Unrealised potential: The story and status of Electron Beam Powder Bed Fusion

In January, Boeing’s new 777X aircraft made its maiden flight, powered by two GE9X engines from GE Aviation. Whilst this was a major moment for both companies, it was also a huge milestone for Electron Beam Powder Bed Fusion (PBF-EB), and the culmination of decades of process and material development work at the driving force behind the technology, Arcam AB. Whilst the many turbine blades used in the GE9X engine are the highlight of the first chapter in the story of PBF-EB, there is also a lingering sense of unrealised potential. Here, Joseph Kowen considers the story to date and highlights a new generation of firms working to increase the technology’s adoption. [First published in Metal AM Vol. 6 No. 2, Summer 2020 | 25 minute read | View on Issuu | Download PDF]

The metal Additive Manufacturing world is blessed with a number of proven technologies that have been diligently developed and improved upon over the past twenty years. These technologies use a wide range of feedstock materials such as powders, wires, rods and filaments. In some processes, energy sources are directly applied to these materials to create a part, while other processes produce ‘green’ parts which then have to be sintered to produce functional metal parts with appropriate metallurgical properties.

When it comes to the business of AM, there is currently only one technology that has a significant, if not outright dominant, position in the market for metal Additive Manufacturing: Laser Beam Powder Bed Fusion (PBF-LB). The main advantage of this technology is that multiple parts, or even large parts, are produced at a reasonably high resolution, in a well-understood and stable process requiring no secondary sintering process, with predictable results. The process is, of course, not without its headaches and drawbacks.

Technologically respected, though often overlooked, Electron Beam Powder Bed Fusion (PBF-EB) resembles PBF-LB, but lags far behind in adoption, despite a promising value proposition in a number of application areas. GE Additive Arcam EBM is currently the dominant provider of PBF-EB technology, and accounts for the vast majority of all PBF-EB machines installed in the market. The question is why does PBF-EB lag so far behind PBF-LB in terms of adoption? In the following article, we will examine the strengths and weaknesses of PBF-EB and PBF-LB, and try to predict where PBF-EB is headed.

A distant second

PBF-EB has, literally and figuratively, been left in the dust by PBF-LB. Metal AM industry consulting firm Ampower estimates that the installed base of metal Powder Bed Fusion machines, which includes both PBF-LB and PBF-EB machines, stood at 9,111 machines at the end of 2019 [1]. Using figures published by the Wohlers Report in the years 2018–2020, we can estimate that only about 6% of these, around 510 units, are PBF-EB machines [2]. This means that, for every PBF-EB machine sold, providers of PBF-LB machines sold more than sixteen machines.

Could an explanation for this be that PBF-EB technology is newer than PBF-LB? The electron beam has been known to science for more than 120 years, whereas the laser was invented only sixty years ago. There is evidence in the literature that early work on using an electron beam to melt metal powder was performed by a group at Katholieke Universiteit in Leuven, Belgium in 1991. The leader in PBF-EB, Swedish company Arcam, began using electron beams in the second half of the 1990s. The first metal PBF machines using lasers began to be commercialised starting in 1994, so there is not much of a time advantage for PBF-LB – if at all.

How it works, and what makes it different

PBF-EB is an Additive Manufacturing technology based on the melting of metal powder by exposing it to a beam of electrons. The process starts with the spreading of a thin layer of metal powder on a build plate. The powder is pre-heated by exposing the entire layer to a stream of electrons. This broad exposure of electrons heats the powder to an appropriately high temperature based on the material being used (Fig. 2). In the case of titanium alloys, such as Ti-6Al-4V, the powder is heated to about 800°C. Other materials require even higher temperatures.

An electron beam is deflected by an electromagnetic field which transfers energy and selectively fuses parts of the layer by raising the temperature of the pre-heated powder to above the melting point of the material being processed. After melting of the selectively-fused parts of the layer is completed, the build platform is lowered and a layer of fresh powder is spread across the build area. Heating and selective fusing of each successive layer builds up the object into the desired shape of the 3D model being produced.

The build process concludes once all layers of the build corresponding to the geometry of the part or parts have been heated and selectively fused. Heated but unfused powder forms a ‘cake’ around the fully-fused part and needs to be removed and recycled in a post-processing step. This is done by mechanically blasting the surrounding cake and removing excess material from internal channels inside the part as necessary.

The basic architecture of a PBF-EB machine includes an electron beam source, electromagnetic coils to guide the beam to produce the desired shape and a build chamber with a moveable build plate and powder spreading apparatus. Typically, the maximum power output of the electron beam is between 3–6 kW. Electrons are emitted from a heated filament or crystal and accelerated by a high voltage. The electromagnetic coils shape and position the electron beam similarly to how light is focused and positioned by optical lenses and mirrors. The build chamber and the EB source remain under vacuum for the duration of the build process. It takes up to about an hour to create the required vacuum. At the end of the build, the chamber is filled with inert helium gas to speed up the cooling process. After a few hours of cooling in helium, the chamber can be safely opened and exposed to air without risk of powder oxidation.

