry, and its layout was planned for maximising the automation of high-value processes, whether currently implemented or intended for implementation in the future. A circuit-style layout has been developed at the facility for uninterrupted end-to-end production flow, and AGV’s are employed to move products or materials around the facility. Build box loading and offloading is still performed manually.

The facility was designed with a centralised powder supply and deploys a number of Solukon powder removal systems. Heat treatment is provided by third party sub-contractors off site.

GF Machining Solutions and 3D Systems

GF Machining Solutions, a unit of Swiss company Georg Fischer SA, partnered with 3D Systems in August 2018 to advanced manufacturing solutions for AM. The partnership paired an established machine manufacturer providing industrialised solutions with a provider of PBF-LB systems. The first fruit of this collaboration involved integrating a System 3R Delphin chuck, produced by GF Machining Solutions, into the DMP Factory 500 PBF-LB system, produced by 3D Systems. This allows the operator to seamlessly move the build plate, which sits on-top of the chuck, from the metal additive machine onto downstream stations for further processing. This saves time in clamping and making dedicated tooling after the part has been separated from the build plate. This modest step in integrating systems paves the way for further automation in the future. More details about this collaboration are reported elsewhere in this issue of Metal AM.

The ExOne Company

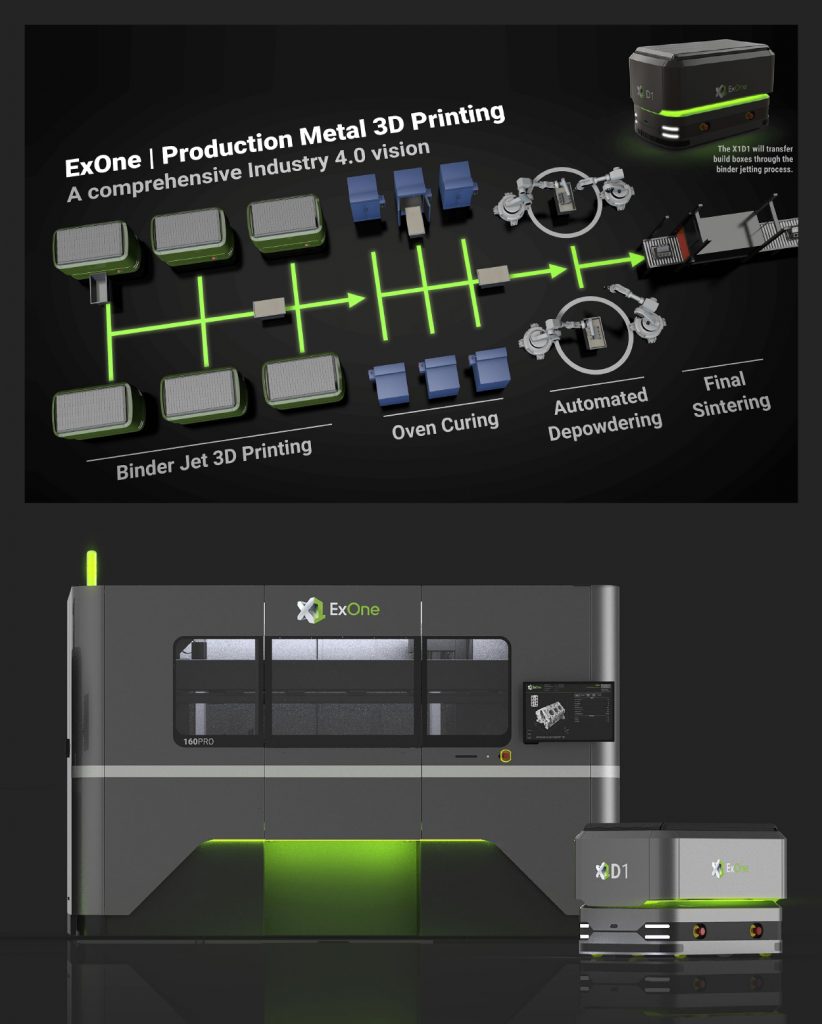

A pioneer in BJT technology, ExOne launched two new metal AM machines in 2019. The build volume of the larger machine, the X1 160Pro, is 800 x 500 x 400 mm, making it a large-volume platform intended for industrial applications. With a volume of 160 l, the weight of the build box can exceed 700 kg when fully loaded, making the logistics of moving it from station to station in the manufacturing process a challenge.

In September 2020, the company announced that the machine would be supplied with either a standard conveyance system, or with the X1D1 automated guided vehicle. This AGV can support multiple machines, reducing the total footprint of the system and simplifying movements between processes.

For many years, ExOne focused solely on the delivery of AM machines. With the announcement of the X1D1, the company is consciously signalling the move of its new BJT systems into real production environments for customers. John Hartner, ExOne CEO, explained that the company is shifting some attention to the need for automation so that it can help customers take full advantage of a smart digital manufacturing system. Depowdering parts has become a key area of focus for the company, as this is where the bulk of labour cost is expended. The company also sees opportunities to speed up the entire process by improving efficiency in this area.

