AMPOWER Report 2021 shows slight growth in manufacturing and material sales despite stagnation

April 6, 2021

Consulting company AMPOWER, Hamburg, Germany, has published its annual market report for both metal and polymer Additive Manufacturing sectors. The report analyses global industry development which took place through 2020 and provides an outlook for the next five years.

The AMPOWER Report 2021 is based on over 300 personal interviews conducted by the company. The surveyed machine suppliers represent over 90% of the system base installed worldwide; in addition, particular emphasis was placed on interviewing users to enable a demand-oriented evaluation of future market developments. In addition to the market analysis, the report contains articles from guest authors who discuss the development of the AM market in individual regions.

A pandemic-related stagnation was reported in the metal AM market, with customers said to be significantly more reluctant to invest. Despite a decrease in sales revenue, however, part manufacturing services and material sales have seen growth. Over the next five years, an annual growth rate over 29% is expected in the metal market.

With travel restrictions in place through much of the year, the typically strong aviation market failed to meet expectations, although this was largely offset by increased activity in the space segment. Many US-based space rocket manufacturers and startups are making intensive use of the technology in engine production.

For the first time, AMPOWER expanded the report to include the polymer market, which proved stronger overall than the metal market for AM. The combined market for the two is expected to grow to over €17 billion by 2025 and, over the next five years, an annual growth of over 25% is expected in the metal AM sector alone.

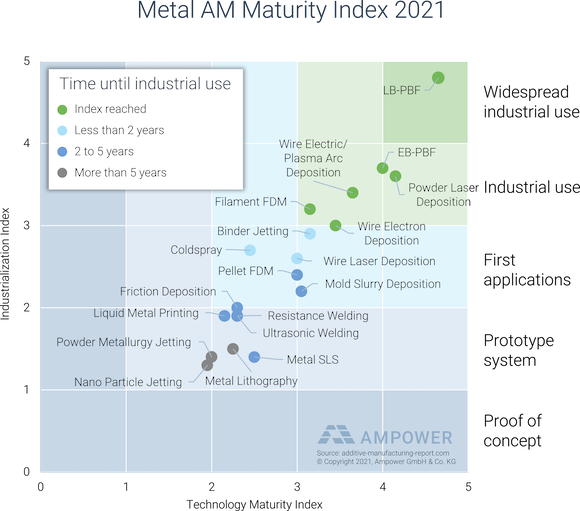

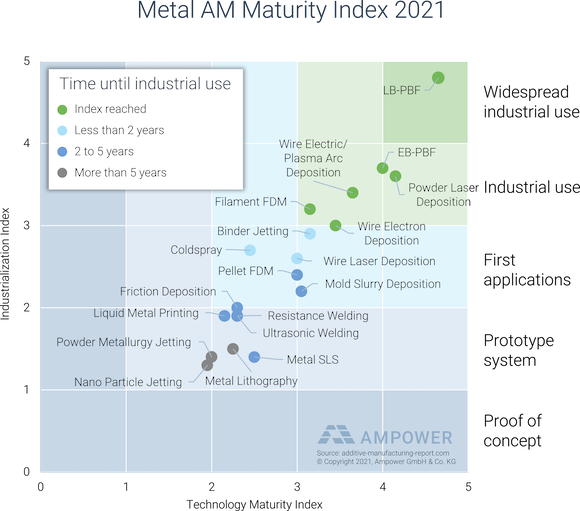

In the future, new technologies will continue to decisively drive growth. Dr Maximilian Munsch, co-author and partner at AMPOWER stated, “Powder bed systems still account for the majority of 3D printing processes in the industrial sector for both metal and plastic. For 2025, we expect a decrease in this share and a significant increase in sales of alternative additive technologies such as Binder Jetting (BJT) in metal and Area Wise Vat Polymerisation (DLP) in polymer.”

“The costs of the new 3D printing processes are falling continuously and are closing in to those of traditional manufacturing technologies,” added Matthias Schmidt-Lehr, partner at AMPOWER. “As a result, Additive Manufacturing is growing significantly more than the manufacturing industry in conventional technologies.”