While the basic function and output from the selective melting of layers of metal powder is common to both PBF-LB and PBF-EB, there are a number of key structural differences between the two technologies. Most significantly, PBF-LB requires a mechanical mirror deflection mechanism to scan a laser beam in a vector process. In PBF-EB, the beam deflection mechanism has no mass and no inertia, enabling a virtually instantaneous positioning of the electron beam over the entire build area of each layer (Fig. 3), and for a large number of melt pools to be processed simultaneously. Melting powder using a laser necessitates the serial fusing of different parts of the layer, or the use of multiple lasers, with important consequences, as shall be discussed.

Common misconceptions

There are a number of commonly held beliefs about PBF-EB that are either misguided or simply not accurate. Some of these myths and misconceptions derive from the fact that PBF-EB lags significantly behind PBF-LB commercially. The main explanation that is offered for why this is so is that PBF-EB was a more complicated technology in its early days of development. As a result, it seems that technicians and operators found it more difficult to master, although electron beams were used for many applications long before the laser was invented.

Another reason may be that many potential users of metal AM technology simply chose the path of least resistance. This may or may not be true, but the unit sales statistics do not lie. It is fair to say that PBF-LB has achieved a higher level of technical maturity – until now. Factors that may have existed in the early days might make an interesting study for historians looking at the way new technology is adopted. What is of interest going forward is what advantages and benefits PBF-EB might offer given what we know now. It is clear is that the Additive Manufacturing industry continues to foster key misconceptions about PBF-EB. The existence of these misconceptions has been an inhibiting factor to the further development of PBF-EB. They should be put to rest if we are to realise and maximise the potential of the technology.

1. PBF-EB is similar to PBF-LB

As we have already seen, about the only element in common is the fusion of powder by a source of energy. The entire basis of operation is different, the physics is different and the outcome and performance are different as a result. The reality: PBF-EB is an independent technology that should be considered on its own merits, without relation to PBF-LB.

2. PBF-EB only works with a limited range of materials, mainly titanium

Whilst it is true that PBF-EB is associated closely with titanium, there are historical and business reasons for this. However, there are no technical reasons that prevent the use of PBF-EB for as wide a range of alloy materials as is available for PBF-LB. What is required is the development of open platforms for testing and optimising processes for additional materials.

3. The surface finish of PBF-EB parts is inherently rougher than PBF-LB parts, and working with fine powders is problematic

Rougher surface finish has been the generally available outcome due to the configuration of machines available commercially. It was observed in early PBF-EB tests that finer powders were repelled away from the powder bed due to an electrostatic charge, causing an effect called the ‘smoke’ problem. This resulted in a reticence to try smaller grain sizes.

The reality: there is no proven reason that PBF-EB cannot work with finer powders and thinner layers. The smoke problem was assumed to exist based on early observations for titanium. With the precise beam control available today, and the ability to optimise beam scanning algorithms for each application, successful PBF-EB processing of finer powders and thinner layers is certainly possible. This can lead to the smoother surface finish of PBF-EB parts.

4. PBF-EB only works with expensive specialist spherical powders

As with PBF-LB, the main reason why current machines need spherical powder is due to state of the powder spreading technology in use today. The reality: improvements in mechanisms for spreading irregular powder will also enable the use of less expensive powders for PBF-EB in the future.

5. Unusually long cooling times make the process uneconomical

Cooling is only one step in the overall process chain. The reality: overall production throughput is what matters and the higher build rate for PBF-EB compared with PBF-LB in most cases more than makes up for the cooling time required.

6. PBF-EB can’t make the large parts that we see made by PBF-LB

In practice, PBF-EB is generally used today for smaller part applications. However, there is no proven factor that limits the size of parts. No machines have been developed yet for much larger parts, but, in fact, the productivity of PBF-EB should scale in a better way than PBF-LB, since maintaining a hot process scales favourably with size.

The PBF-EB difference

Making head-to-head comparisons between the two PBF processes can be misleading. For one thing, performance might be geometry- or application-dependent. However, we can list a significant number of intriguing features and differences, in many cases outright advantages, that paint a clear picture of the strengths of the PBF-EB process.