The vision of the company is to surround the relatively simple build process with technology to make it continuous, hands-free and even smarter. It views BJT automation as a way to lower costs, drawing even more customers to this technology and sustainable manufacturing solution.

Indo-MIM

Bengaluru, India-based Indo-US MIM Tec. Pvt. Ltd. is the largest manufacturer of metal injection moulded (MIM) parts for the aerospace, automotive and other industries, and operates manufacturing facilities in Bengaluru and in San Antonio, Texas, USA. In May 2019 the company entered into a strategic partnership with Desktop Metal, under which it has deployed a Desktop Metal Production System at its San Antonio facility, and plans to add a Shop System in the near future.

Of interest to the AM world is the fact that Indo-MIM, as a leading MIM supplier, is already engaged in the downstream sintering of MIM parts. The deployment of BJT technology simply adds an alternative source of green parts in the upstream stages. So it is particularly interesting to understand its vision for automation, since it understands very well how automation of the process can result in cost-efficient production.

Jag Holla, Senior VP Marketing of Indo-MIM’s US operations, explained that the company views BJT as being in its infancy, but predicted that within the next two years it would mature considerably. He noted that automation would be required if the process were to grow into production scale.

Indo-MIM is satisfied with the strength of the green parts, which are at least as strong as the MIM parts that they are familiar with, if not stronger. Holla foresees that it will not be a problem to automate the unpacking stage using existing robotic technologies. Currently, depowdering is a manual process that takes up to three hours. If the machine were to run in low labour-cost locations, manual processes are not an issue, but in high cost locations the manual depowdering process becomes expensive. Holla estimates that this process can be reduced to about thirty minutes if automated, and envisages that powder removal will be achieved through the fluidisation of the unbound powder, making it easier to process additively manufactured parts.

For unpacking technology to make sense it should be applied to a facility running multiple machines, and currently there is not enough demand for the kind of parts where BJT makes sense. Generally, MIM is cheaper for larger quantities of parts, though Holla expects this will change as knowledge about DfAM expands among customers and build speed increases.

What has been learned?

There are a number of takeaways or insights from our brief and anecdotal dive into the world of automation. Here is a summary:

Some machines just aren’t designed for automation

Automation of the current installed base of PBF-LB will, in many cases, be a challenge, and will be costly, given that the machines were not designed with access to automated solutions in mind. New machines will emerge with greater levels of automation built in, or with an architecture that enables them to be connected to an automated environment with greater ease than is currently the case.

Fragmentation is an obstacle to automation

The existence of more than sixty suppliers of PBF-LB systems means that the market is quite fragmented, with great variability in the interfaces that would need to be developed for automation to work at the mechanical and process level.

We need to look beyond powder

Current industrialisation efforts that have actually been implemented relate mainly to the automatic supply and recycling of powder, but not generally to the processing of as-built parts themselves.

Binder Jetting offers both the greatest possibilities and challenges

Metal BJT technologies, a relative latecomer to the metal AM party, offer greater possibilities for the development of sensible automation systems, which also happen to make more sense for the production quantities that BJT is planning to offer. The impending entry into the BJT market of HP and GE Additive will add fuel to this trend, and it will be interesting to see how these companies address the automation issue.

One of the challenges to automation in BJT relates to the handling of green parts. This will have to be resolved, through mechanical means and/or by part design. Improvements in the chemistry of the binders may bring more robustness when using robotic handling, but it appears not to be a make or break challenge to the automation of BJT. What also needs to be considered is that many of the MIM producers who are driving the industrialisation of metal BJT are already masters of automation, with robotic pick and place systems used in the industry to remove parts from the injection moulding tools and correctly place on trays for debinding and sintering.

Machine makers should focus on their core technology

AM machine manufacturers, whether PBF-LB or BJT, should continue to focus on their core processes. Automation solutions should be provided by companies that specialise in automation, equipped with the experience and the tools to meet the needs of specific customers and unique applications.

Automation must make business sense

Automation must make business sense by facilitating the lowering of per-part costs, and will not be justified in many cases. Automation can also positively impact intangibles in an AM operation, such as health and safety concerns related to operating powder-based technologies, but business cases cannot rely only on soft factors, however important they may be to the overall risk of the business.

In conclusion

Automation and part cost reduction will expand the applications for which AM makes sense. Many machine suppliers realise this, but to date, few have implemented practical automation solutions, either directly or through specialist automation providers.

The argument that automation does not make sense because there are not enough applications that need it will reach an inflection point. Machine providers will start to see automation as a way to increase the number of applications that can feasibly make use of AM, which in turn will fuel the development of automation systems.

As with many technological innovations, the early movers and risk takers willing to bet on automation in AM will reap the rewards, as their experience with the nuances of the AM process chain will turn into a competitive advantage.

Author

Joseph Kowen is an industry analyst and consultant who has been involved in rapid prototyping and Additive Manufacturing since 1999. He is a principal of Intelligent AM, a consultancy on Additive Manufacturing serving the business and financial communities.

Joseph Kowen

Intelligent AM

Tel: +972 54 531 1547

[email protected]

www.intelligent-AM.com