Velo3D results show 160% year-on-year growth

August 11, 2022

Velo3D, Campbell, California, USA, has announced its financial results for the second quarter of 2022. Revenue for Q2 was $19.6 million, an increase of 60% compared to Q1 and over 160% from Q2 2021. This growth was primarily driven by increased Sapphire XC sales, resulting in a higher average selling price.

“Our tremendous success in providing our customers with the industry-leading Additive Manufacturing solutions they need is reflected in our revenue growth, increasing more than fifteenfold since the first quarter of 2021,” stated Benny Buller, CEO. “We have accomplished this while the revenue of our peers has been relatively flat over the same period. As a result, given our expected strength of our business in the second half of the year, it is possible that we will be the industry leader in metal Additive Manufacturing as we exit 2022, quicker than even we anticipated.”

Operating expenses for the quarter declined slightly to $27.5 million, reportedly as a result of lower costs partially offset by higher sales & marketing expenses. Non-GAAP operating expenses, which excluded stock-based compensation expenses of $5 million, were $22.5 million.

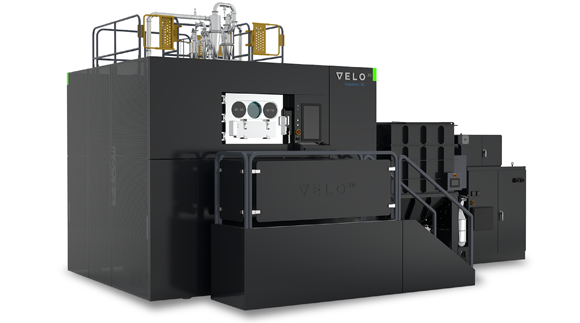

“Demand for our industry-leading Sapphire family of systems remains high as we booked $18 million in new orders during the quarter and exited the quarter with $55 million in total backlog,” Buller continued. “As a result of this strong demand, we now have significant visibility in achieving our revenue guidance this year as more than 95% of our 2022 revenue forecast is now either recognized, booked or recurring revenue. We also expanded our product leadership during the quarter with the recent launch of our Sapphire XC 1MZ. With part sizes up to 10 cubic feet, we believe this is the world’s largest commercially available metal powder bed fusion production system with initial customer shipments commencing this quarter.”

Gross margin for the quarter was 6%; while this was in line with expectations, ongoing supply chain challenges have changed the timing of certain forecasted cost reduction benefits that will impact gross margin in the second half of the year. Bill of material cost savings, which were anticipated for the second half of 2022, are now expected to be delayed until the first half of 2023 as the company reduces pre-purchased, higher-cost inventory acquired in the first half of 2022 to offset ongoing component shortages and delivery delays.

The aforementioned challenges are anticipated to impact the delivery schedule of its remaining launch customer machines with certain shipments shifting to the third and fourth quarter, resulting in more gross margin impact in those quarters than initially forecasted. The company continues to expect its per-unit labour and overhead costs to be in line with its plan due to its manufacturing scale-up. As a result, the company now expects its third-quarter gross margin to be in line with its second-quarter gross margin and fourth-quarter 2022 gross margin to be in the range of 11% to 14%.

“Looking forward, given our first half execution, strong second-quarter bookings, revenue visibility through our backlog and the further scaling of Sapphire XC production, we are very confident in our ability to meet our 2022 revenue guidance of $89 million,” concluded Buller.

The company ended the quarter with a strong balance sheet with $142 million in cash and investments. As a result, the company believes it has the liquidity for ongoing technology investments as well as providing the resources needed to fund its growth plans.