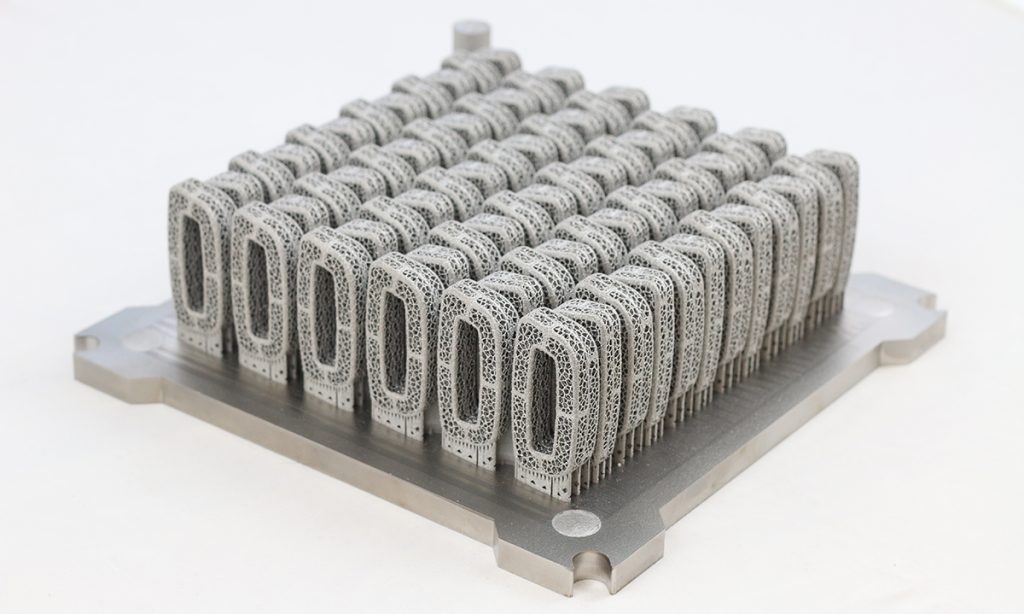

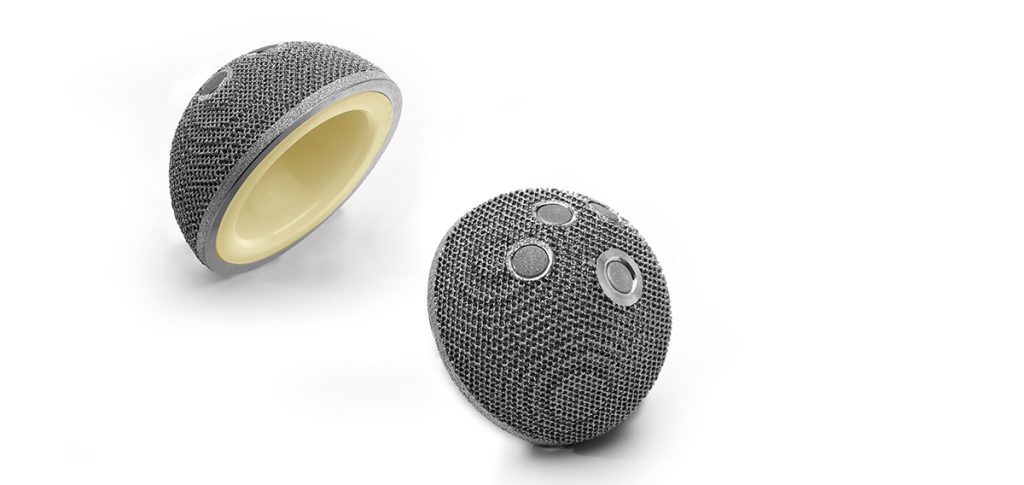

Nested parts with limited support structures

PBF-EB can be used to build large numbers of small parts, or small numbers of large parts, in a single build. Small parts can be nested in a build without the need to build the number of support structures commonly seen in PBF-LB, as the powder cake serves as the support structure (Figs. 4–5).

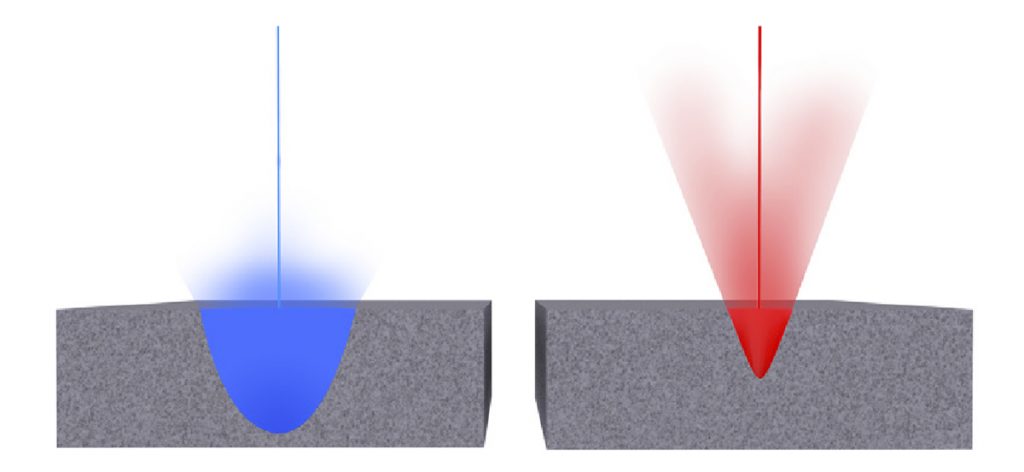

Homogeneous powder melting

An electron beam penetrates deeper into the powder grains than a laser, resulting in a more homogeneous melting of the powder and the ability to melt reflective materials without vaporising the surface of the powder particle (Fig. 6).

A wider range of layer thicknesses

PBF-EB is highly productive and works for a large range of layer thicknesses. This gives the freedom to tweak requirements of build speed and surface finish, depending on the application.

Processing in a vacuum

The melting process is conducted in a high vacuum, the cleanest and safest environment possible. Additionally, the vacuum provides thermal insulation and thus contributes to high energy efficiency.

Cost benefits when scaling up

Electrons are inherently easier and cheaper to multiply to high beam power than laser light. This makes PBF-EB more scalable than PBF-LB for future ultra-fast Additive Manufacturing, potentially competing with traditional manufacturing technologies for high volume applications.

Less thermal stress

PBF-EB is a hot process that maintains a high temperature throughout the build, resulting in parts free from residual stresses. This eliminates or reduces the need for heat treatment, a significant saving in process time and cost, and contributes to a greater design freedom. Thanks to the superior thermal control of PBF-EB, brittle and crack-prone alloys can be successfully additively manufactured (Fig. 7), expanding the application of Additive Manufacturing to materials that cannot be built with any other process, including PBF-LB.

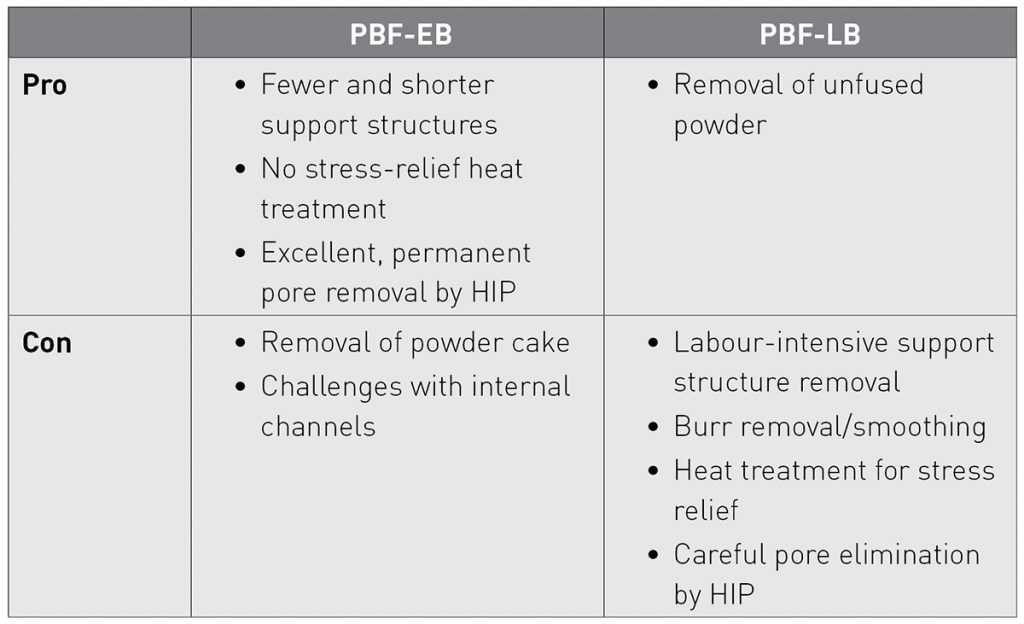

Powder removal and post-processing

Powder management and removal is a critical part of all Powder Bed Fusion processes and is often a source of pain during and after the build process. A related issue is support removal. This is the case with both PBF-LB and PBF-EB, and the topic merits further elaboration.

The characteristics of the PBF-EB build process allow parts to be built with only a limited amount of support structures, as already noted. The supporting cake needs to be removed and recycled by a powder blasting process, which occurs in a powder removal station after the build is completed and cooled. The process uses the build process powder itself as blasting media. The caked powder, after removal, can be fully reused. The process has been engineered to remove the cake without any detrimental effects on the physical integrity of the part. Removal of the cake is a relatively efficient function and only encounters difficulty in cases where the caked material is located inside internal channels.

Powder removal in PBF-LB is ostensibly easier. Since the powder is not bonded in any way to the body of the part, its removal requires either a manual process of removing the powder through air pressure in a powder removal station, or, optionally, with an automated powder removal system used to remove all unfused powder from difficult-to-reach places. What one is left with is a clean, powder-free part but with the support structures in place.

Another post-processing step where PBF-EB excels is Hot Isostatic Pressing (HIP). HIP is often mandatory to eliminate residual porosity in AM components used in fatigue-critical applications. Any process-induced porosity in PBF-EB material contains no gases and is irreversibly and permanently closed by HIP. This is in contrast to AM technologies carried out in a gas atmosphere, where the porosity inevitably traps gas. Gas-filled pores are more difficult to shrink by HIP and, even more troublesome, they may expand back to their original size if the AM part is exposed to high temperature. In general terms, the post-processing trade-off between the two PBF processes is summarised in Table 1.

Cost per part

At the end of the day, users of Additive Manufacturing technology want to be able to produce a part at lower cost. So which technology offers the best deal? It is cautionary at this juncture to say that it depends on the geometry of the part in question. The size of the part and the number of parts that can be produced in a single build will greatly affect the economics. The bigger the build volume of the machine in question, the greater the number of parts that can be built at one time.

There is, however, good evidence to suggest that titanium parts produced by PBF-EB are less expensive than the same parts produced by PBF-LB. This may not be true for other alloys at this stage, since PBF-EB is presently heavily geared towards titanium alloys. In making the comparison, we measure total cost, which means that we include pre- and post-processing costs.

Information supplied by machine manufacturers is helpful in understanding the part cost. GE Additive Arcam EBM commissioned an independent study by Ampower, publishing the results in a GE Additive white paper on PBF-EB [3] and concluded that its EBM process (the trademarked name for its PBF-EB process) was “up to 50% less expensive per part.”

The example provided in the white paper is a bracket which shows a clear advantage for PBF-EB. If we ignore the actual money values that are reported in this white paper, which could vary significantly based on part size, we can clearly see the areas where PBF-EB has the advantage:

- Build preparation: Much easier for PBF-EB, due to simplified support structure considerations and the possibility of 3D nesting

- Cost of powder: Less expensive for PBF-EB (for titanium)

- Heat treatment: Much less costly for PBF-EB, if needed at all

- Build support removal: Generally a less complicated process than for PBF-LB

It is fair to say that, with the exception of support removal, the advantages above are geometry-agnostic.

Ampower also publishes an online cost calculator tool that estimates the cost of metal parts made by all the leading metal AM processes. The tool is based on extensive knowledge and analysis of metal AM machines by the firm. Experimenting with the tool and applying different scenarios to titanium parts of various sizes and quantities, the cost tool consistently returns values in favour of PBF-EB.

There are a number of conclusions to be drawn. The first is that PBF-EB is generally and inherently a less costly process than PBF-LB for a wide variety of titanium parts. Even if the saving is often far less than the claimed 50%, in manufacturing applications even a 10% cost saving is significant. Finally, as more development is performed on materials and when PBF-EB machine build volumes increase in future machines with higher beam power, the cost advantage of PBF-EB will only grow.

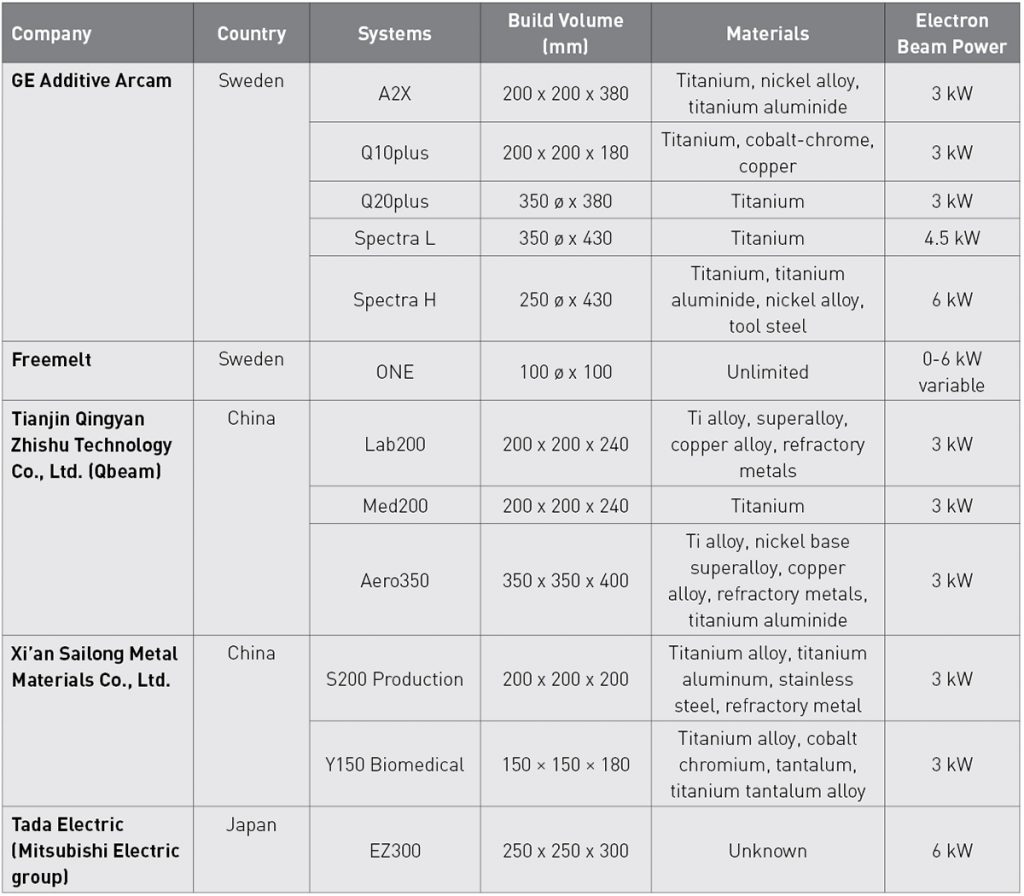

PBF-EB machines currently available

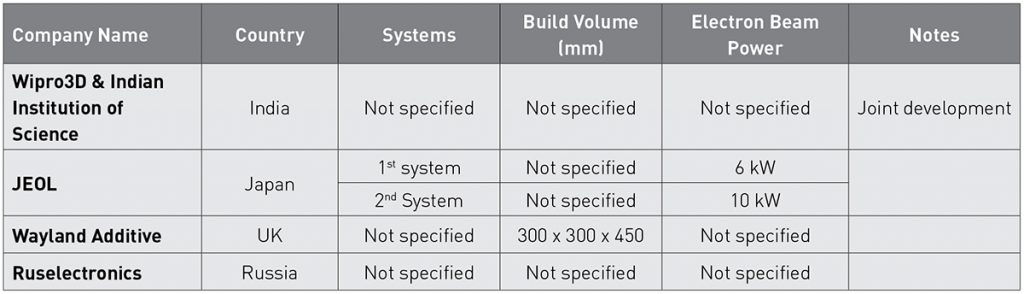

There are a growing number of commercial and non-commercial machines on the market today. To be considered commercial, the supplier must have at least one machine installed and operating in the market. Five manufacturers produce twelve different models of commercial machines (Table 2). In addition, four companies have announced the development of PBF-EB machines (Table 3).

GE Additive Arcam EBM

GE Additive Arcam EBM is by far the dominant supplier of PBF-EB machines today. It was the pioneering force in the commercialisation of the technology and, for many years, was the only supplier worldwide. Founded in Sweden in 1997, its first commercial machine was launched in 2002. The company started trading on the NASDAQ OMX Stockholm exchange in 2012.

In 2018, the company was acquired by GE, which had taken a controlling stake in Arcam in 2016. Today, the company is managed as part of GE Additive. In August 2019, the company opened a new 15,000 m2 Centre of Excellence in Gothenburg, Sweden which will eventually house up to 500 employees.

Arcam made a conscious decision early in its development to pursue high-value applications in the medical and aerospace sectors. Its material selection was limited primarily to titanium alloys and cobalt chrome. To these, they added titanium aluminide (TiAl), which is primarily used to produce turbine blades for jet engines (Fig. 8). TiAl has the required strength at elevated temperatures, yet it has only half the weight of traditional nickel-base superalloys, which is a significant benefit for an industry where every kilogramme of saved weight results in large cost savings over the life of the engine.

In 2019, GE Aviation announced that it had purchased twenty-seven Arcam machines for turbine blade production. Avio Aero, a GE Aviation group company based in Cameri, Italy, now operates more than forty machines to make the parts (Fig. 9). The turbine blades are deployed in the new GE9X jet engine that powers the Boeing 777X aircraft, which first flew in January 2020.

The potential of TiAl materials for jet engine applications was one of the drivers behind the acquisition of Arcam by GE. TiAl is a prime example of the unique PBF-EB capabilities – this material cracks easily if processed with PBF-LB at low temperature.

GE Additive holds a dominant position in the PBF-EB market. However, a spokesman for the company acknowledges that the Arcam management team is welcoming of the entry of newcomers. They believe that the increased competition will help to attract attention to a technology that has yet to reach its true potential. The development of new materials and applications outside of the Arcam fold will, of course, be an advantage for their business too and a key to the future growth of PBF-EB.

Freemelt AB

Also located in Gothenburg, Freemelt shares some of PBF-EB’s Swedish roots. As reported in a separate article in this issue of Metal AM, the driving force behind the company is the belief that what has been achieved until now is only a fraction of the potential of PBF-EB technology. Freemelt believes that the number of applications currently available for Additive Manufacturing is strongly suppressed by the limited number of qualified materials. A scarcity of PBF-EB machines with open parameters, they suggest, hinders development of faster processes and new materials.

The company’s first machine, Freemelt One (Fig. 10), is designed as a tool to assist the industry with expansion of material processes for realising the full potential of PBF-EB. It is a smaller-sized open-source machine optimised for experimentation with new materials and process parameters in a cost-efficient way. Without the ability to experiment, the material choices will remain limited.

The company claims that its innovative electron beam source, with a laser-heated cathode, has much better beam quality at high power and better robustness than traditional designs. This allows very high productivity when fitted to production machines, thus making more applications economically viable in the future. Although small compared with Arcam, Freemelt is the new player that has made the biggest commercial impact over the last year, with a handful of machines shipped to customers in Europe.

Tianjin Qingyan Zhishu Technology Co., Ltd. (Qbeam)

Qbeam is a Chinese company based in Tianjin, which offers three machines in two build volumes. The development team is led by a group from Tsinghua University. The company is not active outside of China, as far as is known.

Xi’an Sailong Metal Materials Co., Ltd.

Another Chinese company, Xi’an Sailong Metal Materials, has been operating in Xi’an since 2013 and offers two machines for aerospace and medical applications. As with QBeam, the company does not appear to be active outside of China.

Tada Electric Company

Tada Electric is a Japanese company belonging to the Mitsubishi Electric group. It has started to sell a production machine called EZ300 and, as of May 2020, their first machine had been sold to Hyogo Prefectural University in Japan. Another Tada machine developed for the Japan TRAFAM research programme, reportedly has a build volume of 500 x 500 x 600 mm, which is thought to be the largest PBF-EB yet developed. This larger machine has yet to be commercialised. The EZ300 machine is half the dimension in each axis: 250 x 250 x 300 mm.

Machines in development

Wayland Additive

Wayland was in the news in September 2019 when it announced that it had raised a Series A funding round. The company, based in West Yorkshire, UK, is a spinoff from Reliance Precision Limited. It has been operating in stealth mode since 2016. Its founders and the technical team behind the company come out of the semiconductor industry, which also uses electron beam technology for semiconductor applications.

Wayland has not yet brought any machines to market, but plans to show its first machine in November this year, with its first sales slated for 2021. In April, the company provided more details on its technology, which it calls NeuBeam. The ‘Neu’ stands for neutralise, as Wayland claims that its machine completely neutralises the negative charging of metal powder particles, which causes what is known as the ‘smoke’ effect.

According to Wayland, whilst its process is a hot process, the powder remains unsintered around the parts. The biggest advantage of this, it suggests, is that the machine can build parts without the powder cake that otherwise needs to be removed by a powder blasting process. If, in fact, the cake removal issue is ameliorated or avoided, it could present a productivity advantage over other machines.

That said, powder cake removal is a mature process that has become effective and continues to improve. It is also not clear how the Wayland process compensates for the benefits that the powder cake provides: a combined support structure and heat sink that is not integral to the parts and, at the same time, allowing operators to stack parts free-floating to maximise use of the available build volume. While it may be possible to put in support structures by choice to stabilise the build, this would eliminate an advantage that PBF-EB has over PBF-LB on the issue of support removal.

It remains to be seen how Wayland’s process works in real life. Its future offering, as laid out in the company’s April press release, looks intriguing and is certainly worth watching to see how it works in practice when the machines reach market in 2021. As with all new technologies, it must face the test of real parts manufacture.

JEOL

JEOL is a Japanese equipment manufacturer and a well-known, long-standing supplier of electron microscopes and lithography machines. It is a member of Japan’s TRAFAM future AM project, a government-sponsored programme to develop new capabilities in a range of Additive Manufacturing technologies. The project has developed two test-bed machines. The second test-bed, set up in 2018, is equipped with a 10 kW electron beam, the most powerful yet seen.

Wipro3D

Wipro3D announced the joint development of a PBF-EB machine together with the Indian Institute of Science in December 2019. No further information about the machine and its configuration is known at this stage.

Ruselectronics

Ruselectronics is a Russian holding company that is developing an PBF-EB machine. The development work will be performed by Toriy Scientific Production Association. No further information has been made public about the project at this stage.

What does this all mean and where is PBF-EB heading?

Compared to other AM processes, PBF-EB has gotten off to a slow start. However, the marathon that is the broader industrialisation of AM is far from over. For a start, there will never be a single winning technology, inasmuch as there is not a single application for AM technology. That said, in the relative positioning of the Powder Bed Fusion technologies, we see a surge in the interest and development of electron beam technology as an alternative to the laser-based machines that have led the race until now. We can expect many positive developments in PBF-EB.

What is certain is that the industry owes Arcam EBM and its investors a debt of gratitude for its grit and perseverance in bringing PBF-EB to market and leading its advancement so far. New participants, standing as they do on the shoulders of those that went before them, are now joining in and helping to take PBF-EB into the next phase of its development. The underpinnings for this renewed and growing interest in electron beam for AM are interesting physics, good metallurgy and – most importantly – attractive economics compared to laser-based machines.

New advancements in PBF-EB over the past five years have eclipsed all of the accumulated developments in the previous twenty years. That is the way of technological evolution in many cases; it is not always a straight line of growth. A segment that was led for so many years by a single dominant player is transforming into an inquisitive, robust and resourceful marketplace of innovation and new ideas.

Whichever way we choose to view and describe the latest developments in PBF-EB, it is undeniably an interesting time for electron beam technology in Additive Manufacturing. We shall continue to watch the next stage in the marathon with eager anticipation. The industry has a long way yet to run.

Author

Joseph Kowen is an industry analyst and consultant who has been involved in rapid prototyping and Additive Manufacturing since 1999. He is a principal of Intelligent AM, a consultancy on Additive Manufacturing serving the business and financial communities.

Joseph Kowen

Intelligent AM

Tel: +972 54 531 1547

[email protected]

www.intelligent-AM.com

References

[1] Ampower Report, www.additive-manufacturing-report.com/additive-manufacturing-market/#001

[2] Wohlers Report 2020, www.wohlersassociates.com

[3] www.ge.com/additive/download-ebmwhitepaper

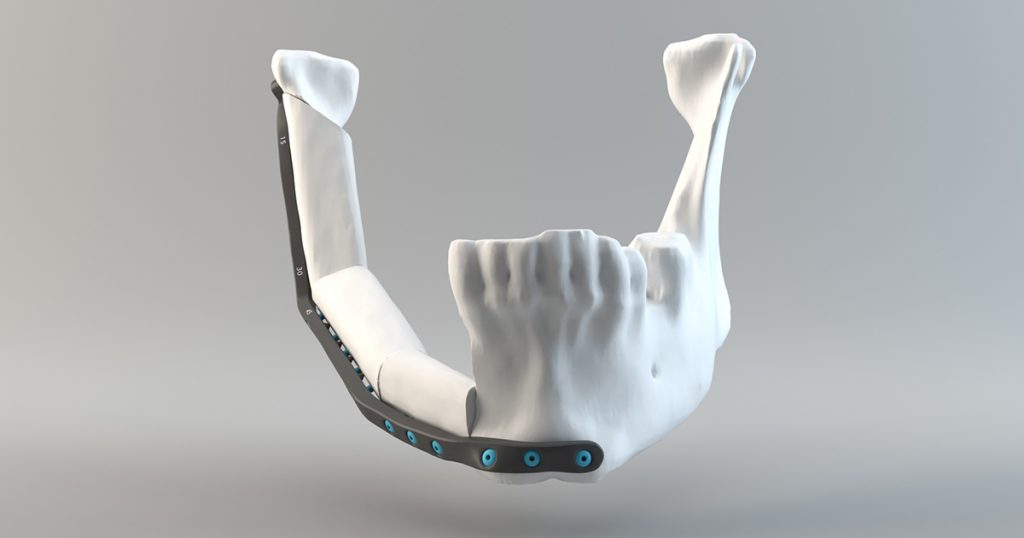

Case study: CRIQ uses Arcam technology for patient-specific jaw reconstruction

CRIQ is a state-owned organisation dedicated to industrial research and innovation in Québec, Canada. It has collaborated with the CHU de Québec hospital to develop ground-breaking solutions to improve medical care.

A team led by François Gingras, CRIQ’s Director of Industrial Equipment, is now applying AM technologies to transform how patient-specific lower jawbone implants are designed and manufactured. This focus will allow CRIQ to offer a three-week turnaround of patient-specific implants, compared to the current six weeks required when using traditional manufacturing. The CRIQ team covers the design and CAD drawing of implants, the AM and post-processing of the implant and finally cleaning and sterilisation.

This allows CRIQ to define and influence pre-processing, design, testing and fabrication machines and ensure consistency and repeatability. The process of medical certification of additively manufactured mandibles through Health Canada commenced in October 2017 and completion of the certification requirements is expected this year – when CRIQ can enter full production.

CRIQ sees the business case for patient-specific implants at a machine level and looking at how to improve patient lives and lower overall costs. “The business case isn’t in a part-to-part comparison; it needs to be justified through system-wide impact. If a patient-specific implant can accelerate patient recovery, reduce risk and lower overall healthcare costs for the Québec Government, then we have a business case,” says François Gingras.

As part of its AM strategy, CRIQ has been using a GE Additive Arcam EBM Q10plus machine since June 2018. “The medical device industry is one of the pioneer industries for AM, in general, and PBF-EB in particular. Additive Manufacturing enables companies to manufacture patient-specific implants and customised devices in small batch production, but still in a cost-effective, industrial process. This way, the technology perfectly serves the trend for more individualised treatments in healthcare,” said Stephan Zeidler, Business Development Manager Medical, GE Additive.

“Improved patient care in orthopaedics, implantology and dentistry demands high-precision, perfectly fitting medical products. In medical and dental technology, there is a demand for parts produced individually or in small batches which must satisfy extremely high-quality standards regarding materials and workmanship,” he added.